Frank Curzio

Why central banks can’t compete with Bitcoin

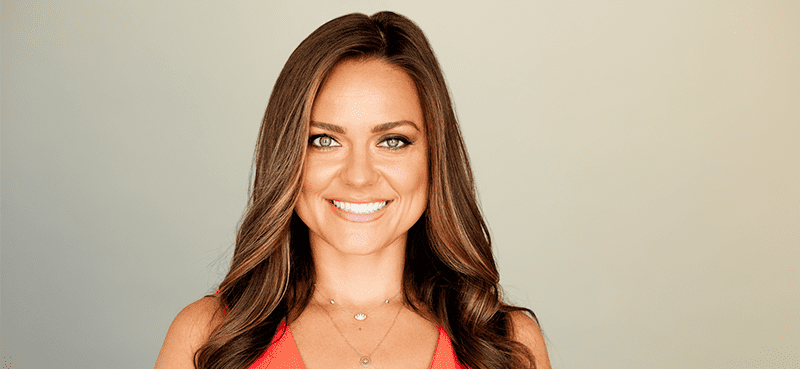

Bitcoin influencer and host of Coin Stories Natalie Brunell joins the show today to discuss all things Bitcoin.

She shares her journey from award-winning journalist to Bitcoin enthusiast… what she’s learned from interviewing brilliant guests… and a recap of the Bitcoin 2022 conference in Miami.

She also explains the benefits of regulation… whether she likes any altcoins… and why a central bank coin is a terrible idea.

Wall Street Unplugged | 884

Why central banks can’t compete with Bitcoin

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on main street.

Frank Curzio: How’s it going out there? It’s Thursday, April 21st. I’m Frank Curzio, host of the Wall Street Unplugged podcast, where I break down the headlines and tell you what’s really moving these markets. It’s a great guest today, first timer. It’s the wonderful Natalie Brunell. I’m not sure if you know Natalie. She’s a huge Bitcoin influencer, Emmy winning journalist, host of the Coin Stories podcast, which is on fire right now. Amazing, amazing interviews, interviews from the top people in the industry, the most influential names, including Michael Saylor, Andy Pompliano… Peter Schiff interview as well, and we’re going to talk about that. But the traction that she’s getting is unbelievable of how many people she’s getting on her podcast, and again, being an influence in Bitcoin. I thought she would be great to come on this podcast and discuss different things with you, especially since she attended the Bitcoin Conference.

Frank Curzio: I was supposed to attend that, and there’s a lot of things going on, something I’m going to share with you, which is a major deal. It’s going to transform our company, which is in the next couple weeks, but I’ve been working really hard on that. But anyway, I have people like Natalie that can give us the scoop on the positives and negatives of what actually happened there. And again, a true Bitcoin insider, someone who’s brilliant and has access to so many great, great people within this industry, which she has on her podcast, Coin Stories. And let’s get to my interview with Natalie right now. Natalie, thanks so much for coming on Wall Street Unplugged.

Natalie Brunell: Thanks so much for having me. Looking forward to it.

Frank Curzio: So, I want to start right off the bat, because I looked at your bio, where you worked for NBC and ABC, I think. You covered wildfires, mass shootings, 2018 midterm elections. You won an Emmy, which makes you an Emmy winning journalist, very, very impressive. How did you get into Bitcoin?

Natalie Brunell: Yeah, it’s a really fascinating journey. I was a newscaster for more than 10 years all over the country, small outlets, local outlets, as well as national, which has been a great privilege and a great learning opportunity for me. And in 2017, while I was working at an NBC affiliate in Northern California, I heard about Bitcoin from some friends. They were investors. They had accounts on places like Coinbase, and they said that this is potentially the future of money, and I did what most people do. I thought, “What are they talking about? This thing is probably some scam. I’m going to lose it. It’s not physical. Maybe it’s like a stock. It’ll go up and down,” and I really didn’t understand it.

Natalie Brunell: And I wish I could tap myself on the shoulder back then in 2017 and say, “Read this book right now,” because it took me about two years to read a book called “The Bitcoin Standard.” A mentor of mine gave it to me when we were talking about Bitcoin, and it really changed my view of everything. It changed my life. It ultimately changed my career, because what it did is, it made me realize that all of the things that I had been reporting on, which I had sort of witnessed on the front lines, this division and polarization of our country through my stories, and also what my family went through, because my family is a first generation immigrant family from Poland. We lost everything in the financial crisis of ’08, ’09.

Natalie Brunell: I connected the dots by reading “The Bitcoin Standard” and realized that most of the problems I was reporting on and had experienced with my family were connected to our broken financial system. Our financial system that, in my opinion, is rigged to benefit the few at the expense of the many to benefit the people in power, to benefit the big corporations, and banks, and politicians at the expense of the average working person. And I really was hopeful that Bitcoin could potentially fix it and bring us to a more egalitarian system that had access to opportunity, and the ability for us to have a Renaissance of the American Dream. So, I started a podcast that was basically a passion project, a hobby, and now it’s my full-time career. I travel the world, and I educate people about Bitcoin, and why it’s I believe perfectly engineered money.

Frank Curzio: So, being a journalist and learning about this in, say, 2017, 2018, the people that you’ve interviewed, and I’ve seen your YouTube channel, which is incredible, guys, Natalie Brunell, go check it out. Michael Saylor, Andy Pompliano, Scaramucci, Caitlin Long, Lyn Alden… When did you come to the point where… How much have you learned from those interviews to the point where you’re like, “Wow, this is much, much bigger than I ever thought?” I mean, was it right away? You said it took you a little while to get to it. But now, being a huge influencer, and you’re all in, I mean, when did that switch, where you were just like, “Wow, holy cow,”?

Frank Curzio: We always learn. I’ve been doing this for a long time. You have your podcast. You learn from your guest, right? You’re always getting educated. When was that point when you’re like, “Wow, this is much bigger than I thought it was?”

Natalie Brunell: Certainly, so it took me a while, and that’s why I think I relate to so many people who hear about Bitcoin, especially in mainstream news nowadays, and they’re curious, but they’re very skeptical, because I was right there in their shoes. One of the reasons why I wanted to do the show is because after “The Bitcoin Standard,” I just went on this journey of self-education. I would consume everything I possibly could about not just Bitcoin, but about our financial system, about the history of the Federal Reserve, the history of money, what is fiat currency, how did empires fall in the past? And there are so many great resources out there, from books to podcasts, to YouTube.

Natalie Brunell: So, I pretty much spent all of my free time just consuming and devouring this information, and became so passionate that, again, Bitcoin fixes a lot of the problems that I was seeing unfold in society at large through my job. So, I wanted to hear the stories of why people that I really respected in the space, like you mentioned, the Michael Saylors, the Lyn Aldens, people who are brilliant investors, company leaders, executives, macroeconomic strategists… Why do they believe in Bitcoin? How did they find it? What were their career paths, and ultimately, what is their opinion on some of the topics related to Bitcoin, maybe some of the misconceptions or the news developments?

Natalie Brunell: So I set out, and I just wanted to sit down and interview them about their lives and their journeys to discovering Bitcoin, and I’m very grateful that because the Bitcoin community is so welcoming and wants to spread adoption and education, that people started to say, “Yes,” to those interviews. So, I was able to sit down with the people I respected and admired the most, the people like Saifedean Ammous, who wrote “The Bitcoin Standard,” Michael Saylor, first CEO of a publicly traded company to go on the Bitcoin standard. Lyn Alden, a really successful investment strategist, all these people that I think are some of the most brilliant minds that we have today in business.

Natalie Brunell: And I heard through them why they really gained conviction for Bitcoin, and that strengthened my conviction in Bitcoin. So it was a process, and it’s taken some time, and now I’m super passionate about bringing others down that journey.

Frank Curzio: And what I like about you too is, a lot of people when they believe in something they only want to talk to people that believe in it. Right? And you always want to hear the other side, right? Especially as you’re a journalist, you want to hear both sides of it, and you interviewed Peter Schiff, and Peter Schiff believes Bitcoin is going to zero. He’s not a big fan of it, and that’s his opinion, but you had that interview, I believe on Fox, and then also on your podcast, but what are your thoughts after that in terms of the respect factor? What do you think? Is he not getting something?

Frank Curzio: It seems like everything he believes about gold is the same thing. I mean, he has everything about central governments and inflation, and it just seems like Bitcoin is the digital version of gold. I mean, you could argue that in different ways, but he’s just so dead set against it. How did that interview go to you, and what’d you learn off of it?

Natalie Brunell: Sure. So first of all, I really love and respect and admire Peter Schiff. I think he’s a really wonderful, valuable historian when it comes to the history of the financial system. And so actually, one of the books that I recommend people read on their Bitcoin journey is a book called “The Real Crash,” which Peter Schiff wrote, and it doesn’t talk about Bitcoin, but it really harps in on the importance of having sound, hard money and talks about a lot of the problems with government spending, and what happened ever since the Federal Reserve was created.

Natalie Brunell: So, I see him as an extremely valuable resource when it comes to information on our financial system. But he does not believe in Bitcoin, and I am convinced that either he just hasn’t studied it as carefully and as meaningfully as we have in the Bitcoin community, or he potentially is now sort of a character in the space, who probably gets more notoriety and more exposure by being the villain of Bitcoin, because I don’t see how anyone who really truly understands Bitcoin, the system, the decentralization, the programming, the scarcity… I don’t see how they can be against it.

Natalie Brunell: And it’s funny, because I think that Peter is actually open to changing his mind. I know certainly he said on my podcast both that he wishes he had thought Bitcoin as an investment when people first told him about it, but he’s also said that if the world evolves to a place where people are transacting in satoshis, then he will admit that he’s wrong. And I appreciate that when people can admit they’re wrong, because we have a lot of people that have come out against Bitcoin and have since changed their minds.

Natalie Brunell: Michael Saylor actually, if you go back to his old tweets, he’s not deleted the ones where he basically said, “Hey, Bitcoin is the same as online gambling, and it’s going to go to zero,” and now look at him. He’s one of the foremost advocates for the technology. So people are first against Bitcoin, or at least highly skeptical of it before they’re for it, and potentially Peter Schiff will be a convert as well.

Frank Curzio: Yeah, and I followed Peter Schiff for a long time, most of my career, 25 years. I don’t think I’ve ever seen him change his mind, but we’ll see if that happens. And “The Crash” book is a good book, but I know he wrote that a long, long time ago, and revised it a few times when the market went higher and higher, but it’ll be interesting to see the inflation thesis is finally playing out for him, which is good, and I always respect that too in terms of interviews. So, he’s welcome on this podcast, and I’ve had a little back and forths a little bit, but I enjoyed it. I like that interview, which was great.

Frank Curzio: Now, I wanted to talk about the Bitcoin Conference. You attended it, and I believe you attended it in the past. What was different this year compared to past years, and is it… I mean, it’s getting to the point where I’m starting to wish they don’t have these conferences, because every time they do, the two to three weeks after Bitcoin usually takes a hit. But what was different this time? I know one of the things you said was organized, but what else? It seemed like it’s a very powerful conference. It gets bigger and bigger every year. What did you notice that was different this year compared to other years?

Natalie Brunell: Yeah. So ,the Bitcoin Conference for me was a very full circle moment, and you’re absolutely right. It is growing every single year. In 2019, they had about 2000 attendees. In 2020, it was canceled because of the pandemic. But 2021, when I first attended last year, it had more than 10,000 people, and this year more than 25,000. So, it is just growing in scale, and it really was truly one of the biggest events that I’ve ever experienced in any industry this past year.

Natalie Brunell: And for me, it was a full circle moment because when I became very passionate about Bitcoin, I really just I set out to do this podcast as kind of a passion project. I didn’t think that I was going to be able to leave my job to pursue Bitcoin endeavors. I just wanted to help educate people, and maybe show a human side to some of these big voices and thought leaders to help people understand how did they come to the conclusion of Bitcoin? Because these people all come from different backgrounds. They have different levels of expertise, a different career path that they’ve taken, and they all came to the conclusion that Bitcoin is the future, and Bitcoin is this pristine savings technology.

Natalie Brunell: So, I set out with no mission other than to do a podcast and learn a little bit more, and I dropped the first couple of episodes at the last Bitcoin Conference I attended, so that I could try to meet people like Michael Saylor and Saifedean and ask them to be guests, which worked. It actually worked. And then in the last year, I don’t know how, but I mean, the podcast has taken off. It has found an audience. I’ve been able to monetize it through sponsorships.

Natalie Brunell: I was able to leave my job, because I was able to secure an income through my work in Bitcoin podcasting and education, and so I came to this second conference less than a year later, and I was anchoring the Bitcoin news desk, and I MC’d the main stage, and it was just… I was honored. I was so grateful that this community opened their arms to me. They welcomed me, and now I’m able to have this very fulfilling career that I think will help usher in this new financial order that’s much more fair, and egalitarian, and based on values, than the one we live in.

Frank Curzio: Yeah, it is amazing. I mean, just looking if you’re on YouTube, or if you watch the same thing with our podcasts, where you can listen to, obviously, on iTunes, but we’re showing it right now, where it looks like you do it every single week, but just the quality of guests that you have on here is really incredible.

Natalie Brunell: Thank you.

Frank Curzio: I mean, and just learning curve, right? Just having these guests is amazing. So, getting back to the Bitcoin Conference, did anything change for you? Were there negatives that you saw? Because we always talk about the positives, especially with everybody that loves Bitcoin, but what was some of the negative? Was there any negatives that you took away that you were just like, “Well, this is a little…” Maybe sometimes too many people could signal the time for… Not a top, but maybe short term pullback or anything. But just, again, you said it’s organized, but I was wondering if there was any negatives from the conference that you knew, that you experienced?

Natalie Brunell: No, I really derive so much value from the speeches and the panels that happen during this conference, and it really puts a spotlight on just how massive institutions and massive brands are taking Bitcoin seriously, which is very inspiring and very confirming of my beliefs about this technology network. I guess the one thing that I would say is that, it’s interesting to see Bitcoin sort of in these choppy waters because of the greater macroeconomic picture. So, I think both of the last two conferences, we had this hope that Bitcoin was going to ascend to these maybe six figure highs.

Natalie Brunell: Last year, the Bitcoin Conference happened right after the China mining ban, so we suffered this massive crash and pullback, and now here we are in this very, very volatile environment, where we don’t know if the Fed is going to hike rates. We don’t know if inflation is going to get to double digits if they keep expanding the balance sheet. Everything is sort of uncertain, and so we don’t have that energy of Bitcoin is on this massive rally and massive run. So, I think that might have of even… It’s amazing how much energy there was at the Bitcoin Conference, but I can only imagine what it would be if we had the event during a massive rally. So, I hope that happens in the future.

Frank Curzio: Yeah. I know, right? One of the big announcements, and this came probably about a month ago, was Biden’s executive order on crypto, right? So, I know a lot of people believe in total decentralization, and that’s okay until you get money stolen, or you send it to the wrong address, and it’s gone forever, right? So putting the framework in place, I’ve argued that… Because you want the government hands-off as much as you can, but you need to know your money is safe, right? You need to know your money is safe in certain places, and you want to try to prevent fraud.

Frank Curzio: It seems like to me when this news came out, the biggest names in the space applauded it. What were you hearing at the Bitcoin Conference? Because I know diehards are totally against it. However, these are the same diehards that believe Bitcoin is going 100,000, 500,000, 1,000,000. In order to get there, you need the institution, the trillions, hundreds of trillions of dollars investment management to come into Bitcoin in order for that to happen, and the only way that could happen is if there’s some kind of checks and balances a little bit, to the point that they know that they’re checking off the fiduciary responsibility and things are safe. What were your thoughts, and were there a lot of conversations about that at the conference?

Natalie Brunell: Yeah, so I definitely think that there needs to be more regulatory clarity to have the appropriate avenues for these big institutions and big pockets to come into Bitcoin, which will drive more adoption at every level, and I do think that it’s coming. I think we’re very lucky to have someone like Gary Gensler in the SEC, who really understands Bitcoin, and who I believe will deem the other alt coins and currency securities, as opposed to recognizing Bitcoin as what it is, which is digital property, and we’ve seen people like Secretary Treasury Janet Yellen soften her stance on Bitcoin, where she was very, very adamant against it. Now she’s softening her tone, and I think Gary Gensler might be in her ear.

Natalie Brunell: So, the president’s executive order was actually a lot softer and a lot more dovish than I think people were expecting. But at the same time, you mentioned the diehards that are against it. Well, I think a lot of people are just worried and skeptical about this central bank digital currency, that we know we’re headed in the direction of a Fed coin and of a form of currency that’s issued directly by the government, and that gives the government direct control over the money, and Bitcoiners don’t want that, right? So, they’re hoping that this isn’t a bait and switch like, “Hey, we’re for cryptocurrencies. Yes, yes, yes, innovation, but here’s the central bank digital currency, and we’re all of a sudden going to be against Bitcoin.”

Natalie Brunell: Personally, I don’t think that that’s going to happen, although I do believe that they will push to the CBDC, and one thing that I do want to mention that I hope everyone recognizes is that the CBDC has a lot of disadvantages and risks, and things that worry me. Right now, the digital wand has been tested, and literally they can set an expiration date for the dollar. So, let’s say we have the need for stimulus or UBI, the government would essentially say, “Hey, you can only use this money until this date in order to stimulate the economy and stimulate consumer demand and consumerism in general.” And so, you’re not actually the owner of the money that’s in your account when it’s a CBDC. You’re not in control of it. Someone else is.

Natalie Brunell: They can freeze your account. They can seize your account. They can incentivize you to spend it at certain businesses. This literally puts the ultimate control in the central authority’s hands, which I think people should be wary o, because I’m a believer in freedom. I’m a believer that if you earn your money, you should be able to spend it how you want to spend it, and I don’t think that some authority should come in and be able to basically make your money vanish at the stroke of a key, or expire on a certain date if you don’t use it. I think that that’s a little bit a scary world. I don’t want to head in that direction, and so I do want to caution people that when they hear “CBDC,” it’s not like Bitcoin. It is a completely controlled, manipulated form of money.

Frank Curzio: Wow, that’s cool. I didn’t know that. Wow. That’s awesome, and you’re right. I think it’s just such a separation there, right? I mean between Bitcoin and what they’re going to produce, because Bitcoin is anti-central governments. Right? So they’re trying to catch up, and I agree with you there, but I didn’t know that, the expiration and stuff like that. That’s very interesting, very interesting. So Bitcoin, right? We talked about Bitcoin, the conference Bitcoin is everything Bitcoin, but what about alt coins?

Frank Curzio: There are companies I would say when I researched this sector, and I’ve been doing it for five years now, six years, I would say 90% of it is garbage and shit, but there are some projects that are amazing, right, that you know about. Is there anything else that you like in this industry that has you excited, or is it, “Hey, I’m Bitcoin, and that’s it.” Which, I’ve interviewed people who will only talk about Bitcoin, but I think I’ve seen you on Twitter and on your social media channels talk a little bit about other things that you’re doing.

Natalie Brunell: So, I am a huge believer in free markets, and I believe that people should allocate their money based on their risk tolerance, and personally, I am Bitcoin only. I started my journey like so many people, and I had other alt coins, and I essentially saw them as what I think they are: lottery tickets or essentially gambling, right? You’re hoping that one of them takes off, and they’re a lot cheaper per unit. So you think, “Well, if I have 1,000 of these, and it goes to 1,000% up, I’m going to make a good amount of returns.” But at the end of the day, as I learned more and more about Bitcoin, I saw the true value of a form of digital property and digital gold, as opposed to what I see all the other tokens and alt coins as, which are securities in companies.

Natalie Brunell: Most of them are backed by central groups, centralized organizations, and venture capital, and you take a lot more risk. Some of them might be profitable, and some of them might have use cases and applications, but you really don’t know. They are not trying to be money. They’re not trying to fix our financial system. They’re not trying to be a form of currency in the real sense like Bitcoin is. So, I caution people when it comes to the other companies because when they are deemed securities, I think there are going to be a lot of question marks. I think there are going to be a lot of losses.

Natalie Brunell: Anyone can create a cryptocurrency today, and there have been many people who have tried to copy Bitcoin, but they can’t due to the network effect and the power of the decentralization. So, I just say invest with caution, and as opposed to the other currencies, the other alt coins, where you have to sort of time the market and figure out when to sell, Bitcoin is about time in the market. It’s about putting your money somewhere, not selling, and seeing it go up in value despite the volatility. So, I’m passionate about Bitcoin, but if people want to invest in others, power to them.

Frank Curzio: Cool, okay. I’m going to bring something up here, and what I like to do with all my interviews, because I’m going to embarrass you. So, not only are you a Bitcoin enthusiast, not only are you an award winning journalists, and have an exceptional, exceptional podcast, guys, you have to check out, which is Coin Stories, but you also have a hidden talent here. You want to explain this for me?

Natalie Brunell: Oh, gosh.

Frank Curzio: This is pretty good. I watched it. I just saw it come up, and actually maybe I could play it really quick.

Natalie Brunell: Okay. Yes. I-

Frank Curzio: So this is a dancing contest, for people who aren’t watching on YouTube, but you were fantastic with this, but this is Dancing with Desert Star. What is it? I haven’t even heard of this before. This is awesome though.

Natalie Brunell: Yeah, so my first job as an on-camera reporter was for an ABC affiliate in Palm Springs, California, and they basically created this massive charity event copying Dancing with the Stars, but it was Dancing with the Desert Stars. So, it was local celebrities raising money for a great cause. So, we raised I think that year $100,000 for the Desert AIDS Foundation, and so they paired you with a professional ballroom dancer.

Frank Curzio: Wow.

Natalie Brunell: And you had to train for six weeks, and we performed in the convention center, and I won the Mirrorball, so that was fun.

Frank Curzio: That is awesome, and I always like to poke fun, because everybody has these little hidden talents, and things that we love, and stuff like that. And you’re actually great. It was great. So, I knew you wouldn’t be embarrassed by it, but that’s awesome.

Natalie Brunell: Thanks.

Frank Curzio: So listen, I want to thank you so much for coming on. I do follow you guys on Twitter, you on Twitter, but, guys, I would definitely suggest following Natalie, and if people want to learn more about you, where should they go? What they could do, and again, I know that you have a huge, huge presence in social media and Bitcoin, so how can they find you?

Natalie Brunell: Thanks. Yeah. So, three places, I’m very active on Twitter. My handle is @natbrunell. My show is on all the podcast platforms and YouTube, it’s called Coin Stories. And you can also connect with me going to my website, talkingbitcoin.com. I have resources up there. I have a way for you to contact me or sign up for my newsletter. So, I encourage everybody to check that out as well.

Frank Curzio: Nat, all great stuff. Well, Natalie, thank you so much for joining us, and hopefully you’ll join us again soon.

Natalie Brunell: Thanks so much for having me. I’d love to come back on, and take care.

Frank Curzio: All right. Take care. Okay. Great stuff from Natalie, really enjoy having her on. Just seeing how long ago, where she started the podcast to where she is right now, and how many people follow her, and being influential is not just covering a subject, right? I mean, she’s targeting a lot of different things, especially women in this industry. And she said, “Well, I just went to the Bitcoin Conference to get out there, and hopefully I could do interviews.” And that’s what it’s about, right? You have to put in the work. You have to go through it. You have to get there. People are going to tell you, “No.” They’re going to tell you, “F- you.” They’re going to say all this stuff about you. You got to push through that, and to see where she is right now, how many followers she has, a YouTube channel, and some very, very big influential names in the industry have come on her podcast. Good for her. Good for her.

Frank Curzio: I hope she’s a major influence for a lot of people out there. You see more and more people get into the crypto world, and I like and enjoy the conversation because there wasn’t fluff there. It wasn’t, “Well, Bitcoin is going to 3 million, and, everyone, you should buy it right now, and you’re crazy if you’re not.” It was just, “Hey, this is what I learned about it. This is why I believe in it. These are the people I interviewed to reinforce that, and I’m going to the conference, and I’m 100% Bitcoin.” I mean, that’s the process of having, not just with Bitcoin, but anything that you’re going to do and be passionate about, and just see the passion there and no fluff, and I love the fact that she did that interview with Peter Schiff. Don’t buy his book.

Frank Curzio: I mean, he wrote that book nine years ago, and then he revised it a whole bunch of times, and again, I’m very honest and open. I’d love to interview Peter Schiff, and I’d have fun with it or whatever. I just think that, again, you guys know how I feel about it. It’s not because he thinks Bitcoin is going 1,000, but the inflation thesis he’s had for 25 years since the eighties, when it was inflation, and sometimes you just got to say, “I’m wrong a little bit on gold,” or whatever, because every single… He was saying that Bitcoin was negatively correlated to technology and growth stocks, and he was saying that now when the market comes down, it’s actually correlated. Right? So, Bitcoin is correlated with the market, and growth stocks come down, and he’s talking about gold isn’t correlated, and I was like, “Gold isn’t…”

Frank Curzio: Basically, if you’re looking at the math behind it, and you look since 2012 in gold, which is interesting, it’s not correlated with anything, right? Because everything went higher and gold didn’t. Everything, every single asset class across the board went higher, every single one, every single one. So just being upfront and fair, and I’d love to have that conversation, have him on, and the back and forth, which I think is pretty cool. I don’t like to talk about people when they’re not here. Hopefully, we’ll do that at a conference or whatever. But getting back to Natalie, really appreciate her coming on, and definitely take a listen to her podcast, which is really, really awesome, so Coin Stories.

Frank Curzio: I started listening to it again. I do a lot of research on all my guests, as you know, before I have them on, and I was very impressed with her work, and I was honored to have her on. So really, really good stuff, guys. So, that’s it for me. Questions, comment, feel free to email me at frank@curzioresearch.com. That’s frank@curzioresearch.com. Enjoy the week, have fun. Make sure you spend time with your family this weekend, enjoy it. And I’ll be back next week. Take care.

Announcer: Wall Street Unplugged is produced by Curzio Research, one of the most respected financial media companies in the industry. The information presented on Wall Street unplugged is the opinion of its host and guests. You should not base your investment decision solely on this broadcast. Remember, it’s your money and your responsibility.

Editor’s note:

If you haven’t started building a crypto portfolio, now’s the time… before Bitcoin bounces back over $60k… and pulls the rest of the crypto market up with it.

The average gain in our Crypto Intelligence portfolio is over 370%—including the losers…

But there are still a ton of buying opportunities across several major digital asset trends—from security tokens… to revolutionary fintech… to the metaverse.

And Biden opened the floodgates for billions to start pouring into this space.