On Wednesday, semiconductor giant Intel (INTC) did something the market rarely forgives: It cut its dividend.

Before the announcement, Intel’s (seemingly reliable) 5.6% dividend was one of the highest among large-cap stocks.

But after the 66% cut, Intel’s dividend yield sits below 2%. It’s still an above-average payout compared to the S&P 500… but it’s lower than competitors like Taiwan Semiconductor (TSM) and Qualcomm (QCOM).

In short, one of the biggest reasons to own Intel—its income stream—is now off the table.

But are there other reasons that make the stock worth considering? Or is it set to suffer the typical fate of dividend-cutters… and enter a long period of declines from here?

Today, I’ll break down what to expect from INTC going forward…

But first, let’s get a better understanding of why the market hates dividend cuts.

Why dividend cuts are a sign of trouble

Typically, after a company announces a dividend cut, its stock price suffers.

It signals that the business may be facing a worst-case financial scenario… and that investors need to reevaluate their thesis.

Income investors, in particular, lose their main reason for holding the stock—its payout—leading them to dump their shares.

And because management knows exactly what this move signals, it’s often a last resort when a company desperately needs to save money.

Dividend cuts aren’t always a bad thing: Ultimately, the saved (and invested) funds could result in a stronger business… a higher stock price… and an even higher yield down the road. But this success is not a given… and it can take a long time to materialize.

In short, companies know a dividend cut will scare the market—so if they do it anyway, the market assumes there’s a reason to worry. So it’s usually a big deal… and sends investors running.

Yet, interestingly, Intel’s dividend cut was just a blip on the market’s radar…

Why the market barely blinked at Intel’s dividend cut

Intel’s surprise announcement sent the stock down less than 2% in two days.

This minimal reaction suggests the market knew Intel’s generous dividend was unaffordable… and that a sizable cut was widely expected.

You see, Intel has been hard hit by a slowdown in PCs. It’s also been losing market share (to AMD) in the highly lucrative server chip sector. And it faces fierce competition in graphics and mobile chips from NVIDIA and Qualcomm (to name just a couple).

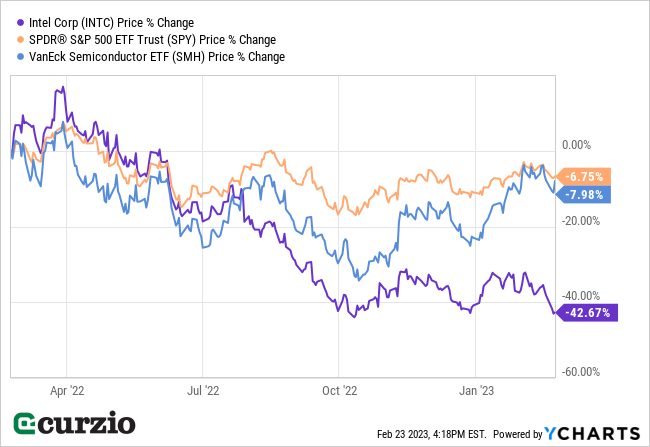

The market knew something had to give… which is why Intel’s stock fell much more than the market—and its semiconductor peers—over the past year.

Barron’s suggested back in June that Intel’s entire future hinges on its dividend policy—saying it would be wise to reroute some of the $6 billion it spends on annual dividends towards projects to help the company remain competitive, like developing new products and building factories.

Now, Intel can start to execute on its long-awaited turnaround. In fact, Morgan Stanley has already upgraded the stock on these grounds.

But that doesn’t mean it’ll be smooth sailing for INTC from here…

Why Intel’s struggles are far from over

Executing a turnaround is risky and capital-intensive. It depends on the underlying strength of the business… And strong businesses aren’t the ones in need of a turnaround.

In Intel’s case, it will need to invest in new factories and its new foundry business, which it desperately needs to stay relevant in a fast-moving, highly competitive semiconductor industry.

Yes, from a “growth” point of view, Intel now looks more attractive than it did a few days ago, as it has freed up the capital needed for a turnaround.

But many income investors—including income-oriented funds and ETFs—will be bailing now that the yield is no longer competitive. This will keep downward pressure on the stock for a while.

Long-term, the story looks a little brighter for Intel.

After all, the company is strategically important to the U.S. efforts to achieve semiconductor independence… and it’s one of the beneficiaries of the $52 billion CHIPS bill.

Plus, it has massive assets, from its $30 billion stake in Mobileye (MBLY) to $80 billion in factories—versus only $12 billion in debt.

But shorter-term, its price is likely to keep suffering. The market will want to see proof that it can turn its business around before it commits in full to a bull case for Intel.

So be careful with the stock… While the dividend cut was the right move, it’s just the first step in a long—and potentially painful—recovery process.

P.S. While most investors got crushed in 2022… the picks in my Unlimited Income beat the market by more than 20%. And my proven “dividend growth” strategy will continue to shine in 2023.

This advisory is the best way for income investors to generate cash in a tough environment. And you can join us—risk-free.