In February 1929, the Rhine River froze over.

The Rhine is the largest river in Europe and the main industrial artery of Germany. Thanks to a bout of extraordinarily cold weather, it froze along nearly its entire length (766 miles).

Almost a century later, we can safely say it was a rare event.

While winters in Germany are cold, temperatures typically aren’t low enough to make the river freeze and endanger industry and transportation—all made easy by the mighty Rhine.

The bigger danger today is hot, dry summers…

For the second time in four years, a stretch of the Rhine west of Germany’s capital is falling to dangerously low levels… and has become impassable for some barges… including those carrying energy supplies like coal.

This is contributing to Europe’s massive energy crisis…

Part of the crisis is also related to Russia’s invasion of Ukraine (and the resulting sanctions against the aggressor).

Germany—the industrial core of the EU—is highly dependent on natural gas exported from Russia…

For years, the country felt so secure in its energy supply that it shuttered nearly all its nuclear power plants. (The three remaining plants are on track to be turned off in December, even as Chancellor Scholz has publicly criticized the plan.)

Meanwhile, Russia is using its energy resources as a weapon against Europe for its opposition to the war in Ukraine.

Since last summer, the flow of natural gas from Russia to Europe has been irregular… and the price of gas has jumped exponentially.

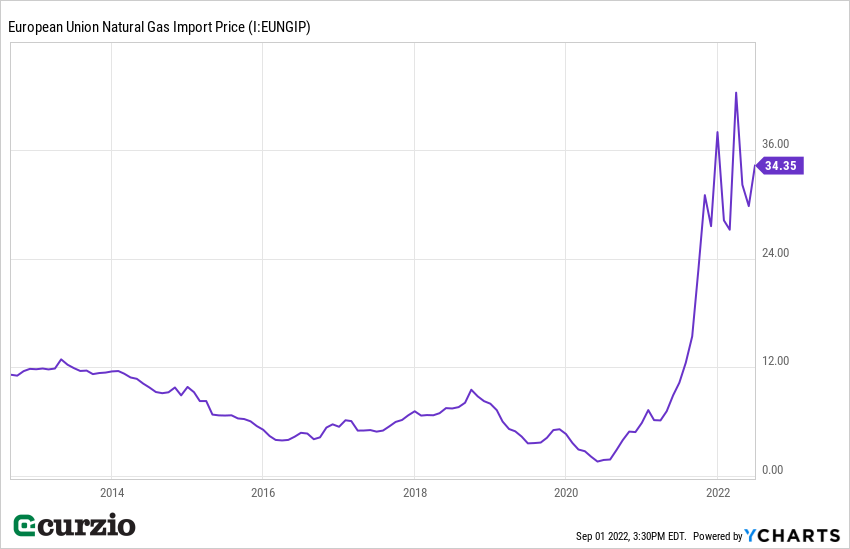

The chart below shows the average import border price for Europe (including the U.K.) over the last decade (through June). It clearly shows the volatility during the first half of the year… and the size of the jump from 2021 levels.

Since June, the situation has only worsened.

The price of one of the leading European natural gas benchmarks, Dutch TTF futures, is up 164% in the past three months… And the benchmark has jumped more than 8-fold over the past year.

In August, gas prices surged more than 20% after Russia reduced the amount of gas it ships to Europe through the Nord Stream gas pipeline to just 20% capacity (and threatened more stoppages), citing issues with equipment… Moscow insiders have said the cuts are to pressure the European Union to ease the sanctions.

Of course, natural gas isn’t the only energy source in Europe.

But this is where the story gets even scarier…

Europe’s worsening energy crisis

The whole of Europe is in the middle of a major heatwave… the continent’s worst in 500 years.

The drought is so bad that its impact is spreading far beyond the Rhine (which is getting too shallow for most traffic)…

In France—where much of the electric power is produced by nuclear plants—the rivers that supply the water are too warm to cool the reactors efficiently.

As a result, 57% of France’s nuclear capacity is offline. France is normally an electricity exporter… but the situation has forced the country to import power… and sent electricity prices soaring.

Low wind speeds related to extreme temperatures mean lower wind power output…

And now, Nordic nations are facing lower hydropower production.

No wonder European electricity prices are skyrocketing.

The continent is saving energy in any way it can.

But winter will be tough… and require some sacrifices, including deep cuts in energy consumption.

The most obvious place to cut: industrial production…

Some large companies are ready to reduce their gas consumption… but it will be harder for others.

In June, when energy prices were lower than today, about 16% of all German companies cut production due to high energy prices. The number is likely higher today—and, if nothing changes, will only increase by winter.

France and Germany—the two largest EU economies and both heavily industrialized countries—will be the biggest losers here.

Much like the rest of the developed world, both countries are dominated by the service economy… But a large portion of their gross domestic product (GDP)—19.5% and 29%, respectively—is generated by industrial production. (For comparison, industrial production accounts for 18.5% of the U.S. economy.)

France, where energy prices are up some 1,000% above their 2010–2020 averages, is set to suffer in the winter months. That’s because the country’s households rely on electricity more than natural gas for heating and hot water. France’s average power demand surges are well above its neighbors… making the country more likely to experience winter blackouts and power cuts.

With its large chemical industry (which uses natural gas as a major feedstock), Germany is also highly vulnerable to skyrocketing energy prices.

The Netherlands—the third-largest position in the ETF (14%)—has a water shortage set to impact its agricultural sector…

Spain and Italy have also been at the forefront of the energy crisis.

Spain was one of the continent’s most energy-poor countries even in 2020 and 2021… and is now ordering its public-facing buildings to conserve power by keeping air conditioners set no lower than 27 degrees Celsius (almost 81 degrees Fahrenheit).

Italy is the third-largest EU economy, the world’s sixth-largest manufacturing country, and a tourist magnet.

The industrial and consumer discretionary sectors are poised for higher costs, lower revenue and profits, and declining share prices in the months—and potentially even years—ahead.

But the truth is that all of the EU is in crisis… The continent is rich and powerful, but the crisis is too big to disregard. No wonder the EU and U.K. stock markets are stuck in a steady downtrend.

If the power crisis isn’t resolved by winter… oil companies will benefit the most.

To find out my favorite stocks to buy right now, join us risk-free at Unlimited Income. The portfolio already contains a few of my favorite energy plays… and I’ll be adding another in the next issue, due Tuesday. Plus, I’m researching several more to potentially add to our portfolio in the coming months.

And I suspect you’ll be better off steering clear of European stocks for now.