Plenty of folks think we’re heading into a recession.

I’m an optimist, so I’m not so sure. But I admit plenty of recent data suggests that could be the case.

History tells us it’s best to stay invested in stocks over the long term. Back in May, I explained why it’s so important to keep contributing to your 401(k). You never want to “sell everything” when the outlook turns rocky.

The better approach is to focus on the best stocks to own during a recession.

Today, I’ll highlight a sector with a long history of outperforming the rest of the market during recessions. It’s one of the few places seeing Big Money buying right now… and there’s an easy way to buy the whole group with just one click.

Why healthcare holds up in a tough economy

Most investors think of healthcare as a defensive sector. When markets turn volatile, healthcare stocks tend to hold up better than the rest of the market… especially if folks are worried about the economy.

You see, people spend money on healthcare no matter what’s happening with the economy. As a result, it’s one of the last areas to see a pullback in revenue during tough times.

In short, healthcare is the opposite of the consumer discretionary sector (which focuses on more expensive “non-necessities,” ranging from sneakers to cars to travel). In a tough economy, we can cut back on vacations and eating out… but we’re not going to cancel our prescriptions or hold off on a hip replacement.

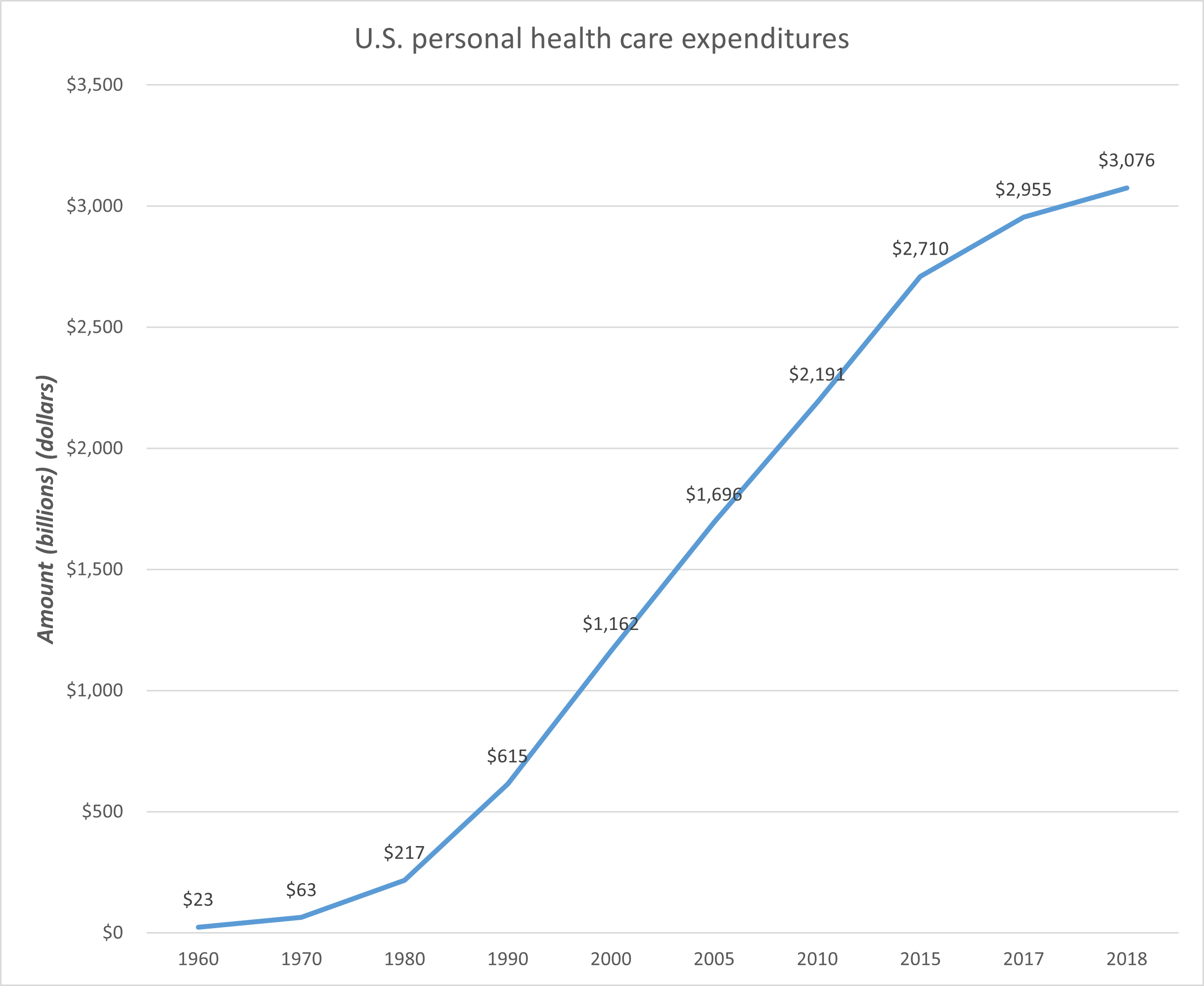

That’s why healthcare stocks fall into the “defensive” category. And over time, the sector benefits from a steady uptrend in spending…

Below, you can see how personal healthcare expenditures have climbed steadily since 1960 in the U.S.:

Click to enlarge

As more of our pocketbook is dedicated to our health, it only makes sense to invest in companies that benefit from that spending.

They’re a good long-term bet in any market…

But during a recession, healthcare stocks tend to really shine. Let me show you what I mean…

A solid place to hide during recessions

The Health Care Select Sector SPDR ETF (XLV) is the biggest healthcare-focused fund in the market. This ETF holds a basket of large, well-known healthcare stocks ranging from drug makers like Pfizer (PFE) and Merck (MRK) to insurers like UnitedHealth (UNH) and medical device makers like Medtronic (MDT).

XLV’s history stretches all the way back to December 1998, which means we can check to see how it held up during the last three recessions. In particular, I want to know how healthcare stocks performed relative to the S&P 500 during these rough periods.

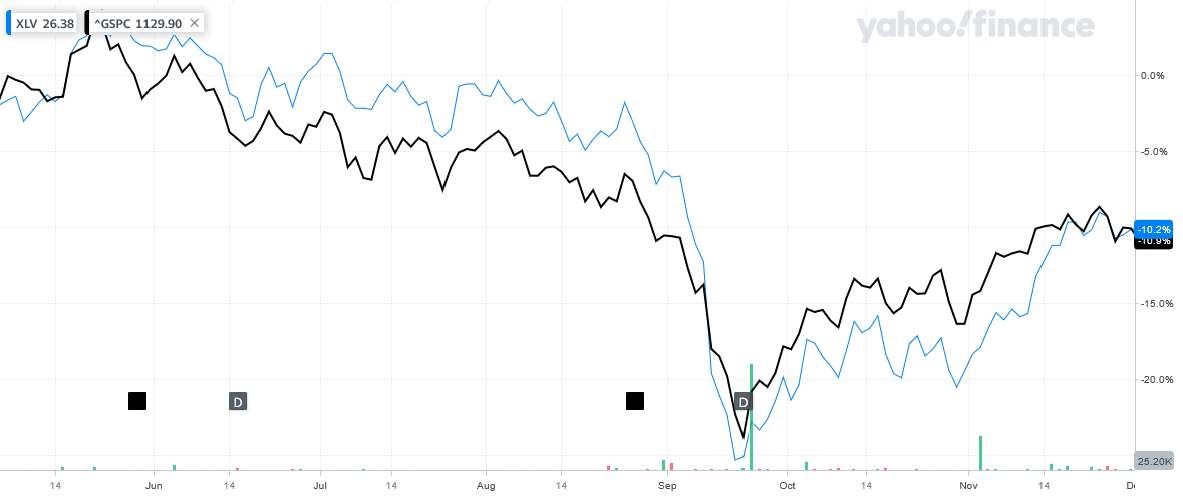

The first period we’ll look at is March–November 2001. Overall, this was a mild recession… thanks in part to multiple interest rate cuts by the Federal Reserve in 2001. As you can see below, XLV outperformed the S&P 500 by a modest 0.7% during the recession:

That may not sound like a major outperformance… but it’s worth pointing out that healthcare stocks held up particularly well until the entire market dropped sharply following the black swan event of September 11, 2001.

Let’s check the next example…

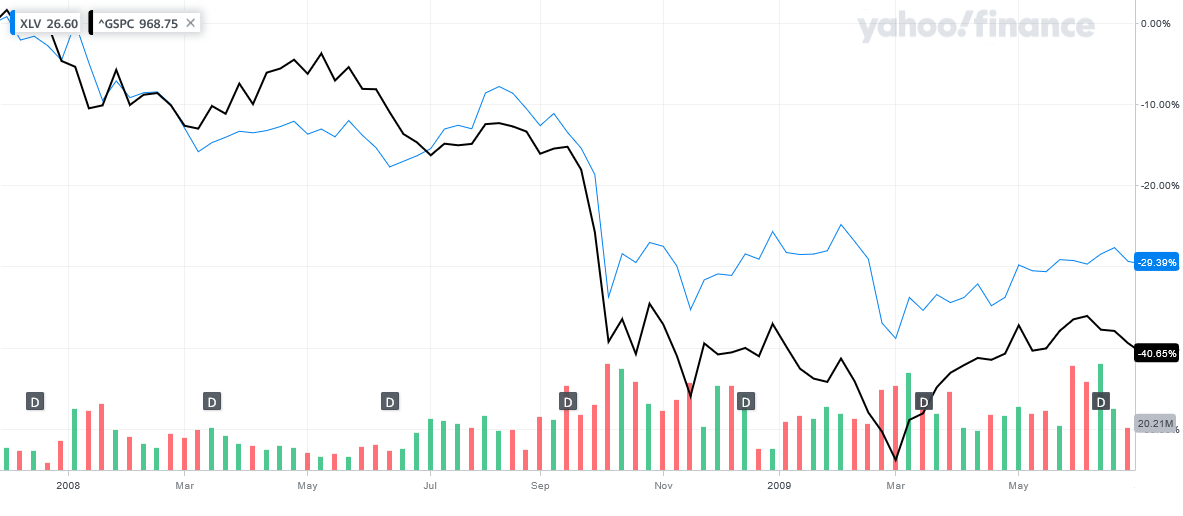

During the Great Recession from December 2007–June 2009, overall economic output dropped 5.1%, according to the Bureau of Economic Analysis (BEA). That’s a massive decline.

During this recession, XLV outperformed the S&P 500 by a whopping 11.26%. See for yourself:

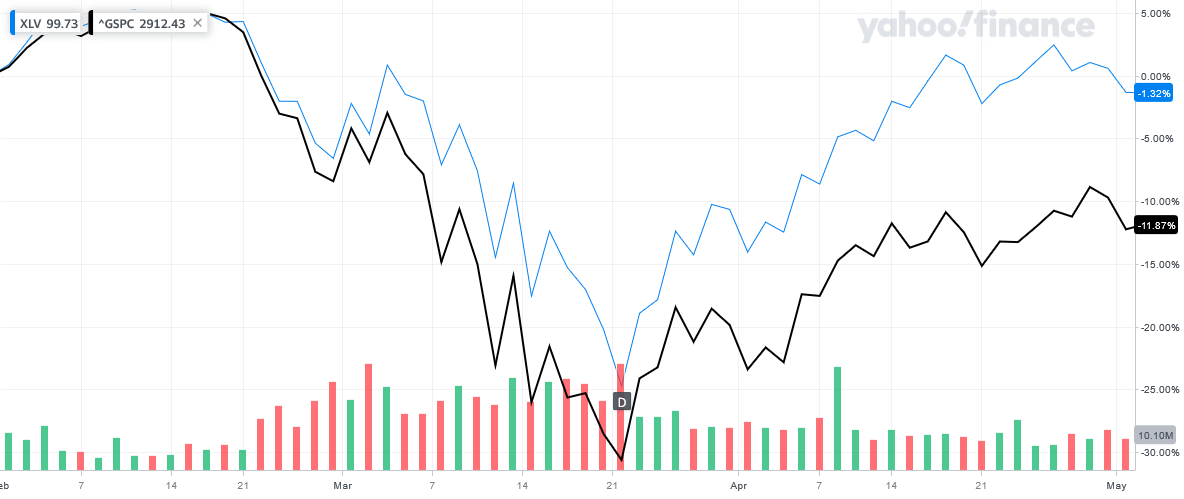

Next, we’ll fast-forward to our most recent recession—the pandemic-driven recession of 2020. This one was short but brutal… Economic output dropped a stunning 19.2% from February to April, according to the BEA.

Once again, healthcare stocks were a great place to be. In that short time, XLV outperformed the overall market by a whopping 10.55%:

In short, history shows healthcare stocks are a solid bet to outperform the broader stock market during recessions…

But let’s check the latest developments to see if that’s holding up today…

This sector is seeing strong results and Big Money buying

XLV is made up of over 60 individual stocks, so we can’t go over them all… But we can check one of the fund’s biggest holdings—UnitedHealth (UNH)—for signs of what’s going on in the space right now.

UnitedHealth is the second-biggest position in XLV. It’s also the biggest health insurance provider in the world. (Note: I own UNH in managed accounts.)

Just last week, UnitedHealth beat analyst earnings estimates by delivering an 18.5% year-over-year increase in earnings… as well as strong membership growth. The company also raised its full-year earnings guidance from $21.45 (at the midpoint) to $21.65.

On Wall Street, this is called a “beat and raise.” The company beat estimates and raised guidance for the rest of 2022. It’s exactly what investors want to see from a company… and it’s even more important during times of uncertainty.

The earnings announcement sent UNH surging more than 5% on July 15. Even better, the stock generated a Big Money buy signal, which means institutional investors were likely buying shares as they ramped higher.

UNH has held up extremely well in 2022. The stock is up about 5% since the start of the year… while the S&P 500 is down about 18%. Below, you can see there’s a mix of Big Money buying and selling (the red vertical bars indicate selling, while the green bars mean heavy buying).

UnitedHealth’s strong 2022 performance is exactly what we want to see.

And it’s not just UNH that’s seeing buying. Big Money has been flowing into plenty of individual stocks in the sector lately.

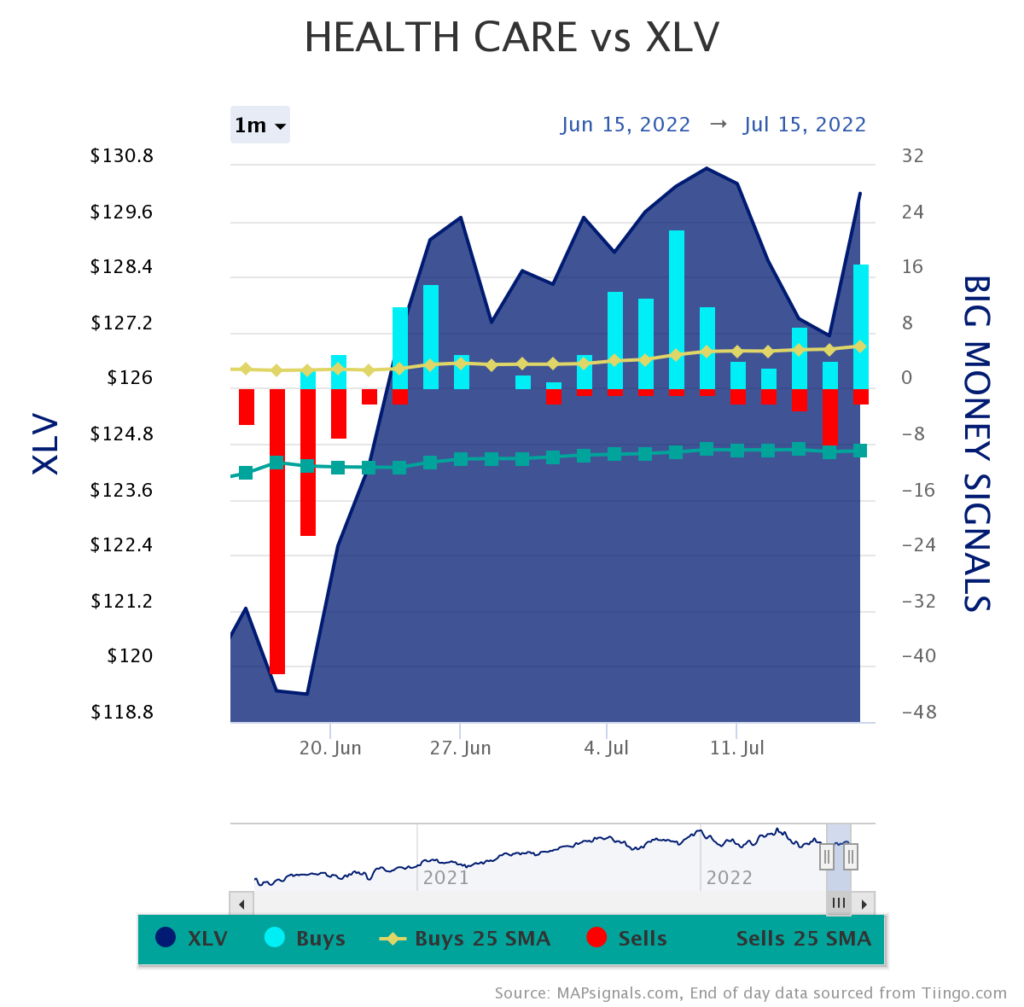

Below, you can see the recent buy/sell action in the sector. This chart plots the number of healthcare stocks getting bought and sold each day. The blue vertical bars show the number of healthcare stocks rising on high volume… while the red bars tell us how many healthcare stocks were being sold on a given day.

Note that this chart focuses on the action over the last month (21 trading days):

As I mentioned earlier, healthcare spending isn’t tied to the overall economy… so it’s no surprise these companies can do well, even as a recession looms on the horizon.

Put simply, the recent action in healthcare stocks lines up with what we’d expect. Worries about the economy tend to send money flowing into healthcare stocks. And the recent positive earnings guidance from UNH—and the Big Money support—indicate the space should keep climbing in 2022.

Buy the whole sector

The recent strength in healthcare stocks isn’t a big surprise. A few months ago, I noted that Big Money was already starting to pour into the sector.

The best way to play the space is with XLV. It’s a big, broad-based ETF with nearly $38 billion under management and plenty of liquidity (it trades over 11 million shares each day, on average).

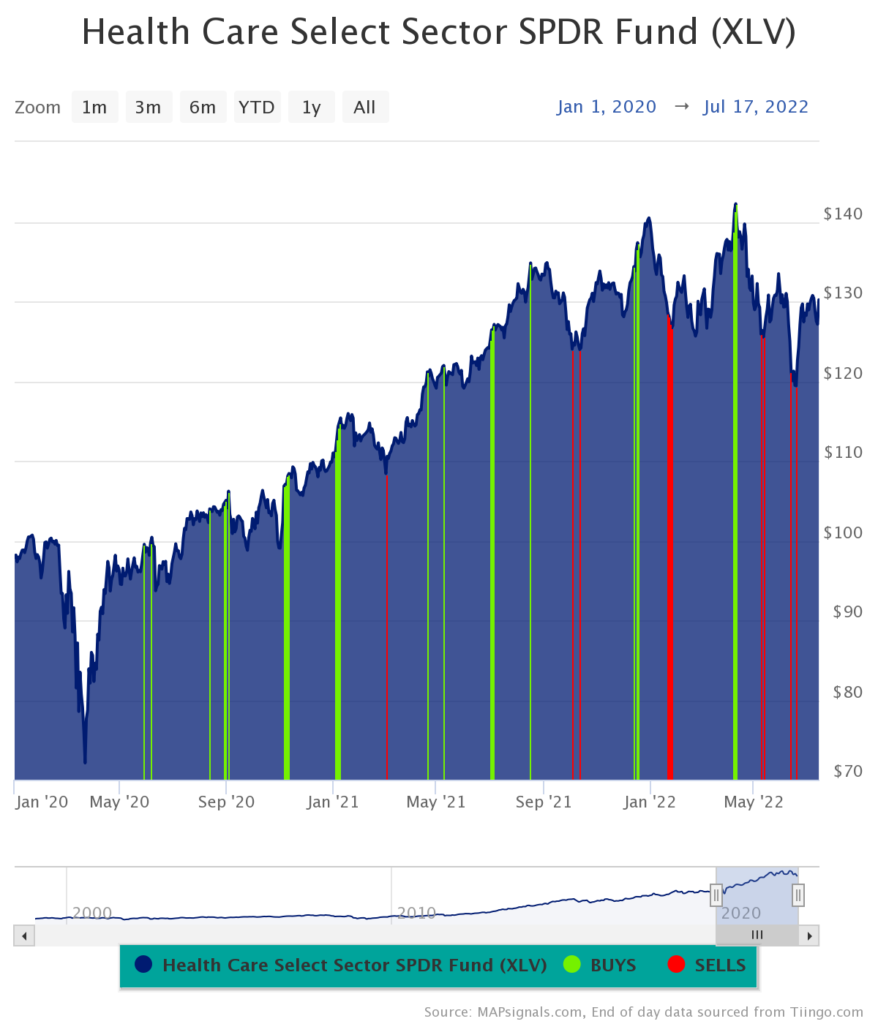

It’s also been a Big Money buy target, with 16 more buys (green bars) than sells (red bars) since the start of 2020:

There’s a good chance we’ll continue to see folks worried about the economy through the end of this year (and possibly longer). History tells us that healthcare stocks typically hold up much better than the rest of the market in a recessionary environment. XLV has shown solid outperformance during prior recessions… and remains a great bet for the current environment.

Editor’s note:

Genia Turanova’s Unlimited Income portfolio is filled with inflation-ready assets across sectors like healthcare… energy… and essential consumer goods…

Genia’s picks spit out regular cash payments—and consistently deliver quick capital gains.

For that rare balance of income and growth in any market… join Unlimited Income—risk-free.