Persistently low oil prices are claiming some of the most reliable dividend-payers on earth…

Yesterday, I explained that oil prices are the result of a near-perfect storm… a combination of low demand and high supply.

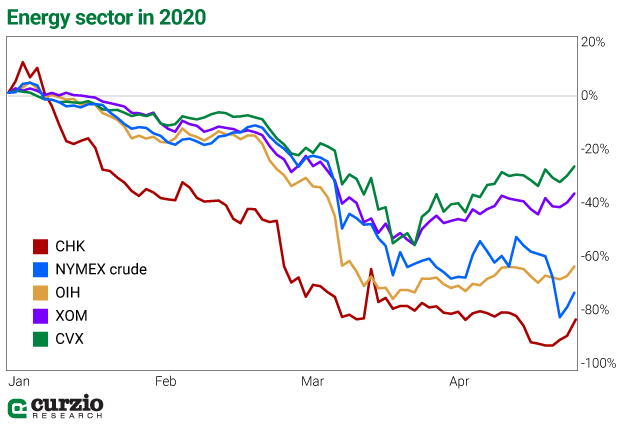

It’s no wonder that year to date, oil companies have underperformed the market.

While the S&P 500 lost about 13.4% in 2020, Chevron (CVX) is down twice as much—27.1%. Exxon Mobil (XOM) lost 36.8% of its value.

And oil drillers and service companies, represented on the chart below by the VanEck Vectors Oil Service ETF (OIH), lost a whopping 62.9%.

If you’re an income investor, chances are you own a healthy basket of energy stocks. They—especially oil majors—typically offer some of the most consistent yields on the market. A reliable business and a must-have product have long been a great combination for income investors.

But it may be time to reevaluate your energy positions and—at least for now—look elsewhere for income…

Exploration and production company Occidental Petroleum (OXY) announced an 86% dividend cut in late March… and the world’s largest oil services company, Schlumberger (SLB), announced a 75% cut last week.

Yesterday, Equinor ASA (EQNR), the biggest Norwegian crude producer, became the first oil major to cut its quarterly dividend—from $0.27 to $0.09.

Shale company Chesapeake Energy (CHK)—down 83% year to date as of yesterday—even suspended its preferred stock dividend.

Some of the energy companies are priced as if they’re going out of business. And many will…

But the leading oil companies in the world, Chevron and Exxon, are here to stay. They’ve been coping with low oil prices by sharply cutting their spending. And both companies have said their dividend is safe.

But they may have no choice if this oil rout continues…

Chevron is one of the oldest companies in the S&P 500 Index. Today, it yields 6.1%.

It’s a very appetizing dividend… if it lasts.

Back in January, it boosted its dividend by 8%, the 33rd year in a row of dividend increases. But considering the oil price is now sharply lower than it was in January, this shouldn’t be a sign of comfort. Chevron is trying its hardest to avoid a dividend cut—but it may yet come to that.

This year, Chevron won’t even be able to break even—it’s likely to lose $0.70 per share in 2020.

In the past five years, it lost more than a quarter of its annual revenue ($139.9 billion in 2019 vs. $192.3 in 2014), and its earnings per share (EPS) plunged 85%.

But it remained profitable, with $1.55 in EPS booked in 2019. Plus, the company’s debt carries the AA investment rating—which means it can borrow at attractive rates.

Chevron is financially strong—perhaps the strongest of all oil companies. It’s been able to control its expenses during these lean times… But it does need Brent crude at around $55 per barrel (the breakeven oil price for dividends) to be comfortable with its dividend… and Brent, an international oil benchmark currently priced at a premium to West Texas Intermediate crude (WTI), closed at only $21.71 on Thursday.

I’m concerned about Chevron… But I’m even more concerned about Exxon. Its 8.3% yield is in even more danger—unless the price of oil rallies soon.

Exxon has said as recently as this March that the company is committed to its dividend.

But it hasn’t announced a dividend increase so far this year—a negative sign. Typically, it does so in April. It did, however, borrow heavily, already selling $18 billion of bonds in the first few months of 2020 (vs. $8.1 billion total borrowed in 2019).

We’ll know more about both companies’ outlook—and their dividend prospects—on May 1, when both report their most recent financial results.

For now, we just have to assume the price of oil is too low for these companies’ financial comfort… and that a dividend reduction is possible.

Dividend cuts aren’t always a bad thing

When a cyclical company must preserve capital—but is otherwise in good shape, the market often expects a dividend reduction. In fact, when dividend cuts are seen as the best-case scenario, stocks sometimes get a price boost… similar to the 9% rally in Schlumberger (SLB) the day after it announced its dividend cut.

When your main product—oil—isn’t selling well and you need to go into conservation mode, the money you would have spent on dividends can often be put to better use.

So, while undesirable from a shareholder point of view, dividend cuts might mean a stronger business when the crisis is over. The market sees the need to save cash… invest in the future… and limit future borrowing. That’s why it might cheer a dividend cut if it does happen.

Long-term, both CVX and XOM are the stocks to own for oil-patch exposure. Both companies are stronger than most of their peers… but to conserve this strength and stay stronger than the competition when this oil slump is over, they might need to go deep into cash preservation mode and reduce their payouts.

Don’t be immediately spooked if that happens. But keep your eye on the price of oil.

The oil majors need much higher prices to both grow and pay dividends. But if they have to resort to a dividend cut, they’ll strive to make it temporary.

In sum, if you’re an energy investor looking for long-term value and dividends, it’s more important than ever to stick with the strongest players in the business.

Next week, I’ll tell you about some alternative places to look for income today…

Note from Frank: After plummeting for weeks, the markets are showing some upward momentum. Have we finally turned the corner on the COVID-19 crisis… or are we setting up for another big market drop?

On April 30, I’m hosting our first-ever webinar: Navigating the New World Order: A Curzio Research Townhall. It’s free to attend.

We’ll talk about the specific risks we still face—and everything I suggest you do to prepare for the coming days… weeks… and months.

I’m also going to answer questions directly from you. Shoot me your question here. If it’s something I can answer, I will. We’re in this together.

You’ll be getting more specific details in the days to come. I hope to see you there!