In 1993, an innovative investment vehicle started a revolution that reshaped the entire investment industry…

The exchange-traded fund, or ETF.

Thanks to ETFs, the average investor can now access most indices, sectors, asset classes, and entire markets without the aid of a money manager.

And more than ever, traditional money managers are feeling the pain…

On February 18 we learned a large asset manager, Franklin Resources (BEN), was buying a smaller competitor, Legg Mason (LM), for nearly $4.5 billion.

And on February 20, Morgan Stanley (MS) announced it was buying discount brokerage E*TRADE (ETFC) for $13 billion.

These two acquisitions tell a story of Wall Street competition and a low-commissions price war. (Asset manager and discount broker Charles Schwab [SCHW] went as far as eliminating most trade commissions altogether.)

They also tell another story… how ETFs reshaped the entire investment industry and made traditional money management less lucrative.

Today, I’ll tell you why ETFs are, to my mind, the financial innovation of the century. And the four things to look for before you invest…

Unlike any other recent M&A, the Franklin Resources/Legg Mason acquisition highlights the impact the ETF revolution has made on our investment options and decisions.

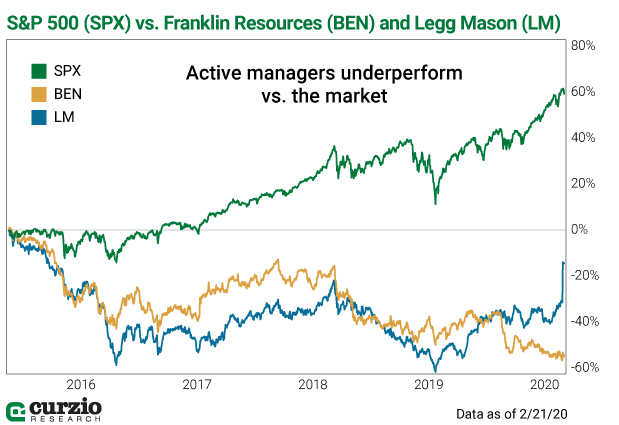

You see, while the market was rallying over the past five years, shares of both Franklin and Legg Mason were losing ground.

Both lost a large chunk of their value…

At the end of last week, while the S&P 500 was up nearly 60% over the past five years, BEN lost more than 53%. And despite the 24% pop on the acquisition news, LM still sits on an overall 14% loss.

What’s been holding money managers back so much compared to the market?

Loss of assets.

Investors have been fleeing the high-fee world of mutual funds and flocking to their fast-expanding, low-fee competition.

For generations, mutual funds—and all of their related fees—have been the only game in town for many investors…

But in 1993, the very first ETF—the famous SPDR “Spyder” ETF representing the S&P 500 Index—was introduced. And that was just the beginning. In less than 30 years, ETFs grew from a tiny newcomer to an industry giant. Last November, assets in all ETFs crossed the $4 trillion mark.

Today, many ETFs cost a tiny fraction of one percent in annual fees, versus an average fee of 1% a year for many actively managed mutual funds (not to mention the additional fees for buying or selling shares in these funds).

In the past decade alone, U.S. equity index mutual funds and ETFs have grown by $1.6 trillion in assets. Over the same time, their actively managed competitors lost almost as much, some $1.4 trillion. And it’s no wonder…

With just one single ETF, the average investor can do things like:

- Purchase all 30 members of the Dow, via the Dow Industrials SPDR ETF (DIA)

- Invest in gold, via the Gold SPDR (GLD)

- Or buy into every corner of the bond market, via the Vanguard Total Bond Market ETF (BND)

ETFs are also great for adding focused exposure to the entire market (like the S&P 500 Index) or its narrower corners (like energy or utilities). With an ETF, you can now buy a position in pretty much any corner of the market, no matter how obscure or remote.

They’re even a good choice for international investing, allowing easy access to most world markets.

And because most ETFs are passively managed, they are much more transparent than mutual funds.

With so many low-cost ETFs out there today, it’s easy to get confused or make a bad investment.

Here’s are four things to consider when selecting an ETF:

Not every ETF is created equal. Most ETFs are passively managed, since they were invented to mimic the leading market indexes. As such, most ETFs are market-cap weighted: the larger the stock is, the higher its role in the ETF (you’ll often have a larger position in Apple, for example, than in Xerox just because Apple is larger).

Some ETFs, however, can be equally weighted. In such a case, every stock, whether Apple or Xerox, would be initially assigned an equal position.

A newer crop of ETF can even be actively managed. If, for instance, Xerox is deemed more attractively valued than Apple, it could carry a higher weight in an active ETF.

Always read the prospectus or, at the very minimum, familiarize yourself with an ETF’s detailed description. Review the fund’s largest holdings and make sure the fund addresses your investment goals. All this information can be easily found on the fund’s website page.

ETFs may charge less than mutual funds, but they aren’t always cheap. Always review the costs—the fund’s expense ratio—before committing to an ETF, especially as a long-term investment. Some popular financial websites don’t provide this information, while others, such as Yahoo! Finance, make the expense ratio easily available.

You can often find a fund’s expense ratio under a “Summary” tab. And don’t forget that you can always go to the fund’s website to review this metric and more.

Watch out for liquidity. All else equal, large ETFs will be easier to trade… and are often cheaper because of it.

Better liquidity also results in a narrower bid/ask spread–and can save you money if you tend to trade rather than invest.

Understand the risks of leveraged ETFs. It can be easy to confuse the two main types of leveraged ETFs… Some track and profit from gains on a specific market or sector, while others track and profit from the losses. Another important thing to remember is that leveraged ETFs are riskier than traditional ETFs… Your gains will be magnified (that’s the “leverage” in the name), but so will your losses.

The key when picking ETFs—or any investment—is always do your homework.

Always know your investments, their costs and risks, and watch out for any overlaps ETFs might have with the active portion of your portfolio.

ETFs are a great way to passively invest in a market or sector while limiting your expenses. And while there will always be a place in our portfolios for traditional stock, bond, and gold investments, more and more investors are turning to ETFs… a quick and easy way to diversify your portfolio in any market.

ETFs have given the entire industry a $4 trillion dollar reason to rethink the way they approach investments and fees going forward…

These vehicles are the best thing that ever happened to the individual investor. And I encourage you to take advantage of them.

Editor’s note: For another ridiculously easy way to diversify, check out The Dollar Stock Club. This portfolio includes sector ETFs… gold miners… fast-growing techs… income plays… and other little-known opportunities selected by Frank’s “who’s who” of industry insiders. Join the club, and get a new, thoroughly vetted stock pick every Thursday… For only $1.