They say nothing goes up in a straight line.

Well, don’t tell that to this market.

So far, 2020 has defied every expectation there is… and the market truly seems unstoppable.

But the truth is, there are many reasons for the markets to pause here—and, quite likely, reverse its recent trends.

One reason is obvious: Our economy is still in the grasp of the pandemic.

The other: The market is supported, more than ever, by fiscal policies (government spending on PPP and other programs) and monetary policies (zero interest rates and unlimited QE).

And while the economy has proven quite resilient, considering all the uncertainties and stoppages it’s enduring, any threat to future stimuli might bring this tech-led rally to its knees.

To steal a glimpse into the future, we can look at second quarter (Q2) earnings reports from some of the largest commercial banks in the country.

These reports are a mixed bag. Together with record revenues (largely due to the surge in bond and stock trading), we’ve seen sharp increases in reserves (protection against bad loans)—the direct result of the weakening outlook for the economy.

The largest U.S. bank by assets, JPMorgan Chase (JPM), said two days ago (Tuesday) that it added $8.85 billion in bad loan provisions during the just-reported quarter. That’s 38% higher than in the first quarter—and more than double (up 143%) what it was for the same period a year ago.

Much of the recession is still ahead, according to JPM’s outlook, and the recovery will be slow. Hence the higher reserves.

Prudent reserve management, together with record-strong trading revenue, should help the country’s most powerful bank weather the recession. And it isn’t alone in staying profitable for the quarter, despite the surge in bad loan reserves… Citigroup (C), Goldman Sachs (GS), and Morgan Stanley (MS) all turned nice profits in Q2 as trading revenue surged for all of them.

Large financial institutions have been supported by the Fed’s liquidity policies, and their trading and investment banking department have been helped by record debt issuance in the U.S.

According to Bloomberg, companies have sold a record $2.1 trillion of bonds through July 15 (compared to just $1.37 trillion in the same period last year), and almost half of this record was issued by U.S. companies.

By keeping the rates low, the Fed helped these borrowers to keep costs of debt low… and this has also helped the banks by keeping their business humming.

But just like every other sector in this economy, not every bank has benefited equally.

Wells Fargo (WFC) even had to cut its dividend… usually the measure of last resort for an established business.

Two weeks ago, I told you the cut was coming… and why it was long overdue. In sum, it stemmed from the uniquely bad situation WFC found itself in after the fake-account scandal. And it was greater than the market anticipated…

WFC cut its quarterly dividend by 80% (from $0.51 per share to $0.10 per share). This came on the heels of a huge loss of about $0.66 per share.

I’d still avoid WFC… but the largest banks in the country look safe for now. They’ll continue benefiting from the same factors powering this rally: unlimited QE, zero interest rates, and massive government spending.

No wonder the financial sector’s relative performance has recently improved.

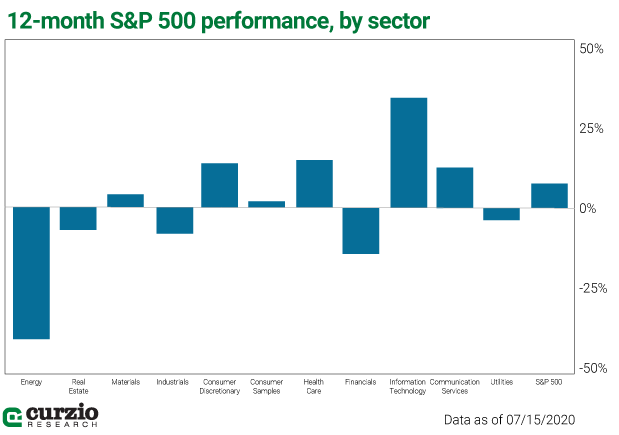

On a year-over-year basis, financials are the second-worst sector in the market (next only to energy, and down 14.2% vs. the market’s positive 7%).

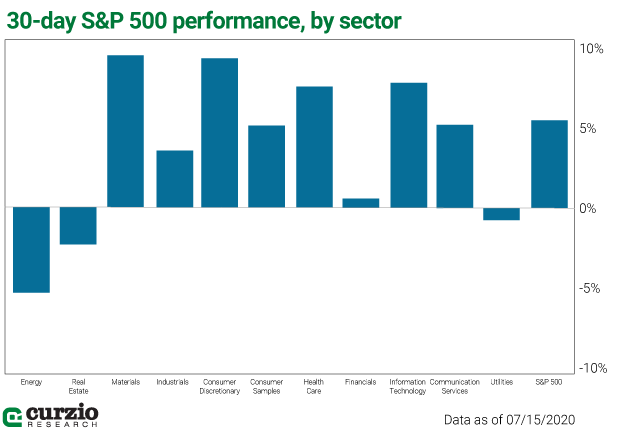

But in the past 30 days, financials have improved somewhat. It’s no longer the second-worst sector in the market. While still lagging the market itself (not to mention the technology, discretionary, and material sectors), financials are in positive territory—up 0.5% over the past month.

Here’s why this pick up in relative performance is important… Financials are now 8th among the 11 S&P 500 sectors.

Historically, financials lag when the market declines, and they often lead the market out of a slump.

Of course, 2020 is very different from any other market we’ve known.

In years past, the Fed would cut rates in a recession… and start hiking as economic conditions improved. Higher rates are good for banks… and so are improving economic conditions. Banks can lend more… the default rate on their loans stabilizes or declines… and they make more money on the spread between short-term and long-term rates.

On the opposite side of the spectrum, zero interest rates and a weakening economy are the headwinds for the financial sector.

Banks borrow at short-term rates (think the interest rate on your checking or savings account) and lend at long-term rates (think your 30-year mortgage). When there’s no spread, there’s little room to make money.

But this past quarter, many banks benefited from the Fed’s policies—as we just learned from their earnings reports.

This isn’t bad for the economy—it needs a strong financial system to survive the kind of turbulence that’s still ahead.

But it’s not necessarily a bullish factor, either. If Fed-created liquidity benefits financials disproportionally, it’s not good for the majority of the economy… and especially for small businesses.

The banks must survive for the economy to survive. But for all of us to prosper, we need to see more equal distribution of Fed-created benefits… stronger bank lending and growing (or at least stabilizing) revenue and profits in sectors other than financials.

It’s something to watch for in the days and months ahead…

P.S. With formerly “safe” companies cutting dividends… and a zero-rate environment… it’s more challenging than ever to find steady investment income.

But with no alternative options, more and more money is going to pour into the best income stocks… supercharging dividend growth and share prices.

To help you take advantage of this enormous growth trend, I’m proud to announce the launch of my new income-focused newsletter, Unlimited Income—TODAY.

To celebrate, we’ve put together a special package for new members at an extreme discount.

Click here to watch Frank’s short video with all the details.