Americans now take for granted that we can tuck away pretax earnings in a 401(k)…

But such a thing was unheard of until 40 years ago.

It was possible thanks to a small, obscure provision to the Revenue Act of 1978 signed into law by President Jimmy Carter.

That small provision allowed an employee to defer tax on his salary if it was invested in the stock market.

From that point on, it was only a matter of time before some smart benefit manager figured out how to use this tax code section to set up a retirement plan. And he did…

In 1979, Ted Benna, a co-owner of a small benefits consulting firm in Philadelphia, realized he could manipulate the code to help pensioners supplement their retirement income. Two years later, his company launched the first 401(k) plan, named for the provision.

And the rest is history…

Over the years, several factors have contributed to the success of 401(k)s: tax deferral, payroll withholding, employer contributions…

Moreover, 401(k) plans make it easy to introduce discipline to the investing process. And disciplined investing pays big overtime, for professionals and novices alike.

Part of the reason it pays so well is a powerful process you may not have considered. One that essentially replaces the need to “time the market”…

Think about your 401(k) as an efficient “dollar-cost averaging machine.” Twice a month (or with some other frequency, depending on how often you get paid), you automatically invest part of your earnings in the market. This happens rain or shine, bull or bear, good value or bad… But, on average, you’d buy the same dollar amount of stocks twice a month, every month, all year long, for as long as you stay employed.

As a side effect of this process, if the market is more expensive, you’d buy less… and if the market is cheap, you’d buy more. All without lifting a finger.

That’s called dollar-cost averaging.

With this method, you’ve eased your way in… and eliminated the need to guess the best time to buy.

In the long run, investors like you and me will continue to benefit from one simple fact: Over time, stocks tend to move higher.

But how specifically you invest your 401(k) is largely up to you.

The easiest and the most rational way to dollar-cost average is to have some exposure to the overall market through a market index (via an ETF or mutual fund).

Most indices, such as the S&P 500, are weighted by the market cap of their constituents. This allows investors to benefit from the success of the index’s best performers… while its worst members wilt and fade away (from the overall performance standpoint).

Let’s take the S&P 500 as an example.

It’s now dominated by Apple (AAPL), the world’s largest company by market cap.

Apple’s success is, in a very big way, the market’s success. Its moves higher translate into higher moves for the S&P 500… but this also works the other way around. Apple share-price declines would translate into a significant S&P 500 loss.

A 1% move in Apple, one way or another, is going to move the market much more than the same sized move in, say, H&R Block (HRB), the smallest company in the index. In fact, it would take an average 1% move in each of the bottom 201 stocks of the S&P 500 to impact the index in the same way as a 1% move in Apple would.

That’s because Apple now has the same total market capitalization as the 201 lowest-cap stocks in the index combined. And the impact on market-cap-weighted indices, therefore, will be similar.

Of course, passive investors who’ve benefited from the rise of Apple would feel some pain if Apple were to sell off. That’s the nature of index investing: Winners replace losers as they rise to the top, and the value of the index reflects that rise.

But if that happens, Apple’s place will be taken by other winners.

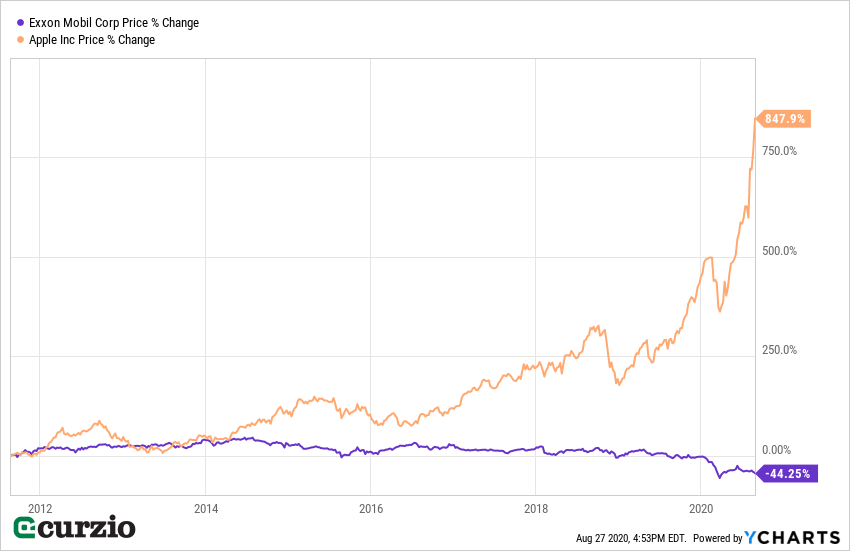

Just like Apple replaced ExxonMobil (XOM) on the top of the market pyramid…

As recently as 2011, Exxon was the largest publicly traded company in the S&P.

Over the past nine years, though, Exxon lost nearly half of its value (most of it this year)… while Apple gained more than 800%—appreciating more than 70% in 2020 alone.

Stock pickers, big-trend investors, or anyone else who recognized early on the changing of the guard from energy to tech all benefited big time by selling XOM earlier in the decade… and switching to Apple.

And the more Apple grew, the more the S&P investors benefitted, too: AAPL now accounts for more and more of their returns… and as XOM faded, its contributions to the index faded as well.

Earlier this week, another index made the switch to even more tech… biotech… and away from energy.

The Dow Jones Industrial Average, a price-weighted blue-chip index of 30 companies, threw in the towel and tossed XOM out. Also out: Pfizer (PFE) and Raytheon (RTX). The trio is being replaced by salesforce.com (CRM), Amgen (AMGN), and Honeywell (HON).

In the months and years ahead, there will be more index changes prompted by the fluid nature of market leadership, whether by committee decision, or because of the market’s powerful moves. Not to mention more market rallies and more sharp selloffs. Nothing lasts forever—especially in the stock market.

But if you have a 401(k), where you probably own an index fund or two, don’t kick yourself for not buying more Apple this year. You likely own a lot of it, via your large-cap index fund or your mutual fund, and thanks to the dollar-cost averaging feature, you already bought more this year.

In sum, dollar-cost averaging gives you an advantage when market trends change… and will help you weather the next market storm when it comes… especially if you have a long enough time horizon.

It’s part of the power—and simplicity—of investing in a 401(k).

Editor’s note: Members of Genia’s new Unlimited Income advisory are already reaping the benefits of her down-to-earth advice for a worry-free retirement. Her recommendations are carefully selected to provide dividend and share price growth in the Covid economy.

Learn more about Genia’s elite strategy for unlimited income… a strategy some of the world’s greatest investors are also using to capitalize in today’s zero-rate environment.