We’ve seen some big losses on stocks lately…

If you look at some of the popular growth stocks within the ARK Innovation ETF (ARKK), you’ll understand what I mean.

The top three holdings in this fund, for example, have been battered this year: Tesla Inc. (TSLA) is down 12.6%… Teladoc Health Inc. (TDOC) 18.8%… and Zoom Video Communications (ZM) 21.7%.

Did these companies suddenly turn into big nothings overnight? Nope. The steep declines are mainly due to investor fears over out-of-control inflation and rising interest rates.

If you’re holding any of these formerly high-flyers (I personally own ZM & TSLA so I feel the pressure too!), pay attention to your personal stop losses and preserve your capital if you’re an active trader. We don’t know how long this downturn will last…

And when hyper-growth stocks are getting killed, there are other sectors to consider. In this kind of environment, I love focusing on dividend-growth stocks…

A true oasis

A quality dividend-growth stock is an oasis in a down market. That’s because dividend growth stocks are stable, with long histories of making money, and they pay dividends at a growing rate. This is where many big-time investors flock in times of fear and uncertainty. When markets are cloudy, seek stability!

Think about it in terms of real estate. When those markets head south, it’s unlikely the top-quality real estate on 5th Avenue in New York will budge much in value… because it’s coveted and has a rich, stable history. Who doesn’t want to be there?

The same is true in the world of stocks. The stocks that can ride out rocky markets are cash-rich businesses that raise their dividends year after year. These stocks win in a selloff.

Shareholder benefits are two-fold. First, there’s owning a great stock. And then there are the dividends, which are like small paychecks.

Imagine what happens if you take those small paychecks and buy more shares of the stock year after year? It can be magical. Let me show you what I mean…

Dividend growth in action

Top-of-the-line dividend growth companies spin off crazy amounts of cash. In general, they dominate their industries and are household names. This is where to focus during uncertain markets.

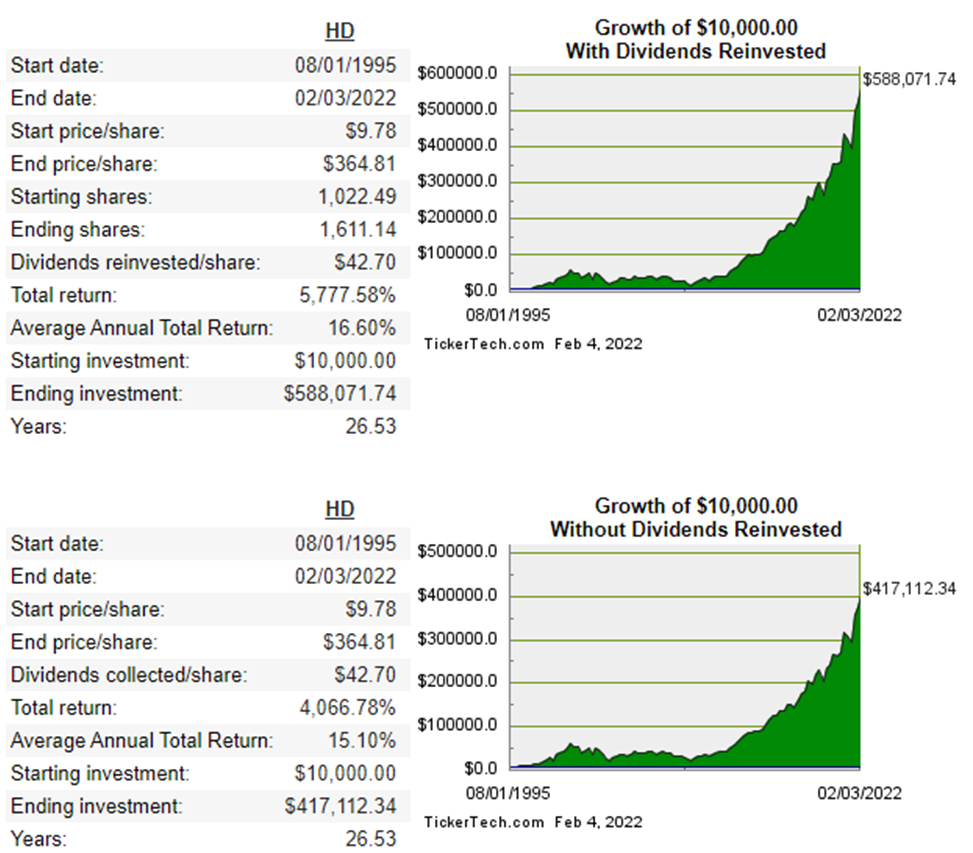

Up first is Home Depot (HD), the home improvement chain. The stock has been surging from the home improvement boom that erupted during the pandemic. But HD also has a history of consistently raising its dividend. Owning HD and reinvesting the dividends over the years has paid off:

As you can see, reinvesting dividends can massively increase your returns. Since 1995, reinvesting dividends in the Home Depot beat out non-reinvestment by 1,700%!

And get this, when stock prices are down, it’s a gift for this kind of strategy – those reinvested dividends buy more shares!

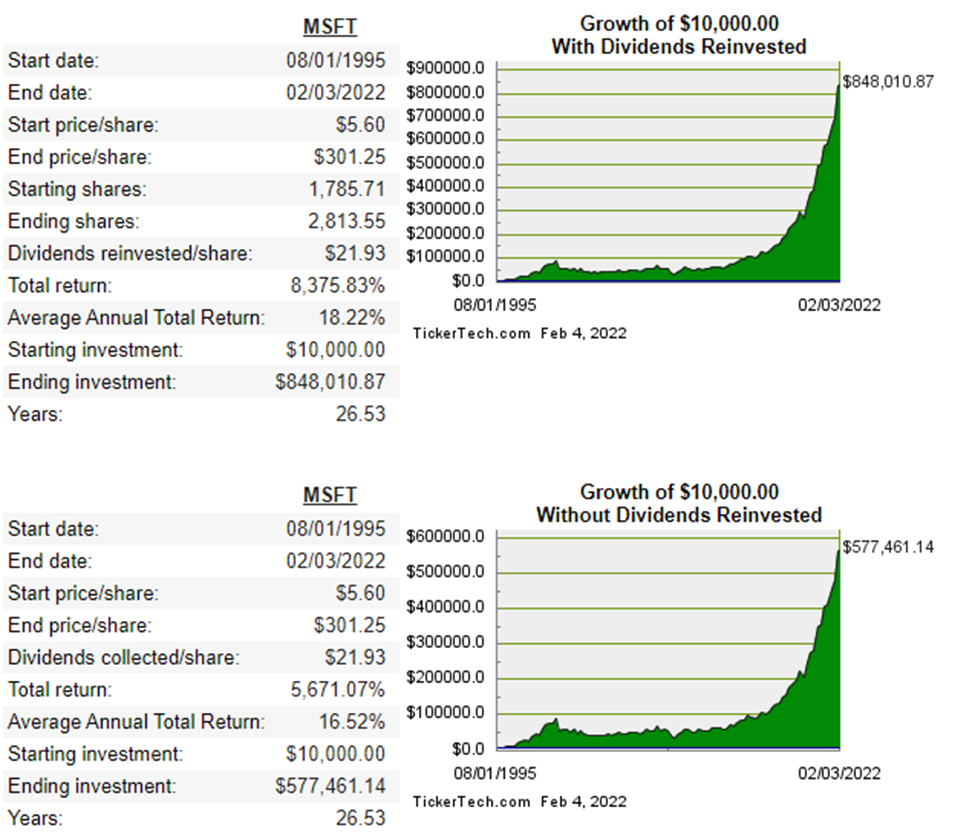

Now let’s look at another example many of you know, Microsoft Corporation (MSFT). Odds are, you’re using a Windows operating system right now. And that’s why MSFT stock is a cash machine.

Check out the difference in reinvesting MSFT dividends versus not – it’s not even close:

Reinvesting dividends since 1995 compounds big time: $848k vs. a not-so-bad $577k.

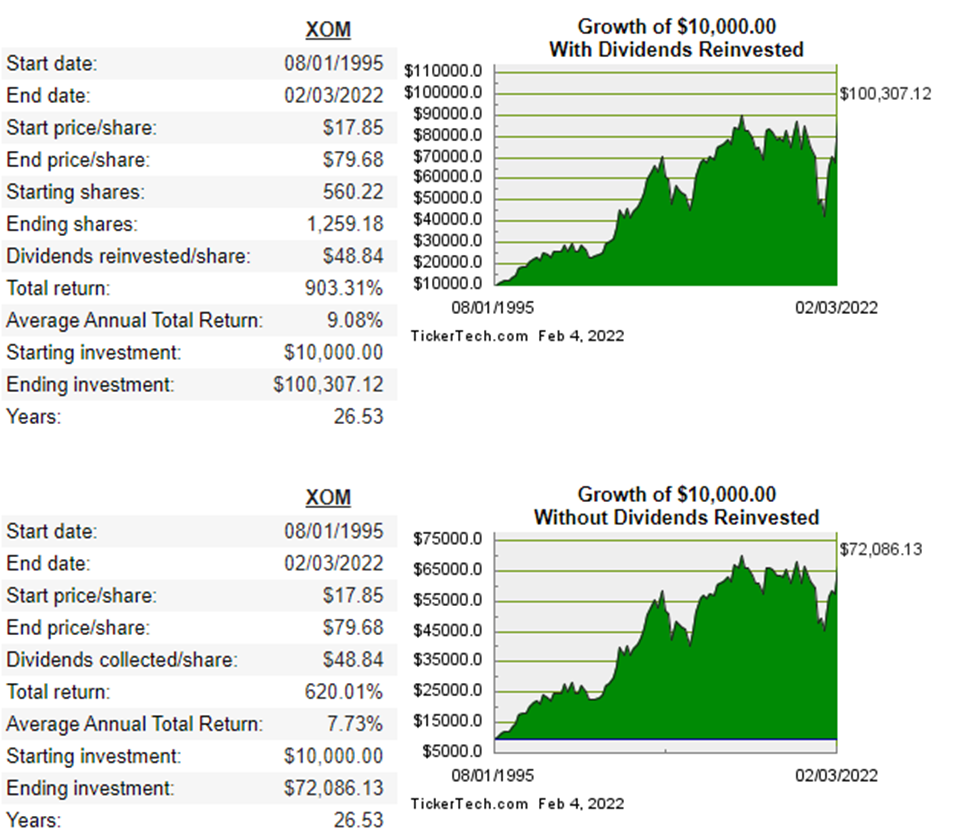

And as a final nod to my energy bulls, let’s look at Exxon Mobil Corp. (XOM), a massive oil and gas conglomerate. Energy stocks generally pay larger dividends, which could add even more JUICE to a dividend reinvestment strategy. It did for XOM:

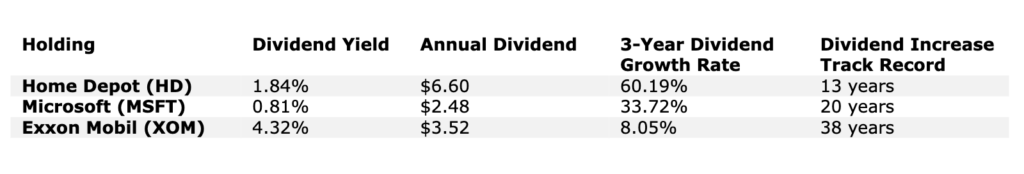

Each of these stocks has a long history of growing dividends:

Look, if you’re not reinvesting dividends, you’re making a mistake.

To do it with an ETF, consider the Vanguard Dividend Appreciation ETF (VIG). It holds lots of stocks that have a history of raising their dividends. MSFT and HD are two of its largest weightings.

In the chart below, you can see this fund wasn’t spared during the recent selloff. It registered a few Big Money sell signals recently. When the market goes “risk off” like it has recently, even dividend stocks get hit.

But this fund is already bouncing back. That’s because selloffs are a gift to dividend-growth seekers…

When share prices go on sale, dividend payouts buy more shares, which further compounds returns over time.

And a well-rounded ETF like VIG is an easy way to get exposure to growing dividends.

The bottom line: Dividend growth stocks can be powerful forces when markets get murky, because quality tends to be the best play in town. Big companies loaded with cash pay increasing dividends in just about any environment.

If you’re struggling with what to do with your portfolio right now, check out my new video on dividend-growth stocks.

Disclosure: I hold long positions in MSFT, HD, & TSLA in personal accounts and HD & ZM in managed accounts.

Editor’s note:

Behind the scenes of the Wall Street Unplugged podcast, Frank’s guests—some of the world’s top corporate insiders—are revealing their favorite ways to profit in today’s volatile market.

And you can access these elite stock tips for only $4 a month.

Become a Dollar Stock Club member, and get the next pick delivered straight to your inbox.