Yesterday, I gave a presentation at the MoneyShow about investing in gold… and my favorite long-term precious metals stocks.

The presentation happened to coincide with a “Fed day”—when the Federal Open Market Committee (FOMC) holds one of its two-day meetings (they take place eight times a year).

At the conclusion of these meetings, we usually learn whether the Fed will hike interest rates.

Apparently, we can relax for three more years.

The Fed announced short-term rates could remain near zero through 2023. The decision—while highly anticipated—was still staggering…

In sum, central bankers feel the economy is so uncertain, it will require at least three more years of federal assistance (in the form of free money) before it’s able to get back on its feet.

The market—spooked by the news—sold off today as a result.

Ultra-low rates might be a good crisis-fighting measure…

But the problem is that they punish savers and encourage excessive risk-taking for borrowers and income investors alike.

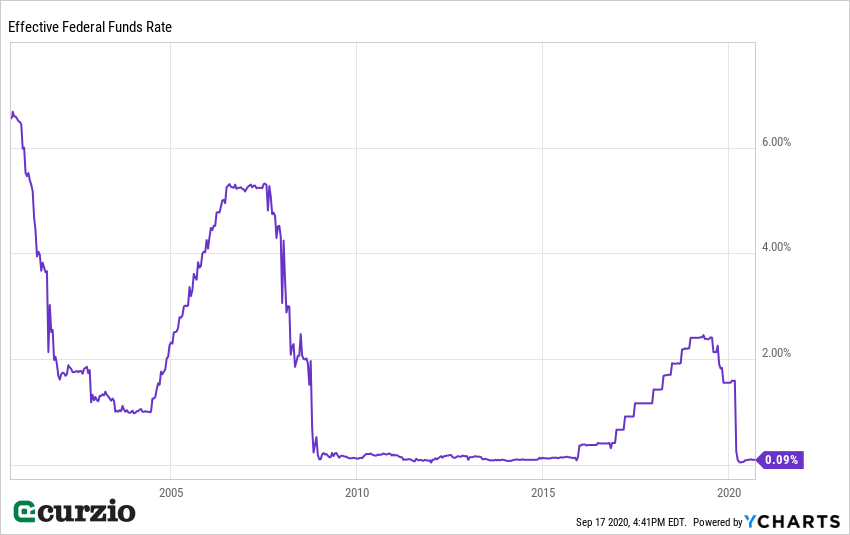

As you can see below, we lived with near-zero rate policies from November 2008–October 2015. After a short break, we’ve now resumed those policies until at least 2023.

From 2008 until 2023… 15 years of mostly zero rates. We’ve never had such a prolonged period of such low rates, which means we’re in uncharted economic waters—and uncertainties of any kind often benefit safe haven investments like gold and silver.

When your bank account or your quality bond doesn’t pay you any interest to speak of, and the real interest rate (the nominal rate minus inflation) is negative, precious metals look increasingly attractive.

While they offer no income, they provide a reliable store of value… in other words, they promise to hold their value in thick and thin.

The Fed’s latest announcement made it a great time for a presentation on gold investing…

During yesterday’s discussion, I received many great questions from investors, including two I’d like to address today:

- Should I invest in silver as well as gold?

- How will the value of the dollar affect gold prices going forward?

The answers to these questions illustrate why gold prices (and silver prices) will continue to rise.

If you’re on the fence about whether gold and silver are good investments, or you’re worried you’ve already missed the big runups, here’s why it’s time to get some exposure to these resources…

Silver vs. gold

Silver has historically been viewed as a “poor man’s gold.” That’s why investment demand for silver often goes hand in hand with gold demand. Silver, like gold, offers protection from inflationary pressures, declining interest rates, and currency debasement.

Silver is cheaper per ounce than gold, but what really makes it unique is that it’s both an investment and an important industrial metal. It’s used for alternative energy (solar in particular), batteries, and medical supplies, to name a few…

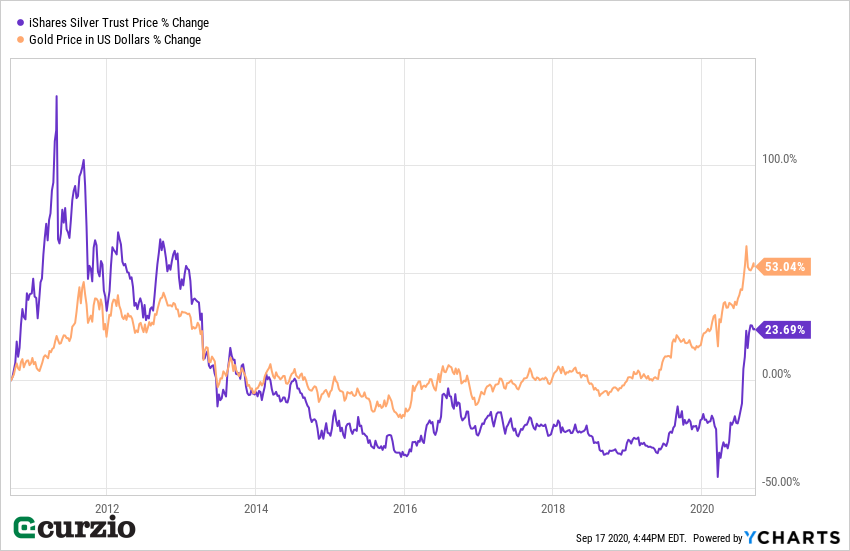

This dual use has been plaguing silver investors for years: Industrial demand has stayed relatively flat over the past eight years or so, keeping downward pressure on the price.

And until we entered the COVID crisis, there weren’t enough macroeconomic concerns to push demand (or price) for silver higher. As a result, silver failed to keep up with gold.

But after lagging gold prices for years, silver is finally entering the spotlight. That’s because it’s also enjoying the tailwind of loose monetary policies.

Despite silver’s 50% year-to-date rally, it has more catching up to do. And with the Fed’s avalanche of free money continuing for at least the next three years, it’s likely to go much higher from here…

Gold prices vs. the strength of the dollar

Gold is priced in dollars, which means a strong dollar will negatively impact the price of gold… and a weak dollar will support the price of the precious metal.

The chart below shows the price of gold vs. the Dow Jones FXCM Dollar Index, which tracks the value of the U.S. dollar relative to a basket of four currencies: the euro, the British pound, the Japanese yen, and the Australian dollar.

While the Fed’s money pumping has weakened the dollar over the past few months, and despite all the ups and downs you can see in the chart, the dollar’s value relative to other leading currencies has been flat since 2015.

Gold, meanwhile, has rallied nearly 75%.

If the dollar were weaker during this time frame, the price of gold might have been higher. But clearly, we don’t need a significant change in the value of the dollar to support a rally in gold.

For more on my take on gold—including some of my favorite investment ideas—keep an eye out for next Thursday’s commentary.

Editor’s note: Genia’s known for helping investors to find income and growth in this zero-rate market. And her precious metals picks have knocked it out of the park…

Right now, big money investors like Ray Dalio and Warren Buffett are pouring money into the same kinds of stocks Genia recommends to her subscribers… because the gains can be extraordinary. Listen as Frank explains Genia’s strategy for Unlimited Income.