The market has come a long way since the dot-com bubble.

The fortunes of industrial-age companies have declined… while tech businesses are having a great time. The S&P 500 is now being led by a group of internet and tech giants… some of which didn’t even exist prior to the 2000s.

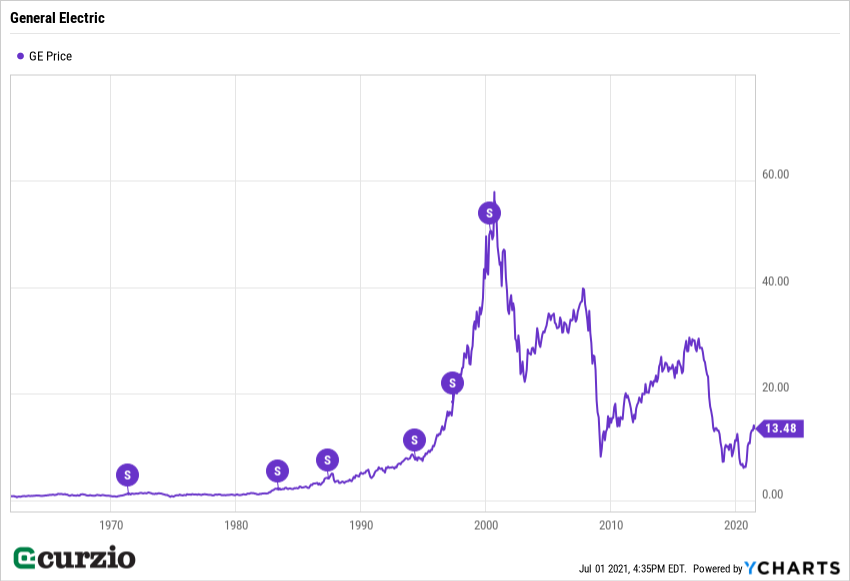

I can’t think of a better example of this change than good ol’ General Electric (GE).

Back in 2000, it was the largest company in the S&P 500.

Today, it’s readying itself for a 1:8 reverse split.

Below, I’ll explain why this isn’t as jarring as it sounds… and what reverse splits can mean for your portfolio…

But first, some basics.

A stock split happens when a company divides its current shares, thereby creating multiple new shares, which trade at a lower price. Existing shareholders receive more of the new shares, but the total value of their position won’t change.

Companies do this to improve liquidity and make the stock more affordable for investors. And there’s some psychology involved: The stock looks cheaper and more attractive purely because its “price tag” is now lower.

For instance, in a 2:1 split (which is pretty common), the number of shares you own doubles and the stock’s price is cut exactly in half.

Nothing else about the company’s business, balance sheet, or outlook changes.

Per-share profits, too, are cut in half… and subsequently the per-share dividend. From a valuation point of view, the company will have the same P/E and dividend yield post-split as it did before.

A 2:1 split might not seem like too much…

But repeat this process a few times… and 100 shares can easily turn into 1,000. Or more.

If this comes together with even modest share price increases, investors stay happy.

GE has a long history of stock splits.

Prior to May 2000, the stock was split six times… All but the last one were 2:1 splits… and the last one, a 3:1 split, happened just as the bubble burst.

Anyone who owned 100 shares of GE at the beginning of this process wound up with 9,600 shares.

But today, GE is far from its former glory, trading at around $13.50 per share.

And the board of directors just made a decision to execute a 1:8 reverse stock split. That means on the morning of August 2, you might notice the share price of GE jumping 8-fold.

The opposite of a split, the reverse split means fewer shares to replace the ones currently in existence…. and a higher share price for the stock.

Often, a reverse split is done to raise a company’s share price to meet the minimum requirements of the stock exchange. For example, a 1:8 reverse split for a $1 stock would translate into an $8 stock… and a portfolio position size of just 1/8 the number of shares.

Once the reverse split takes place, that means that hypothetical 9,600 shares I mentioned above will turn into 1,200 shares.

The total market cap will remain the same… but the stock will seem more attractive simply because it no longer looks like a loser.

For some companies, reverse splits can be a last-ditch play to remain listed on a stock exchange… where factors such as the per-share value require meeting a certain threshold.

But, often, this doesn’t help… Fundamentals win, and a company ends up in bankruptcy anyway, like the mall REIT Washington Prime on the chart below.

Often, reverse splits only prolong a company’s inevitable demise… and that’s why a reverse split is often called a “kiss of death.”

That shouldn’t be the case for GE.

After all, the stock has been rising already… having more than doubled over the past year.

After getting rid of some ballast and selling off non-core parts of the business, GE has retained enough assets and expertise to stage a comeback… if the company plays its cards right.

Making its share price more “marketable” might be a smart move as part of a comeback.

Here’s the bottom line: Taken on its own, a reverse split shouldn’t necessarily mean trouble ahead. Do your homework, and know why you buy (or sell)… regardless of the splits.

Editor’s note:

Genia just shared one of her favorite plays on the semiconductor shortage with members of The Dollar Stock Club.

Get access to this name—and countless others from Frank’s Rolodex of insiders—by signing up today.

At only $4 a month, this is one of the easiest—and best—financial decisions you’ll ever make.