Editor’s note: In honor of Memorial Day, Luke brings back one of his timeless investing lessons: How to adjust your investing strategy in a down market…

We’ve seen some big losses on stocks lately…

If you look at some of the popular growth stocks within the ARK Innovation ETF (ARKK), you’ll understand what I mean.

The top two holdings in this fund, for example, have been battered this year: Zoom Video Communications (ZM) has fallen 41.8%… while Tesla (TSLA) is down 33%.

Did these companies suddenly turn into big nothings overnight? Nope. The steep declines are mainly due to investor fears over out-of-control inflation and rising interest rates.

If you’re holding any of these formerly high-flyers (I personally own ZM and TSLA so I feel the pressure too!), pay attention to your personal stop losses and preserve your capital. We don’t know how long this downturn will last.

And when hyper-growth stocks are getting killed, there are other sectors to consider. In this kind of environment, I love focusing on dividend growth stocks…

A true oasis

A quality dividend growth stock is an oasis in a down market. That’s because dividend growth stocks are stable, with long histories of making money, and they pay dividends at a growing rate. This is where many big-time investors flock in times of fear and uncertainty. When markets are cloudy, seek stability!

Think about it in terms of real estate. When those markets head south, it’s unlikely the top-quality real estate on Fifth Avenue in New York will budge much in value… because it’s coveted and has a rich, stable history. Who doesn’t want to be there?

The same is true in the world of stocks. The stocks that can ride out rocky markets are cash-rich businesses that raise their dividends year after year. These stocks win in a selloff.

Shareholder benefits are two-fold. First, there’s owning a great stock. And then there are the dividends, which are like small paychecks.

Imagine what happens if you take those small paychecks and buy more shares of the stock year after year? It can be magical. Let me show you what I mean…

Dividend growth in action

Top-of-the-line dividend growth companies spin off crazy amounts of cash. In general, they dominate their industries and are household names. This is where to focus during uncertain markets.

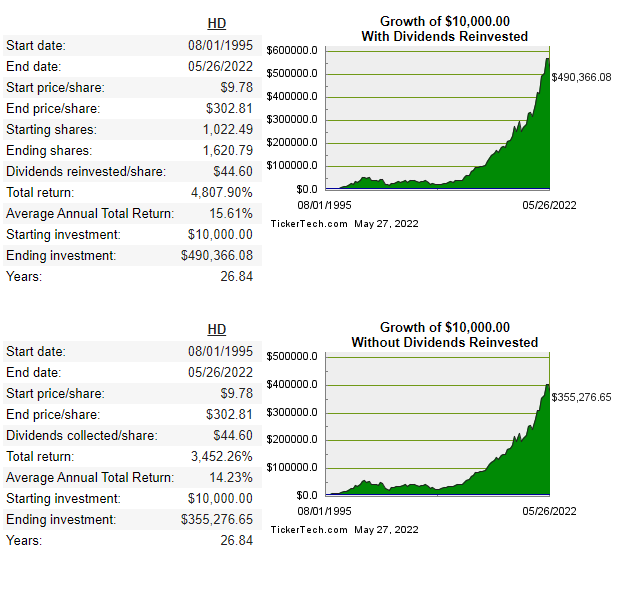

Up first is Home Depot (HD). The stock has been surging from the home improvement boom that erupted during the pandemic. But HD also has a history of consistently raising its dividend. Owning HD and reinvesting the dividends over the years has paid off: Since 1995, reinvesting dividends in the Home Depot beat out non-reinvestment by 1,355%!

And get this, when stock prices are down, it’s a gift for this kind of strategy—those reinvested dividends buy more shares!

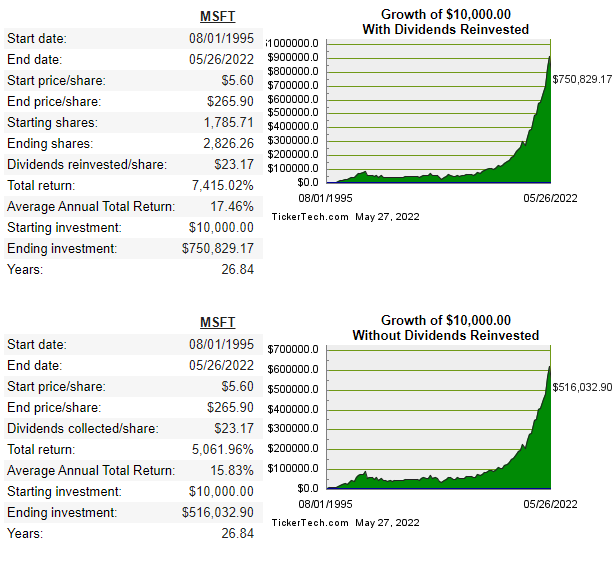

Now let’s look at another example: Microsoft Corporation (MSFT).

Check out the difference in reinvesting MSFT dividends versus not—it’s not even close:

Reinvesting dividends since 1995 compounds big time: A not-so-bad $516k could have been a whopping $750k.

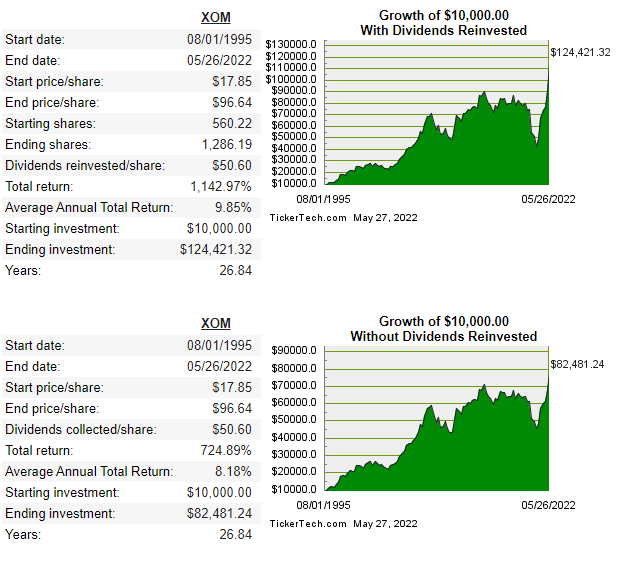

And as a final nod to my energy bulls, let’s look at Exxon Mobil Corp. (XOM). Energy stocks generally pay larger dividends, which could add even more juice to a dividend reinvestment strategy. It did for XOM:

And each of these stocks has a long history of growing dividends, which just amplifies the compounding:

Look, if you’re not reinvesting dividends, you’re making a mistake.

Consider the Vanguard Dividend Appreciation ETF (VIG). It’s an exchange-traded fund (ETF) that holds lots of stocks with a history of raising dividends. MSFT and HD are two of its largest weightings.

In the chart below, you can see this fund wasn’t spared during the recent selloff. It registered a few Big Money sell signals recently. When the market goes “risk off” like it has recently, even dividend stocks get hit.

But this fund is already bouncing back. That’s because, as I mentioned above, selloffs are a gift to dividend-growth seekers…

Remember: When share prices go on sale, dividend payouts buy more shares, which further compounds returns over time.

And a well-rounded ETF like VIG is an easy way to get exposure to growing dividends.

The bottom line: Dividend growth stocks can be powerful forces when markets get murky, because quality tends to be the best play in town. Big companies loaded with cash pay increasing dividends in just about any environment.

If you’re struggling with what to do with your portfolio right now, check out my video on dividend-growth stocks.

Disclosure: I hold long positions in MSFT, HD, and TSLA in personal accounts and HD and ZM in managed accounts.

Editor’s note: If you wish you’d bought stocks at pandemic lows… you have another chance now.

As money rushes out of the market, it’s creating incredible opportunities to buy the best stocks… at historic discounts.

Sign up for The Big Money Report today to find out what I’m buying now.