Retail and real estate go hand in hand.

Retailers need a place to store and showcase their goods, while shoppers need a place to, well, shop.

Of course, thanks to the internet, our shopping habits have significantly changed. Many of us have come to appreciate the convenience of internet shopping and its ability to deliver bargain-priced goods directly to our doorstep. As a matter of routine, we reach for our computer or phone when we need to buy almost anything.

Data shows the country as a whole, too, is now quite comfortable with internet shopping.

The U.S. Department of Commerce estimates that in the third quarter (Q3) of 2019, ecommerce sales accounted for 10.5% of total sales. That’s up from about 4% in Q1 of 2010.

In other words, more than $0.10 of every shopping dollar is now spent online.

No wonder so many retailers have been closing their doors. Sears, Radio Shack, Bon-Ton, Office Depot, Barnes & Noble, Avenue, Payless, Toys R Us, Forever 21… Some of these names are just a shade of their former selves, and others are already gone.

Others are struggling to stay above water.

The Gap (GPS), for instance, used to be a mall staple. Now, it’s closing hundreds of locations “with urgency.”

In a sign of changing times, Dressbarn closed all 544 stores last year, but is planning the relaunch of its website under new ownership in 2020.

Pier One Imports (PIR) just said it will close about half of its U.S. locations, or about 450 stores.

Kohl’s (KSS), to sustain its store traffic, now accepts returns from Amazon (AMZN).

And Walmart (WMT), the largest U.S. retailer, saw Q3 U.S. internet sales rise 41% vs. 3.2% for comparable store sales.

But while there are winners and losers, retail isn’t dead.

And just like with merchants, there are winners and losers in the world of retail-focused real estate. Today, we’ll take a look at the businesses seeing tailwinds in this sector. And two companies in particular that are a good bet for income-seekers.

Who’s winning—and losing—in retail real estate

It might not feel like it, but, according to Moody’s Analytics Real Estate Solutions (REIS), the U.S. retail vacancy rate declined by only 0.3% in the last five years. But current vacancies still sit at 10.1%—too low for comfort.

Of course, no trends are fully uniform. In retail, some sectors are doing worse than others.

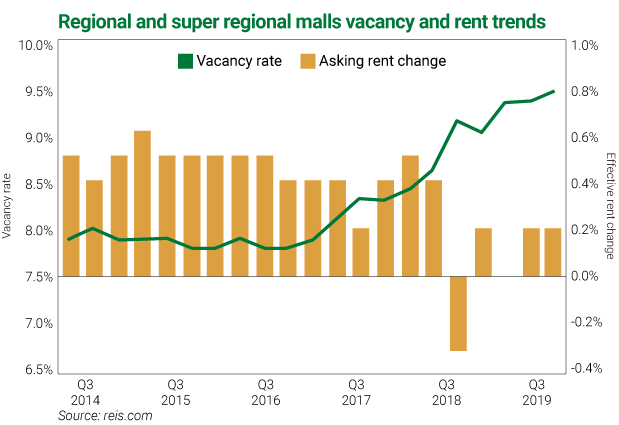

Mall landlords are seeing a weak price environment. Vacancy rates, a major determinant of rents, are in a long-term uptrend. In Q3, according to REIS, mall vacancy increased to 9.4% (vs. 9.3% in Q2)—up from a 2016 low of 7.8%.

But there’s a trend emerging based on the type of shopping center…

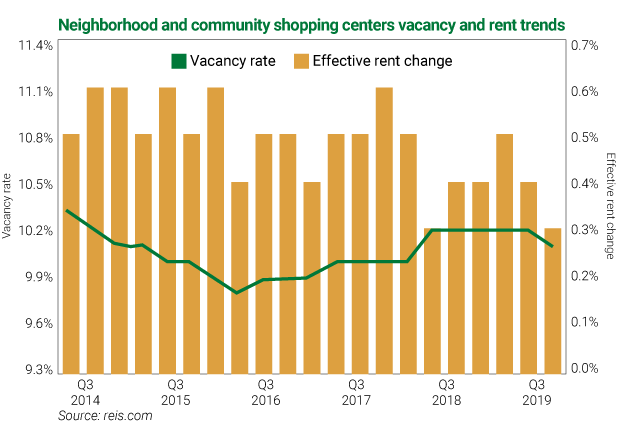

Over the past five years, neighborhood shopping centers with storefront parking and visibility from the street have seen effective rent increases of 0.3–0.6% per quarter, on top of a relatively steady (fluctuating between 9.8–10.3%) vacancy rate. Moreover, the vacancy rate today is even lower than it was five years ago.

On the other hand, there are malls—larger-size enclosed or open-air shopping centers, typically surrounded by parking.

Taken on its own, the vacancy number for malls looks better than the number for shopping centers. But mall vacancies have been on the rise over the past five years—which has clearly impacted the ability of real estate operators to hike rents.

These trends provide some insight into the consistent strength we’ve seen from companies like Realty Income (O), a standalone/community shopping center real estate investment trust (REIT). (It also doesn’t hurt that its focus is largely on non-discretionary spending and low-price- point retailers.)

The stock is up 16% since the end of 2018. And it yields 3.7%.

Other companies that stand to benefit from this trend include STORE Capital Corp. (STOR). Also a REIT, this company focuses on services (restaurants, health clubs, early childhood education), as well as internet-resistant retail (furniture stores, farm and ranch supply, RV and used car dealers). STOR is up 29% since the end of 2018 and yields 3.8%.

If you’re looking for income, don’t let the market convince you retail is dead. You just need to know where to look…

To a healthy portfolio,

| Genia Turanova Editor, Moneyflow Trader |

Editor’s note: If you’ve been following Genia’s work for a while, you know she’s an expert at uncovering fantastic income opportunities. Her latest recommendation for Dollar Stock Club members is already up 5%… and yields 50% more than the S&P 500.

Dollar Stock Club members get a new stock tip—vetted by industry insiders like Genia—every single week. For only $1. It’s hands-down the easiest way to discover new ideas… stay diversified… and find income.

Learn how to get this week’s pick direct to your inbox right here.