In 2007, Lehman Brothers was on top of the world.

It was the fourth-largest investment bank in the country, with a market cap of around $60 billion… and more than $600 billion in assets. It posted record full-year results for net income… net revenue… and profits. In fact, it was the fourth year in a row of record financial results for Lehman.

But the company had less than nine months left to live…

And its collapse nearly took down all of Wall Street and Main Street.

On September 15, 2008, Lehman filed for bankruptcy.

To this day, it’s the largest (and arguably most consequential) corporate bankruptcy in U.S. history.

So what was behind its rapid downfall?

Put simply, the housing bubble…

You see, by the mid-2000s, the U.S. economy and housing market were booming—and Lehman had become heavily involved in mortgage-backed securities (MBS). By 2007, it was the largest MBS holder in the country.

But inflation was picking up… and the Fed started hiking interest rates to combat it. And these rising rates put the subprime housing market in danger.

During the housing boom, countless “subprime” loans were made to borrowers with poor credit, who often weren’t required to provide a down payment or even proof of income.

Another problem was adjustable-rate mortgage (ARM) loans—where the rate would stay low for the first few years of the mortgage, but balloon after a few years.

It was only a matter of time before low-credit, low-income borrowers began struggling to keep up with the rising mortgage payments. And as the boom turned to bust, countless subprime borrowers defaulted on the loans. For MBS investors, those defaults quickly compounded into staggering losses.

Thus began the great housing crash of 2008…

(For a thorough lesson on the mid-2000s subprime market, check out The Big Short—both the movie and the book.)

It soon became clear that Lehman’s business was in serious trouble. For the second quarter of 2008, the company reported a $2.8 billion loss.

In September 2008, Lehman filed for bankruptcy.

For reasons economists still don’t fully understand, the Fed decided not to intervene with a bailout. The ripple effect of that fateful decision tore through the financial markets…

Stocks plunged… businesses around the world lost millions… and unemployment skyrocketed. Lehman’s collapse ushered in the period we now know as the Global Financial Crisis (GFC), or the Great Recession.

It’s been 14 years since the housing crash nearly took down the entire economy… and one would hope the lessons have stuck with us.

But now, we find ourselves in an eerily similar situation.

While we no longer have massively overleveraged players like Lehman in the real estate market… and while housing may not endanger the entire economy in exactly the same way it did 14 years ago… today’s housing bubble has the potential to become the next “Lehman moment.”

What the 2008 financial crisis can teach us about today’s housing bubble

In the wake of the pandemic, we saw a huge surge in home-buying, thanks in part to near-zero interest rates and a massive flood of stimulus.

But the landscape has changed dramatically in a short time.

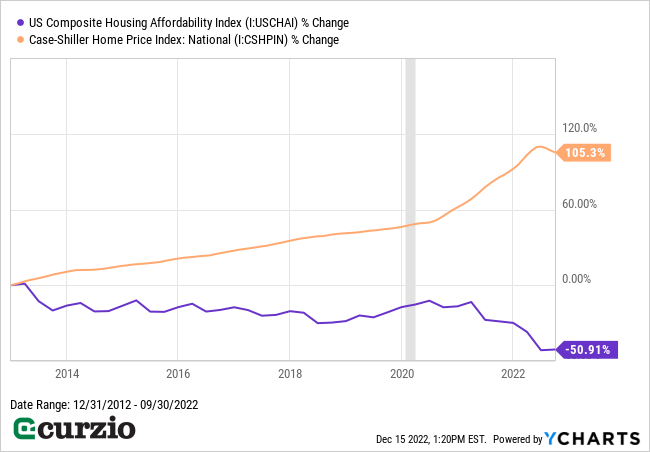

As you can see from the chart above, in the past year alone, housing affordability has plunged by almost a third.

One of the first canaries in the coal mine was Zillow.

About a year ago, the real estate data maven took a $500-plus million loss… laid off a quarter of its employees… and exited its home-flipping business—a sign of the end for the post-pandemic boom.

At the time, the Fed was still trying to convince us that inflation was transitory. (You might remember that we here at Curzio Research had vehemently disagreed—and we were right.)

It took a few more months for the Fed to admit its mistake and start hiking rates…

And today, after the fifth rate hike this year, mortgage rates stand at more than double where they were just a year ago.

Notably, the 30-year fixed mortgage rate is hovering around the same level as during the height of the last housing bubble.

We don’t have MBS this time around… but the housing market is completely frozen now. Fewer buyers are willing to commit to new purchases amid much higher mortgage rates… and fewer sellers are willing to list their homes in a weakening market (especially as declining prices could mean taking a loss).

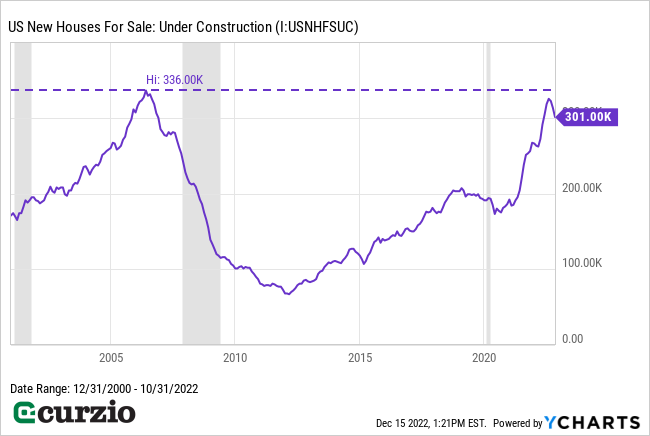

Plus, we’re still seeing a near-record amount of new construction. That’s not as positive as it sounds, as the previous housing boom created an inventory glut that contributed to the eventual crash (and took years to dissipate). And there’s no reason to expect today to be much different.

In other words, while affordability plunges and mortgage costs rise, the market is inundated with supply…

This combination is very dangerous… both for the housing market and the stock market.

As we learned just this Wednesday, the Fed isn’t done with the rate hikes, which means mortgage rates could remain high for a while… keeping purchasing, refinancing, and other housing-related activities low.

And as the risks of a real estate collapse rise, stocks—even outside the homebuilding sector—will also struggle, as we saw in 2007–08. That’s because consumers have so much of their wealth tied to their homes.

The bottom line: The housing market is in serious trouble… So it’s imperative to protect your portfolio from another “Lehman moment.”

I recommend avoiding homebuilders and other housing-related stocks for now… and owning investments designed to profit in a falling market.

For some of my favorite ways to play this crisis, join us at Moneyflow Trader. So far this year, we’ve locked in 18 winning trades for gains as high as 271%. And I expect one of our latest trades—a “housing hedge”—to deliver another triple-digit profit as the sector faces collapse.