Last week, social media giant Reddit (RDDT) and AI infrastructure company Astera Labs (ALAB) both hit the market running…

Following their respective initial public offerings (IPOs), Reddit soared as much as 48% vs. its IPO price. And Astera—an Intel-backed AI infrastructure play—jumped 72%. They’ve added 29.9% and 21.4%, respectively, in today’s trading alone!

The successful IPOs aren’t just big news for the companies themselves… They’ve revived investor interest in the handful of companies that have gone public over the past few years.

That’s particularly noteworthy as the IPO market has seen a significant slowdown recently. Put simply, the renewed interest in this space is poised to benefit a select group of stocks.

Better yet, you don’t have to pick and choose between recent IPOs to take advantage of the uptrend…

Today, I’ll share three one-click investments to profit from the best of the sector.

But first, let’s take a look at why the IPO market has been suffering… and why it still faces significant obstacles in 2024.

Why the IPO sector is in a dry spell

For the last couple of years, IPO investing has been like searching for water in a desert…

In 2022, only 218 new companies went public—vs. a massive 1,080 in 2021 (and 504 in 2020). In 2023, the number dwindled even further to just 171 IPOs. And capital raised by IPOs last year represented less than 8% of the nearly $339 billion raised in 2021.

And while the IPO market has been improving this year—as the success of Reddit shows us—it still faces several obstacles in 2024.

So what’s behind the slowdown?

For one thing, back in 2021, low interest rates made it easier for the market to welcome a bunch of unprofitable tech and biotech companies with open arms (and send them surging in huge post-IPO rallies).

But, as you well know, market conditions have changed since then thanks to the Fed’s inflation fight. The days of zero rates are well and truly over… and investors are much more cautious—demanding a proven path to viability, as opposed to pie-in-the-sky growth stories.

That’s especially true with IPOs, as many tend to fizzle over the long run. Simply put, you must be very selective to profit.

But if you choose wisely, IPOs offer a chance to get in early on the best new stocks in the market… and ride their outsized potential higher.

Now, as I mentioned, the options to invest in IPOs have become more limited these days—as fewer companies are going public. But those that have gone public are doing remarkably well as a group—and they’ve got more upside ahead as the Reddit and Astera IPOs draw more attention to the sector.

And here’s the best part: You don’t have to pick and choose which IPOs you think will be successful…

Instead, you can benefit from the performance of the entire group via dedicated exchange-traded funds (ETFs).

Let’s take a closer look…

3 one-click ways to buy into the latest IPOs

The three best-performing IPO ETFs of the past year have all had a great 12 months, as you can see below—either beating or pretty much in line with the S&P 500’s outstanding one-year 33.6% return.

The Renaissance IPO ETF (IPO) is the purest-play IPO ETF in the market—its holdings have an average age of only 2.2 years.

The ETF achieves this feat by rebalancing its portfolio quarterly—during which it buys shares of recent IPOs… and sells holdings that have been public for over three years.

Its holdings are weighted by float-adjusted market capitalization—and no holding can be assigned more than a 10% weighting. As a result, the fund is well-diversified and can’t be taken down by the failure of one or two holdings.

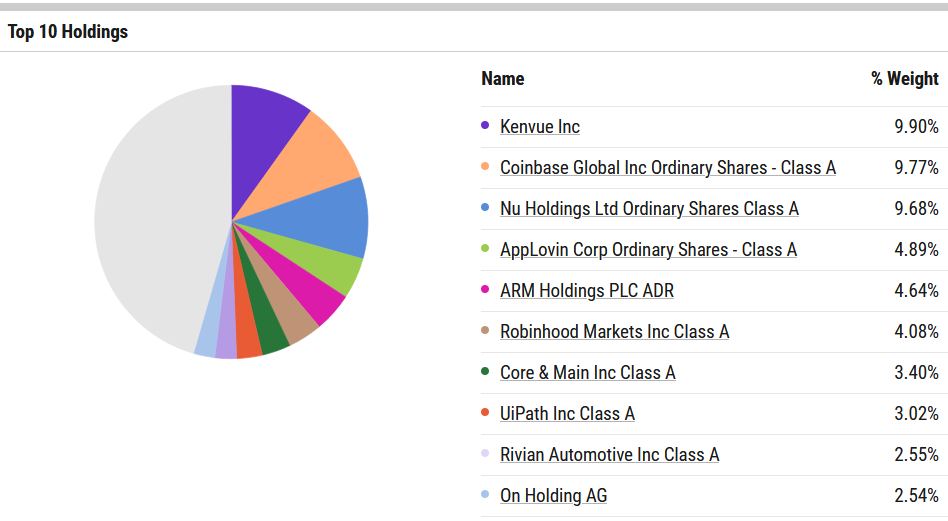

You can see its top 10 positions below—but note that top holdings Coinbase (COIN) and AppLovin (APP), which both IPOed in April 2021, are about to be kicked out of the fund.

And as you can see from the performance chart, this ETF has outperformed the market by a significant margin.

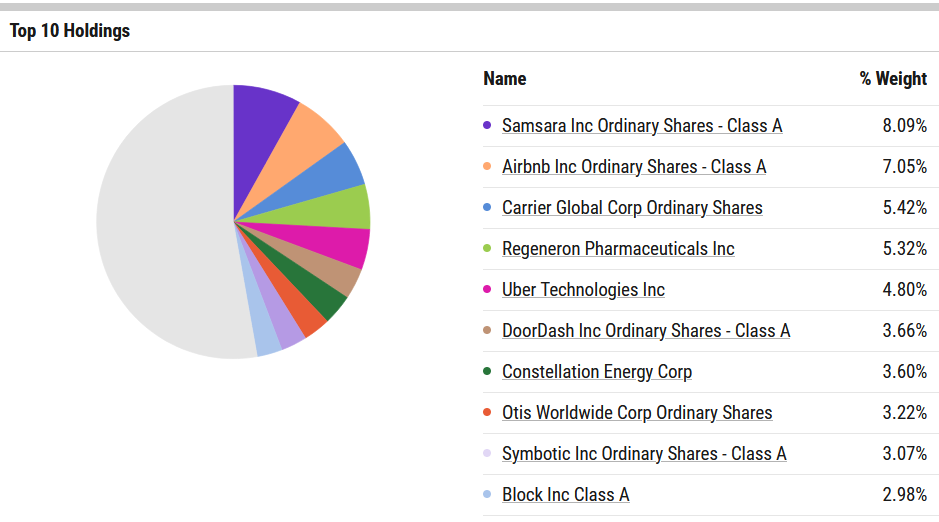

Next up is the First Trust U.S. Equity Opportunities ETF (FPX). This fund follows the IPOX-100 U.S. Index—an equity index that invests in the 100 largest, most liquid U.S. public offerings in the IPOX Global Composite Index.

Eligible holdings are added on the sixth day of trading… and can remain in the fund for up to four years after their IPOs. This rule means less overlap between this fund and the Renaissance IPO ETF… and creates a case for investing in both.

Like the Renaissance IPO ETF, the index is rebalanced quarterly, and no investment can have more than a 10% initial position. The top 10 holdings (below) account for about 47% of the fund’s total portfolio.

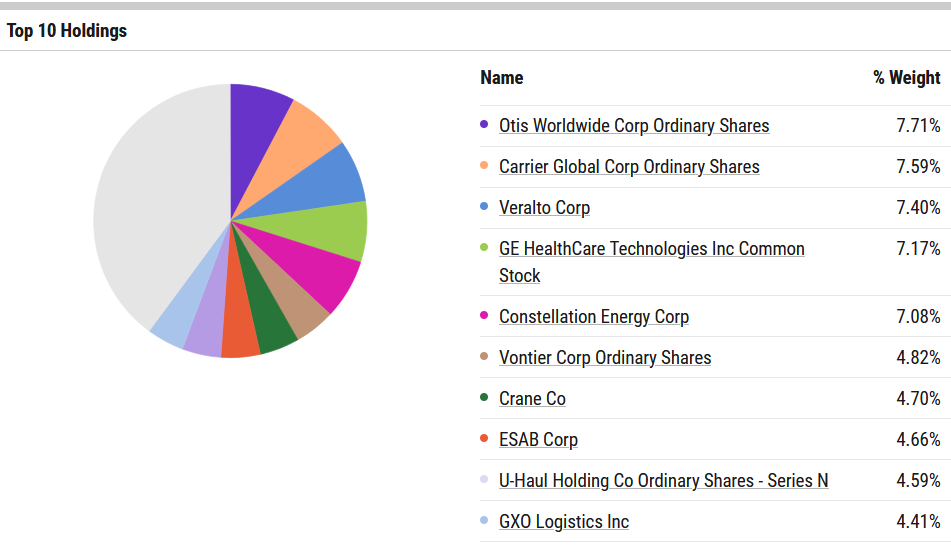

Our third ETF, the Invesco S&P Spin-Off ETF (CSD), invests exclusively in companies that have been spun off from larger corporations within the past four years.

This focus has created a unique portfolio with minimal overlap with the other two IPO ETFs—as you can see below.

While this fund may have underperformed its pure-play peers… many of its more established holdings are already profitable—and, therefore, less risky than those of its competitors.

Plus, the valuations of CSD’s holdings are significantly cheaper than those for IPO and FPX. The average company in CSD trades at just 18 times (18x) earnings—vs. 35.7x for IPO and 26.7x for FPX.

If you’re looking for a cheaper, safer way to invest in IPOs, this fund is a great way to do it.

Conclusion: The successful IPOs of Reddit and Astera have generated renewed interest in the IPO market. The three ETFs above give you a diversified way to buy into the latest IPOs… without needing to pick and choose on their first day of trading.