Yesterday was a banner day for commodities… especially ones leveraged to global growth.

Oil, gasoline, natural gas, copper, and silver all were up. And major commodity indices were trading around their five-year highs.

Commodities are in a clear uptrend, thanks to the recovering global economy and the easy money policies of central banks all over the world.

Last week, I told you about the Canadian market, a major beneficiary of the trend.

Today, I’ll give you a way to benefit in one easy step…

But first, let’s revisit why Canada is the place to be in this market.

First off, it’s that rare developed economy blessed with massive natural resources… and leveraged to the commodities market.

This means Canada, the 10th largest economy in the world, is set to benefit from high resource prices when commodities rally… and can easily survive when resources are on the downtrend.

With commodity prices in an uptrend, the Canadian economy is set to do well. That alone is a great reason to look into Canada for investment opportunities.

But here’s the other reason Canada is so appealing today: its market is cheap.

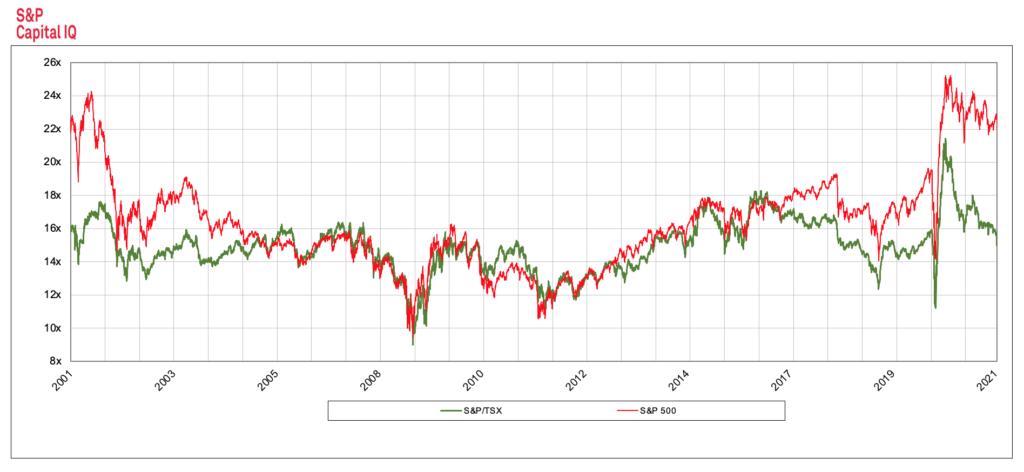

The main Canadian index—the S&P/TSX Composite—trades at more than a 30% discount to the U.S. market.

In fact, it’s the largest discount in two decades, based on expected next-year earnings (forward P/E).

To easily benefit from Canada’s leverage to resources and attractive valuations, you can buy a country-focused exchange-traded fund (ETF).

One popular ETF I like is the iShares MSCI Canada ETF (EWC).

As always, diversification is key. But with this ETF, you can own a piece of some of the largest and most important Canadian companies with just a single trade…

EWC will give you a stake in about 70% of the Canadian market, via 90 mid- and large-cap companies.

And if you think Canada’s ETF is all about commodities, just take a look at its No. 1 holding: Shopify (SHOP), one of the leading e-commerce software companies, has a massive 8.6% weighting in the fund.

Extremely popular and fast growing, SHOP provides a technology platform enabling small and mid-sized businesses to sell their goods online.

The stock, which has appreciated almost 780% in the past three years alone, is extremely expensive. But as part of EWC, having a small stake in SHOP is perfectly OK. If it declines, it won’t bring down the ETF… but its future success would help EWC’s overall performance.

The tech sector isn’t the largest part of the ETF though. At 12.8%, it takes the No. 3 spot, behind the financials and energy stocks… with materials a close No. 4.

Together, energy and materials account for as much as a quarter of the ETF… ensuring its appreciation if commodity strength continues unabated.

Financials—banks, insurance and investment companies—are by far the largest sector in the ETF, with more than a third of all assets invested.

EWC’s top 10 positions include five of Canada’s six biggest banks—Royal Bank of Canada, Toronto Dominion, Bank of Nova Scotia, Bank of Montreal, and Canadian Imperial Bank of Commerce. And the sixth—National Bank of Canada—is in the top 25 largest positions.

Canadian banks are in good shape. With the country’s economy picking up, loan losses are on the decline… and margins are on the rise. Having so much allocated to financials will also help the ETF when Canada’s central bank starts raising interest rates… which might happen as soon as the second half of 2022.

And today, EWC looks good, considering its positioning, valuations… and a yield of 1.7%.

These values won’t last long. As I mentioned last week, EWC tends to outperform the S&P 500 when commodities are in a rally mode.

But for now, you can get the best of both worlds with EWC: exposure to the surging energy and materials industries… and a bargain price.

Editor’s note:

For Genia’s best ideas to play the commodities trend, get her Unlimited Income advisory.

Month after month, you’ll get recommendations that are not only safe… but also deliver market-beating dividends AND capital gains.

We’re talking triple digits from income stocks…

And we’ve priced this essential advisory so anyone can afford it.