Over the last couple of weeks, I’ve explained why today’s staggering inflation will inevitably lead to a recession… and some sectors to avoid as that happens.

But you don’t want to step out of the market altogether…

In this final article of the series, I’ll share three assets you can buy to not only protect yourself… but also profit as a recession unfolds.

But first, let’s look at why staying invested is critical for building wealth, even in dangerous markets…

Why abandoning the market is not the answer

As the market crashes and inflation wreaks havoc on your budget, you may be tempted to stay on the market sidelines—and keep your cash pile safe.

But that’s the wrong move…

Owning stocks is the best recipe for building long-term wealth. And since no one knows when a bear market will end and the next bull market will begin… fully abandoning the market is a losing strategy, even with a recession on the horizon.

Staying invested—through thick and thin—pays off over the long-term. And it’s certainly better than sitting in cash…

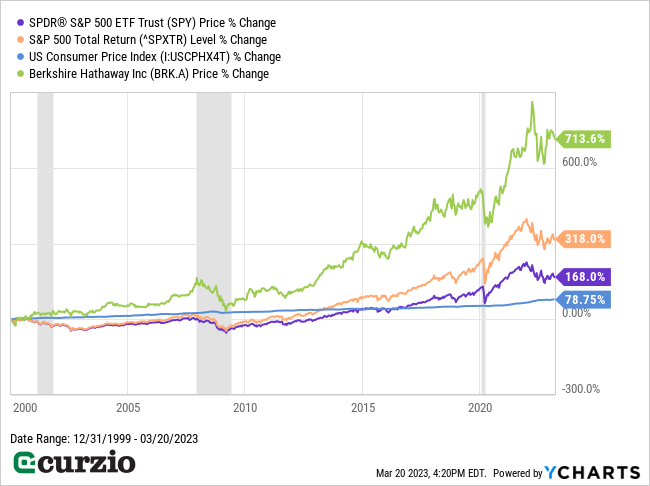

On the chart below, I’ve plotted cumulative inflation (the blue line) vs. the S&P 500 (the purple line) since 2000. I’ve also included the performance for the S&P 500 including dividend reinvestment (the orange line). Gray-shaded areas mark the three recessions we’ve seen this century.

As you can see, recessions are bad for stocks… and falling stock prices can temporarily fail to keep up with inflation. But over the long term (since 2000), stocks are up more than 165%. That return has easily outpaced the damage done by inflation… especially compared to keeping cash under the mattress.

Remember that inflation means a loss of your purchasing power. The higher inflation is, the less your money is worth over time.

For example, an item that used to cost $100 back in 2000 goes for about $178 today. In other words, thanks to inflation, cash has lost almost half of its value over the past 23 years, since it takes almost twice as much money to buy the same goods today vs. January 2000. (You can check the numbers yourself here).

The bottom line: Of all the major asset classes, only stocks have the power to consistently outperform inflation.

That said, as I explained last week, you need to be careful where you invest during a recession: Buying into declining sectors is a recipe for more losses.

Below, I’ve shared three of the best assets to buy, even in a recession. Each will help you make money while protecting your wealth…

1. Buy “franchises” (just like Warren Buffett does)

If you check out the green line on the chart above—which represents Warren Buffett’s investment vehicle, Berkshire Hathaway (BRK.A)—it’s pretty easy to see why Buffett is considered the greatest investor of all time…

While it hasn’t been immune to recession-related selloffs, Berkshire has always emerged even stronger… ultimately appreciating more than eightfold over the past 22 years.

More importantly, we can apply Buffett’s investment lessons to our own portfolios.

The most important concept you need to know is how to invest in “franchises.”

Put simply, Buffett loves these kinds of businesses. In his 1991 letter to shareholders, he offered the following definition:

“An economic franchise arises from a product or service that: (1) is needed or desired; (2) is thought by its customers to have no close substitute and; (3) is not subject to price regulation.”

In short, the product is essentially immune from competition… has a loyal fan base… and allows the company to raise prices without losing a lot of customers.

Examples of franchises in Buffett’s portfolio include Coca-Cola (KO), Apple (AAPL), and American Express (AXP).

By contrast, a “business,” as defined by Buffett, earns exceptional profits only if it’s the lowest-cost operator… or if the supply of its product/service is tight. Even then, these kinds of “businesses” face constant competition.

In short, franchises have certain competitive advantages, also known as “moats.” As the name implies, a moat helps protect a business—and its profits—from competitors.

This is why franchises tend to do better than their less powerful “business” peers across all economic conditions, as they can rely on their loyal customer base to keep coming back, regardless of rising costs. As a result, they’ll typically generate growing profits—and, often, dividends—year after year.

In short, franchises are a near-perfect all-weather investment. They’ll help you sleep well at night, regardless of market conditions.

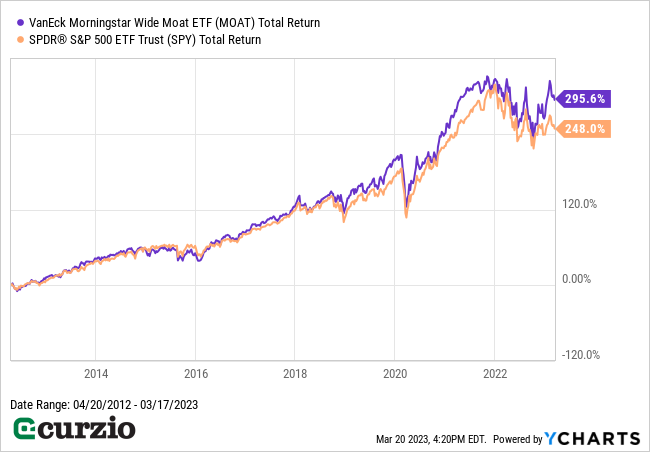

You can build a portfolio of individual franchises… or simply buy an ETF filled with these stocks, like the VanEck Morningstar Wide Moat ETF (MOAT).

This fund owns a basket of companies that have significant advantages over their competitors. Their moats come from five key sources: intangible assets, switching costs, network effect, cost advantages, and efficient scale. These features protect their profits against competition… and make these companies solid investments during a recession.

And, as you can see from the chart above, MOAT has outperformed the market by nearly 50% since inception. That’s the power of franchises.

2. Buy dividend growth stocks… and reinvest the dividends

As you can see from the first chart in this article, one of the easiest ways to improve your investment returns is by reinvesting dividends.

Put simply, dividend reinvestment means using the dividends from an investment to buy more of it. It’s a way to boost your returns whether the market is heading up or down… and it works better the longer you stick with it.

The effects are obvious when you look back at the first chart above. Excluding the effects of dividends, the S&P 500 gained 168% since 2000. But investors who reinvested the dividends back into the index would have nearly doubled that return (318%)… thanks to the power of compounding.

When you reinvest your dividends, you’re continuously growing the number of shares you own. As a result, you’re amplifying your profit potential AND your dividends… all without the need to contribute any additional money.

And there’s another effect that’s especially useful during a recession: When you reinvest dividends during a bear market, you’re buying more shares at lower prices. Not only are you probably getting the shares for cheap… you’re also setting yourself up for even bigger gains when the next uptrend begins. (And in a bull market, you’ll buy fewer shares as prices increase.)

Put simply, this strategy works in your favor whether the market is heading up or down.

The best way to take advantage of dividend reinvestment is to use it on companies that can deliver not just dividend yield but also dividend growth—like the kind I recommend in Unlimited Income. The growing dividend will compound faster, dramatically improving your returns over the long term.

Some of the best sectors to find sustainable dividend growth stocks in a recession include consumer staples, utilities, and healthcare—in short, industries that provide necessary services.

3. Own long-dated puts

One of the easiest ways to profit from stock market declines is by owning insurance via put options.

Buying a put option gives you the right (but not the obligation) to sell an underlying security at a specific price (strike) before a certain date (expiration).

Put simply, put options rise in value when their underlying asset goes down. In other words, they act like an insurance policy against a declining stock (or the market as a whole).

While buying a put will cost you money upfront (like an insurance premium), that’s the maximum you can lose if the asset doesn’t decline. And if it does decline below your strike price by expiration, you’ll get paid.

In other words, your downside is limited to the price of the contract. This makes it a relatively safe way to bet against a specific stock, sector, or index… with limited downside and massive upside.

It should go without saying that you should only invest what you can afford to lose on the “insurance premium.” If you’re wrong about the direction of the asset, or just the timing of your trade, your put could expire worthless.

But if you plan carefully and understand the risks, put options are a great way to protect your portfolio in a recessionary market… and profit handsomely as the stock market declines. You can see this in our Moneyflow Trader portfolio, where we locked in 18 winners during the bear market of 2022… for gains as high as 271%.

Conclusion

While recessions and bear markets are scary… you don’t want to pull out of the market completely. To profit in the long term, you need to stay invested, so when the next bull market comes, you’ll be ready for the upside.

And you can invest safely and profitably—even during a recession—by investing in the strongest franchises… reinvesting dividends… and building insurance via put options.