Like stocks, gold is having a bad week.

Precious metals are not immune from day-to-day market fluctuations, even as long-term trends remain in place. When traders have gains to protect, yesterday’s winners easily turn into today’s losers.

But we’re interested in what happens tomorrow—and thereafter. If the thesis for an asset is correct, or nothing has changed in its fundamental story, a recent decline will prove nothing more than a buying opportunity.

In my latest presentation at the MoneyShow, I talked about the strength of gold as a long-term investment. And in last week’s commentary, I addressed two of the top questions from participants.

Today, I’ll address three more questions:

- Will the gold bull market continue?

- What are the best ways to invest in gold?

- What are the pros and cons of mining companies?

Plus, I’ll share one of my favorite junior mining assets… one with the potential to outperform if the gold regains its momentum.

The case for higher gold prices

Contrary to popular belief, gold isn’t the only beneficiary of economic uncertainty… The U.S. dollar tends to strengthen in these environments, as well.

Because gold is priced in dollars, a stronger dollar will negatively impact the price of gold… and a weaker dollar will support the price of the precious metal.

Long-term, gold doesn’t need a weak dollar to rally. But its day-to-day price fluctuations can be linked to the changes in the dollar.

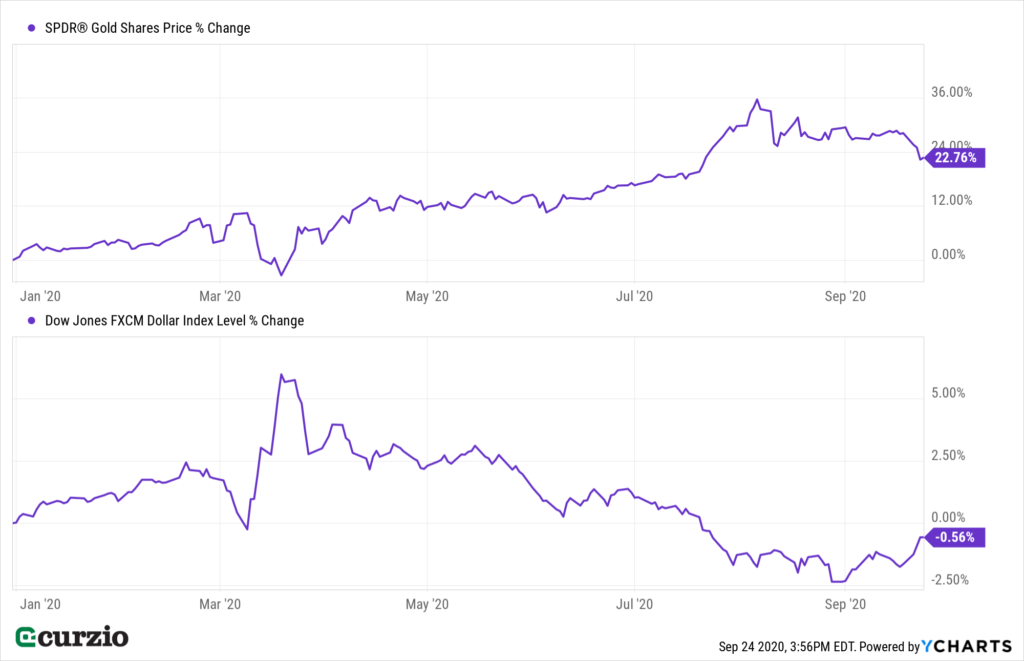

As you can see from the charts below, this year provides a prime example of how short-term gold price fluctuations are impacted by the value of the dollar.

Year to date, the yellow metal rallied more than 22%. And while the dollar stayed relatively flat (down less than 1%) over this time frame, as dollar volatility has increased, it’s in turn impacted gold’s day-to-day swings.

Take a look at what happened during the March market panic—when money was fleeing risky assets.

From March 6–23, the market sold off more than 25%… and the price of gold declined by 7.1%. But the Dow Jones FXCM Dollar Index jumped by 5.3%. (The index tracks the value of the U.S. dollar relative to a basket of four currencies: the euro, the British pound, the Japanese yen, and the Australian dollar.)

Today, the markets are under stress… and the dollar is trading sharply higher. This is often the case, since a distressed market leads to a stronger demand for the U.S. dollar—the leading reserve currency.

No wonder gold, one of the best performing assets of 2020, has lost some ground.

In September alone, the dollar has jumped by 1.9%, while equities and gold have lost 7.3% and 5.1%, respectively.

But the long-term catalysts for higher gold prices remain in place.

The U.S. economy still has a long way to go before it fully recovers from the coronavirus pandemic. And, according to Fed chair Jerome Powell, the economy will need further support.

Monetary debasement will, therefore, continue… and gold remains the main beneficiary of that process.

Nothing has changed in the long-term interest rates picture, either. Extremely low or even negative rates, like we have today, are good for hard assets, including precious metals.

And don’t forget that low rates promote excessive borrowing. The massive (and growing) amount of debt is a deflationary threat, especially if the economy stagnates. Inflation, too, cannot be fully written off—the risk is growing, especially in select corners of the economy. And as I explained in my MoneyShow presentation, gold is one of the few assets that does well during both inflation and deflation.

Three ways to invest in gold

As you can see, the case for gold remains as strong as ever.

But what’s the best way to invest in it?

You may have noticed that in the chart above, I compare the dollar index to the SPDR Gold Shares (GLD) ETF—not the price of gold per ounce.

That’s because GLD and other similar exchange-traded funds (ETFs) have been doing a pretty good job of tracking the price of gold.

In fact, GLD offers several features that may appeal to investors who might normally prefer physical gold (coins or bullion) to “paper” gold: It’s highly liquid… easy to buy and sell… and doesn’t require paying dealer premiums.

While the GLD fund charges a 0.4% annual management fee, owning physical gold doesn’t come cheap, either. Dealer markups, and the cost of storing and insuring gold, can add up. But adding transaction costs to those of storage and insurance makes it less viable for those who simply want to benefit from the upside in the metal—and are not accounting for a doomsday scenario.

In sum, gold bullion is the most direct path of ownership. But for those who simply want to benefit from the upside in the metal, rather than holding it for a crisis event, GLD is a cheaper, convenient alternative.

Both gold ETFs and gold bullion give investors exposure to the price of gold. But neither offers any leverage to business operations, or higher profit potential.

Shares of gold miners do…

As you can see from the chart below, leverage works both ways. Gold miners have underperformed gold when it was declining… and outperformed the metal when it was rallying. All said, miners (represented by the Philadelphia Gold and Silver Index) have outperformed the metal by more than 8% year to date.

This is because of the significant operating leverage that gold miners bring to the table—a rise or a decline in the price of gold tends to disproportionately impact the miners’ profits. In a bear market for gold, you can expect producers to lag the metal… and in a bull market, they’re likely to outperform.

Gold miners, therefore, offer higher return potential in a gold bull market.

But not all miners are created equal…

Senior vs. junior miners

Large-cap gold stocks, also known as senior miners, include such market leaders as Barrick Gold (GOLD), Newmont Corp. (NEM), Agnico Eagle (AEM), Kirkland Lake Gold (KL), AngloGold Ashanti (AU), and Kinross Gold (KGC).

These companies all own functioning mines, and their gold output is naturally worth more when the price of gold is higher.

After several years of flat or declining gold prices, senior miners have become more diligent with their capital expenses… and more responsive toward shareholders’ returns.

For example, all of the companies named above pay annual dividends. Barrick Gold (GOLD), one of my favorite gold plays and Warren Buffett’s controversial gold investment, has doubled its payout over the past year.

On the other hand, junior miners generally aren’t producing gold yet. They’re in the business of searching for gold, building out newly developed and possibly underexplored deposits.

Junior gold miners are therefore even more leveraged to the price of gold… both to its upside and its downside. For some, lower prices mean their new deposits aren’t viable, or not worth further exploration.

By contrast, a sharply higher gold price can make a junior company’s reserves more valuable… provide incentive to expand those reserves through further exploration… and make mining more feasible.

Keep in mind—gold miners with only one prospective mine come with an added risk: concentration. If it turns out that a mine contains less reserves than initially estimated, or if its ore grades are lower than expected, the company would have no “plan B.” Declining output potential and higher capital expenditures could hurt the business prospects—and shareholders—disproportionately.

To avoid single-company risks, consider holding a diversified portfolio of junior miners, or an ETF like the VanEck Vectors Junior Gold Miners (GDXJ). Because of the extra leverage inherent to junior mining, GDXJ will likely lag its larger peers if gold declines from here… but it also has the potential to outperform if a bull market in gold continues.

As a pure—albeit riskier—play on the price of gold, juniors cannot be beat. I recommend them if you’re looking for the accelerated growth potential and can handle the extra risks.

Large-cap miners are a safer play, but they offer less leverage to gold’s explosive potential. If you’re looking to diversify with added income, I’d consider a senior miner like GOLD.

Editor’s note: Genia’s known for helping investors find income and growth in this zero-rate market. And her precious metals picks have knocked it out of the park…

Right now, big money investors like Ray Dalio and Warren Buffett are pouring money into the same kinds of stocks Genia recommends to her subscribers… because the gains can be extraordinary.

Listen as Frank explains Genia’s strategy for Unlimited Income.