No one is immune from the coronavirus—not even the mighty Apple. The tech behemoth made headlines yesterday as it announced it would not be able to meet the second quarter revenue guidance it gave on January 28, due to the the impact of the coronavirus outbreak.

I’ve been warning about the possible economic effects of this virus for weeks… and Apple’s latest announcement proves it—the markets cannot ignore the coronavirus forever [49:22].

But first, Scot Cohen, hedge fund manager and executive chairman of Wrap Technologies, shares the incredible story behind the company… and an in-depth update on this growth name [17:26].

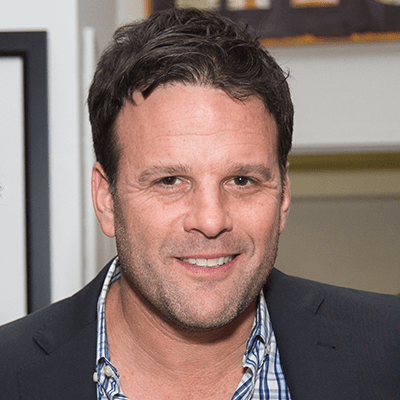

Frank Curzio

Ep. 709: Why we must heed Apple’s major coronavirus warning

Wall Street Unplugged | 709

Why we must heed Apple's major coronavirus warning

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on Main Street.

Frank Curzio: What is going on there? It’s February 19th, and I’m Frank Curzio, host of the Wall Street Unplugged podcast, where I break down the headlines and tell you what’s really moving these markets. I have to say, getting some emails… when I say some, probably about 10 times the amount of emails I get after a podcast… after the last week’s Wall Street Unplugged, about the coronavirus. Some warnings in there, I said this is something I hope that I’m wrong on, because I don’t want to see people die and get infected. I’d rather be wrong on this idea than right, and telling you to protect yourself… and let’s get into it, because there’s a lot of more stuff we need to cover, and it’s important you realize what’s going on, because what they’re reporting in mainstream media is absolutely wrong… is absolutely wrong.

Frank Curzio: You look at the coronavirus, I say it’s going to be a big impact to China. On Monday afternoon, what do we see? Largest company in the world, Apple, warned that it’s not going to make its revenue guidance due to iPhone delays caused by the coronavirus. It starts. This is just the beginning. Apple… again, one of the largest companies in the world. They have how many suppliers? Let’s say dozens and dozens of suppliers who make parts for the iPhone, so there’s no way those companies are meeting estimates. Apple is probably building its next generation phone… I don’t know if they’re calling it the Apple 12 or whatever, but they start building it now, it comes out in September… they’re adding a 5G components.

Frank Curzio: So, not only is the iPhone 11 being impacted, so is the next generation of the iPhone, which is going to be released in September. How are they going to get all this time back?

Frank Curzio: Now, if you’re looking at earnings season… almost over. We have earnings good for the most part, but again, stocks near all-time highs, nobody cares what’s going on, yet the companies that are reporting are even telling you that they’re worried. 30 percent, guys, 30 percent of the companies of the S&P 500… warned about the coronavirus and how it may impact revenue. Tesla said, oh, it’s going to impact revenue for a couple weeks; now, it could be a material impact.

Frank Curzio: Now, I’m telling you, and I’m being serious with you… I am not a perma-bear, I’m not a perma-bull, I wasn’t bearish on the market… again, I let my research do the talking. And I’m telling you, every company that has their supply chains in China, every company that has more than 10 percent revenue exposure to China, and every company whose growth component is tied to China… and I’m talking about a company like Starbucks, Under Armour, McDonalds, Nike, Tesla, Levi’s… Levi’s just opened up their flagship store, like a 7,000 square foot, I believe it’s in Wuhan right in ground zero. All these companies… again, the supply chains, the ones with 10 percent of revenue, the companies I just mentioned whose growth component is tied to China… are at risk right now.

Frank Curzio: Levi’s… nobody cares; up 20 percent since November when the outbreak started. Nike sitting near its all-time high; again, nobody cares, even though most of their growth… what is it, 21 percent of their growth came from China? Tesla, all-time high, even though their factory in China just opened, and that was a big part of their growth component. Again, Tesla is not trading on fundamentals, that’s not trading on anything; I know there’s people giving you $7,000 price targets. Why wasn’t these price targets implemented when the stock was at 300? Again, when it goes high, you get the euphoria, everybody loves it. What’s going on right now is mostly algorithms; it has to do with front running the market, destroying shorts; that’s what’s taking place in the market right now. It’s not a fundamentals. I’m not saying that stock… 7,000 price target. That’s a 1.3, 1.4 trillion dollar valuation on Tesla if that would happen, so, I mean, you can go… how about 1,500? Nice double from here. Or 2,000. No, no, no, 7,000. I’m going to get that report, so the DCF model is going to very, very interesting to see how they came up with that. Again, they have to justify. They can’t just put in there… they’re going to show how that company is going to have a 1.4 trillion dollar market. How it goes 7,000… I’m curious about that, to see how they with that.

Frank Curzio: Anyway… so, earnings season almost over. You have 30 percent of the companies in the S&P 500 telling you that we’re worried about the coronavirus, it could impact revenue. Now, we have the largest company in the world saying that… they’re warning that coronavirus is going to impact their estimates next quarter, at least next quarter.

Frank Curzio: So, according to the recent numbers, there’s a little over 73,000 infected. This number is probably more like 700,000; again, I’ll get into that in a minute. We have a little over 1,800 people who died, which amounts to two and a half percent of the people infected. It’s important to realize that number. When you’re looking at the flu, it’s less than one percent; if you’re looking at SARS, it was 10 percent. But early on, because the government was lying about these statistics… not being forthright, telling our best scientists, “Nope, you can’t come into our country to help us.” Why? Why? You don’t want us to help you save lives? I mean, even if it happened here, we want the best people in the world to come here to help save people, and you’re not letting us in. Why do you think that’s happening? Why?

Frank Curzio: You do that math on it, because a lot of this stuff, guys, is not going to be figured out with numbers. I know the numbers. I could tell you the numbers. I could you tell the projections. The biggest part of your analysis if you want to be a great, great analyst is your common sense, okay? And you have to use your common sense, because people are trying to put numbers behind this, and the numbers don’t make sense since there’s 500 million people on lockdown, and nothing even close in the history of mankind have we seen something like this, but we’re comparing it to a whole bunch of things… comparing it to the swine flu, comparing it to Zika… what happens with the markets? They usually bounce right back. We haven’t seen anything like this. It’s really scary.

Frank Curzio: And now, getting back to that infected… two and a half percent. That number has been going higher and higher, which is surprising because it was below two percent last week. And there’s no signs of this slowing, no signs. It’s important when you think about that, that number. I mean, that scares me a little bit. I mean, you get the flu, fine; less than one percent, everybody just goes on their way; you get your flu shot, hopefully, you can avoid it. But at two and a half percent, I’m thinking twice before going to work, I tell you. I know… looking at those cases, and you saying, “Well, a lot of it has to do with infecting people with respiratory problems, heart disease, older than 65-year-old males, and stuff like that.” Still! I mean, you have kids, you have children; that impacts them, as well. I mean, that’s where you’re seeing the highest death rates from this. It’s very scary.

Frank Curzio: And imagine you being on lockdown in your house. When they say, “Hey, lockdown is over,” are you just going to run out, especially considering the virus isn’t contained? No, it means you’re probably going to catch it.

Frank Curzio: In the meantime, China, which accounted for 39 percent of the global economic growth in 2019… that’s according to the International Monetary Fund, 39 percent of global economic growth, right? 39 percent… is completely shut down, right? 500 million people on lockdown. Again, use your common sense. Put it in perspective. How many people in the U.S.? 370, 80 million? Whatever it is? So, we’re looking at 500 million people… think about everyone in the U.S. Think about if you were on lockdown. Imagine if you’re not allowed to travel, leave your house… no trains, buses, transportation… nothing. I mean, that’s… I won’t curse, but it’s frickin’ crazy. It’s insane. I mean, guys, you’ve got to put this in perspective here.

Frank Curzio: I mean, people think, oh, it’s going to bounce right back. I mean, it took nine months for SARS. It was 8,000 cases. There’s 73,000 infected and I can tell you, those numbers, times them by 10, at least by 10. And I’m going to tell you why. This isn’t me guessing, I’m going to tell you why. I’m going to share a lot more stats with you later on. There’s no reason you have… Ed Hyman, who’s… Evercore, one of the best economists in the world for over 30 years; I mentioned him last week. I think he won Best Economist for like 39 out of 43 years or something from IBD. But he’s predicting China in 2020… so, the full year… their real GDP to hit four and a half percent. That’s for the year. That’s the lowest in 30 years. This includes them having a zero percent growth rate next quarter, which is Q1, which I think is insane, followed by six percent growth in the second quarter, which I also think is insane.

Frank Curzio: So, I’m looking at maybe two percent, two and a half percent… remember, China is going to report whatever they want to report, and that’s fine. But you can’t lie when it comes to your earnings in the U.S.; you can’t lie about that stuff. Okay? And it is pretty crazy when… you look at Apple, and… not just Apple, but most stocks are all-time highs with very high multiples, and you’re taking the growth component out of the market, and yet stocks are still trading… Apple trading at 25 times earnings? I mean, priced for perfection.

Frank Curzio: And now, they just warned… and they didn’t just warn, they said, “We’re not even going to provide guidance,” and they’re supposed to generate between 63 billion and 67 billion in sales next quarter. Granted, they have that big, wide gap because they have no idea; it’s the largest gap that Apple probably ever had when it comes to revenue numbers. And they said, “Well, you know, coronavirus”… they removed it. They took it off. And they didn’t say, “Well, it’s going to be 60 billion now, or 55 billion, or estimates may be off by five, seven percent.” They don’t know. They don’t have a clue.

Frank Curzio: You know what uncertainty does to stocks. You know what uncertainty does to the markets. People are assuming this is going to be over in three months and everything is going to be fine. What if they’re wrong? I’m not telling you to short the markets blindly, and you have to be careful even with that, because China is going to just say whatever they want; they’re going to just make good on all the loans for all the major companies; they’re going to just push so much money into the market, right? They’re saying, “Oh, it’s almost contained. It’s not too bad.” But yet the government is allowing re-financing for almost all loans that are due this year. Massive, massive money being injected. Why, if it’s not that bad? It is that bad.

Frank Curzio: When Apple comes out and says, “We don’t know what we’re going to report”… I mean, they can’t even put a 50 handle on it? A 55 billion dollar handle? I mean, 63 billion was the low end. They don’t know. Think how scary… that’s a large company that has no idea. We don’t know when these sales are going to come back. We have no idea when we’re going to be able to start. I mean, how are they going to launch their phone in September when they can’t even fill the orders for the iPhone 11 right now? Assuming this lasts just as long as SARS… again, 8,000 cases, compared to how many… I don’t know. That’s the common sense part.

Frank Curzio: And the best part… I’m still seeing people… and I’m not going to call them experts, or on TV; they’re not, because they’re idiots… but they’re comparing the coronavirus to SARS, still. I mean, SARS took place… again, nine month span from 2002-2003, only 8,000 people were affected. We have 73,000. It’s going to go much, much higher. I’m going to share those stats with you later in my Education Corner.

Frank Curzio: Only eight Chinese provinces were impacted during the SARS outbreak; just had minor containment measures. Today, it’s spread to all 31 Chinese provinces; over 500 million people on lockdown. How are you comparing this to SARS? Before SARS hit in 2002, Chinese residents took 16 million trips outside the country. That was in 2002. 2018, which is the latest statistic available… that number increased tenfold. 162 million residents traveled outside the country. Nobody’s traveling right now in China, not even within China. I’m not even talking about internationally; again, numbers I’m going to share with you later.

Frank Curzio: Want to keep comparing it to SARS? Fine. 2003, China was the sixth largest economy in the world; accounted for just four percent of global domestic product. Today, it’s the second largest economy in the world; it accounts for close to 17 percent of the world’s GDP, and like I said earlier, almost 40 percent of the global growth, according to the IMF, in 2019.

Frank Curzio: And when you look at this, and I said it earlier… it’s something that’s never happened, a lockdown of this magnitude in the history of mankind. How do you compare this to anything? The fact that they’re going on and comparing it is just insane, but you know what? No worries. Don’t worry. You have nothing to worry about. Things are going to be fine. Stocks always rebound when we have outbreaks like this. This is different this time. We’re not solving this thing in three months. There’s not even a lot of information that’s being given right now. We’re not going to solve it even in six months, not even in nine months. The negative impacts could last well into 2021 before people are no longer afraid to leave their homes and go back to work… because they are afraid, and they’re very afraid.

Frank Curzio: In my educational segment, I’m going to break down the coronavirus even further, and it includes tons of stories, it’s going to include more numbers. I promise I’m not going to bore you. It’s even going to include emails that I’m receiving where you’re going to see some of the impacts this is having that people are not talking about. And forget about just Apple and the suppliers and how many companies sell… like AT&T, Verizon, these companies who are going to… the retail outlet chains, the Best Buys, the Walmarts, when Walmart’s release… just like from the cases and the chargers, and all the stuff that goes along with these phones… I know because I own my own phone store. It’s crazy.

Frank Curzio: But if you have any exposure to China, you better listen to this segment, because this is going to be new statistics, new things. You’re going to see huge impacts to markets that you wouldn’t even believe, that nobody’s talking about, and the numbers I’m going to share with you are really going to blow you away, and it’s not going to be in a good way.

Frank Curzio: But first, I have a great guest for you today. His name is Scot Cohen. This is the first time I’m doing an interview with him on the podcast. You may have seen him in a video of mine, because Scot is the Executive Chairman of Wrap Technologies, a company most of you should be familiar with if you’re a subscriber. Wrap makes the BolaWrap, which is the first 100 percent non-lethal device that shoots Kevlar rope, it’s used just as fast as a gun, and it wraps around the victim with hooks. I know about this because I got wrapped myself, and it was unbelievable; I couldn’t move. It’s much safer than using a taser, and of course, much safer than drawing your gun.

Frank Curzio: I followed this company for pretty close to two years. It was on the pink sheets back then. Today, it’s on the Russell 2000, trades on the NASDAQ; they hired one of the former founders of TASER as President, and now finally starting to see lots of orders, not just from police departments domestically in the U.S., but from police departments all over the world.

Frank Curzio: So, you may be familiar with this, because I taped a 40 minute video about it when I got shot with this device. I interviewed top police chiefs. I interviewed Scot. I really got attached to this story, because this is not a white thing, a black thing, if you hate cops, if you like… it’s not a Democratic thing or a Republican thing; it’s a save lives thing, and this is something that’s saving lives, and everybody that sees it, police departments all over the world, are understanding that. That’s why they’re starting to deploy this, including the LAPD department.

Frank Curzio: So, I interviewed Scot in that video, which I filmed probably around 18 months ago. And he’s a very successful hedge fund manager, managed around 300 million… become a mentor to me; just always there to answer those tough questions about my business when it’s growing… hiring, things he went through since he’s taken a lot of companies public over his career… made investors a lot of money over the years. So, Scot is a rock star, a great guy, and you know what? Let’s get to that interview right now.

Frank Curzio: Scot Cohen, thanks so much for joining me on Wall Street Unplugged.

Scot Cohen: Thanks, Frank. Good to be here.

Frank Curzio: So, let’s dig right in, because we were introduced by a mutual friend who thought I would really be interested in this new idea. So, we got in touch, you told me the idea, and I think this was around 18 months ago, and I absolutely was blown away. I loved it. That idea was Wrap Technologies, and let’s start from the beginning.

Frank Curzio: Explain Wrap Technologies, because there may be people listening to this for the very first time.

Scot Cohen: Yeah. Thanks. Yeah, I mean, that was probably two years ago, or two and a half years ago, already? And to your credit, you got it right away and connected with it, with the taser history and so… you were one of the early ones to catch on to what we were doing.

Scot Cohen: But it is a remote restraint tool… the purpose of the tool is to restrain pain-compliant, not inflict harm or… a safer, easier way to take somebody into custody where nobody gets hurt. That was the idea four years ago. We thought it would take six months and a half a million dollars. Here we are, four years later, about 30 million dollars; now we’re on the NASDAQ trading, and we went from three people to close to 40 people. Now we’re in 150 departments; when you first got exposure to this, we weren’t in one department, so it’s been about eight months to get into 150 departments or so.

Scot Cohen: And we’re in 40… maybe 35 or 40 different countries. We’ve trained thousands of line officers, and now we’re some of the biggest cities in the country, LAPD being the biggest one that we’re most proud of, with a full-scale test going on right now where we’re in every district in L.A. So, I’m excited to be here with this right now, and an opportunity to be on every law officer’s… every officer in the country’s belt… the opportunity to get on that belt is something that can really have an impact on the world, and that’s super exciting to me.

Frank Curzio: Yeah, and Scot, we have come a long way. I remember 18 months, at least… longer than that… I mean, the stock was trading over the counter. The BolaWrap was an amazing device, but you didn’t really have the supply chain in place or how to train officers, and no orders yet, as you just said. You’re just starting to meet with Attorney Generals, I believe, and police commissioners. I mean, you invested in lots of companies over your career. When did you know that you were on to something big?

Scot Cohen: It was seeing the reaction from the chiefs which started to confirm, and these were some smaller departments. But then when you saw… the more departments that we were speaking with, the more training that I witnessed, the more large cities that we were presenting in front of, the more sheriffs that we started having conversations with, the better the product was performing… these were all validators, but it wasn’t until that activity just kept ratcheting up and ratcheting up quickly. I mean, this all happened within the last two years. It’s really taken a new pace.

Scot Cohen: I thought a breakthrough for us was hiring Tom Smith, who was the architect and co-founder with his brother at TASER. There hasn’t been a new device on the belt, a new tool for law enforcement, in 30 years, so when Tom evaluated this with his people and his network, and agreed come onboard, that was another validation for me that put a signal or showed a path towards how important this tool would be, and the validation of that was a combination of seeing the reaction of officers, attorney generals, policymakers, mayors, chiefs, sheriffs… that whole ecosystem has all lined up, in my eyes, anyway, and I’m seeing more and more validation. Every day that we go on, there’s more validation that this is going to be the tool, the next new tool that’s going to be on every officer’s belt.

Frank Curzio: Now, you just mentioned Tom Smith, right, who is, I believe, one of the co-founders of TASER, who’s now the president of the company. Go through even further how important this was, because when I covered TASER, and this one of the reasons why I got attached to the story… when I covered TASER, it was very early on, and I saw the ups and downs and the training that had to be done, and the bureaucracy behind getting orders domestically in the U.S. It’s never an easy process compared to, I think, overseas, where they’ll probably just say, “Hey, we want orders.” “Okay, here you go.”

Frank Curzio: But how important was it for Tom to come on, because he’s been through all the negatives, right, with TASER to become the company they are today? But there’s just a lot that goes on behind the scenes, isn’t there?

Scot Cohen: What Tom brought to the table, it was impossible to understand the magnitude of his contribution. At first, I just thought it would be putting together the sales distribution network, tapping some of the overseas connections, but it became much more than that. Immediately, he started weighing in on policy. He started weighing in on safety and sort of putting the right lawyers together to help up with potential litigation that would be coming our way if this, in fact… if an attorney got a hold of it… experiences they went through in TASER early days, and even today.

Scot Cohen: Yes, his relationships absolutely did come to bear, but he understood the manufacturing process there, the logistics with that… the talent, and all those areas… to be able to look at a manufacturing line and be able to weigh in on the efficiencies of that, and the people that needed to operate and be on that line were… Tom is able to weigh in all this, given his… the guy is just so in tune to this business because he built this business from scratch. When you do that, and you go all in, it’s easy for you to see things that remind you of the past, and also, he’s making changes and adjustments constantly, and saying to himself… well, and I hear him saying this… we do this, but we should be doing that, and we made this mistake; now, let’s go this way… and this is going to come up to bite us in the butt someday, so we need to adjust and do this.

Scot Cohen: That’s invaluable. It would have taken us a decade if we didn’t have Tom driving the ship. It’s really been invaluable for us.

Frank Curzio: No, that’s great stuff. And look, early on, I flew to New York City to meet your team. I got shot with the device. I put it on a video and everything; it was really great. Also interviewed police chiefs, 30-year vets… it was incredible stuff. But after talking to them, I got really attached to this story, and it wasn’t from a financial perspective, right? I mean, our job is to make our investors money.

Frank Curzio: From a personal perspective, after interviewing and seeing the faces on these officers and saying, basically, “Man, I wish I had this device in this situation or that situation,” I guess… talk about the emotional component, right, because that’s what attachment… I didn’t know I’d get that emotionally attached to this, because at the end of the day, and even with these guys explained… look, you listen to what you have to listen to the public opinion about police officers, no police officer wants to draw their gun, nevertheless shoot anyone, even if it’s a clean shoot, and this is something that could easily prevent that.

Scot Cohen: So, when you put yourself in the situation of these officers or people that are on the front lines, the thing that’s made their job incredibly difficult is the amount of access everybody has to those situations, either the body cameras or the individuals that are walking around with their cell phones taping everything. So now everything they do is in the public eye, so they’re being criticized for every move they make.

Scot Cohen: That is incredibly stressful for them, and so to be able to serve them with a tool that makes their job safer from a litigation standpoint, or just from a physical standpoint, and to be able to achieve that with this tool… and then beyond that, say we have a mental illness situation where the person is not having a good day… to be able to save that life, and that person who could be in harm’s way, with something that doesn’t escalate the situation, but just is able to deescalate… that’s an incredible gift to be able to provide that for both sides. And since not only do each of those sides win, but society wins when the tool like this is used and deployed, versus some of the alternatives that are out there that have… there just hasn’t been that choice available for people.

Frank Curzio: Talk a little bit more about that domestically disturbed, because I live in New York City for 35 years; I didn’t know this. I knew this from basically interviewing DeLuca, which is the chief of all chief of police at one time, and he was telling me that one out of every four calls to New York City police are for domestically disturbed. So, these are people that just may walk towards you, or they don’t know better, so you have two options: you tase that person… if they have a heart condition, good luck, or if you tase them, they could fall on their face… or you shoot them to protect yourself, which either of those result in death or serious injury, right?

Frank Curzio: So, talk about that, because I never realized how big that market is when it comes to domestically disturbed, and it seems like that’s really what so many of the police commissioners and people who are deploying this… it seems like that’s a major focus.

Scot Cohen: Yeah, it is, because there’s been no real way to deal with that situation that just keeps escalating. Up until now, it’s… either you’re going to go hands on, which you never know what that mental person… you don’t realize the strength that that person could have, or what they have on them. So, if you’re going hands on, you could find yourself in a dangerous situation real quickly.

Scot Cohen: And now if you go… or, let’s say that you start off… and your training suggests that you should start off with a heavier use of force, a higher use of force, a gun or a taser… now you’ve come into a situation where it’s escalating. So if you go for a tase to restrain somebody or just to get control over the situation, and let’s say the tase doesn’t actually connect and it doesn’t work, which happens just about 50 percent of the time… it’s a hard shot and it doesn’t always activate… now you’ve really escalated the situation. Now, you’re going to be forced to use a gun.

Scot Cohen: And when that happens, that’s a sad situation for the person that could have been killed or seriously injured, but it’s also a traumatic experience for the line officer that had no choice but to go to that higher use of force after an attempt with a taser didn’t work, and then that person now is being critiqued by the public, either by his body camera or his chief, or that pedestrian that witnessed it and recorded it and turned it into the local news for everybody to watch and witness… and then your destiny is determined by the juries. Was that a proper use of force or not? And if it wasn’t, there’s a good chance the officer could be in jail for the rest of his life, and that’s a terrible place to be.

Scot Cohen: And that is, like Chief Deluca said, it’s 25 percent of the calls. It’s 25 percent of the situations that are happening in America today; big cities and small. It’s the same situations in New York, Philadelphia, or some small department in Iowa. It doesn’t matter. We’re all running into the same issues.

Scot Cohen: Recently, I had a conversation with the former commissioner of Philadelphia. It’s the fifth largest department in the country. His name is Rich Ross. We were watching video that we have on our site of mentally ill, mostly… having a bad day, dazed and confused, may or may not have a knife, but certainly the police had been called. And I asked him how often… and the use of force, the only option the officers have, is a taser or their gun, or if they’re coming with a billy club and you’re coming swinging that, that’s going to look terrible, and it’s escalating the encounter.

Scot Cohen: But I asked him, how many times in Philadelphia does this happen, where you’re coming on to a situation like this that we show on our website, where the person’s just dazed and confused, could cause harm… may or may not… just unpredictable. He said it happens multiple times a week. I mean, think about that. That means multiple times a week in the city of Philadelphia, these encounters are happening, and therefore, the officer’s got to make a judgment call, and if makes the wrong judgment call there because he or she is scared, and goes to a higher use of force and deploys that, and it goes wrong? Jeopardizes your job. Could jeopardize your freedom. That’s not a good place to be.

Scot Cohen: BolaWrap fills that gap.

Frank Curzio: And that’s what I was going to say. I mean, it makes sense, right? BolaWrap, it reminds me of Uber, right? It makes sense that when you go to an Uber, you’re probably not going to use taxis all that much. I mean, it’s just cheaper, it’s safer, it’s so many things.

Frank Curzio: And I compare it to Uber because when police officers, chiefs, commissioners, attorney generals… when they see the device, it seems like they all want to deploy it. And I really see this on the belts of police officers all over the U.S. and all over world; with that said, there’s always risk to a business or a business model, as you know. And what are some of the risks that you see, because I know this is something that you always focus on with every investment, everything you do, and probably why you hired… a big initiative was to hire former TASER guy to reduce a lot of risks we talked about… but what are some of the things that you see that could become a risk? Is it supply chair issues, or is it regulatory issues? Bureaucracy? What are some of the things that you see that worry you a little bit, because it seems like this trend, it’s happening, it’s going to happen, it’s going to continue to get bigger… but there’s always bumps in the road in every single business?

Scot Cohen: Yeah. First risk… and these risks change, right? They’re fluent. So, the first risk I would say was, does the device work? Is it wrapping enough where it can stop somebody in the tracks and do what it’s supposed to do, which is restrain. And the answer to that is, I’m proud to say, yes. After plenty of capital, bringing on better people from manufacturing logistics and sourcing better supplies, our product is working better than 90 percent of the time, so we’re proud of that. It took a long time to get here, versus four years ago when the wraps were so inconsistent and we didn’t know why. So, there’s been a lot of effort, a lot of capital, and a lot of really good people around the table figuring out how to get this to be optimized to the state it’s in today… so, that’s number one.

Scot Cohen: Number two is capital. A lot of guys have good ideas… even have some that works. But if you can’t get the capital, it’s very hard to pay the right people to execute, both on manufacturing, sales, support, training. The things that I just mentioned there aren’t simple and they cost a lot of money, and multiple people need to manage that process. It’s not easy. I just rattled it off like it was easy, but it’s not. You need to incentivize the people. You need to come up with proper practices, both on the governance audit and comp side.

Scot Cohen: Now we have 40 people that we’re responsible for, and we all have to be going in the right direction. If one of us is weak, or one of us is not doing the job, it jeopardizes the whole business. And furthermore, if you have a wrap that goes the wrong way and it’s caught on video, that’s not going to be helpful to our business. Not everything goes perfect, not every wrap is clean, but you better believe it… in the beginning, everything counts, and you’ve got to show up and be the best you can. Our wraps have to be as consistent as they can, and we need to support that. If there’s a problem, a question, something happens, we need to be all over that and own that, and that takes leadership, teamwork, alignment, capital and passion… all those things to make this a success, and that’s one of the things… I think if you combined all those things, that’s what made us get to where we are now, in a position to, again, deliver on having this BolaWrap on every officer’s belt, not only here, but around the world.

Frank Curzio: And let’s finish with that, around the world, because it seems like you got those orders first, and to me, it seems like they’re a lot easier to get, but also it requires… there’s a big testing phase through that; you have to go overseas to do this, or wherever you’re selling this device. What are maybe some of the countries… not all of them, obviously, since I’m just asking you… I mean, is it easier to deploy these things internationally, and what are a few of the countries that are really interested in this?

Scot Cohen: The easy answer, the quick answer is yes. Let’s just go… but it’s not that simple. Yes, because in many countries… TASER hasn’t been as successful globally. Plenty of large countries, and small, consider tasers inhumane. It’s an electrical weapon; it’s a form of torture. So, tasers haven’t been nearly as successful as they’ve been in the U.S. I think in the U.S., there’s about a 85 percent or 90 percent penetration rate. Overseas, it’s a fraction of that. So, let’s just start there.

Scot Cohen: And in other cases, in Europe, there’s plenty of places where police don’t even carry guns, okay? So, what are they carrying? Are they carrying batons and pepper spray and handcuffs? So, there is nothing. There’s nothing for that. So, in many cases overseas, it’s just a whiteboard. It’s a white space.

Scot Cohen: So, when we came in with this, it immediately clicked. We can see by the social media that’s going on in those other countries, whether it be Japan, Germany, Spain, Indonesia… where else… South America, Brazil… our videos are going viral, and the reason is… in my opinion, the reason why the videos are going viral and the reason why TV is catching us… I think we’ve been aired over a thousand times just domestically, and there’s no way for us to understand how many times internationally, but… the reason why is the people want it. The community is speaking. The media is speaking to the community, and the communities are responding, and therefore, this product is getting into the hands of countries that need to have some kind of answer for whatever situation is happening in their countries. And that’s why it’s sticking and landing so well in those outside the U.S.

Scot Cohen: But in the U.S., there’s other things that we have to deal with that… budget cycles, there’s lots of different decision makers; there’s 18,000 different agencies in the U.S. Overseas, you might have one country that’s in charge of a 200,000 person line officer, or sometimes bigger, and it’s one person making that buying decision. I mean, there’s other people that are weighing in, but it’s much more centralized, and they don’t have nearly as many choices as they do here in the U.S.

Frank Curzio: And so, if someone wants to see some of those videos, because it’s millions, even tens of million people have been watching them… how can people see that? Do you have a place where they can see a lot of those?

Scot Cohen: Yeah. We don’t even know… I mean, these aren’t videos that we produce. They’re producing them, so… I think some of it is on our website, but if you Google it, and you look at the one that’s going on in Brazil or Japan… I mean, I think the Brazil one got 30 million views. There’s one in Japan that got nine million views. There’s one in, I think, Spain, I’m not even sure, that got another 25 million views.

Scot Cohen: So, I don’t know. Someone will forward me the ones that are super active. I’m not sure which one is active now, but you can go on up and see that, and on our site, we try to put plenty of the media that we can hands on, on our site, so you can see countless castings or airings of the BolaWrap, talking mostly about our demonstrations… the BoloWraps come to Salt Lake City, the BoloWraps come to some small town in Georgia.

Scot Cohen: And that’s just on demonstrations. What I get excited about is, what’s going to happen when the wraps start showing up? We’ve had three wraps to date, but what’s going to happen when that wrap gets caught on video and it goes viral? I think there’s going to be much more news happening as it relates to the actual wraps versus the demonstrations, and we’re already seeing that. We’re seeing media… and we get forwarded these… where the newscaster or the local news is saying, “Well, there was a shooting in XYZ district. Where was the BolaWrap? Why didn’t our officers carry the BolaWrap?” “There was a taser incident where this 86-year-old got tased and hurt or killed. Why didn’t we have the BolaWrap?”

Scot Cohen: And we’re hearing that more and more and more. Reporters are reaching out to us. Newspaper and local station… and national stations… I think we’ve had probably at least 10 nationally televised segments on the BolaWrap. So, I see more and more of that coming, but a switch from demo and training to actually wraps and saving lives.

Frank Curzio: It’s great, because I know that you have a history of making your investors money, and again, being a hedge fund manager or a newsletter writer and stuff… but just seeing this feel-good story where this device saves lives is really cool.

Frank Curzio: And for me, personally, Scot, I just want to thank you because when I got introduced to you, you didn’t know me, and we talked about this… and I went out there and we hit it off really quick, and we talked about a lot of things other than Wrap and different ideas, and you’ve helped me out tremendously, so it’s been a big benefit for my subscribers… I know they’re thankful… and a big benefit to me, as well, so I just want to say thanks.

Scot Cohen: Well, I give you all the credit, because we didn’t know each other… the minute you took a look at this thing and saw that video, you knew there was something there and you were early. You were way early. You were the first guy to print on this and the first guy to really do the deep heavy lift, and started to do the work and spent more time than anybody at that point in time. And still, I mean, the work that you did was… I think that’s what got you to come up with that report.

Scot Cohen: And guess what? I’m happy to say that you were right. You were early and you were right. I mean, the business has changed a lot since you first reported on us. So, I’m grateful that James introduced us, and I hope that your subscribers and your investors will benefit in the future for us, going… for us showing more and more Wraps, and hopefully, in your subscribers’ towns, they’ll see BoloWraps on their officers’ belts, protecting them in the communities… and that’s our goal here, so I really appreciate it, Frank.

Frank Curzio: Me, too. Thanks so much for coming on. I know you’re a busy man. Keep doing that good work. I know the subscribers love it. And we’ll talk again soon.

Scot Cohen: Awesome. Thank you.

Frank Curzio: All right, guys, great stuff from Scot. I said early how he’s been a mentor to me. When I first met him, I talked about my business, the publishing business… how we launched a security token, which he found fascinating, but he was one of the people I went to and said, “Listen, tear this idea apart for me,” and he asked me a whole bunch of questions; I answered them; he was like, “Holy shit. This makes sense.” I said, “That’s what I think, too.”

Frank Curzio: We launched our security token, Curzio Equity Owners token, which will go free trading in July, and since we launched and since I… just covering that industry, it’s amazing how far it’s come. It’s amazing how many people are reaching out to us now, big companies, doing tens of millions, even hundreds of millions in sales… want to launch security tokens… and they’re calling us to learn how to do it, which is really exciting.

Frank Curzio:

But I remember, one of our talks, and he was asking me, “How big is your market?” And I told him how much our competitor is generating; nobody understands how big the financial newsletter market is. It’s a two billion dollar-plus industry, easily, a year in sales. It’s unbelievable, and it’s a high-margin business. It’s a very tough business to get the infrastructure in place: credit card processing, everything. We’re there and it’s cool.

Frank Curzio: But he asked me, “What are your goals?” And I said, “For Curzio Research, it’s pretty simple.” I said, “I want to win, and I’m very competitive, and I want to be the biggest in this space,” and he quickly stopped me and said, “That shouldn’t be a goal.” He goes, “I was the same way early on, I just had a big ego,” and it led him to making poor decisions. So he was like, “Go slow. Don’t be arrogant. Set small goals for yourself, your company”… just a lot of things that made sense from the mistakes that he has made.

Frank Curzio: And Scot is just one of the numerous people… I’m fortunate enough to be in this industry 25 years. I’ve helped a lot of people make money. I’m surprised, probably about 15 years ago, that the people who actually listen to this podcast: just business owners, so many great people; also, hedge fund managers and just… a lot of people have reached out, and I’ve reached out to them, and a lot of people have helped me. People have been through this process… again, you want to limit risk as much as you can, just like Scot mentioned with hiring the co-founder of TASER. I mean, just having the supply chain in order, making sure that you’re training these people. You know how hard that is?

Frank Curzio: I mean, what use is it if you get hundreds of thousands of orders, but yet you can’t fill them for three years? That’s not a good thing. It’s not a good thing. So, you want to limit your risk as much as possible, and Scot has helped me with that.

Frank Curzio: Just one small example of how he’s helped me, and just for you young entrepreneurs out there… and even for you older, successful people… no matter how young or old you are, how much experience you have, it doesn’t matter if you’re Elon Musk or Bill Gates, there’s always people who are smarter than you, always people that can educate you, and always people that can help you become a better person… a better manager, a better CEO. So, always listen. It doesn’t hurt to listen.

Frank Curzio: But real quick here, Scot’s also sharing another big idea with me, one of his next investments. It’s going to be open to credit investors; so, this is a private company that plans to go public in the future. I’m going to share that with my Curzio Venture subscribers over the next month or so. It is an incredible company. I already looked at it. I’m meeting with the heads over the next few weeks. It is really, really incredible… has me excited. I have lots of questions, but it looks really, really exciting. It’s something that I’m pretty sure I’m going to be… I’m definitely going to invest in if I give it to my subscribers.

Frank Curzio: But just a few questions… again, I like meeting people in person before I do this. This is very, very important, and this person is an entrepreneur, sold numerous companies; very, very wealthy, and he’s got a big edge on this massive market that is going to get bigger and bigger that few people are talking about, and it has me very excited. So, I can’t talk much about the company, but if I do give it to Curzio Venture subscribers, I’m investing in it, as well. I like to do that, so I’ll share that idea with you once everything is ready to go, once my due diligence is complete. Again, it’s going to take place over the next two to three weeks, because it is a private company. That, we’re going to be able to participate in the capital raise, and the plan is for this company to go IPO shortly after; that’s the plan.

Frank Curzio: And last thing here, just a quick disclosure: I am an investor in Wrap Technologies. I have not sold one share. I believe in their long-term story. I’m not someone that tells you, “Oh, this could go up 10X, 20X, you could make 5,000 percent next week if you buy before 3 pm today,” which we see in promotions. But when you see those promotions, there’s a nice disclaimer: “We cannot buy our own stocks that we recommend.” Even though we think it’s going to go up 10,000 percent and you’re going to be a billionaire, we cannot invest in it based on our policies; it’s not like that here. I eat my own cooking. I’m investing in the stocks. I haven’t sold a share, so I’m not coming out and pitching an idea. I just want to let you know, I am an investor in this. I just love it. I think the product makes sense. I think almost every police force will eventually carry it because it does save lives and it will save lives.

Frank Curzio: But I remain very positive in the name, which… it’s going to be similar to TASER. You’re going to have ups and downs and different orders. We’re in it earlier than anyone that’s going to buy it now, so if you do buy it, if you do like it, do your own due diligence, go to the website, ask millions of questions; assume I don’t know what I’m talking about; and if you do decide to come in, what I would do is I would suggest scaling into it, because it is going to be volatile. It was volatile. We invested in it at, I think, 3, 3.50, 4, and it went to 7, then it came back down to like 3.50, and now it’s at near 7 dollars again.

Frank Curzio: So, you’re going to see with that these companies. It’s based on orders, but they’re just starting to get in lots and lots of orders, and I think… the long-term story for me, it’s a 200 million dollar market cap. I could easily see this being a billion dollar company going forward. It may take two years, it may take four years, it may take six years, but it’s something I believe in, and it is a small cap, and it is risky, so just be careful, guys. I just want to make sure I have your back, we disclose everything, but yeah, I think there’s good opportunity there. But if you’re going to invest it in now, just scale and sort of be patient. Build your position up over time, because long-term, I really do like this stock, and only put in money that you can afford to lose, because it is a small cap. And again, I just want to be upfront with you guys.

Frank Curzio: Now, let’s move on to my educational segment. Here we go. Hopefully you’re paying attention.

Frank Curzio: So, what do we know about the coronavirus right now? And this is as of Tuesday afternoon, which I’m doing this podcast. By the time you hear it, it’s Wednesday, after the close.

Frank Curzio: So, we know that the infection number is 73,000, a little bit above that; deaths, close to 1,900. But I want to cover some of the things that mainstream media is not telling you. Let’s include some of the stories in the past two days, and news that comes out that’s on smaller but reputable sites, but for some reason, nobody cares.

Frank Curzio: So, one of the things… the CDC now admits that coronavirus can be spread by people who aren’t showing symptoms. So, there is people get the coronavirus, test positive, but don’t have any symptoms. You’re going to be working. If you’re in China, you’re going to go back to work next to people like this, and they could transmit that disease to you. We already knew that, but the CDC just confirmed it.

Frank Curzio: And it’s funny because China says, well, about 80 percent of our factories are now running. Of course, oil and gas sectors, electricity… all state-run companies. Of course, they’re not close to full capacity. They just turned on… it was off, now it’s on. So, most have been turned back on… again, not even close to full capacity, the workers working there. Macau’s trying to re-open their casinos. The government said operators can request another 30 day extension to prepare to open, and that was after the 15 day closure. But the government actually said this, that operators can request another 30 day extension to prepare to open, but after these 30 days… after these 30 days… they’re going to be required to open.

Frank Curzio: So the government’s like, “You’re opening. I don’t give a shit. You’re going to open. I don’t care how bad the coronavirus is. I know it hasn’t ended, but you’re going to open those casinos.” Think about that for a minute. The government is basically forcing these casino operators to open, regardless of risk. It’s kind of interesting.

Frank Curzio: Although we’re hearing signs that the spread is getting contained… I keep reading stories, it’s slowing down, it’s slowing down… we heard that at 20,000, 30,000, 50,000… now, it’s 70,000. It’s slowing down. Okay, if it’s slowing down, then how come cities in Wuhan, as of yesterday… Wuhan is basically ground zero for the coronavirus… they’re further tightening travel restrictions? So, this started on Monday; local residents will not be allowed to leave their homes outside of designated hours. If they do or if they disobey, they’re going to be subject to detention. You let me know what detention means. Detention here is not a big deal; detention in China, I’m sure it’s a really big deal.

Frank Curzio: So, for something that’s supposedly deescalating, coming down… risks are coming down… you’re putting on more restrictions. You’re tightening travel restrictions right now. It’s crazy, because there’s a story in the New York Times where they said this professor, who is 40 years old, teaches at prestigious college, China… her husband almost died. So, they are near one of the districts or one of the cities that have special rules with the lockdowns… not just lockdown, but listen to this, this was pretty cool. So, the husband almost died. He didn’t almost die from the coronavirus; they were eating dinner and eating fish and he choked on a fish bone. She left to take him to the hospital; they wouldn’t let him take it… you can’t. According to the neighborhood rules, only one person is allowed to leave the house.

Frank Curzio: So after a while, they actually saw the situation, they said, “Okay,” but who knows? I mean, maybe if that person is infected, now you’re at a hospital or whatever, but think about that scenario. You’re going to put someone in detention, detain them, whatever it is… for how many days, weeks… what do you do? I mean, this isn’t just about the coronavirus. People get hurt all the time. 1.3 billion people in China, 500 million are on lockdown. So, I’m sure some of these people are sick, and maybe they can’t make it to the hospital, but you can’t take them because only person is allowed with… I guess, proper paperwork or whatever it is, to travel, or to go to the hospital? I mean, that’s crazy. These are just some of the little things that are popping up.

Frank Curzio: I don’t know if you saw shipping companies… so, the shipping companies that carry goods from China to the rest of the world, they all saying that they’re reducing the number of seaborne vessels, and this is measures to stop the spread of coronavirus, which is killing demand for their services and threatening to disrupt global supply chains. This is on Tuesday. Have you seen the Baltic Dry Index lately? Take a look at it. In September, it was 2,500. It’s 434. It’s crashed, and they’re saying, “Look, we’ve got to take vessels off the market. There’s no demand. China’s shut down.” But again, no need to worry, because JP Morgan is all over this. JP Morgan has got it figured out. They say, “Peak Corona is only three weeks away. Our analysts estimate,” based on their model… they’re predicting the peak to occur in three weeks around early March. This implies a time scale of about eight weeks from global attention to peak, and they put in the wonderful sentence, “which is quite comparable to that of SARS in 2003.”

Frank Curzio: Why are you comparing this to SARS? It’s like comparing the global credit crisis to a recession, a normal recession, a normal pullback in the market. It was different. We needed measures. Without employers, it would have went over 30 percent. Nobody agrees with it, everybody hates that the banks got bailed out, but if you just left it alone, it could have destroyed the entire financial markets globally. You can’t compare that to, oh, we had a recession in 2002, or, oh, the technology crisis… no, this was different. This was leveraged. This was end of the world stuff. Yet, you’re comparing it to something that’s really… it can’t be compared to.

Frank Curzio: Mac Lipsitch… yes, that’s a real name. He’s Harvard Public Health… smart guy… talks about the coronavirus… widely followed. He says, “It’s likely we’ll see a global pandemic.” A pandemic happens… 40 to 70 percent of people worldwide are likely to be infected in the coming year. This is an article in the Wall Street Journal, actually. Again, nobody’s really talking about it.

Frank Curzio: You had people at Los Alamos National Lab. Okay, these are the guys that really nailed the cost of the 2003 outbreak for SARS. They modeled it, they nailed it, they got it right, and someone asked them, “What do you think about the coronavirus?” And they said, “Based on our models, at least 550,000 cases, maybe 4.4 million or something in between.” They’re only reporting, what, 73,000 cases? Based on this model, these are people who actually got SARS right… are saying between 550 and 4.4 million people. Think about the impact that that’s going to have on the global economy.

Frank Curzio: Let’s keep going here. Look at Hong Kong. Well, if you saw travel restrictions, the visitors… so, they usually average around 225,000 visitors per day. Since the start of this thing, it’s down to 3,000. How do you think that’s doing for their economy? And that’s the biggest point here, guys. What people don’t understand is the negative impacts that the coronavirus is creating. And I’m not talking about outside the normal things, like, wow, China’s economy is on lockdown and Apple… I’m talking about outside of that. And when you have 500 million people on lockdown and scared to go back to work, I mean, you can’t model it. You can’t model it. You have to use your common sense. Picture yourself… if you were in that situation, what would you do? You think you’re going to rush back to work? Absolutely not.

Frank Curzio: I mean, maybe if you’re single, and you’re 35, 40, and healthy, maybe… but if you have kids, are you really going to risk that and get the coronavirus, come back, and give it to your kids? If you go back to work, you’re probably going to get infected, and the death rate is creeping up. We haven’t seen that. I mean, with SARS, it was kind of like, oh, 12, 11, 10 percent… I mean, we’re seeing a death rate creep up? It’s probably below one percent, but really, if China… that’s the one thing negative thing about lying about your numbers, if they’re saying 73,000 people and only 70,000 are affected, it’s two and a half percent… which was below two percent, so that makes me nervous for leaving my… wouldn’t it make you nervous?

Frank Curzio: Let’s go with some of those impacts real quick, because you have Hyundai, which I mentioned last week… production shut down at its South Korea plant. South Korea? What are you talking about, South Korea? It’s crazy. But they’re not getting their parts from China. They’re closed down. 35 percent of all their production comes out of those plants. The London Fashion Show is huge. It’s this week. Not only do you have people wearing masks in London, but there’s several designers that said they’re not able to attend. They can’t show their clothing lines since China makes their clothes. It’s where they produce. I mean, China… by far, the world’s leading supplier of textiles.

Frank Curzio: The Olympics are being held in Japan. It’s only 157 days away, not that long. They’re already talking about it, of how they’re going to put risk measures in place. They’re talking about it. I mean, it’s not Zika, right, which scared how many athletes from going to the Olympics in Rio… I mean, just from a few people dying. Think about the impacts it’s going to have in Japan on our athletes. Are athletes really going to travel there? Because this thing… again, we’re not talking about a long time away.

Frank Curzio: I wanted to share a couple more things for you before I go here, because here’s some of the emails I’m getting from subscribers. An emailer… frank@curzioresearch.com… my job is to get this story right, and everything I see tells me you should fear this. This is a risk that’s serious, and with markets… we’re in a growth market, and stopped sharing at all-time highs… to assume that this is a short-term risk is absolutely crazy. If I’m wrong, no big deal. Lower your exposure to China stocks. You’re still going to have other stocks that are going to do well with no exposure to China. But if I’m right, it’s going to save you a hell of a lot of money, and that’s what we want to do. We want to protect those gains that we made, because all the newsletters… even you’ve got crypto-newsletters on fire right now. Crypto, gold… good safe havens are in this.

Frank Curzio: But you want to protect a lot of that capital, right? I mean, my job as newsletter writer… not just to give you ideas that you can make money on. No. My job is to be there for you when things aren’t good, and this is one of those times where I think you have to worry. Could I be wrong? Of course. Everybody could be wrong about everything, but it’s worth taking some off the table. Again, I’m not telling you to short the markets where you’re going to get destroyed and living on park benches. I’m telling you, just lower your exposure to some of these stocks.

Frank Curzio: In fact, Micron is getting upgraded. Wynn Resorts is getting upgraded. The worst is over. You’re out of your mind. Tesla, all-time highs. A lot of that growth is tied to China. We don’t know how long this is going to last. Apple just reported, they said we have no idea what our guidance is going to be. We can’t even give you a number. We thought the number between… whatever… 63 and 68 was good enough… 68 billion. It’s not. We have no idea. They don’t even know.

Frank Curzio: But here’s some emails I’m getting, and feel free, if you’re impacted by this, I want to know, because these are stories nobody is really talking about. And Aaron wrote to me that, “Hey, Frank, these posts showed up on Reddit. Take it for what it may, but they seem legit.” I like Reddit. There’s especially the furniture one, and he has, losing jobs at growing but small company that makes hearing aids, and then another one, Chinese textiles that make furniture not arriving until June. This person was told to prepare their resume. And he says, “Are you hearing anything like this similar from your subscribers and listeners?” I am. These stories are impacting lots of companies outside of China.

Frank Curzio: Brought up another company in New Zealand who just… all kinds of hardware for showers and they have all these orders… they can’t fill them. Sorry, we don’t even know. We don’t know when we’re going to be able to fill them. That’s crazy. Forced them to go to another competitor, or whatever, that doesn’t have exposure to China, for showerheads and stuff like that.

Frank Curzio: Looking at Ollie… Ollie writes in and says, “Hey Frank, I read your advisory last week about China.” This is Curzio Research Advisory. “Just wanted to give you a data point on it.” He goes, “We just moved and bought our first ever home in San Diego, where we just moved. We’re redoing the floors, and the vinyl planks we wanted were only partially in stock. No big deal, right? We have the first half now, and get the rest on reorder when it comes in. Wrong. The flooring store called their distributor, who is sold out. They say they have zero visibility into when they’d get their next shipment from China. coronavirus has ground everything to a halt.” He says these support your thesis. This is the impact that nobody is talking about in so many different businesses.

Frank Curzio: Then Bob writes in… this is a really good point. This is common sense. He goes, “Hey Frank. One thing I’ve not been hearing anything about regarding the coronavirus… what about the people in factories in China and elsewhere who physically handle the products that we buy? Wouldn’t that open up the possibility to spreading the virus to consumers from this source, as well? How would that impact the markets?” It’s a good question. I’m sure they will be sterilized or whatever they need to, but it’s a good question. I mean, if something is coming from China, do I really want to handle it right now? I don’t even know what the statistics or what they’re saying is true.

Frank Curzio: Remember, regardless of China and how much stimulus they’re going to push into the market, and how much they’re going to tell you about their figures not being good, and how much they’re going to say, “Well, we don’t need any help solving this. Don’t worry about it. What, you’re a professional, you’ve been doing this for 50 years? No, we don’t need your help. We’re going to keep this in-house.” Crazy.

Frank Curzio: U.S. companies… they’re going have to report earnings next quarter, and you’re going to see more warnings come out than you’ve seen probably in the last eight years. More companies like Apple are going to come out over the next month or two and lower their estimates drastically, and it’s almost every one that has exposure to China. Just be prepared, because when that happens… looking at Apple, it’s not going to fall two, three percent… a lot of these companies have even more exposure to China, they’re going to fall 10, 15, 20 percent. I mean, that’s how much these companies are up pretty much in the last five, six months. Just be careful. They’re not calling for that all out-market crash, but for stocks to be trading at all-time highs right now, assuming that coronavirus is not a risk at all is absolutely insane. So, lower your exposure to China. I provide a way to play this in my Curzio Research Advisory newsletter, along with dozens of companies that should be avoided at all costs… at least, lower your exposure. If you’d be interested in learning more and finding that, go to curzioresearch.com.

Frank Curzio: Again, I said last week, got a special offer; it’s 49 dollars for the year to subscribe to the newsletter. It is a 16 page report, details, and I’m going to continue to update it to all my subscribers, because this is a risk you need to take seriously. Again, I hope I’m wrong on this. I hope you come back and say, “Frank, you were wrong on it.” Again, I don’t want people to freaking die and stuff, but the things that I’m reading, what I’m hearing from everybody, is a lot different from what’s being reported, and you know what? You need to be careful. Not all the time… we’ve been pretty bullish for a very long time… this is one of those times we need to be careful.

Frank Curzio: So, guys, that’s it for me. Any questions, comments… I know I’m going to get a lot. I’m getting tons of emails. Again, email frank@curzioresearch.com, anything that you’re seeing about the coronavirus, positive or negative. I’m not looking for just negative stories. Just positives and negatives, different stories that you’re hearing… if things are coming back online, we want to know that, because then I’ll take my trades off or whatever, but I’m not hearing that right now. Again, the best source is real-time information from you. This podcast is getting bigger and bigger. Word of mouth… I really appreciate it. And the reason we get ahead of these things a lot is because of the trends that I hear from you guys when you email at frank@curzioresearch.com.

Frank Curzio: So, that’s it for me, and I’ll see you guys in seven days. Take care.

Announcer: The information presented on Wall Street Unplugged is the opinion of its hosts and guests. You should not base your investment decisions solely on this broadcast. Remember, it’s your money and your responsibility. Wall Street Unplugged, produced by the Choose Yourself podcast network, the leader in podcasts produced to help you choose yourself.

P.S. Last week, Frank released a special issue of Curzio Research Advisory… breaking down the truth about COVID-19—including the names and sectors to avoid… and his two favorite strategies to protect yourself from a possible market crash. Learn how to access these ideas today.

And if you haven’t yet seen Frank get “shot” by Wrap Tech’s revolutionary nonlethal weapon, watch the video now.