No one likes to lose money…

But as investors, we’re bound to take losses from time to time. Maybe your thesis was wrong… maybe the company you own lost a major contract… or maybe the overall market crashed—pushing shares of the stock you own down 20% with it.

It happens to all of us. Heck… even the greatest investors in the world—like Warren Buffett, Carl Icahn, and David Tepper—are wrong sometimes.

What separates great investors from average investors is their ability to manage losing positions… or limit their risk on an investment when things don’t go as planned.

Two strategies I use to help limit risk and manage losing positions are position sizing (how much money you’ll put into an idea) and a stop loss.

I’ll break down these easy-to-use strategies below… And also provide a real-life example of how they helped me avoid a catastrophic loss on one of the best dividend-paying companies in the world.

| Recommended Link | ||

| ||

| – |

Your position sizes and stop losses should fit your comfort level. As a general rule, I use stop losses between 20–35%.

Just remember… your potential reward factors into how much risk you want to take. In other words, don’t use a 35% stop to generate 50% returns. I only use 35% stops on positions that have more than 100% upside (based on my research) over the next 24 months.

You should also use smaller position sizes for higher risk investments. If you normally put around 4% of your portfolio into a position, consider putting in only 2% if it’s higher risk.

To lower your risk, you may also want to scale into a full position.

For example, if you’re planning on putting $5,000 into an idea, buy $2,500—or a half-position—first. Then buy another $2,500 over the next few months. If the stock moves higher, you’re in the position and making money. If it moves lower, you can add to your position at a better price and lower your cost basis.

I recommend putting no more than 2–4% of your portfolio into any one position. It’s an easy way to limit big losses. And if you do this with a 25% stop loss, you’re only risking a small percentage of your overall portfolio.

You can handle a lot of small losses… But if you have a large loser, say over 70%, it will crush your portfolio. It will reduce your “dry powder” for other opportunities… as well as your emotional energy. Each time you look at your portfolio, that kind of loss will stick out like a sore thumb.

Remember, there’s always another opportunity. So stick to your stops… and cut your losses.

I’ve made my share of mistakes over my career. Like when I recommended shares of Diebold Nixdorf (DBD) in July of 2017…

Diebold is the leader in banking technology and ATMs. It was supposed to be a safe company. It’s been operating for over 100 years… and held one of the longest streaks for consecutive annual dividend increases at 59 years. That’s longer than McDonald’s, Procter & Gamble, and the rest of members in the Dow Jones Industrial index.

The company had a great growth catalyst… Its largest customers are the biggest banks in the world—and these banks need to upgrade their systems with the latest software technology. The upgrades would lead to billions in revenue for DBD…

It also recently took over its largest competitor, Wincor Nixdorf. This made it the No. 1 player in the industry.

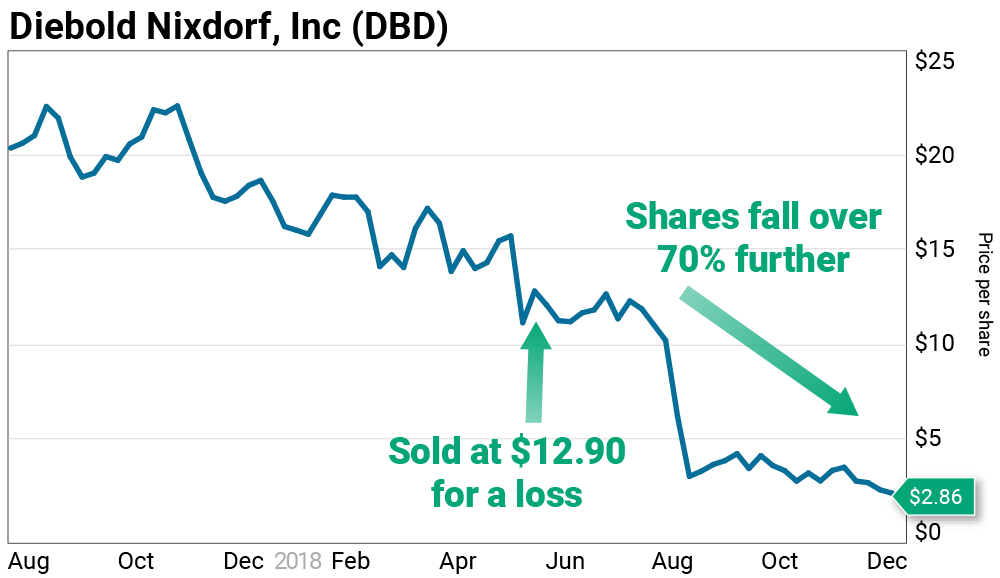

But as you can see from the chart below… management failed to execute. Large banks (which already signed deals for future work with DBD)… began to delay orders. They held back spending due to uncertainties around new regulations and deteriorating market conditions in global markets.

When I first recommended this trade I explained that we’d place a 35% stop from our cost basis. In May our stop was triggered… and we sold for a loss.

The story was still intact… Big banks still need to upgrade their technology. I could have justified staying in and ignoring our stop, since my thesis was still sound.

But we followed our plan.

Banks continued to delay orders… which caused sales and earnings to decline rapidly. This forced DBD to renegotiate its debt with creditors—triggering several downgrades by the major credit rating agencies.

DBD declined another 70% from where we stopped out of the position. That’s a catastrophic loss… and almost impossible to come back from.>

It’s never easy to admit your mistakes. In fact, most money managers and financial newsletter editors never talk about their losers publicly. It’s just not good marketing.

But we all have losing positions from time to time. Instead of ignoring the bad… prepare for it. Embrace it. And learn from it. That’s what great investors do.

If you don’t have some type of stop loss on your investments, I suggest doing so right away. The key is to limit your losses. This will help you maintain your capital… which can be used to buy new exciting ideas. More importantly, it will keep you in the right frame of mind… focusing on the future instead of on that one position that continues to plummet.

Good investing,

| |

| Frank Curzio with Daniel Creech | |

P.S. I’ve just shared two of my investing strategies with you… but my Wall Street Unplugged All-Star Portfolio members have access to a third… an elite intelligence network of CEOs, hedge fund partners, top sector analysts, and even a few billionaire investors who share their favorite under-the-radar picks. And right now, you can gain access to these picks for only $1.