A speculative frenzy has been pushing the market higher in 2023.

One of the clearest signs is the exploding popularity of risky trading vehicles like “0DTE” options.

Today, I’ll explain what 0DTE options are… why they’re sowing the seeds for a major market-wide decline… and how to profit from the coming pullback.

But first, let’s take a quick look at why investors’ risk tolerance has expanded beyond reasonable levels… and how it’s led to one of the most popular—and risky—investment trends of 2023.

Speculation is driving the 2023 rally… but not for long

For the past three years, we’ve been in a “buy the dip” market…

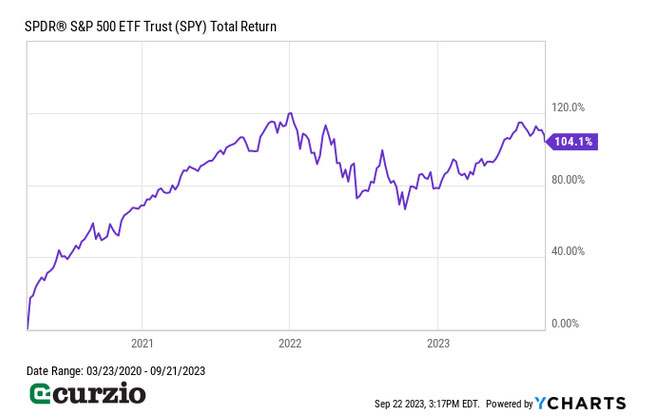

Stocks enjoyed a steady uptrend in 2020-2021… following the short but vicious 2020 bear market—which sent the S&P 500 plunging 34% from February 19 to March 24.

In January 2022, the rally gave way to the bear market of 2022, as the S&P 500 fell 25% between January and October.

But once again, the rebound was swift. The market surged nearly 30% from October 2022 through July 2023.

Put simply, aside from a few months in 2022… investors have typically been rewarded for buying the dips.

In total, the S&P 500 is up more than 100% in just three and a half years. (You can see all of this market action on the chart below.)

The size and power of these rebounds have conditioned investors to take bigger risks. After all, if the market doesn’t stay down after a big decline—and always rallies sharply instead—it doesn’t seem risky to bet on more gains.

Put simply, investors feel they have nothing to fear.

This increased risk tolerance has led to growing demand for low-probability, high-payout bets. Of course, Wall Street has been happy to accommodate individual investors’ growing risk appetite with new shiny tools.

And one of the most popular—and riskiest—trends of 2023 is 0DTE options…

You might have heard of 0DTE (zero days to expiration) options. As the name implies, these options are super-short-dated… expiring within a day of being created. This makes them a perfect instrument for individual investors who want to gamble on big, short-term moves in the stock market.

Because these options have such a short lifespan, they’re highly speculative and incredibly risky. You’re much more likely to end up with a loss than with a gain. However, the slight chance of outsized gains is enough to entice investors to buy.

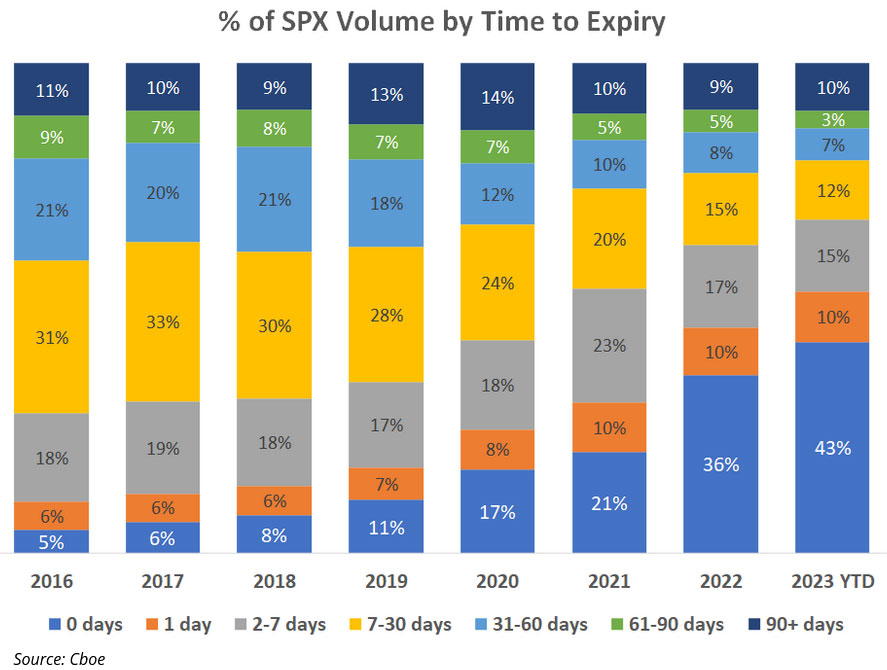

In fact, 0DTE options have exploded in popularity. In 2016, they accounted for just 5% of total option-trading volume. Today, that number has soared to a massive 43% (as you can see from the chart below). By March 2023, folks were trading a total $1 trillion a day in 0DTE options.

The surge in 0DTEs is being driven by individual investors—who now account for 30–40% of 0DTE volume.

That’s a massive number… and a clear sign of the speculative fever that has spread among individual investors.

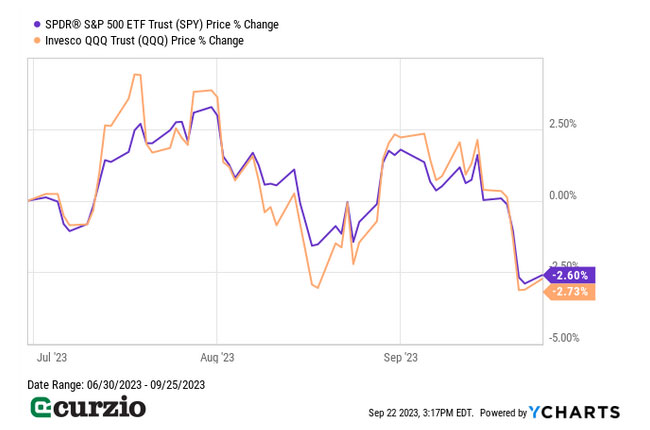

On the other hand, institutional investors—the “smart money”—have turned cautious in recent months. By the end of June, call trading (leveraged bets that the rally will continue) by retail investors exceeded that of big institutions for the first time in almost a year, according to Bloomberg.

In other words, the smart money was betting the rally would end… and it was right. Since July 1, the S&P 500 and the Nasdaq 100 are down more than 2% (as you can see below).

This is one of the surest signs of a coming market correction: The outsized enthusiasm of individual investors is increasing just as institutional investors are pulling back.

And 0DTE options could be the catalyst behind the next big market decline…

Earlier this year, analysts at JPMorgan estimated that large market moves would cause these options positions to spark buying or selling to the tune of $30 billion. That’s massive—especially considering the total market cap of the entire S&P 500 is around $40 billion.

Put simply, these 0DTE trades can amplify any big move in the S&P 500 index.

Last month, Goldman Sachs blamed 0DTEs for fueling a short but steep selloff on August 15, when the S&P 500 lost 0.4% in just 20 minutes.

In other words, the smart money is not only telling us to be prepared for a selloff… it’s saying 0DTEs could make it much worse.

Bottom line: Institutional investors have become increasingly cautious in recent months… while individual investors are ramping up their risky trading using 0DTE options—which have grown popular enough to trigger big swings in the stock market.

Fortunately, there’s a better, lower-risk alternative to 0DTE options. Even better, this strategy gives investors a way to profit on the stock market declines we’re likely to see soon.

Build market protection with long-dated put options

Unlike 0DTEs, long-dated put options don’t expire for several months—leaving more room to benefit from longer-term moves in a particular stock or sector.

And because put options allow you to profit from a falling market, they can pay off big as the speculative fever in the market recedes.

They’re also an inexpensive way to protect your existing portfolio during a market downturn. All you’ll pay for this protection is the price of the option (think of it as an insurance premium).

Plus, with long-dated puts, unlike 0DTEs, you don’t need to react to every single market move.

And while longer-dated options are more expensive (all else equal) than the near-term ones, you’re essentially paying for the time you need for the trade to work out.

If you plan carefully and understand the risks… a good selection of long-dated puts will make you money when the current market greed gives way to fear—triggering the next market-wide selloff.

P.S. Don’t let long-dated put options scare you…

In Moneyflow Trader, I walk you through how to utilize these valuable trading tools every step of the way.

And the strategy works: During the bear market of 2022, our portfolio booked 18 winners… several for triple-digit gains.