Some of the largest biotech stocks are about to join the ranks of the leading income-generators…

Yes, you heard that right.

Many biotech companies have already transitioned from the hot-growth businesses of a decade or two ago into steady cash-flow producers. And their medical innovations are literally paying dividends.

Today I’ll tell you about a couple of large-cap biotechs that have been steadily growing their payouts for years… and are likely to keep their dividends intact even in this economy.

These companies are financially strong, have industry-dominating franchises, and are in a position to develop (or acquire) new drugs and drug candidates.

The largest of the biotechs is Amgen (AMGN), with a market cap of about $140 billion and a 2.7% yield… It also has $8.9 billion in cash and investments on its balance sheet.

The company’s highly profitable—and is expected to make as much as $15.34 per share in 2020.

We’ll know more tonight when AMGN reports its most recent quarter. But barring an unexpected development, I expect its quarterly dividend of $1.60 per share to remain intact.

AMGN is also a relatively inexpensive stock, trading at about 14 times (14x) future earnings.

But what’s likely to keep it in the market’s sights is its immunology expertise… and its possible contribution to solving the COVID-19 crisis.

On April 2, Amgen and Adaptive Biotechnologies (ADPT) announced a new collaboration. While details are scant, this new venture aims to develop neutralizing antibodies to potentially prevent or treat COVID-19.

I don’t have to tell you how much this would matter for the economy… and for AMGN’s future outlook, if this venture succeeds.

AMGN isn’t the only dividend-paying biotech with a possible role in helping the world get through the recent crisis…

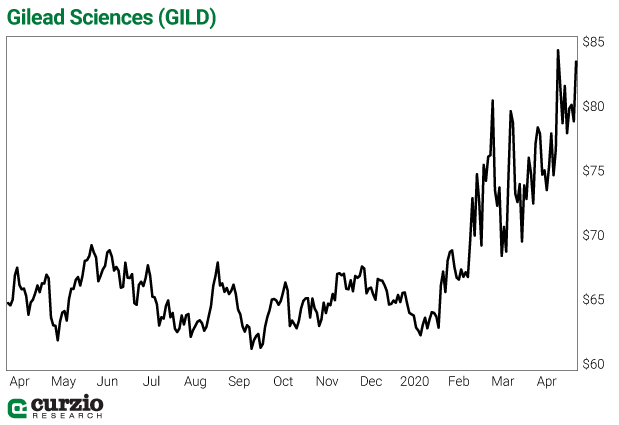

Just take a look at Gilead (GILD), another large biotech (market cap $105 billion) repeatedly making headlines this year.

This U.S.-based biotech has a long history of solving big medical problems… and it’s at it again, thanks to its old Ebola drug called remdesivir—one of the most-promising options to treat the coronavirus infection.

So much rides on a potential COVID-19 treatment that good news on remdesivir could propel the entire market higher…. just like yesterday.

The moderately positive market opened some 500 points higher and rallied 2.2% on the day… a bullish move credited to good news about remdesivir…

Although remdesivir is still being studied, preliminary results from the National Institutes of Health indicate it might be effective in treating COVID-19. More results are expected soon.

Gilead isn’t likely to make much money on remdesivir—not initially, anyway—but it will still benefit if the drug works. That’s because governments around the globe can be expected to stockpile the most-effective COVID-19 treatments, and remdesivir (if proven effective) looks to be first among them.

Gilead’s stock rallied too on the news yesterday… up 5.7% higher on the day… and up 28% in 2020.

And that’s not counting its generous 3.3% dividend.

GILD has been paying a dividend since 2016… and in February, the company hiked its quarterly payout by 7.9%—to $0.68 per share.

While AMGN hopes to use its immunology and antibody-therapy expertise in finding a coronavirus treatment, GILD’s claim to potential success is its vast experience treating viral infections.

Gilead actually cured hepatitis C—a momentous and rare achievement. Approved in 2013, a drug called Sovaldi offered the Hep C cure… and its successor Harvoni cut the required time by a third (to 60 days instead of Sovaldi’s 90 days).

The company also owns the most powerful HIV franchise in the industry, with 11 commercially available HIV medications and a robust pipeline of next-generation therapeutics.

In the U.S., about 80% of people living with HIV are on a Gilead-based regimen therapy (and millions of people are receiving Gilead HIV therapies in low- and middle-income countries).

Plus, Gilead has been promoting a strategy of preventing HIV by taking a single pill a day (Truvada and Descovy).

Gilead is also working on a cancer drug franchise. In 2017, it acquired Kite Pharma, a cancer biotech focused on the so-called CAR-T (chimeric antigen receptor T-cell) therapy, for $11.9 billion.

Another large cancer acquisition—a $4.9 billion takeover of immuno-oncology firm Forty Seven—closed on April 7, 2020.

With steady businesses and well-established franchises, both AMGN and GILD are great stocks to own if you’re worried about the market… want to bet on a COVID-19 treatment… or simply need income.

P.S. Don’t miss our FREE livestreaming townhall event tonight at 8 p.m. Eastern. I’ll be joining Frank to explain how you can find profitable opportunities in this market—and any market. Plus, Frank’s going to be taking your questions LIVE.

It’s going to be lots of fun. If you haven’t yet, you can reserve your spot right here. Hope to see you there!