Believe it or not, one of my best investment moves didn’t involve buying or selling a single share of stock…

When I was a teenager, I committed to setting aside money each and every month specifically for long-term investing.

At the time, I knew nothing about stocks, markets, sectors, or anything else. But I knew I wanted to have a lot more money later in life.

I opened a brokerage account and added a few hundred bucks every month. I didn’t have many bills when I started, since I lived with mom and ate her food for free.

But over time, I treated this contribution like another bill in my monthly budget…

Mortgage—check. Utilities—check. “Retirement bill”—check.

At first, the amount I invested was small. Then it grew and is much bigger today. And there’s a great chance my “retirement bill” 10 years from now is even bigger.

You might think my “retirement bill” strategy sounds crazy. But it’s how I keep myself focused on growing wealth over time… regardless of what’s happening in the stock market.

You see, it’s hard to keep your emotions in check when investing.

We tend to get excited when the market goes up… and fearful when it goes down.

These emotional swings can be dangerous—especially if you get scared and stop investing every time the market hits a rough patch.

But using this same simple strategy will help you avoid the emotional rollercoaster… and greatly improve your chances of long-term investment success.

Here’s how…

Savings in action

OK, you’ve dedicated an amount to contribute to your “retirement bill” every paycheck, but now what? How do you invest?

The most important step is committing to the monthly contribution.

And here’s the nice thing: It doesn’t matter how much you set aside. Starting small is still starting. If you can only set aside $50 a month… that’s a great start. You can always raise the monthly contribution later. Even better… think of the increase as a future goal to work towards.

Keep in mind, this is money you won’t touch for many years. Its sole purpose is to slowly build your wealth. The most important thing is to stick to the plan by setting that money aside every month, no matter what.

The simplest method is to take a sliver of each paycheck and roll it into your brokerage account. Most online brokerages will be happy to help set this up. Usually, you just need to provide them with the routing and account numbers for your bank account… the amount you want to contribute… and which day of the month the transaction will happen.

When I started, I would send a check to a financial advisor every month. The money would go straight into a broad market index fund. Today, simpler options include ETFs like the SPDR S&P 500 Trust (SPY) or the Vanguard 500 Index Fund (VOO).

Back then, there was a minimum amount you needed to get started—usually $1,000 or more. But now, most brokerages have much lower investment minimums.

Plus, you don’t need to worry about having hundreds of dollars to buy a single share of a fund anymore. You can now buy “slivers” of stocks and ETFs for as little as $5. And most brokers offer a variety of choices when it comes to automated investing: Your monthly contribution will automatically purchase a mix of ETFs, stocks, or mutual funds… based on the allocation you choose when you set up the account.

Once you set up the plan, keep at it… and watch it snowball.

As I explained last week, time is your most valuable asset… and someone starting with $5,000 can turn into a millionaire over 30 years, generating a gain of over 480%.

Now let’s look at an example of this kind of automated investing…

Let’s say you commit to investing $200 a month. To keep it simple, we’ll put it into a single fund: the SPDR S&P 500 Trust (SPY).

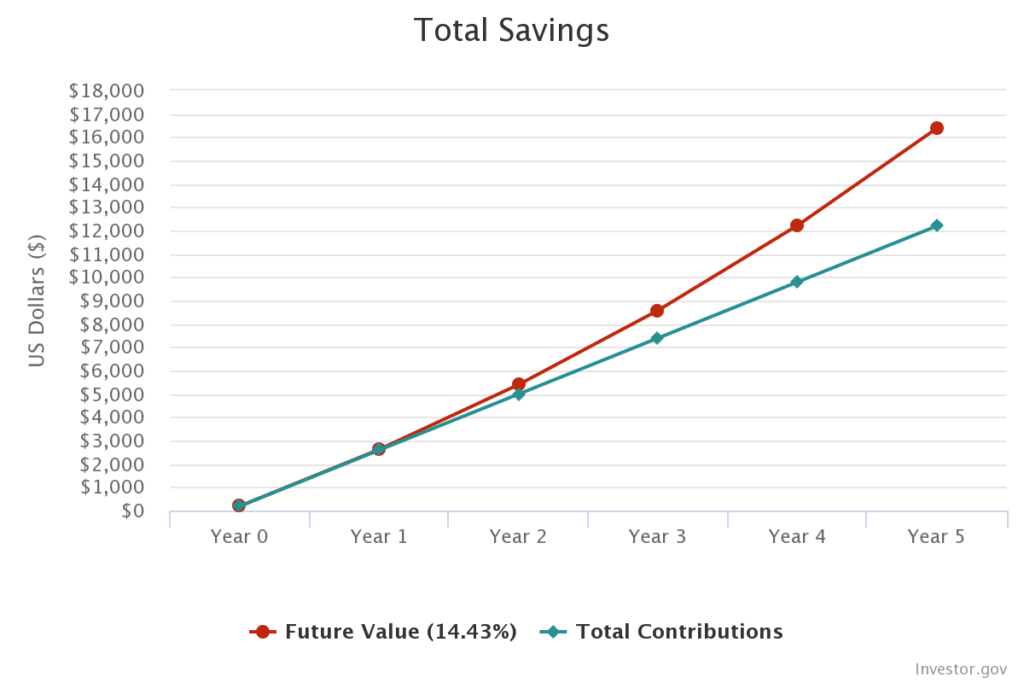

For this example, we’ll say you started the plan five years ago. You put $200 into the account at first… and added $200 every month since (for a total of $12,200 invested over time).

Here’s how the SPY chart looks over the past five years:

The average annual return for SPY from 2017–21 was 14.43% (assuming you reinvested the dividends).

But remember, we didn’t start with one big lump sum… we added $200 each month. As a result, the account shows a slow and steady growth rate.

Below, I’ve included a chart to show the results. The lower blue line is the money you contributed to the account… while the higher red line shows the value of your account over the five years…

And just like that, your long-term savings—built by paying your “retirement bill” each month—grew into slightly more than $16,392. And if you keep at it, your account will eventually blow past the six-figure mark over the years.

Commitment is key

I can’t stress this enough: The real “secret” here is the commitment to making a monthly contribution. By automating the process, you reduce the potential for emotions to get in the way of your investing.

But if you don’t keep at it, the above example won’t happen. It’s especially important during bear markets… which cause many investors to panic and stop buying (or worse, sell their long-term holdings).

History shows the stock market generates massive gains over time. But it doesn’t go up in a straight line. Making a regular contribution—regardless of the ups and downs—can save you a ton of mental stress… and ensure you end up retiring comfortably.

Editor’s note:

Start building long-term wealth—simply and stress-free—with Unlimited Income.

Full of high-yield, high-growth assets in energy… real estate… industrials… precious metals… and more… it’s one of the best “buy-it-and-forget-it” portfolios on the market.