2022 is coming to a close, and the market is down about 14% for the year… one of the worst selloffs in a generation.

Yet, even in this market, some stocks have done surprisingly well…

So far this year, dividend stocks—which largely reside in the “value” half of the market—have beaten the S&P 500 by a wide margin.

Today, I’ll explain why you need to own this sector in 2023… and share three exchange-traded funds (ETFs) to get you started.

Why dividend stocks crushed the market this year

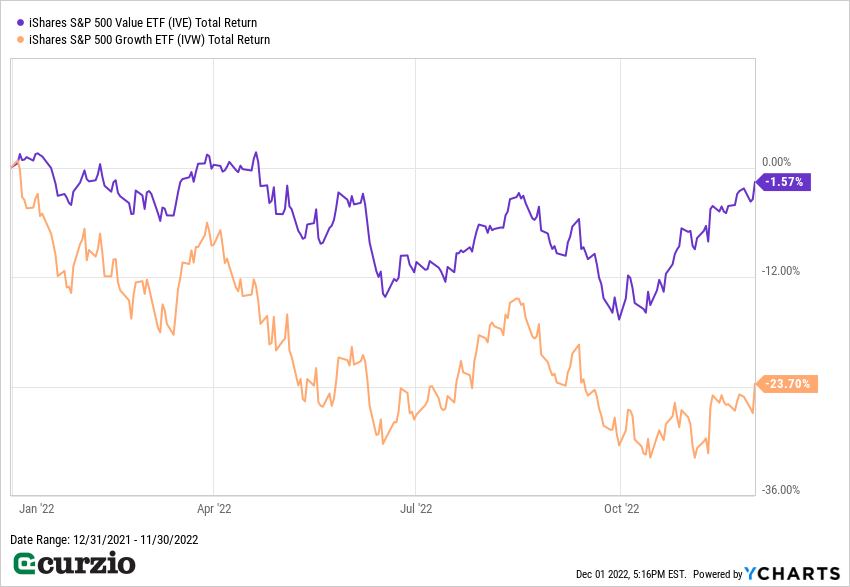

Take a look at the chart below, which shows the year-to-date performance of the “value” portion of the market, represented by the iShares S&P 500 Value ETF, vs. its “growth” counterpart, represented by the iShares S&P 500 Growth ETF.

As you can see, while growth stocks lost 24% this year, value is down just 1.6%. This should come as no surprise to our readers—I predicted this would happen earlier this year. And dividends are one of the biggest reasons for this amazing performance.

Dividend-paying stocks are often more resilient in a weak market for a few reasons…

For one, they’re typically safer than their zero-yielding counterparts. These businesses are mature enough to generate cash beyond their necessary expenses… and their dividend payments are proof of their financial discipline.

Secondly, companies generally don’t want to hold more cash than they absolutely need… Excess cash on the balance sheet can make a company an acquisition target—not an ideal scenario for managers who want to keep their jobs. So the more money this type of company makes, the more it will increase its payout.

Third, dividend-paying stocks are uniquely suited to a high-inflation environment. Since the 1930s, dividends have contributed roughly 40% to the S&P’s total returns… But this number jumps to 54% when inflation averages 5% or higher (like it did in 2022).

From an investor standpoint, these cash payouts can help weather the pain of a bear market. And earlier this year, when rates were still at zero and bonds were yielding next to nothing, investors started flocking to dividend stocks. But even as bond yields have risen this year, investors have been happy to stick with dividend stocks, as (unlike bonds) they offer both rising payouts and price appreciation.

The market conditions of 2022 are likely to continue for the foreseeable future—which means dividend stocks are a good bet going into next year. Here are three names to profit from this trend in 2023.

Three dividend ETFs for 2023

Exchange-traded funds are great investment vehicles because of their structure: Like mutual funds, they offer a diverse group of assets in a single investment. But unlike mutual funds, which only update their price at the end of each day, ETFs trade like stocks. In other words, their price reflects the changing value of their assets during the trading day, not just at the market’s close—which can be crucial in a volatile market.

Plus, you can choose between different strategies—such as high income… history of dividend growth… and even “dividend dogs.”

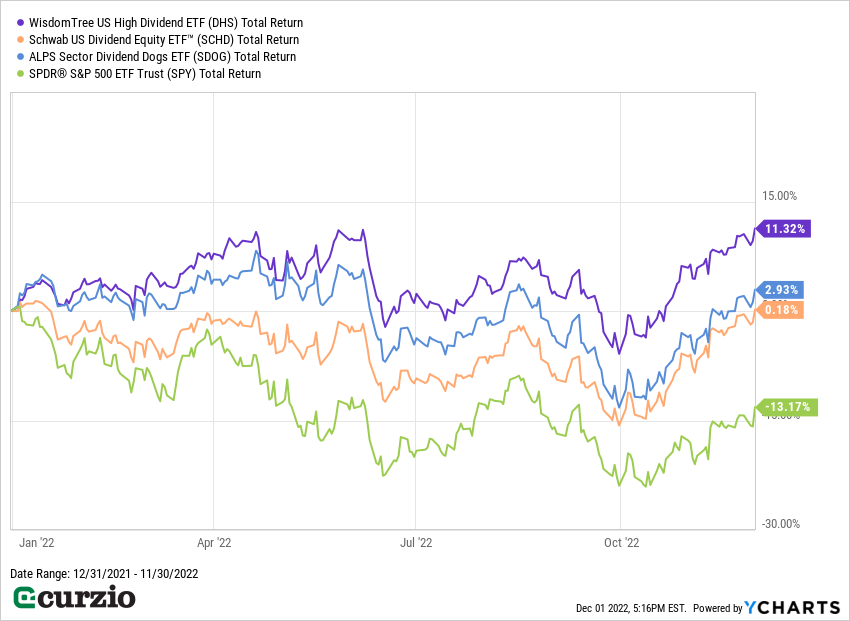

The three funds I describe below cover each of these strategies. And as you can see from the chart, all three have significantly outperformed the market this year.

The WisdomTree U.S. High Dividend ETF (DHS) invests in the highest-paying dividend stocks—with a twist: Each holding is rated based on its value, quality, and momentum… and the higher the stock’s rating, the larger its weight in the fund for the upcoming year.

Currently, energy giants ExxonMobil (XOM) and Chevron (CVX) are the fund’s largest holdings, representing about 15% of total assets. The rest of the fund’s top 10 positions includes big, stable pharma names like AbbVie (ABBV) and Pfizer (PFE)… along with blue-chip tobacco stocks like Philip Morris (PM) and Altria (MO).

The fund is well diversified, with more than 300 holdings in total. And it delivers a dividend yield of around 3.2% currently.

The Schwab U.S. Dividend Equity ETF (SCHD) tracks the Dow Jones U.S. Dividend 100 Index, which focuses on dividend quality, sustainability, and history. The criteria for inclusion in the index (and the ETF) includes dividend yield, free cash flow, debt, return on equity, and dividend growth rate over the past five years.

The ETF (which includes 100 stocks) has Merck (MRK), Amgen (AMGN), and IBM (IBM) as its top three positions. And, like the previous pick, SCHD offers a 3.2% dividend yield.

The ALPS Sector Dividend Dogs ETF (SDOG) is a unique twist on the dividend theme. It uses a modified “Dogs of the Dow” method of picking stocks… by including the five highest-yielding stocks in each of the market’s 10 sectors (with each holding equal weight). As a result, its portfolio is smaller (only 50 stocks) and more equally distributed across the major sectors.

Plus, SDOG’s portfolio doesn’t significantly overlap with any of the large-cap index-based ETFs you might already own (or with the ETFs above). Its top three positions—Gilead (GILD), Valero (VLO), and the Interpublic Group (IPG)—only account for 7.5% of the fund.

SDOG currently offers investors a 3.8% dividend yield.

Alternatively, you could buy high-yield, inflation-fighting individual stocks, like the kind I recommend in Unlimited Income. Many of the stocks in our portfolio are already sporting double-digit gains… but several are still in buy range.

In today’s volatile market, investing in less expensive, dividend-paying stocks that can sustain and raise their payouts can be a winning strategy. Not only does it generate income, even in a bear market, it also ensures you’re in a position to profit when the next bull market begins.