Forget Evergrande… the market already did.

In a huge turnaround, the S&P 500 turned from a 1.3% decline to a 0.4% gain this Wednesday… and added another 0.8% yesterday…

The biggest risks stocks face this week… this month… and possibly even into 2022… come from the debt ceiling debacle and energy price crisis.

The debt ceiling is one of those man-made problems that can be resolved with relative ease, as it has been in previous years—if politicians come to an agreement.

Left unresolved, the debt ceiling can harm the market and your portfolio.

The good news: The Senate approved a debt ceiling extension until December, which means the market has another couple months before it starts fretting over it again. And there’s still time for us to protect ourselves against the worst-case scenario.

But the market is watching another huge story that can impact your portfolio and your pocketbook: The energy crisis.

Today, we’ll talk about what’s happening… and an easy way to fight back against surging energy prices.

Due to increased demand and years of underinvestment, the world is facing very real shortages of oil and natural gas… and prices reflect this.

This week, oil prices jumped to the highest level since 2014. And natural gas continued its wild ride.

Here in the U.S., natural gas (measured by its Henry Hubs benchmark) is up 145% year to date—a massive four-fold increase off 2016 lows.

Unlike oil, which is relatively easy to transport around the globe, natural gas is still largely consumed relatively close to where it’s produced… To cross the ocean, gas must be liquified at significant cost (and with massive infrastructure)… while land pipelines can carry it for much less.

That means the prices of natural gas on different continents can vary widely…

In the chart above, that 800% spike is related to the energy crunch during the Texas cold spell earlier this year.

But if you think that’s crazy… you haven’t seen the recent pricing for Dutch TTF, a regional natural gas benchmark in Europe.

Over the past year, the TTF benchmark rallied almost eight-fold (695%).

The natural gas rally in Europe occurred more gradually… and for a longer-term reason: Winter is coming… and storage facilities in Europe are running low.

Meanwhile, China has ordered its energy companies to secure winter supplies at all cost. From coal to oil, the country plans to buy everything it can if its domestic supply falls short.

All of this puts upward pressure on crude oil demand, because, in many cases, oil can replace gas or coal as a source of energy.

Bloomberg reports crude consumption has recently risen by around 500,000 barrels a day.

In sum, the spikes in oil and natural gas prices are related… and we should expect more of the same into winter months.

The best—and safest—way to play surging energy prices is via the Energy Select Sector SPDR ETF (XLE).

It’s up more than 45% in 2021 and 85% in the past year. With this much energy demand, profit growth for the companies XLE tracks is all but guaranteed.

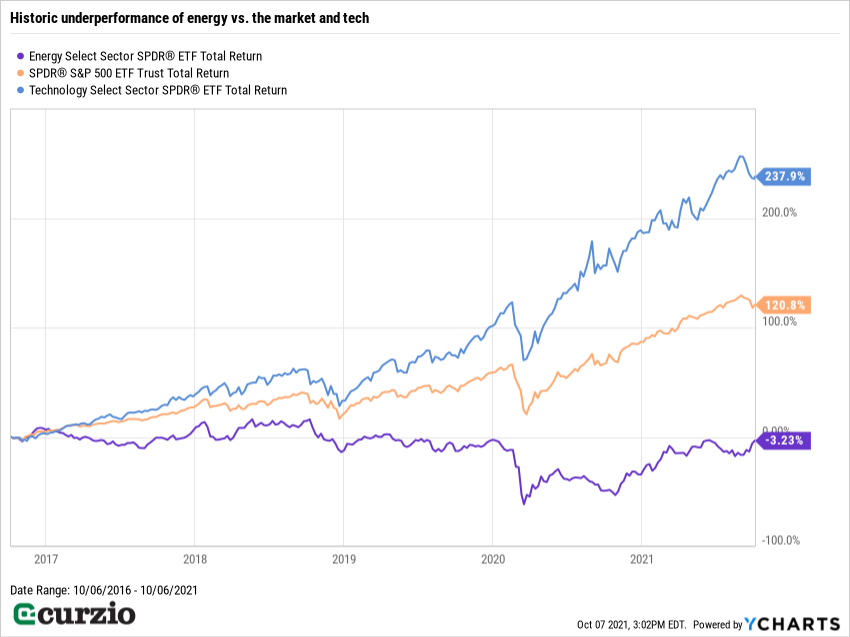

Over the past five years, while the rest of the market rallied, energy stocks slumped.

Even if you count dividends, the sector is down slightly over a period when the overall market more than doubled… and tech stocks more than tripled.

This means energy stocks are still undervalued… and still a bargain relative to the market and to tech stocks.

XLE has more than 40% of its assets invested in just two energy majors—Exxon (XOM) and Chevron (CVX). But it will also give you exposure to smaller producers… oil service companies… and even pipelines. Plus, it currently offers a 3.9% dividend yield.

Don’t go overboard with your energy bet—energy stocks are equities and they’re not immune to market woes… especially if higher inflation makes the Fed hike interest rates earlier than expected… if policy-makers make a big mistake not raising the debt ceiling… or if the Evergrande fallout spreads beyond China.

Still, if you must pay more at the pump or in heating bills, you may as well hedge these expenses with some energy stocks. The sector is undervalued… and its profit outlook has sharply improved over the past few months.