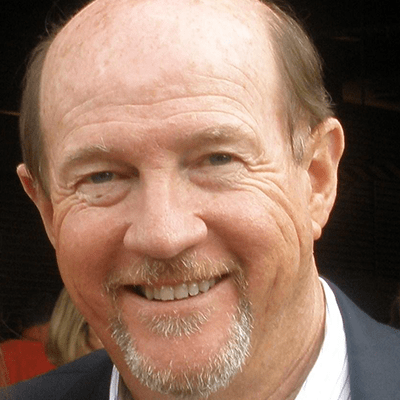

This week, I sat down with legendary Texas wildcatter and president of Chisholm Exploration, Cactus Schroeder.

If you’re not familiar, Cactus is one of the smartest men you’ll find in the oil business. For 40 years, he’s drilled around the most prominent basins of North America… including involvement in over 1,000 drilling projects. In this episode, Cactus and I discuss the hardships going on in the oil industry right now… And why there’s more short-term pain ahead. We also take a look at oil prices and talk about what needs to happen before drillers become profitable again. [22:16]

Regular listeners know I’ve been bearish on Disney for a few months now. In my educational segment, I break down why I’m still bearish on this massive media company, and why I believe it could fall hard from current levels. [59:12]

Frank Curzio

Ep. 716: Why oil prices could crash 75% from current levels

Wall Street Unplugged | 716

Why oil prices could crash 75% from current levels

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you, on main street.

Frank Curzio: What’s going on out there? It’s April 8th. I’m Frank Curzio, you’re listening to the Wall Street Unplugged podcast where I break down the headlines and tell you what’s really moving these markets. Congratulations. We’re in a bull market. We’re up 20% off the highs, based on definition of bull market. That’s a bull market. So buy, buy, buy, pretty crazy, especially on Monday, the market surged 7%. And if the S&P 500 goes up 5% a year, that’s really good. It’s been going up a lot more than that lately, in past years.

Frank Curzio: But we’re talking about one day, 7% surge. That was on news that the amount of coronavirus those cases in New York city may be leveling off. You can also see much fewer deaths than were previously modeled, right? And of course, that’s great news. It’s the news we all want to hear when this thing is going to end. But when I look at what the president was saying just on Friday, prepare for the worst two weeks of our lives. Meaning that it’s going to get worse the next two weeks, but let’s celebrate because that’s going to be the peak. Almost to the point where people believe that it’s over. Not that it’s going to slow, we’re seeing a light at the end of the tunnel, a small light that it’s completely over.

Frank Curzio: And it’s just surprising, two days later after the presence said that, administration, again, I’m not picking on anyone. It’s not political or whatever. I’m just tell me what he said, but two days later, after saying the worst two weeks of our lives, now it’s corona virus cases, the infected are leveling off. Which means, we may be able to restart the economy soon. Again, we’re all hoping for that. But for the markets, a surge to these levels, it’s pretty insane. I understand. Yeah, all of us in the US, it’s been a horrible period. I get it. The US is in dire need of good news, and here it is. So I understand these people jumping into stocks on Monday with S&P pop 7% one day, followed by a 1,000 point move higher on Tuesday before it gave up all those gains. And now I’m doing this mid-day, close to one o’clock and we’re up 600 points on the Dow, a little over 2.5%.

Frank Curzio: And when I look at the names that are going higher and these rally, especially on Monday, these are the names that are generating no revenue, or will be impacted the most. You’re looking at airlines on a rebound. Casinos, retailers, cruise lines. Some of them pop 20%, 25%. Again, these got hit the hardest, and are bouncing up. But some of these names have surged 25% plus, this week. And you have to ask yourself why? Why would that happen? It’s because those are the names with the high short positions. A lot of these companies could go bankrupt. When will people get to go on cruises? Are they going to go to restaurants? I don’t know. Well, back to restaurants, is it going to happen right away? I don’t know. A lot of these companies are in trouble. They can’t pay their rent. So I understand people shorting them saying, “All these guys are done.”

Frank Curzio: With that said, when you had the highest short position and these names start moving up, say 10%, 15% you’re short member. You can get destroyed. They keep going higher. So short investors, they get squeezed, meaning they have to start buying back their positions, which pushes the stocks even higher and higher and higher. That’s definition of a short squeeze. But before you run out and buy stocks, before you have that fear of missing out, which I’m getting so many emails about, I want to go over a couple of things with you. Let’s start with past recessions. So we have 14 of them dating back to the great depression, 1930s. The average recession lasts 13 months. And during these periods, GDP declines an average of 5% while unemployment averages around 9%, a little bit above 9%.

Frank Curzio: We are in month two of the recession. When these numbers come out and they’re going to be revised, GDP number revise, revise, revise, get revised three times. In six months, nine months from now, we’re going to say, “Okay, the recession started in, probably, February, late February. So we’re two months in. That’s it. So looking at that, and then going into the GDP numbers, right? Expected to fall, is what we’re hearing out there. This is consensus. Fall by 25%, plus, next quarter. And I’m hearing as much as 50%, but 25%. But everything is closed, and everyone’s on the impression that Q4 everything’s going to go back online, right? Because Q3 is where you’d be seeing negative numbers as well.

Frank Curzio: And unemployment is to surge to at least 15%. It’ll probably be over 20 and that number is going to… It’s not going to be the most accurate number because the government is paying companies to keep their employees. So if you take a loan from the government, you can’t find your employees while you take that loan. And there’s little clauses in there, if you saw it, that you might have to pay it back. They don’t know yet, which I think is great, but it’s pretty crazy. Banks are we going to be reporting soon. They going to let us know exactly what’s going on. There’s going to be very, very important conference calls. You probably won’t have to listen to them because it’s going to be headlines everywhere, what exactly is going on.

Frank Curzio: So, let me say these numbers again. Average recession, 13 months. That’s based on… Average GDP declines an average of 5%, unemployment is around 9%. We are projecting 25% declining GDP this quarter. 15% plus, in unemployment. Again, that’s going to be very conservative. I see the number go high. And we’re only in month two. So do you really think that it’s only going to take two months to fix everything here? It’s just two months. Just a blip on the radar. That’s it. Something that we’ve never dealt with in the history of our country, something that we’ve never dealt with. Total lock downs, complete lock downs every place. This is new to anyone, to everyone. Every doctor. They don’t know. Nobody knows. There is so much uncertainty. Just the models, look at the models. Everybody says models, models. You want to think about models? Look at models. I see them the most when I’m in Florida for the hurricanes, and there’s like 15 models, and you have the European model. They’re all wrong every single time. They’ve been wrong on every single time.

Frank Curzio: These are the guys who spend a fortune on these models and they’d been wrong to where these hurricanes are going to hit, because it matters to the people in Florida, and in Georgia and the Keys and stuff like that. And they’re always wrong. If you go from like… And they are even wrong up to like the week, week and a half, it’s going to hit. Like even a couple of days come in. So we’ve got to be careful with models here because we really don’t know. This isn’t like something we can look historically and say, “This is how it happened.” And that’s what we’re doing here. We’re comparing it to SARS, which was a nightmare.

Frank Curzio: I’m comparing it to past recessions. Based on that, dire situation here. But people believe that, “Hey, this is going to bounce back and people are going to be just fine. Everything’s going to be okay.” If that’s the case, why is the government scrambling to provide more loans to small businesses if everything’s okay? Why is it meeting with banking executives today? Why is it meeting with oil companies, the executives, the travel industry executives? You have to realize this is not a short term problem. I wish it was. I really do. I thought it would be, just with China being infected.

Frank Curzio: But once it spread to the world, you put on any news channel, pounding at our head, “You need to stay home no matter what.” When the reason why we need to stay home is because we want to stretch out that curve cause everybody can’t get sick at the same time, because if they do, we don’t have the supplies in the hospitals. But it’s gone from that to being totally scared, and scaring the hell out everybody. If you get this… Listen, not Fauci said that two million people max, would get this. I don’t know if it’s going to be right or not. You can even go higher than that if you want. Go to three million, 3.5 million, if we did nothing. That’s what he said, many people would die. That’s 0.6, 0.7% of our population.

Frank Curzio: The 99.39 9.4% of population is put on hold and doing nothing while this happens. So you have to be careful because, when you look at those rates, it’s not so much of a health scare, where if you get it, most people recover. Yes, we know it’s different with old people. But to scare people to the point where they’re going to change the way they do things, it’s going to crazy. And when you look at these recessions and past recessions, it’s a reason why we always retest lows in recessions, because there’s numerous problems that come up that we don’t see. Like the coronavirus resurfacing after New York is told to go back to work at the end of this month. Do you think that’s crazy? That’s what Dr. Fauci is predicting right now. I don’t know if he’s going to be right. He doesn’t know if he’s going to be right. Nobody knows. But if you look at past data, they resurface. If they do, are people going to go back home again? That’s not priced in right now at this market. No way. And that’s a possibility. I’m hoping it doesn’t happen. But that’s massive uncertainty.

Frank Curzio: You’re backstopping small business, like Cheesecake Factory, that said it can’t pay their rent no more. You’re paying most of the employees full salaries while they’re unemployed. Yet, you’re not backstopping the reits. Who owned the malls where Cheesecake Factory stores located? So if Cheesecake Factory is not paying their rent, do you think other people in the mall is going to be paying rent when they’re closed? No. They’re going to say, “Well, Cheesecake is not paying. Why am I going to do it?” That’s what’s happening right now. So what happens if these companies don’t get paid their rent, when you’re looking at rates, these mall operators? What happens? What happens if they shut down? These are companies that are paying the lighting bills, energy bills, security guards. If they shut off, none of the stores can operate. But are you bailing them out? No. I haven’t heard yet. I don’t think so. But you’re telling everyone they don’t have to pay rent. That is definitely going to impact them.

Frank Curzio: Russell 2000, 30% of these small caps never made money. They’re not profitable. That’s okay. Since they were growing faster than the overall market for many, many years. Most these companies are doing well and growing again. And if you’re a small business, again, you want to make those numbers so you’ve got to probably pay taxes as possible. Right? But most of these companies have high yielding debt, which they had no problem paying. That’s fine. Again, they’re growing. The cash flow is coming in. Now these couples are completely shut down. They’re not generating revenue, a lot of them. And the high yield debt, that market’s not being backstopped by the government right now. That’s directly tied to small businesses, which you’re throwing all this money at, and trillions and trillions and trillions at.

Frank Curzio: You’re looking at a $21 trillion economy for the US, right? That’s our GDP. You think $2 trillion is really going to help when we shut down everything? Are you crazy? I mean trillions more are going to come into the system. Maybe that’s why people say, “Well, I could buy it because the government is there.” It doesn’t matter how much money you give to people, you give it to them, what do you think they’re going to do with it? Do you think when they get those checks in the mail, the stimulus checks, you think they’re going to go online immediately and spend that? They’re going to put it in savings. They’re scared to death right now. How is that going to filter in the economy in the short-term or… Short-term is usually considered one year, but even longer-term, when people are fearing for their jobs?

Frank Curzio: And what happens when things open back up for restaurants, bars, casinos? And you’re looking at restaurants, guys, they’re definitely going to practice social distancing. They’re going to remove, conservatively, at least 20% of the tables to make sure there’s distance between everybody. Slot machines, the same, at casinos. They’re going to have spaces in between them so you don’t have like 10, 15 in a row, which means you’re taking fewer slots on the floor.

Frank Curzio: I don’t know if you know this about most small businesses, but most of them have less than three months of cash, or three months in working capital. And we’re going to be pretty much shut down for a little while, probably through this month and into May, if I had to guess, no matter how much optimism it is. I have to tell you, even when we come back online, a lot of these companies, minimum, are going to see a 20% decline in sales, restaurants, casinos. The social distance is going to be practicing. And I have to tell you, with small businesses, you guys know as well. Talk to your friends who own bars, who own restaurants, very tough businesses.

Frank Curzio: If you tell them that they’re going to generate 20% less revenue, that’s the difference between them being open and going bankrupt. They can’t operate the shop. That’s a big margin. That’s a big number for most… imagine if Apple… Again, Apple is another story. But they said they’ve got to produce half the amount of iPhones, they don’t know if they’re going to come out with a new one this year. You have over 150, probably over 200 companies now that removed their guidance from the market. So you don’t even know what the hell they’re going to earn. They don’t know what’s going on. Some suppliers are still… We had Avago come out and say, “We’re seeing supply disruptions.” They supply the whole, all the major technology companies, every major mobile phone manufacturer, the laptops, Dells, Hewlett-Packards, all of them. That’s one of the major suppliers saying, “Our supplies are not all online yet.”

Frank Curzio: So, if you don’t have the parts to make an iPhone, how do you sell it? That’s where we are right now. Everything’s all locked down. And China’s kind of on lock down. They may say, “Oh, everything’s going back to normal.” It’s not. It’s not going back to normal. Not right now. Yeah, they might have opened some of these places, but they’re the operating at 25%, 30% capacity, when you talk to the people who actually live there, and work in these factories. And forget about what the government is reporting.

Frank Curzio: The most important thing I could tell you, because at the end of the day, the numbers do matter. You’ve earnings. They drive stock prices. It’s always been that way. It doesn’t even matter the quality of the earnings. It could be through buybacks or whatever, financial engineering, whatever it is. But as long as your earnings are going high, you deserve a premium, and that’s fine. But that’s what drives stock prices, especially through the growth market. Even though it’s trading at a very expensive multiple because we have super low interest rates, which yes, we do still have, in government help, but because you’re seeing that growth continue. Now it’s shut off. And now let’s look where the market is priced today, compared to know the earnings that street thinks these companies are going to make in 2020, which amounts to around a 5% decline in 2020 earnings from 2019. That’s a consensus estimate.

Frank Curzio: And just to put a number on, it’s around 156. That’s a total amount. $156,000 is the total amount of earnings for all S&P 500 companies. Stay with me here, because trust me, this is extremely important. If you’re thinking about going in and blindly buying stocks here and just going crazy because you’re looking at some estimates come down to 120, 125. But right now, the consensus, when they’re telling you on TV that a company’s trading, “Hey, there’s companies trading at 19 times earnings, at 20 times earnings.” They base it on numbers that don’t exist, that are very, very, very, very aggressive. And even based on these numbers, even if we’re only going to see a 5% decline, we’re trading at 19 times forward earnings right now. It’s the same multiple we trade at in early February right before stocks started to crash. Except, we deserved that multiple back then, because things were growing.

Frank Curzio: Everything is shut down. Not just us, the world economy is shutdown. 19 times forward earnings. And you want to put that in perspective, the average multiple for the S&P 500 over the past 10 years is around 15.5 times. During grow times, we usually see 17 times, or 19 times, which we saw. During recessions, that multiple bottoms out at 10, like it did during a credit crisis, but usually comes back around 12 to 13. That might not sound like a big deal to you, right? Well 19 to 13, that’s a 30% decline from current levels. And again, that’s based on using the current estimates which have not really been updated. You have a 5% decline in earnings year-over-year.

Frank Curzio: And now for the bad news, what happens if earnings fall further? For me, I’m saying 25%. I think that might not be enough. Again, everything’s shut off. Well, 200 companies removed their guidance. They have no idea what they’re going to earn. And you have Disney Parks shut off. Nobody’s going. The revenue, the earnings is shut off right now. But if you look at a 25% decline in earnings from last year, which I think is reasonable, that puts the S&P 500 earnings for this year at around 120 bucks. So it’s down 25% from the $162 in total earnings that we earned in 2019. Please stay with me. I know I’m throwing numbers at you.

Frank Curzio: But based on the 121, which is a 25% decline in earnings, right now, we’re trading at 22 times forward earnings, which is the highest valuation we’ve traded in, in pretty much two decades. In a market where almost every company is on lockdown. Think about that for a minute. You’re looking at analysts on TV that say, “We believe it’s got to be a quick recovery.” And common sense just says that’s crazy. Why? Because even if you’re looking at companies, listen to what they’re saying. They’re coming out and saying they drastically cutting capex. Capex is the money used to grow your company, upgrade facilities, used for M&A, mergers and acquisitions, buying other companies. They’re cutting back 25%, 30%, 40% some of these companies. So if they’re cutting capex that much across the board, how can they grow at the same rate as they did in 2019, even with the government support? They can’t.

Frank Curzio: So, I would say we’re at a more dangerous market today, based on valuation, than we were back in early February. And I’m not saying this to scare the hell out of you. I’m just telling you what I see. And that’s what I do here. I don’t have an agenda. You haven’t seen me bearish in a while and I’m not just pouring it on here. These are the numbers that I’m seeing. This is what I based the call on in early February and said, “Guys, you got to take profits here. We’re shutting off the growth engine of the world in China. And we’re trading at a huge growth multiple, and a lot of these companies depend on China for their growth, like the McDonald’s, like the Starbucks. A lot of technology companies, Apple, shut off.

Frank Curzio: But it’s pretty crazy when you’re looking at those numbers, those are simple numbers I’m giving you. And what do you think, if you had to guess, just on a percentage-wise, even if you’re not a math person, or you’re not into the stock, but you just like buying stocks here and there, what would you say earnings are going to decline this year from last year? You think it’s just going to be 5% with every business shutoff. And not only that, 35% of these profits come from overseas, and they’re all on lock down. What do you think that number is going to be? Maybe you say 15%. Maybe say… If you’re even saying anything more than 5%, or even at 5%, we’re 19 times from our earnings, which is insane.

Frank Curzio: The one market that I’m getting tons of questions on is energy. A lot of debt, prices falling, is there going to be a deal between the Saudis and/or basically OPEC and Russia? And even some of the best names are down 70% plus, as oil has crushed to $20 a barrel before recovering a little bit. I’m seeing little bit of bid under these names in the past two days. The president is very hopeful that OPEC, Russia, they’re probably going to come to the table. We’d get a supply agreement. Because right now, they’re both flooding the markets with oil at a time where, Holy cow, there’s no place to store this stuff. And look at demand. When we look at demand, there’s no planes in the air. There’s hardly any cars on the road. The factories aren’t operating, falling off a cliff, 30%, 40%, 50%.

Frank Curzio: So, I know a lot of you may think some of these names are cheap. But if you listen to my next guest, which I think he’s probably going to change your mind, you may think differently. That guest is Cactus Schroeder. And if you’re not familiar with Cactus, great friend, one of the smartest guys you’ll ever meet in the oil industry. Super connected. Knows many of the higher ups in major oil companies. He’s been doing this for over 40 years, wildcatter. He’s a founder, president of Chisholm Exploration, oil exploration company, and lived through tons of these ups and down cycles. Tons of them. And when I say is a great friend, this is the person that taught me about fracking, 2010, 2011.

Frank Curzio: So, I flew to Texas Midland. I asked to take me on a tour of Midland and which is the Permian basin where it’s located. Took me on rigs and showed me exactly… I just asked a million questions. So it was great. Also, every County in the Eagle Ford we drove through, and we spent like a good week doing this, he’s probably sick of me. But it was an amazing experience for me. And just to see from someone who’s lived through these ups and downs, these cycles over and over again, I asked him to come on the podcast. He agreed. Cactus is not a perma-bull or a perma-bear. If you listened to him previously. If you’re new to the podcast, you may have not heard from him, but he’s a guy that bases decisions, because he makes a living drilling wells, finding oil. That’s how he makes his decisions.

Frank Curzio: This isn’t like an analysis going, “No, I think this has got…” No. He makes a wrong decision, he loses millions. So the information he’s getting is from his boots on the ground, what’s going on right now in Texas. And this is the guy that always calls it how he sees it. It’s going to be a fantastic interview. Guys, if you have a position in oil, any oil company, or thinking about taking a position, please give this interview a listen. It’s going to be worth it. And let’s get to that interview with Cactus right now.

Frank Curzio: Cactus Schroeder, thanks so much for joining us on Wall Street Unplugged.

Cactus Schroeder: Oh Frank, it’s so great to be here and to hear your voice again.

Frank Curzio: Well, pretty crazy times right now. And I know that you’ve lived through numerous cycles in oil industry, where you’ve seen oil crash, you’ve seen it bounce back, recovered over $100 a barrel during peak times. How is this crisis different?

Cactus Schroeder: Well, I think what has made this crisis different is throwing in the coronavirus, which is just, demand was already being heard quite a bit. And then when you throw this in, and all the airlines shut down, the commercial boating and luxury liners have shutdown, that it’s a perfect storm of demand destruction plus just throwing millions and millions more of crude oil on the market every day. And there’s basically no place to put it. The pipelines are full, the refineries are full, the storage is full. I just read an article in the Wall Street Journal that talked about Saudi loaded up all these oil transport ships and nobody will take them. They have no place to sell the crude. They’ve produced the crude, but in the ships, and none of their customers can take it because they don’t have any place to put it.

Cactus Schroeder: So, it’s a pretty dire situation. And unless is done pretty rapidly, there is going to be another price collapse. I’ve already been notified by Sunoco that what they’re going to pay me for my crude, the difference between April, I’ll probably get about $25 per barrel oil for my crude. And then, May, I’m going to get single digits, probably around $6 a barrel. And by the time you take out taxes and trucking and things like that, I’m basically producing it for free. And so I’m not going even going to get my operating costs out of it. So if it goes to single digits, we’ll have to shut it in. And it’s just kind of depends on who’s in the best financial shape, are the ones that’ll survive.

Cactus Schroeder: You’re going to have companies like Chesapeake and one’s already filed for bankruptcy, Whiting Petroleum. They’re the largest producer in Williston Basin, which is the Bakken Shale play, has already filed for bankruptcy. And the producers are just the beginning. At least they have a certain amount of cash that some of them stuck away, and some of them not at all, and some of them hedged their production. But the poor service companies are going to get slaughtered. The service companies, basically, are going to have no work, because everybody is going to shut down their drilling, and work overs, and completions and everything along those lines.

Cactus Schroeder: And if it goes to single digits, they’ll have to shut down their production. And I’m not looking forward to that. And it’s just the perfect storm between the coronavirus and the problem with Russia and Saudi Arabia.

Frank Curzio: You know, before we get to Russia, Saudi Arabia, which is very, very big deal, because that’s what they’re talking about in the news right now, and the president mentioning OPEC, and everybody may be coming to the table, but could you explain what that means? How much you’re going to get for barrel now, and how much you’re going to get for a barrel next month, to people who are not in the oil industry, what does that actually mean? That your next month they’re telling you, Sunoco… Like who is Sunoco and it’s $6. What exactly does that mean?

Cactus Schroeder: Well Sunoco, who is purchasing it, well, Sunoco owns pipelines down to the trucking of the oil, and then they’re there. Parent company is Energy Transfer Partners, who also owns a lot of pipelines. And Sun owns probably, I’m going to say eight or 10 refineries. Well, the reason that they’re putting the price so low is, if they bought the production, there’s no place for them to put it. And so without any type of storage, you’re kind of sunk. Trump initially wanted to come in and buy excess production to up our emergency petroleum reserve, but Congress shut him off from doing that.

Cactus Schroeder: Now he’s going to rent space so that if somebody wants to rent space in those salt domes, they can rent space, but they’re all in there, and continue producing the oil. But that’s only going to last a very small amount of time. The only storage that I’m aware of right now is, we’re storing this and salt domes, strategic petroleum reserve. But other companies might look into these salt domes that, particularly around the Houston area, and probably between Houston and New Orleans, and start putting crude back into salt domes, privately held salt domes.

Cactus Schroeder: That’s kind of an exercise in futility. You’re pumping it out of the ground, transporting it to the salt domes, and putting it back in the ground. Why don’t you just shut in your production? So that’s probably not going to make any sense for them to put it in their own salt domes. But the space and the strategic salt dome that the United States owns will probably be filled up within a month. And so the biggest thing right now that we can do is shut down our production, or come to some type of agreement with Russia, Saudi Arabia, where we cut down on our production.

Cactus Schroeder: But I think the bottom line is, we don’t have to reach an agreement. We already are, just based on price. And even Saudi Arabia and Russia cannot survive with $5 or $6 oil. And as you saw with this Wall Street Journal article, well I guess it was… Let me see here. It was in Wall Street, April 2nd, last Thursday. And they have all this oil and no place to go with it. Nobody wants to buy it at any price. And so it’s a pretty critical position that we’re in. Everybody’s going to have to come together and shut it down for a while. Some of these reservoirs can be damaged if you shut them in. Not all of them, but some of them. And the other part is, when do we go back to semi-normal society, where people are going to get on an airplane and go on vacation, and become consumers again?

Frank Curzio: Well, talk about the price, because thanks to you, and we have great history together where you took me through every County in the Eagle Ford, the Wilson Bay, Midland and just Permian everywhere, right? So I got a full crash course of exactly fracking, and I think it was 2010, 2011 around there with you. I know you probably got sick of me if all the time and all the questions I asked you, but…

Cactus Schroeder: Not all.

Frank Curzio: So, talk about the price that these companies need, because I’ve seen them report that, “Hey, we could produce for under $30 a barrel in some places in the few counties within the Permian.” But you brought up a good point when we talked off air, that these guys really drilled these projects first, and then it’s usually, the cost of that for the rest of the wells are a lot more than that. But talk about the pricing. What price do these guys need? And I know it’s different from the Permian. We’re talking about shale producers here, from North Dakota, but what price do they need to make this economical? Are we looking at $35? Is it $40, $45?

Cactus Schroeder: I think there’s very few places that can produce at $40 a barrel. Now, I’m talking about in the United States. There are some areas in Saudi Arabia, vertical production, I understand they can produce it at $3 to $6 a barrel. I find that hard to believe. But that’s a different kettle of fish. In the United States, the biggest part of our production is horizontal shale production. That’s what’s really grown us to be energy independent. And I don’t think even at $40, that they can break even. I think $50 oil is a lot closer to break even for the folks in the Permian basin.

Cactus Schroeder: If you start getting up into the Williston basin and the Bakken Shale, because it’s so much colder temperatures, the rock’s not quite as thick, it’s a higher price point. I think that they have to have $55 to $60 oil for them to break even, from what I’ve seen. And the largest producer in the Bakken has gone bankrupt. That should tell you something right away. And he sits on the president’s council. Anyway, that’s a pretty sad state of affairs. Scott Sheffield, the head guy at Pioneer, he came out the other day and he said probably 50% of the public EMPS are going to go bankrupt over the next two years.

Cactus Schroeder: So, a lot of those public EMPS have hedged their production anywhere from 12 months to 18 months. Some of it, they only hedge maybe 30% of their production. Some of them hedge as much as 70%, 80% of their production. But when those production hedges go away, they are just as dead as the people that didn’t. So they can only survive so long with those hedges, and cutting back their personnel, shutting down their drilling operations. And you hate to produce oil at a loss. If it goes to $6 a barrel next month, there’s no way they can produce it at that. Every barrel they pull out of the ground, they’re losing money.

Cactus Schroeder: And as Rick Roll says, you can’t make it up on volume. So things are going to get pretty dire in the industry over the next, I want to say, 30 to 120 days. And it will continue getting bad until we get back as a society, using the same amount of production we were using back in January or December. Russia and Saudi are going to have to do something. They will do something. I’m not sure exactly what they’ll do, but they are being just as bad a shape as anybody else. And they don’t have other industries around, that that can back them up. Russia has mining, probably, but Saudi Arabia, 100% of their economy is petroleum-based.

Frank Curzio: When you talking about the supply numbers, just to bring the audience in here, think about how much oil we use. There’s much, much fewer cars on the road. You just drove from the Mexico to Texas yesterday. You were telling me you barely pass any cars at all. You’re looking at all the airlines grounded? You’re looking at the factories shut down right now. So massive amount of supplies, almost no place to store it. Why would companies, when you said they don’t want to produce and not make a profit, but why would companies continue to producing? Because I know we’ve also touched this offline, which is a result of the pipelines, because no one’s really talking about the pipelines. But what about the current wells that are completed that are currently pulling oil out of the ground? It doesn’t seem like these guys are stopping them right now.

Cactus Schroeder: Well, I think everybody, every company is different to a certain extent. They all got, basically, the same problem. But some companies have production that they really can’t shut in, like some of the major oil companies that are doing these big time floods in West Texas, or the people that are offshore, that it makes it pretty tough to just shut in that production and with all those facilities out there, particularly going into hurricane season. So anyway, it’s not as easy as it sounds, walking over and turning a tap on a faucet is way over-simplification, because you do get into reservoir destruction when you shut these things in.

Frank Curzio: Yeah. That is interesting. But even with the pipelines, right? These companies have contracts with pipelines. Do the pipelines forgive them, kind of like with some of the… What the president’s doing, where you have companies like Cheesecake Factory saying they can’t pay their rent, then we’re okay, we’ll backstop that. Nothing’s being backstopped here. These still expect to get paid and get that oil in the pipeline, right?

Cactus Schroeder: Yes. And there are contracts out there too. Say, if you’re a production company like Pioneer, and you’ve made a contract with energy transfer partners to put X amount of barrels in their pipeline per month, and if you don’t, you’re going to get sued. Well, it goes to $6 a barrel, most likely the pipelines are full already, and they can’t get any more in there. So is Pioneer going to sue ETP because they can’t get their oil in there? Or is ETP going to sue Pioneer because they shut their wells in and aren’t putting any crude in there at all? So it’s kind of the old chicken and the egg story. It’s going to present a lot of potential lawsuits. I don’t know where it’s going to go. All I know is the bankruptcy attorneys are going to be very busy. And that’s… I don’t see it doing anything but getting worse, even if…

Cactus Schroeder: We’d have to have a perfect storm coming the opposite direction, where we have a cure for the coronavirus, and everybody can go back to 100% normal, and Saudi Arabia and Russia reaching an agreement that’s mutually acceptable to both of them, to try to prop up prices in the $50 per barrel range. So I think that the chances of that happening aren’t real good anytime in the next 120 days. I’m optimistic because I’m seeing a lot of the Corona virus where it’s plateaued in some areas. But when’s the next time you think you’re going to go out in public and meet somebody new and shake their hand? Shaking hands might be become a thing of the past, even if we do get vaccinations for it. It’s really turned around the way we live. And restaurants, are they going to have to reduce their seating capacity? Are they going to… A restaurant that can seat 100, can they only seat 50 now because they have to keep a certain distance from one another? Waiters and waitresses are all going to have to wear face masks and plastic gloves.

Cactus Schroeder: You have a certain amount of folks out there that have been really rattled by this. You’ve had some people that were already germaphobes to start out with, and it’s going to make that nothing but worse. And then also, people that are in that really tough group of being either 65 and older, or have existing health conditions, whether it’s emphysema, or a bad heart, or any number of underlying conditions that are going to keep people from going back to any type of way of life.

Cactus Schroeder: I know for me, I’m 65 and in good health, I’m going to think I’m going to go back to a fairly normal life. But I don’t think I will ever get on a cruise ship again. I saw how people got trapped in there and couldn’t get out. And even when they got to dock, people wouldn’t let them out. And so I’m going on a… Not that I’m a big cruise ship guy anyway, but I don’t think that would be a… I think that’ll be one of the last businesses to recover. But who knows? It might create all kinds of new industries in medicine where not only can we knock out this coronavirus, we can learn a lot about other flu viruses and how we can inoculate ourselves from them, better than we have so far.

Frank Curzio: Yeah, no. I think we’re all hoping for the best here. Talk about you… This is like a dire warning for you. And just, if this is the first time I listened to Cactus, I’ve interviewed him several times, probably it has been a while, but I remember 2014, ’15 when prices really started coming down, and a lot of these companies were supposed to go bankrupt, but yet happened to survive for some reason. You weren’t this dire. You were like… You were actually saying maybe it’s a good time to maybe start a fund to buy some of these assets. Is that something that you’re thinking about now, or it’s more like, “Hey, this is survival mode.” And no one’s really thinking like that right now.

Cactus Schroeder: Well, I think that there are definitely things to be bought out there, and they’re on different levels. Like, you see people or companies that are sitting on a ton of cash, like the major oil companies, or Berkshire Hathaway. They’re out there licking their chops right now, because as soon as these companies go bankrupt, they know that they can step in, and pick them up, buy them 10 cents on the dollar, hold onto them until things get better. And this will pass. I don’t know that we’re going to see $50 oil next year, but I think that in 2021, we’ll probably see oil jump back and the $35 to $50 range would be my guess. Maybe that’s optimistic. I don’t know.

Cactus Schroeder: I think a lot of things in the stock market are going to recover quite rapidly, at least I hope they do. So it’s tough to make any kind of prediction right now because we’ve never seen a commodity price crash because of pandemic, and as well as the largest oil producers in the world getting at odds with each other. So that’s why you never had that demand destruction because of a pandemic within any of these other oil price crashes that I’ve incurred.

Frank Curzio: Now there’s a lot of people listening to this, looking at these stocks getting plummeted, right? So they might thinking, “A lot of this is factored in.” I don’t think single digits over the next 120 days is factored into any of these stocks, to be honest with you. But some of them, when I see Devon in the single digits, I’m like, “Whoa, this is insane.” But talk about the majors, because like you said, they have great balance sheets. Both CEOs go on TV and say, “We’re maintaining all dividends.” For some reason they’re saying, “It’s the most important thing. This is our priority,” which I don’t know why that’s your priority. The 70% yields right now, I would cut them in half. You’d still going to be much more than double the S&P 500, and you could use that cash to buy the assets that you just said, 10 cents on a dollar. I don’t know why it’s such a concern where that’s their entire focus right now. That’s our biggest.

Frank Curzio: But getting into those names, because you said that they have cash and they can produce lower, but you also brought up the refining part because that’s where they could have big margins. Why is that going to be a problem?

Cactus Schroeder: Well, that’s where they’re least vulnerable, because number one, they have cash. And right now, cash is king. Number two, they’re totally integrated. They own refineries, they own pipelines, they own service stations, they own oil and gas production, they own leases. They’re in it from top to bottom. And if the price of oil goes to $6 a barrel, they can still refine their own crude, and still get a decent amount of money for the crude product, whether they’re manufacturing plastics or medicines or fertilizer, or whatever it is they’re manufacturing, as long as the economy recovers, they’re going to be able to make their money on that end. So they are not as vulnerable as an oil and gas production company.

Cactus Schroeder: And then the other one that’s even more vulnerable than the oil and gas production company is the service companies, the people that own the drilling rigs, the work-over units, the people that are doing the dirty work, or doing the logging, or the cementing, or the acid, or the fracks. Those people… It’s cut off. They’re not getting another dime, other than what very few rigs are running now. In fact, I think rig counts are fallen by like 50%, or something like that, over the last six, eight, 10 months, I think. So all of those folks are really in super bad shape. Not that they were in great shape to start out with, but they’re going to be going under rather rapidly.

Frank Curzio: So, talk about what you’re seeing in the industry since it’s boots on the ground, obviously. You’re in Midland, you’ve taken me to drilling sites when I went down in 2010, 2011. What are you seeing in terms of what you’re hearing out there, in terms of employees? Are they looking to lay off a significant… Are we’re looking at 30%, 40%, 50% of what you’re hearing out there? And could it get worse because, I don’t see the government running to bail out this industry, like they’re bailing out cruises or try to provide a floor under it, just until it comes back. But what are you seeing from the unemployment front, because what you’re telling me right now, it seems like everybody should be cutting by minimum 50%.

Cactus Schroeder: Yeah. I think, and I’m not sure exactly of the rules, but I think if you have 500 employees or under, the US will backstop their wages for what, two, two and a half months. And it’s probably going to be like QE-1, QE-2, QE-3. We’re probably going to go through several different phases of appropriating money, to try to keep these companies alive. But if you’re a company like Slumber J or Halliburton, and you’ve got over 500 employees, you don’t get that backstop. So already I see where Halliburton and Slumber J are laying off 30% and 40% of their personnel. And I would say a large part of them are here in the Permian Basin. So that’s one thing that some of these smaller companies like mine, we get backstopped because I don’t have very few employees.

Cactus Schroeder: But my employees, I was going to keep anyway. I’ve been through this so long, it’s one of the reasons I’ve been able to survive, is that I don’t have a lot of employees. You’ve been in my office, you see what it looks like. And so when times are good, I employ engineers and geologists and land men and in all of these other folks on a project by project basis. And I don’t really keep them on a payroll. I just pay them based off of the work that they do. And that’s one of the reasons I’ve been able to survive. So anyway, I’ll still be around. I don’t know that they’re going to be a lot of old friends still around, but when things fall this fast, I keep thinking something will come along that will turn it around, maybe not real fast, but as I tried to tell my kids, nothing is as bad as you think it is. And nothing is as good as you think it is.

Cactus Schroeder: I remember in the summer of 2008, we were looking at a… I was getting paid $148 per barrel of oil. And I thought that’d be never be another poor day, but obviously it was I wrong. And just since then, I’ve gone through three downturns. But you learn how to live with them, and if you’re small and nimble, that makes it a little easier. It’s just these companies that have leaned over their skis a little too much, and I think from a financial standpoint, are going to get caught with their pants down. And I think a lot of it’s going to happen sooner than later. I think Trump is going to try everything he can to help the industry out. But I think the only industry that people hate worse than all the oil industry are probably attorneys, maybe. I don’t know.

Cactus Schroeder: Anyway, we’re not the most popular people on the planet. And so we’ll see how it all falls out. I’m always optimistic. I think probably within two months, we’ll be able to have this coronavirus at least corralled, to where everybody’s going to get a test. You’re going to know whether you ever had it or don’t have it. And people that have had it, they’re over it, that we’ll be able to give their plasma to help the people that do have it. And then the folks that do have it, we’re going to be able to isolate them, where it can’t spread anymore. And so, I’m… I’m very optimistic about that, and hopefully that’s in 30 to 60 days. I feel like I’m an idiot. I’m glued that TV every 4:00 o’clock, seeing what Trump has to say next.

Cactus Schroeder: But it’s I’m definitely optimistic about something changing there. I think that the oil deal is probably not… It’s going to take a long time for that demand to come back to where it was.

Frank Curzio: And Cactus, really quick, let me stop you there, because even if they have a deal, and let’s put this in perspective because I don’t want to pour on the bearishness here. I really don’t. We’re all hoping for the best, and hopefully this thing turns. But consumption is over 90 million barrels per day, right? We were producing whenever it is to make that up. But we’re talking about no airplanes, no flying. 90% down foreign travel for these people. Cars aren’t… The factories are closed. Everything across the world’s on lockdown. I’m hearing 30 million, 40 million decline from the producers, or try to cut back on that supply. But if they come out, which we’re expecting, right? There’s probably going to be a deal because these guys can’t survive either, at single digit prices, if that’s what it’s going to be the next month or two.

Cactus Schroeder: There will be some kind of deal. I’m fully confident of that.

Frank Curzio: But is it going to be enough? Because these deals usually like 10 million, 15 million. It seems like that’s not going to move the needle unless we… Because even when we go back and everything goes online, it’s going to be very slow. It’s going to take a long time. A year, year and a half, maybe even two years before you get even to maybe 75% of that capacity, that people stop working and everybody feels comfortable again. But it seems like… I could see them coming out and saying, “Hey, we’re cutting 10/15 million, whatever it is, and the market’s going up because that’s a great thing. But when you really look at the numbers, you still need more, right? It’s pretty crazy when you look at the numbers.

Cactus Schroeder: Oh yeah. And just look at the school buses and the buses that run around big cities. Nobody’s getting on buses. No kids are running buses. No schools are running buses. There’s no buses going to a band concert. There’s no buses going to football games. There’s no buses for any athletics, for any school. And they burn an awful lot of fuel every day. And in a lot of towns, that’s the way people get around town, is just on the local bus. And all the local buses are shut down. So it’s not just airplanes. And so it’s going to be quite a while before we see that demand destruction get healed up.

Frank Curzio: I like to finish with this, and it’s going to be a tough question, and I know you don’t short stocks, but you have thrown out some names because you’re just tuned to everything that’s going on in your areas. And I remember going in into your war room and maps everywhere, and there was companies like XYM. And you’re like, that’s Exxon on. You knew everybody. They were like subsidiaries of everybody. With that said, is there anything that you’re seeing at a price where… Because I do know that sometimes you buy some of these stocks. Is there anything worth, like the majors, which you can even buy them here? You think they still have trouble? Or is it just, “Hey wait right now, let’s see what happens in the next couple of months,” and you might have a better buying opportunity.

Cactus Schroeder: Yeah. I think if I was going to start buying into stocks, the majors are the lowest I’ve ever seen them. And I think they will recover the quickest. If I was going to buy oil and gas stocks, I think that’s what I would probably concentrate on, because they’re totally integrated up and down, A to Z. They can do it all. And so, they will survive, no matter what happens. And the other thing is, they’re going to be able to buy a lot of these other smaller companies that can’t make it. And they can sit on those reserves. Oil is still there. They can buy those reserves. They don’t have to produce them next year, or in three years, or five years. They may not produce those reserves for another 10 years, and they have the capital to sit on it. And if you can buy reserves at $10 a barrel, and wait five years, and produce them at $50-$100 a barrel, you’ve killed them.

Cactus Schroeder: And so that’s what I look to see, is that I think I’m going to look up, sometime, and look at Midland, and the only two companies left out there are going to be Chevron and Exxon.

Frank Curzio: Yeah. Pretty crazy stuff. And yeah, I’ve never heard. Yeah. Like this dire before. And yeah, I hear you though. So hopefully it is a short-term problem. But let’s end with this, which is really cool, because this is much more important, because it looks like you may be getting into another industry, right? Because you talk to me, and people don’t know that you have a history of being great at tennis, which I’ve heard numerous times, and you build a tennis court and nobody could do anything. And it was funny because it seems like a lot of people are looking to do things, and they’re knocking on your door to go play tennis on your tennis court, right?

Cactus Schroeder: There you go. I can get back into athletics. Oh no. We’ll still be in the old industry. We’ve got a lot of things going on. And like you said, I’m probably going to be looking around at things to buy. And that’s going to be a real possibility, because I think it’s going to be way better in a year than it is now. A lot of this stuff is going to get healed up. But I think some of these people can’t survive a year, particularly the folks that haven’t hedged. And so, it will be an interesting story.

Frank Curzio: Yeah. And we’re hoping for the best, especially as a lot of employees in that industry that are probably going to lose their job and hopefully be able to get it back and things recover quickly. But Cactus, I just want to say, for me, learning as much as I did from you in the oil industry has helped my subscribers tremendously through the years. You took the time to take me out to different oil fields, really go over everything with me. I probably asked you 1,000 questions. You answered all of them. We had a great time. For me this is a pleasure. I mean I want to thank you. I know my subscribers thank you, and you’re coming on, and how busy you are. So, I just want to say thanks, and I really appreciate it, buddy.

Cactus Schroeder: Anytime Frank. Take care.

Frank Curzio: Thanks buddy. I’ll talk to you soon.

Cactus Schroeder: See you.

Frank Curzio: Wow. Pretty dire stuff there. I’ve never heard Cactus that down, that negative. He did say, “Listen, this is a short-term problem,” and long-term he’s optimistic. But I’ve interviewed him during past times, and spoken to him in the last two major, you could call it recessions or downturns in oil, and he was more looking at, “Hey I’m going to buy assets here if you want to get guys together that you know, and credit investors.” And he turned out to be right during those times. And 2014 and 2015, and also, during the credit crisis. But he’s not even talking about that now. It’s interesting stuff. It really is.

Frank Curzio: But it’s funny with Cactus, because I asked him about tennis. When I was hanging out with Cactus, he took me to so many different places, and almost every person that he introduced me to, because everybody knew him at all the restaurants, where everybody knew him. And again, if you want a picture of him, he sounds exactly, it looks like Larry the Cable Guy. So it’s great. And he’s just a nice, nice guy, and his family’s amazing, all great tennis players. And he is like a tennis legend in Texas.

Frank Curzio: And it’s funny when you look at him, because you wouldn’t think that. But even everyone that was meeting, they were like, “Hey, what’s going on? Do you know Cactus?” I’m like, “Yeah.” And he’s like, “Did you ever see this guy play tennis?” Nothing about oil, just tennis. But I thought that was funny. One more quick story I think you guys are going to enjoy is, when we were going out, again, I’m coming from New York. You know how Texas people feel about New Yorkers, right? I love Texas. I really do. But I get it. I was wearing shorts, t-shirt, sneakers, low black socks, and just ready to just go out. It’s very, very hot. We’re going to go into the field, just dress down. And he goes, “I have to make one… I just have to go one place. I’ve got to speak at this event. There’s about 25, 30 people there about oil and what’s going on in Midland.” He’s like, “I forgot I had to do it. It’s going to take about 15, 20 minutes.”

Frank Curzio: So, I go in, and it’s like a little town hall, and everybody’s walking in, strapped guns on each side of their waist. Just the jeans, plaid shirts. Every one of them looked at me like they were going to shoot me. And Cactus was like, “He’s okay. He’s with me.” So immediately once we left there, I said, “Can you do me a favor? Pull over.” He pulled over. I bought a camouflage hat, camouflage pants. I just like… Let me fit in a little bit more. And it was just funny. But I love Texas, and man, what an education.

Frank Curzio: But a lot of crazy stuff he just said there guys. Single digit oil. This isn’t something he’s guessing. This is something that Sunoco told him. That’s how much they’re going to give him. So this is boots on the ground. This isn’t like, “Hey, this could go…” That’s not factored in right now. I don’t think it could stay that way that long. We’re going to hopefully see a ton of supply in the market, but one of the things he didn’t really get into that we talked about offline before the interview, is how the current wells that are in production, you go through the fields and you see the pumps, they’re not stopping that production because they have to fill the pipelines because they signed contracts with them.

Frank Curzio: So, you’re not seeing us producers completely cut back here. They’re still producing. A lot of them were hedges, still producing, which 47% of the global production is hedged at around a little over $50 for this year. Next year, it’s 3% of global production is hedged. I pray, I really do. I pray, because today’s environment’s going to look like it’s spectacular compared to next year if we still see prices under $25 under $30 into next year. I’m hoping that doesn’t happen. It doesn’t sound like Cactus believes it’s going to happen. He was a little more optimistic longer term. But let’s see how this plays out. But just interesting information you’re not hearing any place else. This is what I want to bring you, boots on the ground, people who make their living doing this, and they’re going to tell you exactly what they’re doing right now, like Cactus. So guys, this podcasts about you, not about me. I like to bring these guests, and try to bring as many great guests on as possible. But let me know what you thought about that interview at frank@curzioresearch.com.

Frank Curzio: Now, let’s get to education segment real quick because I know we’re running too late here, and have these podcasts galore. But getting lots of questions on Disney. I saw a couple of upgrades last week. We just had a downgrade yesterday, of Disney. This is a company that I say you should go short at 140. And I said to short it because everyone was optimistic about streaming, and they were adding tens of millions of subs to Disney plus, but people don’t realize that streaming is one of the worst businesses in the world. Nobody has proven that they can make money on it. It costs billions and billions. Look how much Netflix spends, 10, 12 billion, $15 billion just for content. Hulu’s losing $1.5 billion, and everyone’s rushing into an industry that has no purchasing power. Right?

Frank Curzio: We saw that with Netflix, when they tried to raise the prices, a lot of people canceled. And now you have even more competitors in the space, which, a starting, HBO plus, Amazon. Some of these companies are starting to give their content away for free during these times. Got a little lucky where we fell like 120-ish around, and then a coronavirus hit and this thing fell below $100, but still trading around $100 here. Be very careful with this name guys. This isn’t personal. I know Disney is a family name. People don’t look at it, just like they didn’t know that GM was going to go bankrupt. So many great analysts that were covering that, they said it was going to be great.

Frank Curzio: For me, it’s just about the numbers. It’s not personal. It’s not like, “Hey…” If things switch, I’ll say Disney is a great buy. But Disney is in a lot of trouble guys. People don’t realize this, and aren’t talking about it that much. And this is something that really needs to be addressed before the shit hits the fan here, because if people see this company really go down and things go bad, you talk about sentiment being weak already. I mean we yes, we’ve seen a little bit of a bounce in the market. Forget it. If you see a company like this, this is a family company everyone in the world’s familiar with. Maybe the most popular brand in history, the greatest marketing company in history.

Frank Curzio: Let’s get some of those numbers, because you’re looking at how are they being impacted? Probably more than any other company in the Dow, than Boeing. And Boeing trying to get backstop because that’s kind of a monopoly. It’s a duopoly, really. But they control 45% of manufacturing for airlines. Why? Airbus also controls 45%. So we know that has to get bailed out. There’s hundreds and hundreds of suppliers that flow through that company. I went to Everett Washington plant for Boeing. Amazing. Definitely go see if you get a chance. One of the biggest manufacturing facility in the world. Unbelievable. But when it comes to Disney, huh? Are you looking at TV advertising? Spending is down right now. For certain channels, certain things are out. They say, “Well we’re doing okay. More people at home watching TV.”

Frank Curzio: But yeah, when you’re looking at the properties like ESPN, no live sports. Talk about billions in revenue lost. One half billion specifically just for the NBA, which you’re not going to see the playoffs this year. Theaters. Are they going to go back to normal? People are going to go watch these movies in theaters at the same rate that they did in the past? No. Can Disney release its movies on Disney plus? Sure. But they’re going to lose billions of dollars doing that. And you look at the Marvel movies, Frozen, Star Wars, they generate over $1 billion each in the theaters. You look at the Marvel schedule, this is very…

Frank Curzio: This is a little difficult to understand, but that Marvel franchise, which again, is the biggest franchise in the world in movies, it’s even bigger than Star Wars in terms of the money it makes. They have a whole plan of roll these out. They have to roll them out a certain time. Like what is it? Black Widow is coming at with Scarlett Johansson, but things happen in that before you can release the next movie. Things happen next. So it’s very time-sensitive. What does that mean? They have to push all these back. And as they push them back, Marvel is not the only movies that they produce. They have a ton of other movies on slate for later this year, whether it’s Mulan, or whatever.

Frank Curzio: So, when I look through these entertainment companies that produce movies, they try to make sure they release their top movies by themselves on that weekend, when nothing else is really going on. You don’t see two or three great, great movies at the same time. Right? Usually one comes out one weekend, and then maybe the other weekend. This way you’re not taking money away, since people may go to movies once a month, instead of three times in a weekend. But now it’s going into your other schedules. You’ve got to release them on the same weekends going forward? That’s a big deal.

Frank Curzio: Parks aren’t going to remain closed forever, but international travel is going to be down huge in ’21 in ’22. I go to Disney Parks all the time. We have the annual pass. I’d say about, minimum, 50% of people don’t speak English. They’re all foreigners, which is cool. That’s great. They’re going to Disney. They go there, they have fun. Are they get to during these times? You can’t tell me it’s going to be at the same rate as 2019? How many grandparents that do you see when you’re in Disney, where they’re taking their grandkids to these parks? Are they going to go knowing that if they catch the virus, they can get seriously ill? No, they’re going to cut back.

Frank Curzio: You’re looking at it streaming, where again, nobody can make money on this industry, and nobody has pricing power. Disney has 25 million subs and they’re growing, and maybe in six months to 12 months, they’ll have 50 million. But a lot of those were free names coming over from Verizon. If you have a full membership at Verizon, where getting full data plan, you get a free yearly subscription to Disney plus. Let’s see what happens when those names roll off, because I know what Disney wants to do is they don’t want to say that they have 40 million subscribers, and the following year they say they have 30 million subscribers, because then the stock will really crash, because people will believe that this is a great thing. And even if they decide to stay with these customers, Disney is going to have to spend billions and billions on new content to keep them around.

Frank Curzio: If you look at streaming, it’s about new content. People are going to watch the existing stuff. I get it. You have kids. I do too. And you’re going to watch the movies that they’ve watched 100 times. They’re going to watch a few times, but you want to see new content. That’s why people pay for Netflix. That’s why people pay for the other places. What are they going to do with Hulu? The reason why Netflix is spending over $10 billion a year for new content. Disney said, “Whoa, we might spend a billion or two.”

Frank Curzio: Now what’s crazy, when I think people don’t understand, is Disney leveraged itself probably at the worst possible time you could do it. Again, it’s, didn’t do it on purpose. But you’re looking at a company that spent over $70 billion for Fox’s entertainment assets, which are probably worth less than 50 billion today, if they would’ve waited. Again, note, hindsight it’s 2020. But just shows you what’s going on this in this world right now, right? Now Disney has over $50 billion in debt, which is by far the most… 2018, it’s more than double the amount they had in 2018. Disney was never really a highly leveraged company. They’re a highly leveraged company, betting big on streaming.

Frank Curzio: 40% of this 50 billion is due over the next five years, including $7.5 billion this year. Stay with me, with the numbers here, because Disney was supposed to generate around 5.5 billion in free cashflow. Those were the estimates this year. They also have $6.5 billion in cash. Well, that comes out to $12 billion. Yet, the cashflow estimate is going to be easily less than $2 billion. Easily. Probably more like one, one and a half. Again, they’re not generating anything. Nothing is coming in. So even if we say it’s to be $2 billion, which is optimistic, you’re using the $6.5 billion in cash, and $2 billion in cashflow, that comes out to $8.5 billion. Remember the $8.5 billion number.

Frank Curzio: I’m just going to throw a few more numbers at you. I promise, you’re going to understand this. Just $8.5 billion. Now Disney has a $7.5 billion dollar payment due this year. They were also paying over $3 billion in dividends. So that’s $10.5 billion. I’m not throwing in any debt downgrades, assuming everything’s going to come in. But you’re going to see more debt downgrades, right? Disney’s hardly seeing any revenue come in, which is just pretty crazy numbers when you think about it. And that doesn’t include the billions and capex it must spend on new content for its streaming services. That’s where the demand is going to come from, that new content. If you’re looking at the math, it doesn’t add up.

Frank Curzio: My Wells Fargo downgraded the stock from buy to hold. They lowered their target from 155 to 100, where it’s trading around now, which is a complete fricking joke. It shows you why you can’t trust Wall Street at all, all these sell side firms, because I look at that report, they reduced 2020 earnings on Disney from $5.77 to $2.66. Right? Even at $2.66, it’s probably aggressive. Massive cut. But they also lowered their 2021 earnings from $5.91 to $2.42. What does that mean? They’re expecting Disney, their earnings to decline from 2020 to 2021. Guys, I don’t know if there’s another company in the S&P 500 that’s projecting that.

Frank Curzio: But everyone’s expecting a huge downfall on earnings this year followed by huge earnings next year as everything comes back to normal. Wells Fargo is predicting that earnings are going to decline year-over-year. And if you’re using those estimates, their estimates, right? They have $100 target on this, and they downgrade it to hold. Based on their estimates, Disney’s trading at 38 times 2020s, estimates and 41 times 2021 estimates. I know you guys understand P ratios. I told you how high 19 times earnings… Again, you could deserve it 25 times, if you’re growing super fast, two or three times the overall market. Nobody’s growing.

Frank Curzio: Nobody deserves more than a 15 X premium here. Maybe a few companies that are growing, we’d like the DocuSigns and the Zooms maybe, where business models is seeing surge in demand because of what’s going on. But most companies, no. And this multiple should be at 15 max. And you’re talking at 38 times. Always, business is going to see significant declines, even when the virus contained, which we don’t have any f-ing clue yet. So why wouldn’t they lower it more? Because Disney is going to have to raise a shit load of money, excuse my language, and Wells Fargo wants to be that guy that’s collecting those fees. But based on their report, this stock should be trading more closer to like $60, $65 a share, which I know a lot of people find insane, but at the end of the day, you have to look under the hood.

Frank Curzio: I have nothing personal against Disney. So I’m still getting questions on Disney, “Is now time to get in?” I hear on TV, “Disney with their slate.” Guys, everything’s shut off. This is a company that’s going to be more impacted than almost everyone, not just now, but when things get turned on. It’s a people company. It’s a family company. People get together, they hang out. It’s going to be different going forward, which is very, very scary. There’s so many more names. I would say almost every name of the Dow is probably a better buy right now, than Disney. Almost anyone you could pick, even Boeing. I know they’ll out-perform Disney. So be very, very careful guys.

Frank Curzio: Maybe the government comes out specifically, and just bails out and covers the whole balance sheet, who knows? And then changes. I’ll change in a second. But right now, and this is a company that’s not going to get bailed out. There’s a lot of competitors in the industry. It’s not like the cruises, or the airlines, or even Boeing. It’s pretty scary when I look at the numbers. So I just wanted to cover that for you guys. It’s getting lots of questions. Nothing personal against Disney, but this is what I see and I like saying and talk about it, because not too many people are really looking under the hood. They just think, “Disney. Wow. It’s down from $140. It’s $100. It’s American company. It’s great. This thing is definitely going to come back.” You got to look at the numbers. Nobody realized that they’re more leveraged today than they ever were.

Frank Curzio: Okay guys. Lot of stuff there. When the market’s up like this, yes, I’m going to give you facts. You should be negative. And when the markets are down, I’m probably going to see pockets of places that I can give you optimism. But right now it’s one of the most uncertain markets, and I think one of the most risky markets that I’ve seen probably in the last five years, at least, if you looking to buy right now. There’s so many uncertainties with pricing in absolute perfection. I hope we get that absolute perfection. I do. But we’re not going to, and I think you guys know that as well. So just be very, very careful about these crazy moves we’re seeing. 2%, 3% moves. Dow up 1,000 Tuesday. Come back down. It’s negative. Finishes the day down. You’re going to see a lot of that over the next few months guys. So just be patient with our picking away. If you are a Curzio Research Advisory member, we just sent you five picks. Well, actually three, but it’s part of a five part portfolio. We’re picking away at some really, really great names I’ve done research on. You guys getting that today. You should be reading it now if you listen to this podcast. But you can’t pick away some of these names. Just be very, very careful guys.

Frank Curzio: So, last thing, quick note here, I just thought that my statistics for Wall Street Unplugged, and notice that downloads are approaching triple digits. It’s surging right now, just Wall Street Unplugged. I also do, Frankly Speaking, that podcast used to be everyone. And on that feed, but I took it off. It’s only available to the paid subscribers. Guys, Frankly Speaking, you really would’ve got dialed in into what I was seeing the credit crisis and what I was seeing during this crisis, just answering questions from my subscribers. So that podcast is available to subscribers only, to a subscriber to any one of our products. Even Curzio Research Advisory, which I lowered the price to $49, not monthly, but a year, for you guys, just so you can get quality research, hear my thoughts of what I’m saying. Yeah, that’s the lowest price we have offered it for, and it’s not going to be rained out long. But I understand people going through hard times, they want to know what to do with their 401Ks, and I lowered it to that price.

Frank Curzio: But even getting that, you’re going to get access to the Frankly Speaking podcast, which is every Friday, about 30 minutes. I just take three, four or five different questions from a… You can write them in, just put the title, Frankly Speaking, frank@curzioresearch.com, and I’ll answer it for you. But I was going to ask if you want, it’s amazing to me how many downloads we’re getting for this. It’s resulting in, that we could almost ask anyone that come on this podcast and they’re going to come on, because that’s what it’s about. It’s how big the audience is, right? And that’s where people want to come on for. And that’s thanks to you.

Frank Curzio: And listen, if you really liked this podcast, and if I help you in any way possible, listen, go to iTunes. There is a place where you can write a review and place how many stars? It can be one star, it could be five stars. But even the more ratings we have, the more we move up the iTunes charts. And we were ranked number one most listen to podcasts in the business investing section through numerous cycles. And getting there just puts us more in the spotlight, which is cool. And the more downloads that we do get, again, a podcasts for free, but it’s going to allow me to bring on even bigger and bigger guests like leading doctors, Anthony Scaramucci, Cactus in the field. Cactus has always been a guest.

Frank Curzio: But the guests that we’re getting, the quality people we’re reaching out is really, really cool. So yeah, if you guys want to do that, that’s cool. If not, I understand. But I really appreciate all the support. Just humbling to see how many people actually listen to this, which is awesome. And I just really, really appreciate it. So guys, if you want more info, daily info, just go to my Twitter account @FrankCurzio. I’m trying to post as much as I can, three, four times a day. And it’s absolutely free. Another three site is our Curzio Research YouTube page. Please go to the Curzio Research YouTube page because I just interviewed Lenore Hawkins again, from Italy. Very important. That’s the playbook, right?

Frank Curzio: We’re not looking at China, because we can’t believe the numbers. We’re looking at how Italy is coming out of this, and they’re seeing declines in cases and affected and deaths, which is fantastic. Listen to this interview first, because it’s not all great in Italy right now. It really isn’t. And some of the things that she said was surprising. It’s a video. So it’s cool. You get to see us talking on video. That’s absolutely free at Curzio Research YouTube page. She talks about the euro, She talks about the problems that Italy is having right now, what she thinks is going to happen, what the government’s doing, when they’re planning on opening up, which again is no time frame yet. And we’re following Italy. And we’re excited because, “Hey, we could open up at the end of this month.” We’re three weeks behind them, and they’re not going to open up at the end of this month. They might go into May now.

Frank Curzio: So, if we’re following Italy, and you think we’re going to fall on that same path, you want to listen to this, because this is boots on the ground again. She’s on lockdown in Italy. She’d been in lockdown the whole entire time, and there’s parts where she gets emotional because you know she really, really cares. So it’s a good interview guys. Curzio Research YouTube page. And listen, that’s it for me. Thanks so much for listening. As always, I really appreciate all your support, and I’ll see you guys in seven days. Take care.

Announcer: The information presented on Wall Street is the opinion of its hosts and guests. You should not base your investment decisions solely on this broadcast. Remember, it’s your money, and your responsibility. Wall Street Unplugged produced by the Choose Yourself Podcast Network, the leader in podcasts produced to help you choose yourself.

P.S. This morning, I released a special episode of Wall Street Unplugged… an exclusive follow-up interview with analyst Lenore Hawkins, currently living under quarantine in Como, Italy. It’s a fascinating, emotional conversation that reveals the “real” economy vs. the financial economy… and why the difference is critical for investors to understand today.