If you’re nervous about the recent flare-up of Middle East tensions, you’re not alone.

Even though stocks have largely held their ground in recent days, investors showed significant interest in market hedges… such as U.S. Treasurys and gold, two time-tested haven assets.

In just a few days, the yield on the benchmark 10-year Treasury note declined by 9 basis points, from 1.92% at year end to 1.83% on Tuesday (bond yields decline when prices rise, and vice versa).

Gold, too, has moved higher. Yesterday, it traded around $1,575 an ounce, its highest price since 2013.

Still, increased hedge interest and geopolitical concerns did little to derail the markets. On Tuesday, the S&P 500 closed 0.2% higher than at year’s end a week ago. Stocks continue trading near all-time highs, and many investors don’t seem to be ready to quit while they’re ahead.

Yes, it’s important to stay invested… even in uncertain times like today.

But this doesn’t mean you should simply ignore these new risks. Especially when it’s easy to start building your defenses.

Today, I’ll tell you three ways to do it… literally.

Defense stocks—in addition to hedges like U.S. Treasurys and gold—can help protect your portfolio when geopolitical tensions heat up.

First, defense companies are seen as beneficiaries of military conflict, hence their role as geopolitical hedges. These stocks often act as market hedges in the time of economic stress, too. That’s because the defense-contractor business is largely insulated from economic uncertainties.

With the U.S. government being the largest (and sometimes the only) customer, growth for these companies depends on U.S. military spending. Global uncertainty means big business for U.S. defense companies… and right now business is booming.

In 2018, U.S. military spending grew by 4.6% to $649 billion, a much faster pace than the 2.9% growth in GDP. And it was the first time since 2010 that the country’s military spending increased compared to the year before.

While not fully immune from economic woes, U.S. defense companies could continue to rally even into recession.

History also tells us that in times of market stress, investors often seek refuge in the defense sector.

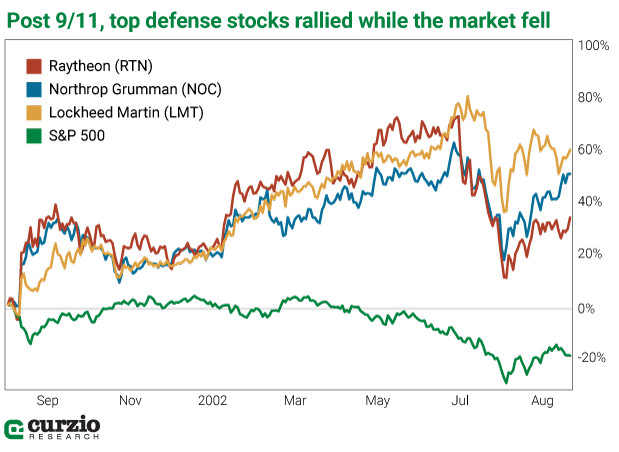

For example, while the market fell after September 11, 2001, most defense contractors rallied.

Take a look at the chart below. It shows the market’s price action vs. Lockheed Martin (LMT), Raytheon (RTN) and Northrop Grumman (NOC), from September 2001 to September 2002.

As you can see, after rallying into the end of September 2001 (on geopolitical tensions), the three defense companies continued to sharply outperform the market…

By September 2002, the S&P 500 had declined by 19.2%, while LMT was up by 58.9%, RTN by 33.1%, and NOC by 49.8%.

It’s not a bad idea, therefore, to arm yourself with a small position in defense stocks. If the geopolitical (or economic) situation gets worse, these stocks are likely to respond positively.

Of course, it’s always best to do your due diligence on any position you consider buying. But studying the entire sector takes time, and you might want to get defensive right away.

If that’s the case, you can invest in a defense-focused exchange-traded fund (ETF). This way, you can own an entire portfolio of defense stocks—with only one trade.

Here are my top three defense ETFs:

- Invesco Aerospace & Defense ETF (PPA)

With an expense ratio of 0.59%, this ETF is the most expensive of the three… but it’s also the most diverse. This ETF holds the stocks of 50 companies involved in the development, manufacturing, operations, and support of U.S. defense, homeland security, and aerospace.

The top 10 positions account for about 57% of the fund’s $1.1 billion in assets. They include big names like Lockheed Martin, United Technologies (UTX), Honeywell (HON) and Boeing (BA)—each stock accounting for around 7-7.5% of the fund’s total portfolio.

- iShares U.S. Aerospace & Defense ETF (ITA)

Started in 2006, this ETF is the largest of the group, with some $5.5 billion in assets.

While its investment objectives are quite similar to PPA, the portfolios are different.

For one, ITA is quite top-heavy. It only owns 34 stocks, and the top 10 positions account for 75% of the entire portfolio.

Its number one stock is Boeing (BA), a whopping 22% of the fund’s assets. Then it’s United Technologies (UTX) at 17%, followed by Lockheed Martin (LM), with 6.3% of assets.

The fund’s expense ratio is relatively moderate 0.41%.

- SPDR S&P Aerospace & Defense ETF (XAR)

The cheapest of the three, XAR, has some $2 billion in assets and a 0.35% expense ratio.

With only 40% of its total assets in the top ten positions, XAR is less concentrated than PPA and ITA. Each of its top three positions—Northrop Grumman, Aerojet Rocketdyne (AJRD) and Lockheed Martin—roughly accounts for a modest 4% of the portfolio.

If you’re looking for a less concentrated option—meaning less impact on your portfolio if a company runs into trouble—XAR is a good place to start.

But all three of the above ETFs are liquid, and any one of them is a good choice for targeted exposure to the aerospace & defense sector.

Just make sure the fund you select complements your portfolio… and doesn’t overlap too much with existing holdings.

To a healthy portfolio,

| Genia Turanova Editor, Moneyflow Trader |