By now, you know I’m all about the data.

And the latest numbers show a clear trend in the stock market: Selling is picking up.

It’s been a theme for a few weeks. I referenced the changing landscape a month ago, when I said to expect a jump in volatility.

Since that post, the major indices have clocked new all-time highs.

But things aren’t so cheery under the surface…

When buying slows and selling grows, it’s generally a sign a pullback is on the horizon.

But don’t worry–even in a bumpy market, there are still great places to put your money… like one of my favorite low-volatility funds.

Let’s start by looking at the “big picture”…

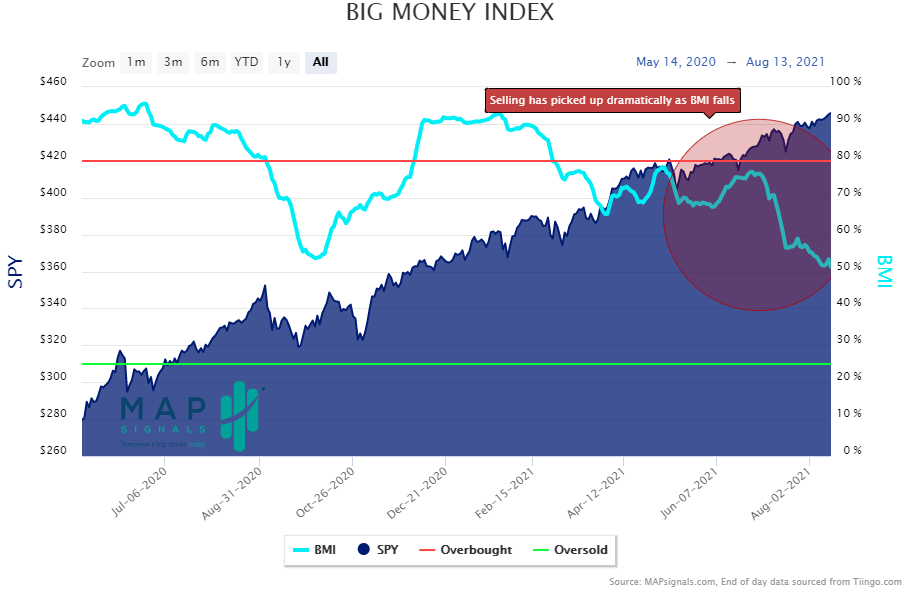

The Big Money Index continues to fall

Markets don’t move based solely on news headlines. They move up and down based on supply and demand. When demand is strong, that means buyers are hungry for stocks… and markets zoom higher. But when demand for stocks is weak and sellers are plentiful, the stock market pulls back.

And that’s what we’ve been seeing lately.

The Big Money Index (BMI) tracks buying and selling happening in stocks. When the BMI falls, it means more stocks are getting sold than bought. Have a look:

I’ve circled a dramatic pullback in the BMI over the past couple of months. In late June, the BMI was sitting just under 80%… Today, it’s hovering right around 50%. That means over the past five weeks, the number of stocks getting bought vs. sold has been approximately equal.

If we dig a little deeper, we can figure out which types of stocks are getting bought vs. sold…

Don’t be fooled by a rallying market

You may have noticed the S&P 500 keeps rallying. That’s because a few major constituents—like Apple (AAPL), Microsoft (MSFT), and Google (GOOG)—are holding the index up. The S&P is market-cap weighted… which means the largest stocks have a much bigger effect on its performance than the small-cap names.

Meanwhile, many small-cap stocks are struggling big time… The Russell 2000 small-cap index (which isn’t market-cap weighted) is down 4% over the past two months… while the S&P 500 is up 5.4%.

Let’s take a closer look…

Below are all of last week’s Big Money buys and sells, sorted by market cap (from small to large-cap). The bars on the far right show the total number of buys vs. sells for the week. This gives us an idea of the buying and selling happening in small caps vs. large caps.

Click to enlarge

Notice small-cap companies (market caps of $500 million–5 billion) saw 141 sells, compared to 80 buys. In other words, small caps are seeing almost twice as many sells as buys.

By contrast, large-cap stocks (market caps over $50 billion) saw nearly three times the number of buys compared to sells (44 buys vs. 15 sells).

In other words, most of the selling is in small-cap stocks.

But the BMI doesn’t care about market cap. Selling is selling. When it picks up, the BMI falls…

And when the BMI falls, it usually indicates a pullback is coming.

The perfect fund for a volatile summer

So, what’s an investor to do? Run and hide?

Absolutely not.

Let’s be honest, who doesn’t want a healthy pullback? I know I do. That’s the time to go shopping for great stocks.

That’s exactly what I’ll be doing once a pullback eventually comes.

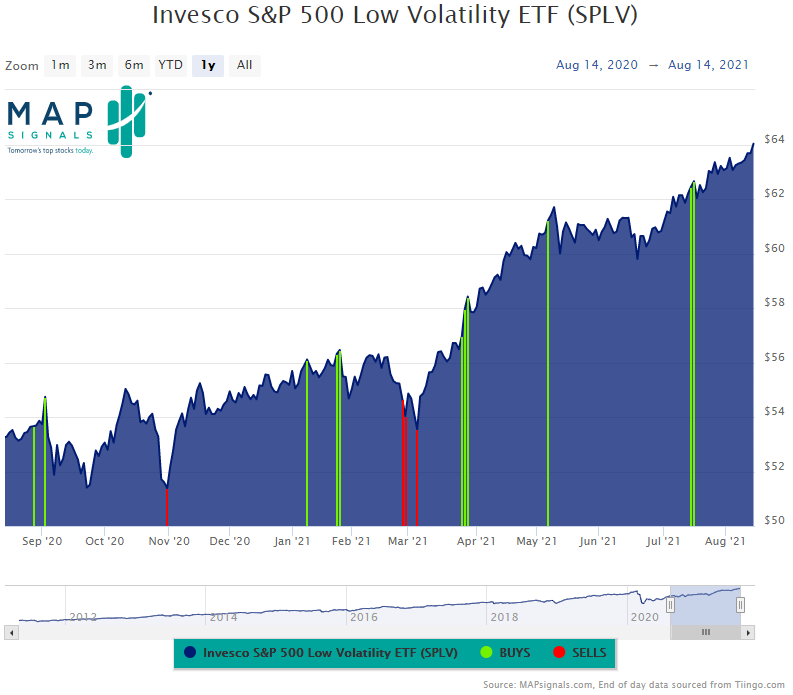

But for now, during the bumpy summer months, lower-volatility funds—like the Invesco S&P 500 Low Volatility ETF (SPLV)—are the place to be.

SPLV has a nice mix of big stocks that are known for being steady. It has large weighting in sectors like staples, utilities, healthcare, industrials, and financials. Many of these groups have done well recently, lifting the fund to highs. Let’s take a look at the Big Money data for SPLV…

As you can see, there have been lots of green signals—or Big Money buys—over the past year… and six since April.

The trend is your friend. I’ve learned to not fight it!

Here’s the bottom line: The data shows there’s quite a bit of selling happening with stocks. Mostly it’s focused on small-cap companies… but this could definitely be the start of something bigger. Until the data firms and buyers start to increase, a low-volatility fund like the SPLV is a great place to invest.

P.S. Want to get my absolute favorite stocks—the ones getting scooped up by Big Money players?

Check out my newsletter, The Big Money Report, where I uncover the best growth stocks on the market.