“Skate to where the puck is going to be, not where it has been.” – Wayne Gretzky

I love this quote from the most famous hockey player of all time.

Gretsky surpassed everyone else in the game… by a long shot. Was it his athletic ability or understanding of the game that elevated him to the top? Likely both… but I’d argue that the latter likely separates the great from the elite.

As with anything, the more time we spend learning something, the better we become. I’m sure Gretzky’s forward thinking kept him a few strides ahead of everyone else… and this same mentality is what we need to succeed in the markets.

At my research firm, MAPsignals, we follow the Big Money to help us see where “the puck”—i.e., the market—is going. It isn’t a perfect system, but many years of experience have helped us better our game.

We were able to predict massive buying in stocks post the election. And our data spotted two sectors leaving the station three weeks ago.

Of the latter, I highlighted two exchange-traded funds (ETFs) for upside. Since then, the SPDR S&P Regional Banking ETF (KRE) is up 14.21%… and the SPDR S&P Retail ETF (XRT) is up 8.52%. Meanwhile the S&P 500 (SPY ETF) is up only 4.70%.

Winning on Wall Street isn’t about being flawless. (Trust me, I’ve had plenty of blunders.) It’s about having a process. I encourage anyone trying to master the markets to do the same. Find what works for you—and stick to it.

Following the Big Money is how I stay ahead of the market’s next moves.

And here’s what it’s signaling next…

Big Money points to new highs…

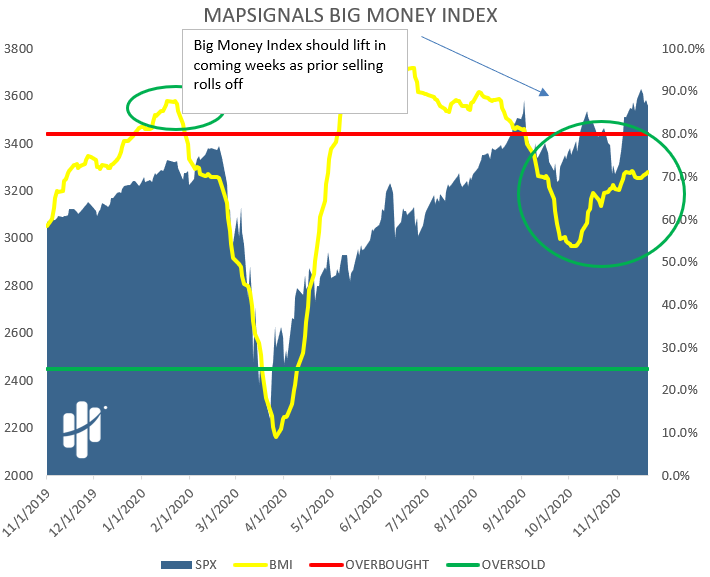

The Big Money Index (BMI) is a five-week moving average of daily Big Money buys and sells. Right now, it’s rising… indicating buyers are in charge:

I’m sure you’ve heard the phrase, “The trend is your friend.” Well, I’ve learned to not fight the trend of Big Money.

So, why am I bullish? Because I’m predicting a big increase in the BMI in the coming weeks. (I’ll circle back to this in a few weeks—whether I’m right or wrong!)

In general, where the index goes, the markets follow—kind of like when the puck is shot to the other side of the rink, all the players race after it.

Now, stay with me…

I mentioned that the BMI is a five-week moving average. That means the events of the last five weeks determine the trend.

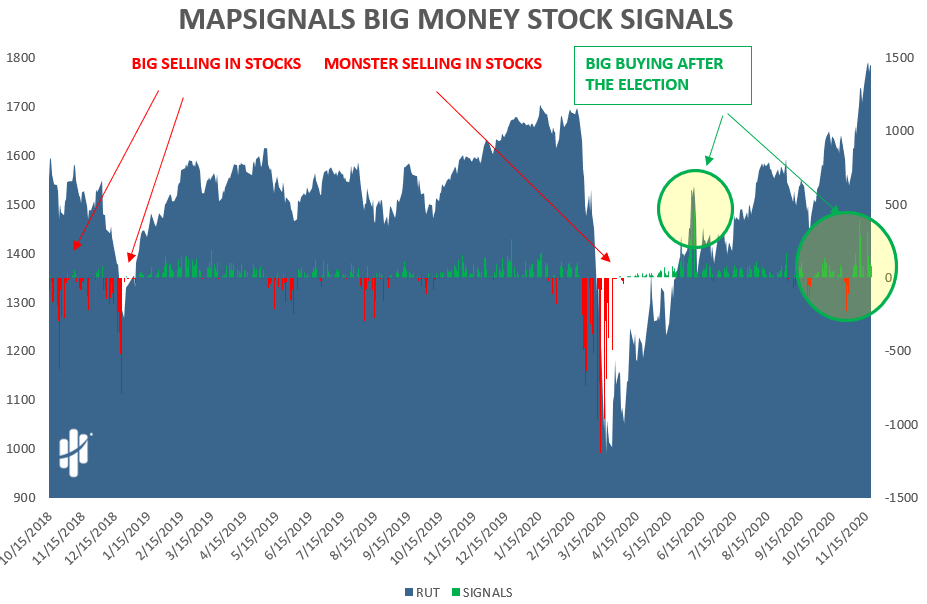

Below are the daily buys and sells that make up the index:

Now, I want to zoom in on the important part:

You see the big red signals? That was the selling we saw ahead of the election. And those sell signals are anchoring the BMI.

When these signals start to roll out of the five-week BMI window, the index will likely rocket higher. And, like I said above, where the index goes, the markets tend to follow.

The signs point to more upside for the markets. I’m predicting happy 401ks and brokerage accounts…

So there you have it—my playbook for the next few weeks.

The bottom line is this: if you’re going to win at Wall Street, find what works for you. And think ahead. The puck is always headed somewhere.

Editor’s note:

Frank’s incredible network of millionaires, corporate insiders, and analysts has provided stock ideas you won’t hear anywhere else—picks that’ve 5x’d… 10x’d… and even 35x’d Frank’s money. And every Thursday, he shares his favorite idea from his network with Dollar Stock Club members.

Here’s how to get the next stock pick… for just $1.