There aren’t many markets that can teach us, at least in some way, about today’s stock action…

But 1998 to 2000 stands out.

That short time period had it all…

The dot-com boom and the excitement of new technologies… mergers and acquisitions… high-profile IPOs… and even an end-of-the-world scare. (I’m sure we all remember the Y2K debacle.)

The dot-com era moved indexing, do-it-yourself investing, day trading, and exchange-traded funds (ETFs) to the mainstream… paving the way for stock price decimalization in 2001.

The tech-heavy Nasdaq Composite doubled in just a few months.

Pets.com, eToys.com, BroadVision, RealNetworks, and pretty much every other dot-com was flying—while old stalwarts like Coca-Cola, Procter & Gamble, and Disney were languishing.

But in 2000, the bottom fell out…

Internet-related high-flyers fell out of favor, and overvalued markets corrected. And while the entire market declined, it was the unprofitable dotcoms that sold off the most. (As it turns out, profits—or at least a promise of future profits—are important.) Some names disappeared, and many never recovered their former glory.

March 2000 was the high point for the Nasdaq. It would take more than 15 years for the index to claw its way back to those levels.

I happened to be in New York at the time, studying for my MBA in finance.

But the events of these two years gave me a crash course in how the markets really work… and provided some of the most valuable lessons I would ever learn about investing.

Yes, sometimes the market gets ahead of itself. The truth is, there isn’t a good way to determine what the “top” is.

But staying away isn’t the solution. Time and again, the market shows us it rewards long-term optimists…

And if you’re one of the many investors looking for income today, you definitely don’t want to sit on the sidelines…

That’s because we’re at a unique moment in history. With the baby boomer generation in or near retirement, there’s greater demand than ever for passive income. And we’re going to see more and more money pouring into income vehicles.

I’ve designed my newest investment advisory, Unlimited Income, to help you take advantage of this tremendous opportunity.

As many of you know, income assets are one of my specialties. Before joining Curzio Research, I was an analyst and portfolio manager, responsible for millions of dollars in client assets. I also edited two successful income-focused investment newsletters.

I’ve been in the investment industry now for nearly 20 years, and there’s nothing I love more than helping my clients and subscribers find little-known opportunities to boost their income stream and ease their way into retirement.

With dividend-focused strategies, you can afford not to worry about where the market is going in the next month… or even the next year.

If the market keeps going higher—great. Your opportunity costs will be minimal… and you’ll be enjoying a total return (share price appreciation plus dividends).

If the market changes its mind and turns down, you’ll be rewarded with dividends anyway. (If you select your investments carefully, of course.)

And if you choose to reinvest those dividends, you’ll continue to build a bigger position… collecting even more dividends in the future.

Today, the market is flat year-to-date, having recovered much of its pre-COVID ground, and growth-stock sectors like those in the Nasdaq Composite Index are booming. It’s tempting to ride that wave, despite the inherent risks of non-profitable stocks.

But what if I told you it’s possible to achieve outsized returns and dividend yield, for much less risk?

With today’s economy, that’s exactly the opportunity we have… and I’ll continue to encourage all of you to take advantage of it in these pages.

I’ll say more about this opportunity in a moment. But first, let’s briefly take a look at the dot-com bust… what it has to teach us about the markets… and the power of an income stream.

Lessons from the dot-com bust

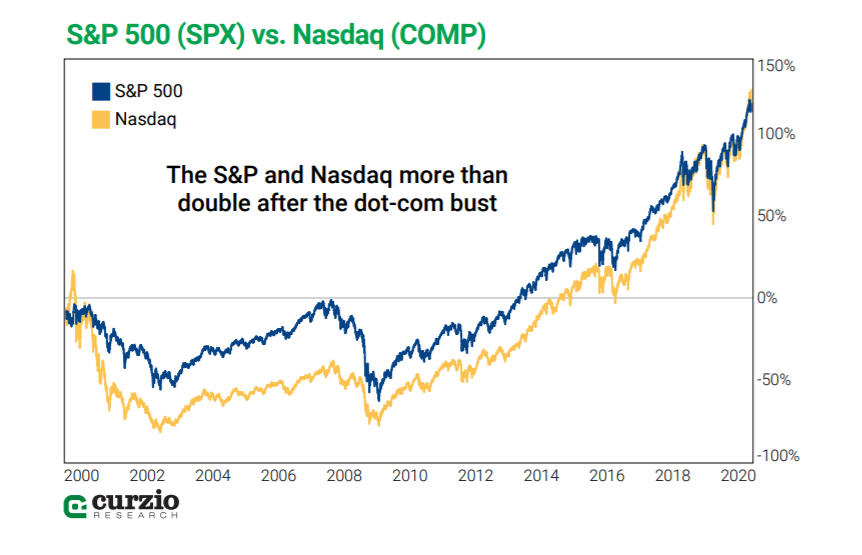

The Nasdaq bore the brunt of the dot-com selloff. And while the S&P 500 took a heavy hit too, it recovered its losses faster. By early 2013, the S&P had left it all behind… more than two years earlier than the Nasdaq.

That’s because unlike the Nasdaq, in order for a company to be listed on the S&P, it must be profitable. Even for those unlucky investors who invested in the S&P at the very top of the dot-com market, it’s been a profitable ride since about 2013 (with a few detours, including the COVID-19 selloff).

The dot-com bust and subsequent long-term recovery also taught us that some things will always be important for stocks.

Regardless of where we are in the market or business cycle, business viability matters.

Revenue generation matters. Valuations matter. And, for anyone who wants some peace of mind (not to mention income), dividends matter.

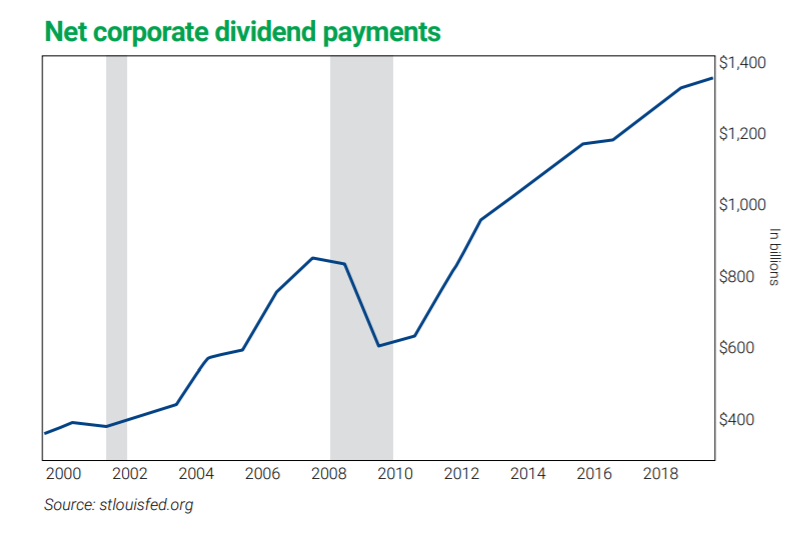

Now, I want you to pay special attention to my next exhibit.

The chart below covers the same period as the chart above (1999-2020).

In just 20 years, the total value of corporate dividend payments jumped 3.5 times (3.5x)—from $373.5 billion in 1999 to $1,340.7 billion in 2019.

That’s much faster than the approximately 130% (2.3x) market appreciation over the same time.

More importantly, corporate dividends have exhibited much less volatility than the market.

From 1999 to 2019, the only period these dividends weren’t rising was during the Great Recession. As soon as the recession was over, dividends recovered—and then some. From $622 billion in 2009, they more than doubled by 2019.

The post-COVID market, you might say, has already shown us that not all dividends are safe… in harsh markets they can be cut or eliminated.

And you’d be right. But the strongest companies still pay, and several—like Costco (COST) and Procter & Gamble (PG)—have even hiked theirs.

How to double your market gains

The stock market is a unique mechanism for business ownership. Shareholders collectively own the business… and share in its successes and failures.

Investors tend to choose companies with the best future—the companies that promise the best reward. And that reward consists of two major elements: stock price appreciation and dividends.

As the two charts above illustrate, dividend income can be a great way to smooth your stock market ride and add to your total returns.

Over my 20-plus years of studying the markets, I’ve learned trying to time market action with any real precision is an impossible task.

We can do our best to anticipate the market’s next move, but there will always be an element of unpredictability from one day to the next.

Over time, though, the market always trends higher. And dividends contribute to a significant part of total returns.

Despite all the turbulence of these two decades, had you invested $1,000 in an ETF representing the S&P 500 (I used the SPDR S&P 500 ETF in the chart above) on December 31, 1999, you would’ve made $2,280 by January 2020… more than double your money (127.9%).

With dividend reinvestment, you would’ve made $3,300… more than triple your money (231.5%).

Year over year, the S&P is up 8%—while our economy has declined, which has many of us worried.

But as you’ve seen in the charts above, the market rewards long-term optimists.

And with the Fed’s zero-rate policies, income investors have few options but to buy dividend stocks. That means we’re going to see a flood of money pouring into this sector… in fact, we already are. The best of the dividend stocks–some of which are already in our portfolio–are rallying with the market.

The problem is, with today’s economy, many formerly “safe” high-yielders… and even blue-chip stocks are cutting dividends left and right… and some of the income stocks you hold may no longer be reliable.

Under these conditions, investors could gravitate toward income stocks with the highest yield. But as I’ve discussed in these pages, excessively high yields are one of the warning signs of an impending dividend cut—and a declining business.

Thanks to government stimulus, the market keeps climbing with little regard for fundamentals… But as we saw with the dot-com bust, fundamentals will eventually matter. And financially strong, steadily profitable companies will reward investors once again.

I designed my new, low-cost income advisory to help investors avoid slow-growth pitfalls and ensure a steady income stream for years to come… with the added boost of stock appreciation.

And it’s working…

I’m happy to report that since we began beta testing Unlimited Income in February, we’ve seen significant gains in eight out of nine positions… while collecting healthy yields. (Our one straggler is down only marginally—less than 1%.)

To try out my new service—completely risk-free—and start earning income today, click here.

Editor’s note: Genia’s had an amazing year so far… generating quick gains like 125%… 149%… and even 508% for her followers during the recent financial crisis.

But as she’s shared with you today, she sees a new opportunity on the horizon… one that could potentially hand fast-moving investors quadruple-digit gains.

In a new presentation, Frank explains how Unlimited Income members can cash in on this massive opportunity… Watch here.