In the financial world, December 31 isn’t just a day on the calendar.

This date marks the end of the fiscal year for many companies. Come January, the bulk of U.S. companies will begin reporting fourth quarter (Q4) and full year results… as well as many helpful insights into the future of the company.

Traditionally, the Q4 earnings season starts when Alcoa, a leading aluminum company, delivers its report. (In 2020, it will report on January 15.)

Naturally, Wall Street will be watching as the earnings season unfolds, on the lookout for the best companies… and so will I—insights that I’ll be sharing with you in these pages.

We always enter a New Year with a portfolio heavily impacted by the events in the markets over the last few months.

Now is a good time to think about rebalancing your portfolio and positioning it for the year ahead. I recently talked about making changes that will help with taxes.

Today, I’ll tell you where to start looking for gains in 2020…

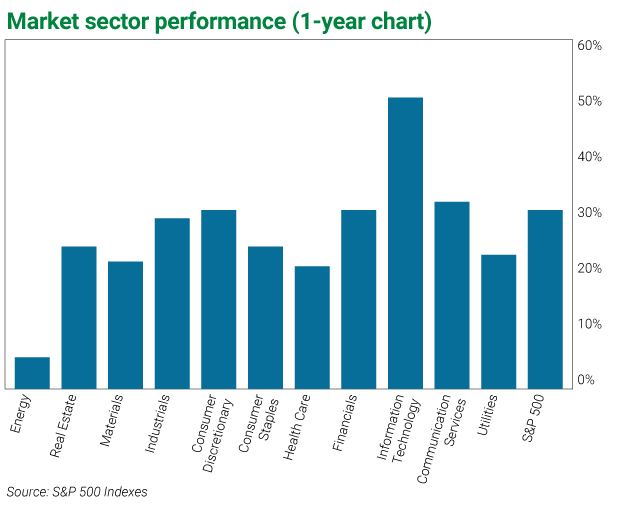

Clearly, U.S. stocks have done extremely well this year.

As of last Friday, the large-cap S&P 500 Index returned more than 28% year to date. In 2019, it set a series of new all-time highs.

And, as you can see from the chart below, every single market sector has been positive over the past 12 months. This trend was led by the technology sector, which returned an unbelievable 49.4%.

Strength begets strength. Based on this return alone, I wouldn’t be in a hurry to bet against the tech stocks en masse in 2020. There will be exceptions, of course—and, as we learn more about the newest tech trends, company outlooks may change. But for growth investors, the tech sector will remain a consideration for years to come.

For 2020, though, there are three sectors I’m watching closely. I believe they’ll surprise on the upside…

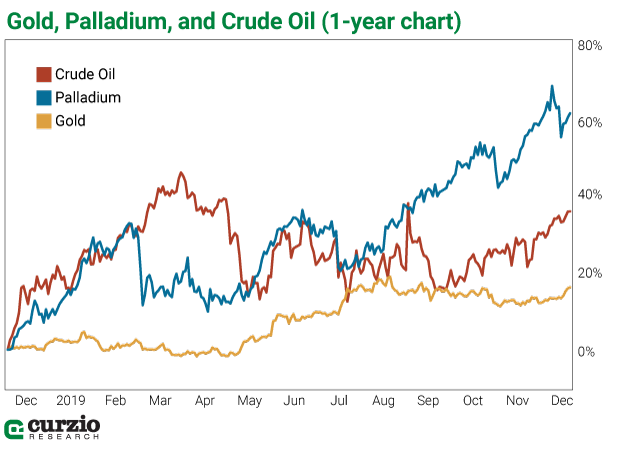

No. 1: Commodities

If the world economies avoid a recession, commodities strength will continue. This includes precious metals like gold (often used as a market hedge) and palladium (set a new record over the past year thanks to growing demand and dwindling supply).

No. 2: Energy

Over the past five years, energy is the only sector that’s failed to deliver positive investment returns, with a 23% overall loss.

(To compare, over the same five years, tech has been leading the market by a wide margin, returning 128% vs. 55% for the S&P.)

Despite a nearly 7% gain in 2019, energy was still the market’s worst performer.

But it looks like the time for energy stocks has finally come.

I base this conclusion largely on the price of oil. Up almost 36% from levels a year ago, it’s done even better than the stock market. In my book, this makes oil a standout for 2019. Since profits in the energy sector are largely dependent on the price of oil, this bodes well for 2020.

With the market at all-time highs, value investors will increasingly look to energy stocks for their potential.

No. 3: Healthcare

For 2020, an election year, healthcare might be a controversial choice. But I think the probability of new drug-pricing legislation or other reform in 2020 is low.

Longer term, healthcare spending will be driven by the aging world population, as well as new drug discoveries and advances in biotech. As a group, healthcare stocks will have growth tailwinds for years to come. It’ll be a sector to watch for to both growth and income investors.

As Q4 reporting kicks off, the Street is looking at whether companies have delivered—but mostly, they’re focused on any new insights, or forward guidance for the new year.

Long term, it’s fundamental economic growth and accumulation of profits that will dictate the market’s direction, or a continued bull market. To outperform the crowd, investors must remain vigilant and watch for signs of changing conditions. This is why watching earnings is a must.

In 2020, I expect the three sectors above to be among the top performers…

To a healthy portfolio,

| Genia Turanova Editor, Moneyflow Trader |

Editor’s note: Genia has a remarkable track record for picking stocks—and making her subscribers money—over the course of her two-decade career. Her investment advisory, Moneyflow Trader, will help strengthen your assets when the market is surging higher… And build your defenses against a market decline. Learn more here.