The great Yogi Berra had a way with words. He once said, “You can observe a lot by just watching.”

I took that quote to heart this weekend by doing a deep data-dive.

I took a detailed look at what big institutions are doing so far in 2021, especially when it comes to which sectors they’re buying.

What I found was eye-popping.

As you probably know, 2021 is off to a much better start than 2020. Actually, that’s an understatement. In terms of performance, the difference is “night and day.” The world was in chaos one year ago… it was hard to find any bright spots for investors.

Today, the situation is the exact opposite. It’s difficult to find a dark spot. Economies are reopening, people are getting vaccinated, kids are going back to school, and signs keep pointing to an economic recovery.

And that’s exactly what the data is showing. And one sector is way ahead of the rest in the eyes of big institutions. But the Big Money is buying almost every sector so far in 2021. That’s a great sign for the stock market.

Eventually that narrative will change. But until then, the trend is your friend.

And that’s what I’ll be sharing with you today: the biggest sector trends.

Let’s dig in.

Q1 Big Money sector footprints

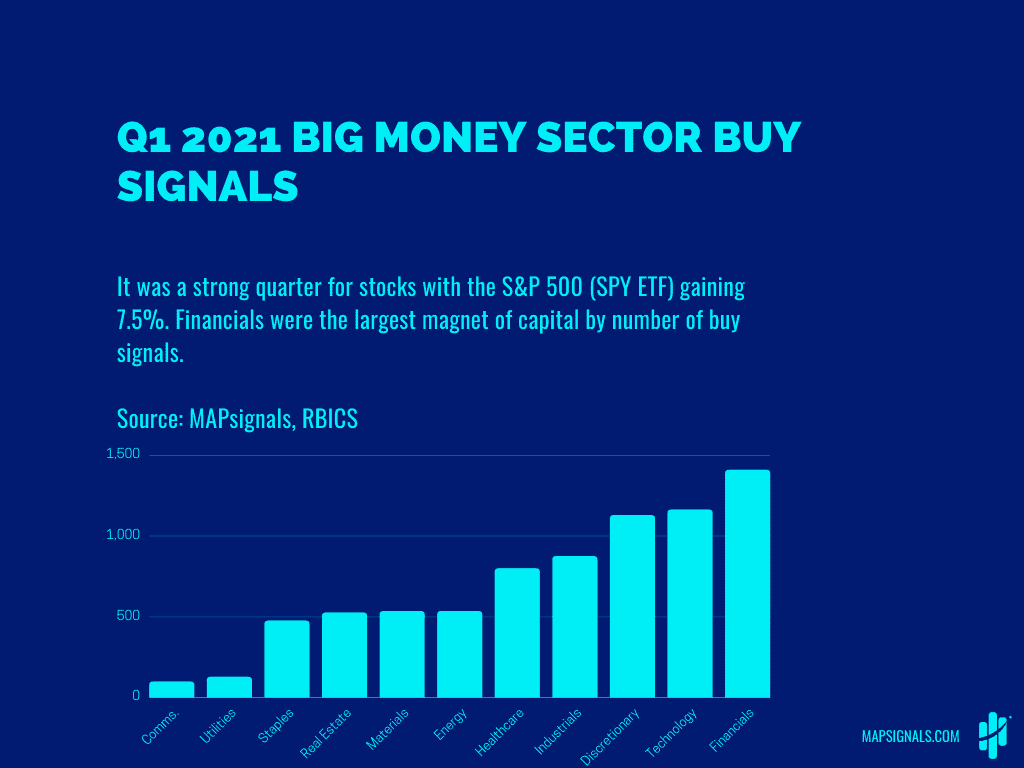

The first quarter was strong for stocks. The S&P 500 ETF (SPY) gained 7.5%.

But, which sectors saw the most buying? In the chart below, I’ve added up all the buy signals across each sector of the stock market during Q1. As you can see, financial stocks were the top dog in terms of Big Money buying:

But this data only tells us part of the story. It doesn’t account for the size of each sector. You see, some sectors have bigger universes than others. The tech sector is huge. It includes 275 companies. Meanwhile, the energy sector has just 86 stocks.

In order to get a better idea of which sectors had the fastest “velocity” of Big Money activity, we need to account for the size of each.

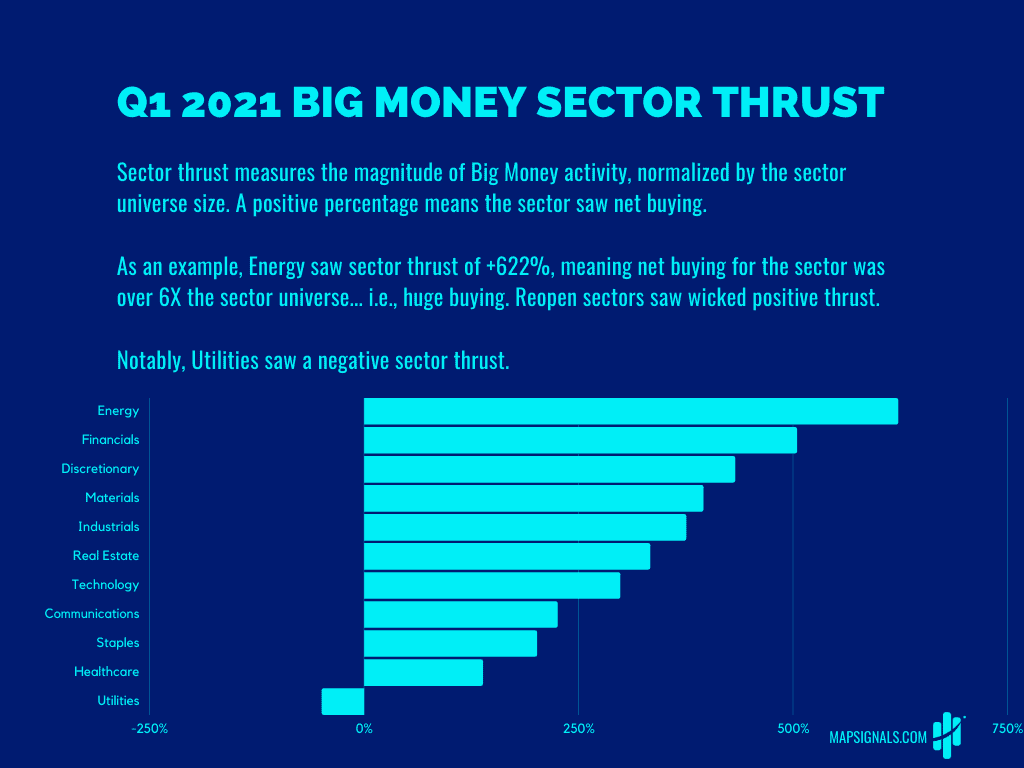

To do that, I took the buy signals from the chart above, subtracted sell signals, and divided by the number of stocks in each sector.

Here are the results…

I call this number “sector thrust.” It gives us a clear picture of the Big Money buying in each sector.

Obviously, a bigger number is better. I’ve shown the numbers as a percentage so you can see how much buying there is relative to the size of each sector.

As you can see above, Energy is the clear winner. This sector saw monster buying relative to its size. It had a sector thrust of over 600%. That means there were 6 times (6x) as many buy signals as there are total stocks in the sector. That’s a huge amount of buying, especially compared to other sectors.

Notice that although Technology came in second in our first chart, it dropped to seventh place when we adjusted for the number of stocks in each sector. Put simply, the Big Money buying in tech stocks wasn’t impressive during Q1. That explains why tech stocks have lagged the rest of the market recently.

Meanwhile, Utilities had negative thrust. That means my data showed more sell signals than buys during Q1.

And remember when I mentioned that last quarter was night and day different compared to a year ago?

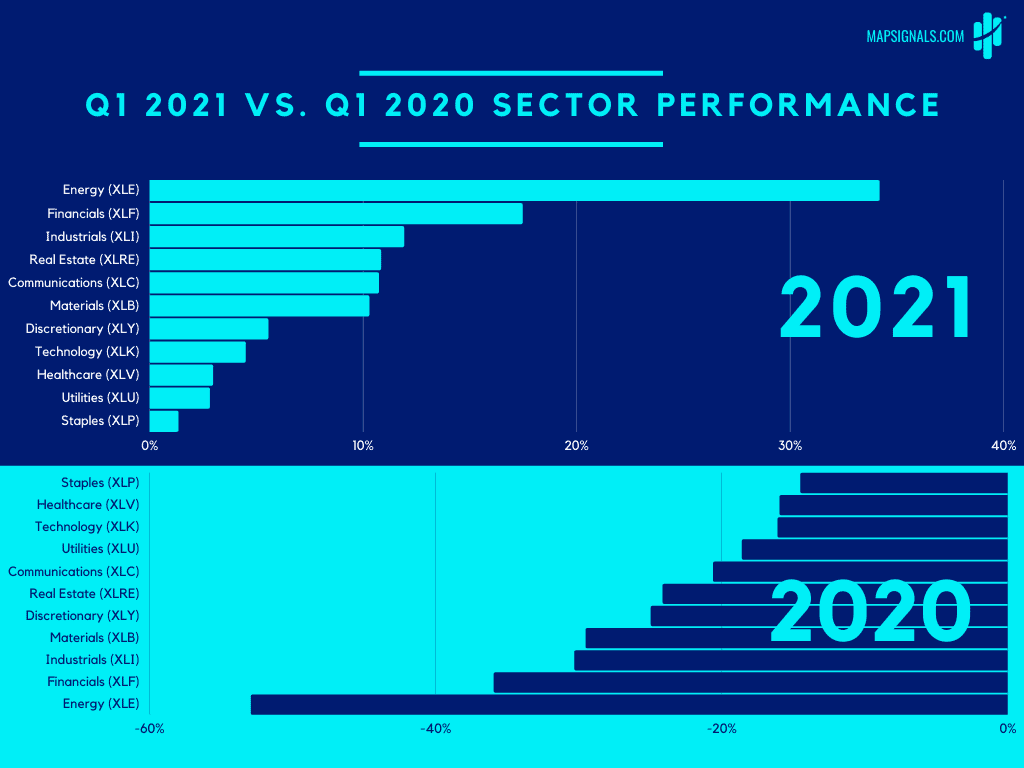

Take a look at this year’s performance vs. last year:

The latest performance is almost the exact opposite of last year.

It’s as if the sectors were flipped. Energy, Financials, and Industrials were last quarter’s leaders. But in Q1 of last year, they were the three hardest-hit sectors. Similarly, Staples were the worst-performing sector this year. But they were the best place for investors to hide during Q1 2020.

In short, we’re seeing one of the greatest “reversion trades” I’ve ever seen. A year ago, certain sectors suffered an extreme selloff. Today, they’re swinging back the other way.

This matches what we’ve been seeing in the stock market. Since November, the markets have been a one-way train higher. Small-caps and reopen sectors have seen relentless buying. And each dip has been a buying opportunity.

Based on the data, the no-brainer move is to buy energy stocks. It’s the sector with the most support from big institutions.

The simplest way to play this trend is to buy the Energy Select Sector SPDR Fund (XLE). This ETF includes two dozen large-cap energy stocks, including large positions in Exxon Mobil (XOM) and Chevron (CVX).

Another great option is to buy the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD). I mentioned this fund last week, when I wrote about the uptrend in high-dividend stocks. SPHD includes dozens of high-dividend names, including large positions in both the energy and financial sectors.

The bigger takeaway is that markets are positioned for more upside. The latest numbers show that big institutions have an overwhelming appetite for stocks. And you’d be crazy to bet against this trend.

I hope your portfolio is along for the ride.

P.S. Every month, my colleague Genia Turanova sends Unlimited Income members her favorite dividend idea on the market.

But in this month’s newsletter—coming out tomorrow—she’s got FOUR new recommendations for high yield… and high growth.

Become a member today and get these stocks delivered to your inbox—along with the rest of Genia’s favorite assets to create long-term wealth.