If your portfolio is heavily exposed to the technology sector, it’s probably feeling immense pain right now.

Tech has been punished in recent weeks as investors worry about inflation, interest rate hikes, and the Federal Reserve’s plan to stop buying bonds (aka, “tapering”).

But these are today’s concerns… What about tomorrow?

I’m a positive person and I believe these issues will subside eventually. Most of the time, folks let their fears get the best of them. (Remember the Y2K panic?)

It’s easy to get swept up in the hysteria of today… and lose focus of the bigger picture (the long term).

But history and experience have taught me to avoid getting emotional when the market takes a dip. Instead, I’ve learned to look for opportunity when fear is high. Warren Buffett famously said it’s wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”

And based on history, it’s a great quote… and today, it’s time to be greedy…

The “buying desert” is really an oasis

The post-pandemic bull market has spoiled investors. Plenty of folks now think stocks always go up.

But long-term investing isn’t all balloons and buttercups. Sometimes it’s uncomfortable… Today’s tech investors are experiencing one of these rough patches right now.

Plenty of high-flying funds have fallen by double digits. Put simply, tech stocks have been blistered lately.

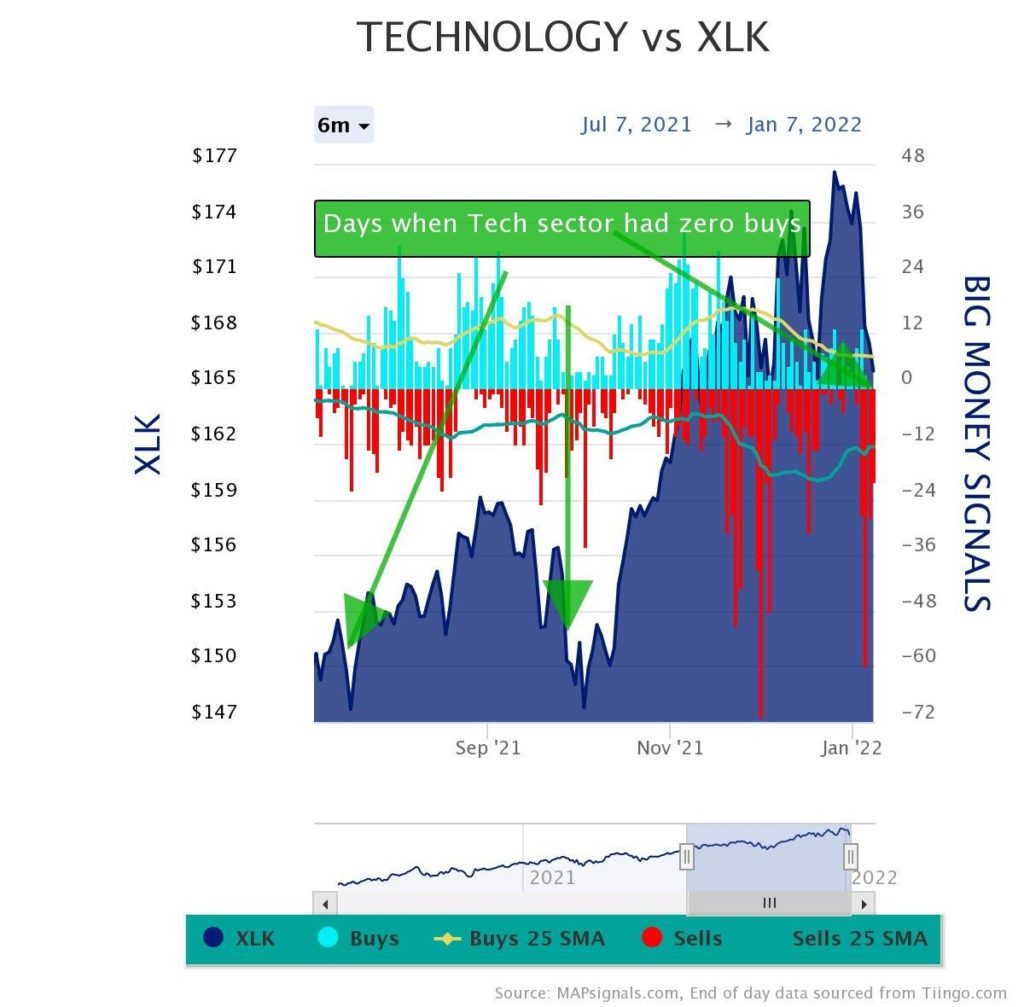

And the data shows it’s ugly out there. On Friday, Big Money institutional buying in tech absolutely vanished. In fact, there wasn’t a single tech stock that triggered a buy signal in my Big Money database.

Believe it or not, this “barren desert” is a great setup for hunting beaten-down stocks.

Below, I’ve included a six-month chart of the daily Big Money buys and sells across the tech sector. I drew an arrow pointing to Friday’s data of zero buys (at the far right). I also drew two arrows highlighting the last two times there was zero buying in tech stocks (July 16 and September 28, 2021).

Here’s the important part: In both recent cases, tech stocks generated solid gains over the next month. In other words, the “zero buying” days were the start of a big rally… with the Technology Select SPDR fund (XLK) generating one-month gains of 3.59% and 6.81%, respectively, on those dates.

Notice the two green arrows… and how those turned out to be great times to buy.

This is why the recent “No-Buy Friday” has me excited… I’ll be spending the next week looking for bargains to scoop up.

You might think that’s a crazy plan… but, as I’ll show you below, history tells us that big pullbacks are usually a great time to buy.

Worrying about today doesn’t help tomorrow

It’s easy to get caught up in fear, especially when you hear about it all the time. It’s more difficult to take a step back and think of the long-term picture.

To combat this tendency, I often ask myself, “Will this matter a few months from now? Or in a couple of years?” If the answer is no, I stop worrying. It keeps me focused on the long term. Try it, it might work for you, too.

Another good way to stay future-focused is to look at the market’s historical performance, which gives us some long-term perspective… and ignores day-to-day volatility.

Even better, these kinds of tables can help us see opportunistic points. Let me show you what I mean…

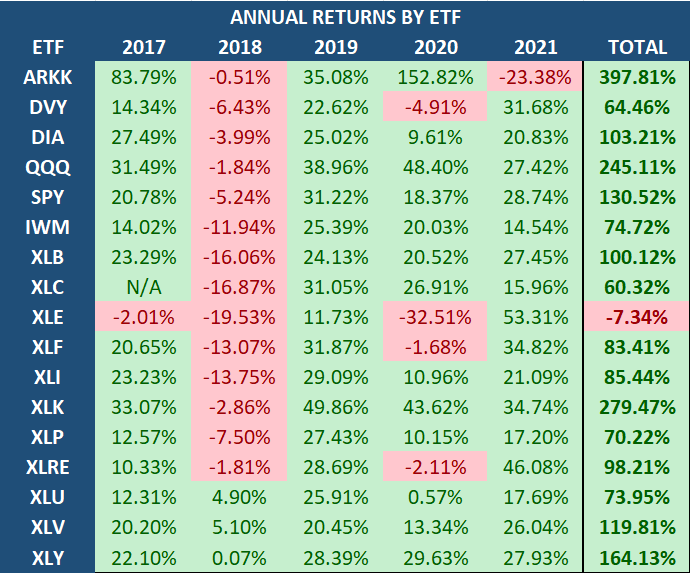

The table below shows sector performance (via more than a dozen sector-themed ETFs listed along the left side) in each of the past five years. I’ve also included some broad market funds, like SPY…

OK, I admit there’s a lot of information to take in. But if you look closely, you’ll see that stormy markets (like the one we’re in now) often preface tomorrow’s green pastures.

Notice how nasty the performance was in 2018… but it turned out to be a great time to buy (as most funds surged higher in 2019). Also, notice how 2020 had four funds that were red… each of these funds rocketed 30%-plus the next year.

In short, there’s a good reason to focus on tomorrow, rather than today. History tells us it’s almost always a good idea to hold through a market pullback. And if you’ve got some cash on hand, a correction is often a fantastic time to buy.

It’s an especially important idea for tech investors today. Prior high-flying growth stocks are getting smoked… It’s evident if you look at the ARK Innovation ETF (ARKK), which is full of fast-growing tech stocks. The fund got absolutely crushed last year (in the chart above, you can see it fell more than 23%).

Bottom line: Zipping up the bear suit and being fearful is not a good strategy. Most sectors tend to bounce back with a vengeance after hitting a rough patch.

And tomorrow’s picture for obliterated tech stocks will be much brighter. If you look at the historical patterns, it’s clear that buying weakness has paid off handsomely… as long as you’re willing to ride out the volatility.

Remember, the key to successful investing is playing for tomorrow.

Later this week, I’ll be posting a new Lessons with Luke video covering this exact topic.

P.S. Today’s market conditions are exactly the kind I love to see…

As money rushes out of the market, it’s creating incredible opportunities to buy the best stocks… at historic discounts.

Sign up for The Big Money Report today to find out what I’m buying during the current pullback.

If you wish you’d bought stocks at pandemic lows… you have another chance now.