A group of COVID-battered retailers and similar stocks are now flying high… led by video game store GameStop (GME).

GME more than doubled yesterday (January 27)—soaring from $40 to $468 within a week. Even after declining by 43% today, GME is up close to 950% year to date.

Clothing retailer company Express (EXPR) more than tripled yesterday and is up 420% year to date. And the list goes on…

It’s impossible to look away… or not want a piece of the action.

But longer-term—defined in this case as a few weeks—this kind of action is not sustainable… and definitely not good for the market.

We do see 1,000% gains in a week—but rarely. Historically, they’ve been largely confined to a group of thinly traded penny stocks… and often follow a boom/bust pattern. Short-term doubling or tripling is much more common. Normally, a stock can double quickly if its future outlook sharply improves (or if the company is bought out).

But the story behind today’s stratospheric rises is different…

These high flyers have a lot in common: they’re relatively low priced (or were at the start of this year) and heavily shorted. These two factors—low price and large short interest—go hand in hand: the market saw little value in the businesses, and shares sold off… with expectations for more declines.

Traders—congregating on Reddit message boards like WallStreetBets—disagreed. Their positive opinion, supported by massive buying, has turned into a self-fulfilling prophecy.

But it only works if everybody’s buying.

When the buying wave ebbs, these stocks will decline as fast as they ascended.

It’s a game of musical chairs on steroids. As tempting as it might be to jump in, it’s extremely risky… and the longer it goes, the riskier the game. Remember: there’s no such thing as a free lunch.

We’ve seen these boom and bust patterns many times over the years…

Stocks that see a huge wave of buying interest—supported by stories of new technology that will dominate the world (like in the final months of the dot-com era), or a newly created asset class (like cannabis stocks immediately after the legalization of pot in Canada)—come crashing down when traders try to cash in by unwinding the bets.

There was plenty of similar weirdness in 2020…

Remember Hertz (HTZGQ)? Last May, this car rental giant, a victim of COVID-related air travel collapse, filed for bankruptcy protection.

In early June 2020, just a few days later, small buyers converged on shares of the bankrupt company, bidding the stock 350% higher in just two days… and nearly 600% higher in less than a week. In a span of two weeks, the stock traded from under $0.50 to above $6 a share.

As sure as the force of gravity, market forces ultimately prevailed—and the stock dropped to about $1.50 per share. Even after being swept up again in the small-cap frenzy, Hertz now trades under $2. Equity holders who bought in last summer expecting a swift recovery are still waiting.

While most of today’s market darlings aren’t bankrupt, and the market is supported by near-zero interest rates and unlimited liquidity (expected to last well into 2022 and possibly beyond), many of these high-flying businesses are in a precarious situation—which was the reason short sellers converged on them to begin with. These companies might not deserve their 2020 declines… or maybe they did. It’s still for the market to figure out.

To find the right equilibrium price, it’s important to prevent market manipulation of all kinds from happening.

But the army of retail traders, ostensibly fighting hedge fund market manipulations, are also messing with market equilibrium—only in a different direction.

Their wrath for short sellers is highly misguided.

It’s very important for the market to let a negative opinion on a stock be known. And there are two basic ways a trader or investor can express a negative view: by not buying a stock (a passive stance), or by shorting it (an active stance).

But today, with passive vehicles like index ETFs accounting for about half the market, going on a buying strike isn’t enough.

The beauty—and danger—of index investing is that it doesn’t differentiate between the many stocks in the index. With every dollar that goes into an index fund, a certain amount goes into every single stock in the fund… proportionately to that stock’s index weighting.

Price discovery—one of the most important goals of a functioning market—is then left to active investors. Some of them must be long… And some must be short.

It’s common to blame short sellers for all the ills of the market… up to banning some short sales altogether, like the SEC did in 2008.

But as I mentioned, this blame is misplaced. GME and its peers soared to unthinkable highs because too many available shares (the “float”)—more than 100% in some cases—were sold short.

This was playing with fire.

To sell a stock short, it should be borrowed from someone who’s long, creating a balance. If you can sell short the entire float or more, the process is broken.

Academic research shows what we all intuitively understand: a well-functioning market needs traders of all kinds, and having active short sellers actually reduces stock volatility after negative earnings surprises.

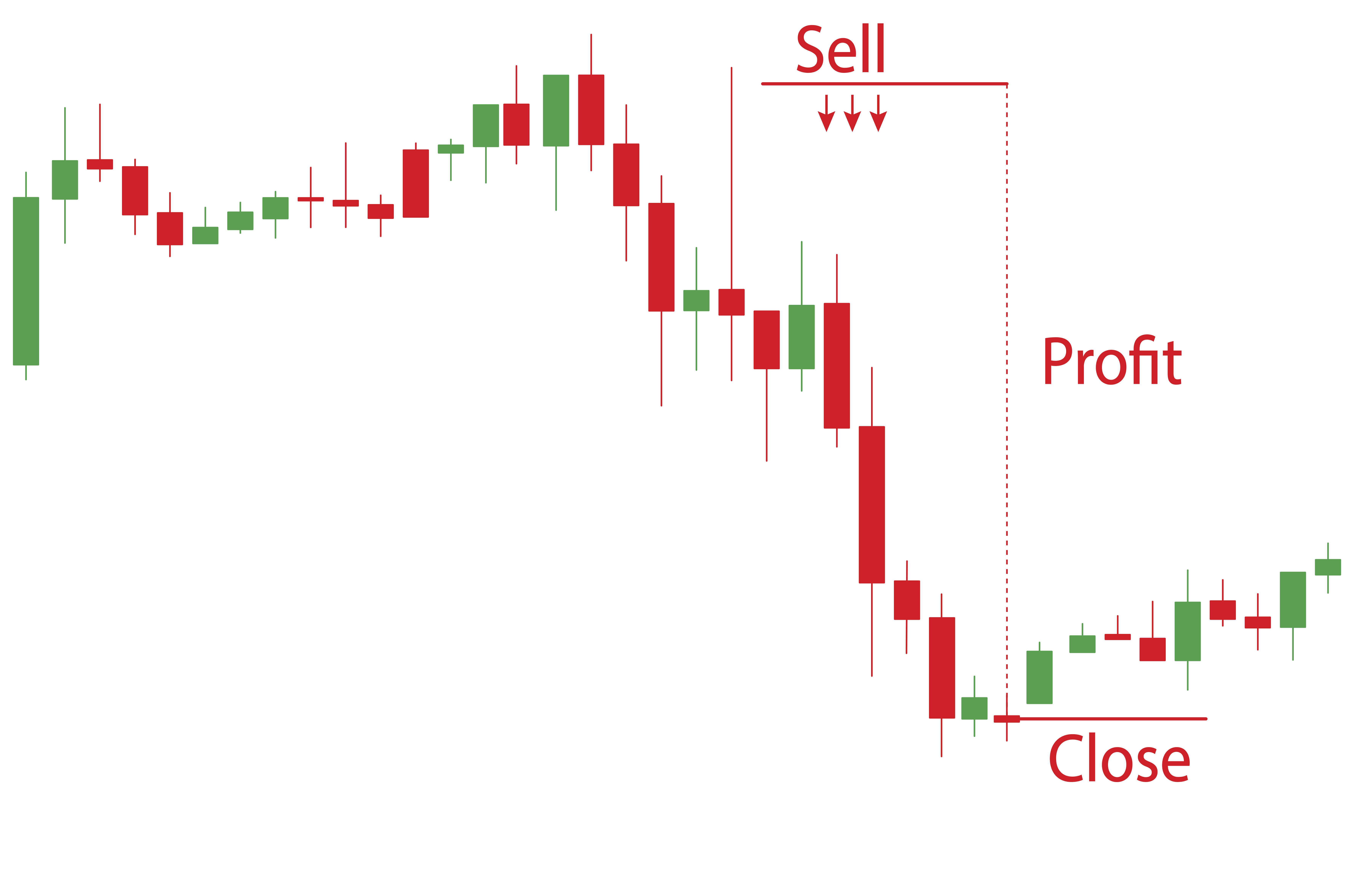

But this GameStop melt-up also highlights the advantages of buying a put option versus shorting a stock: put investors can only lose their original investment.

With a short position (when you borrow and sell a stock at today’s prices, with a goal to repurchase later at a lower price), you can rack up unlimited losses if a stock price rallies significantly… like it did for GME and its peers.

A short sell

Melvin Capital and Citron Capital were reportedly forced to cover their GameStop short positions at much higher prices (a forced buying called a short “squeeze”).

I don’t know when GME or AMC will return to Earth… or at what price they’ll land.

But they won’t stay at these unnaturally elevated levels. Their fundamental positioning won’t change because their share prices are higher… although they might not crash down to where they were at the beginning of the year.

Regardless, a rally like this isn’t a good thing for the market as a whole. Similar rallies have often preceded market tops.

Stay vigilant… build some extra cash cushion in case of a market downturn… own a few hedges in different sectors… and stick with quality stocks.

Long-term, your portfolio will thank you.

Editor’s note:

If you’d like some piece of mind in these volatile times, Frank urges readers to follow Genia’s put option strategy in Moneyflow Trader. When the market falls… and most investors are losing their shirts… you could be sitting on triple-digit gains.