Bitcoin, security tokens, NFTs…

Each of these inventions is revolutionary… upending the financial markets.

But they’re not the first innovations to change investing as we know it…

The first exchange-traded fund (ETF), the SPDR S&P 500 ETF Trust (SPY), debuted in 1993… and took the market by storm.

For the first time, investors could buy and sell all 500 companies in the S&P—at any time during trading hours—as if they were just one stock.

Naturally, more ETFs followed.

You can now own pretty much any corner of the market with an ETF… and you can also short the market with certain ETFs (if you’re bearish).

This wide reach and ease of trading make ETFs invaluable… especially if you want to hedge your portfolio from the many unknowns we’ve encountered during the current bull market.

Today, ETFs offer some of the easiest ways to protect your portfolio… especially if you adhere to a couple of simple rules.

Last week, I talked about why you can’t get complacent in this market… and why you should consider hedging your portfolio.

And today, I’ll tell you more about hedging with ETFs.

It starts with a group called “inverse” ETFs…

Inverse ETFs are great if you want to hedge your position… or expect the entire market (or a specific sector) to decline.

But as useful as these ETFs can be, they require more attention than your average fund. This is especially true for their close relatives: double- or triple-leveraged ETFs—regardless of which side of the market they’re designed to play.

Let’s take a quick look at how inverse and leveraged ETFs are different from other funds… when to use them… and two easy rules to lower their risks.

How leveraged ETFs work

As you might know, a “leveraged” investment can generate higher profits than an unleveraged “normal” investment—but it will also generate higher losses vs. the unleveraged investment. There’s no way around this fact. Because leverage amplifies your gains, it also amplifies your potential downside.

Whether you’re a bull or a bear, there’s a leveraged ETF you can use to deliver the exact opposite return of the market or sector… or double and even triple the return.

Let’s say you think the market is due for a selloff.

To benefit, you can buy the ProShares Short S&P 500 ETF (SH), which promises to deliver the opposite of the market return. If you want to make an even bigger bet, you can aim for double the inverse return by buying the ProShares UltraShort S&P 500 ETF (SDS), or even triple the return via the ProShares UltraPro Short S&P 500 ETF (SPXU).

There are other inverse equity ETFs you can choose from this list of top ETFs; they all work using leverage. (See examples below.)

A leveraged ETF can buy or sell on margin, can be long or short futures, or set up some other asset swap arrangement.

But these assets have different rules… essentially requiring leveraged ETFs to start every trading day anew.

In a practical sense, this means they can aim to deliver their promised results daily… but not on a continuous basis.

You might think it’s the same thing… but it’s not.

The higher the volatility—with big swings in the underlying index—the more the actual return on a leveraged ETF will differ from the expected return.

Let’s take a look at a couple of examples.

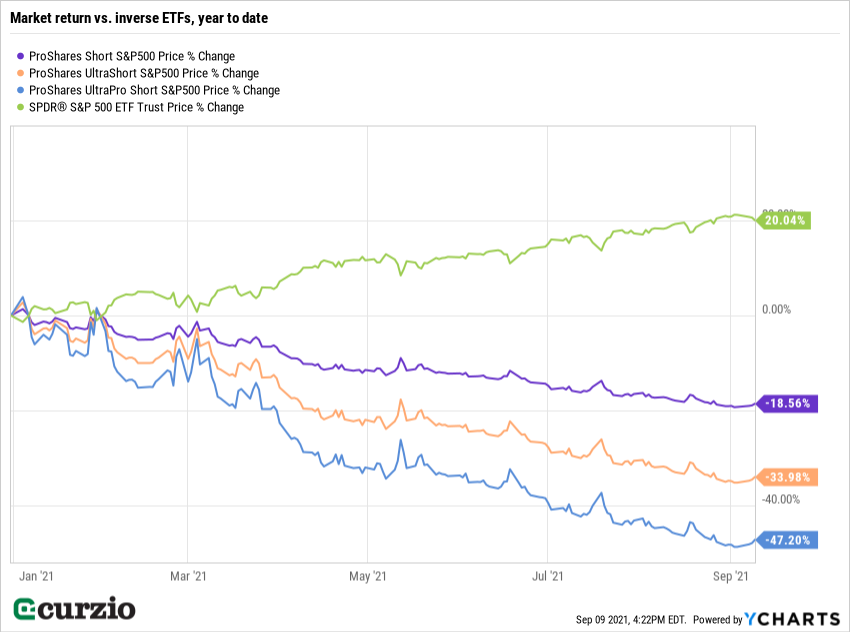

Both charts below plot the market via the SPDR S&P 500 ETF (SPY) vs. the trio of ETFs I mentioned above… but for different time periods.

First, let’s take a quick look at year-to-date returns.

As you must know, the market hasn’t seen as much as a 4% selloff this year…

But as you can see below, each of the three inverse funds has still underdelivered… by a lot.

And the higher their leverage, the larger the difference between their promised returns and their actual returns.

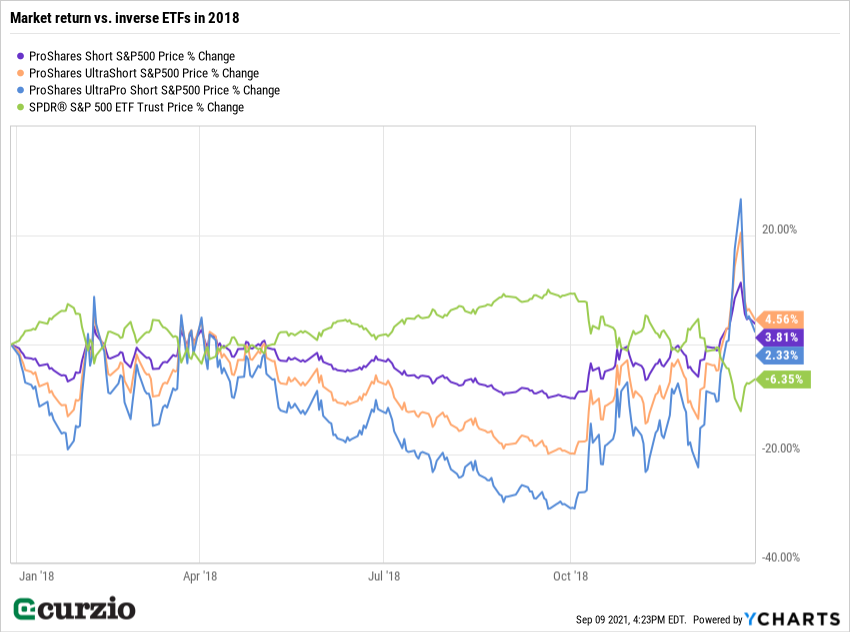

Now let’s take a look at a less bullish and more volatile year for the market, 2018. With the S&P down some 6.4% that year, you’d think inverse ETFs would have generated big returns for their owners.

Not so fast. For an ETF to use leverage, it has to buy some type of derivatives (like options, futures, or swaps) to amplify the gains/losses… and those derivatives come with different regulatory requirements and added costs.

These additional costs, along with the ups and downs of the market, mean that all three inverse funds underperformed their goals… even during a rough patch for the stock market.

The more volatile and directionless market action is, the worse an inverse fund performs.

This is also true for exchange-traded products that aim to double or triple the returns of a specific index.

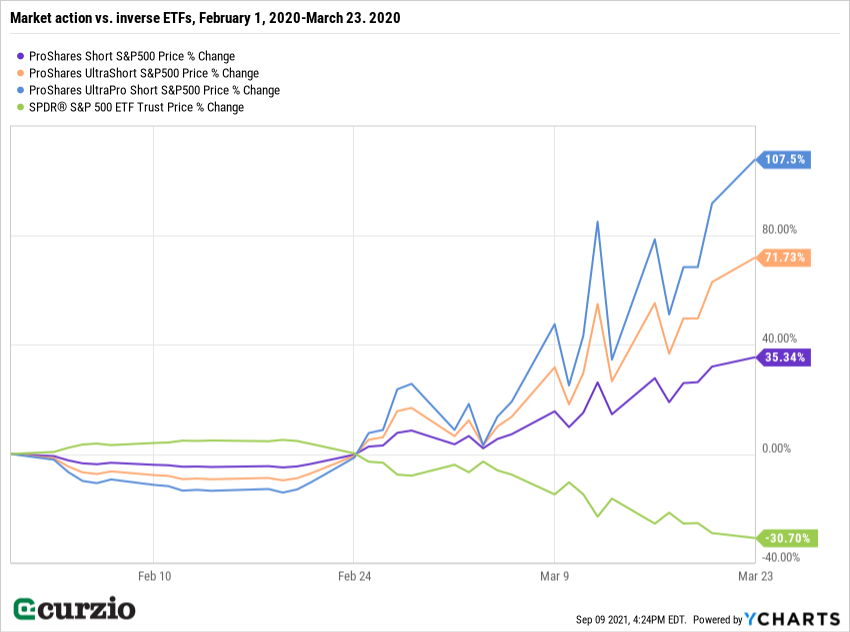

On the other hand, when the market dives sharply—like it did in the COVID selloff of 2020, you’ll be glad you had these hedges… as their performance gets close to expected.

I illustrate this on the chart below.

With the market losing more than 30% in March 2020, all inverse ETFs delivered solid gains: a 35% return for SH, nearly 72% for SDS, and more than 107% for SPXU.

In sum, these vehicles are designed to track daily changes only. If you hold them long-term, they tend to underperform the desired return… and the more volatile the market is, the more their returns will lag (due to the use of leverage).

Nothing can beat the simplicity of hedging with inverse ETFs. But to use these funds, follow these two simple rules:

No. 1: Use inverse ETFs only for short-term trades. They’re much better for quick gains and focused hedging than for the “buy and forget” portion of your portfolio.

No. 2: If you don’t want to take any unnecessary risks, stick to the lowest-leverage ETF available. The more leveraged your ETF is, the more it can deliver if you get it right… but the more it will lose if you’re wrong.

Editor’s note:

If you need risk hedges, let Genia take the guesswork out of it. With her Moneyflow Trader advisory, you’ll have protection from the market’s downside… while still capitalizing on its upside.

It’s an essential service Frank follows with his own money. Here’s how it works.