Editor’s note: Today, we’re bringing back a timeless lesson from Luke that encapsulates how focusing on the “big picture”—especially during a bear market—is the key to generating massive long-term returns.

Among the many great quotes from Warren Buffett is this gem: “The stock market is a device for transferring money from the impatient to the patient.”

The simple fact is this: Time is the most important ingredient to generating wealth. With enough time, anyone can get rich.

This is true because of the magic of compound interest.

You might have read about this idea before—but it’s a critical concept for novice and experienced investors alike… and it’s all the more important to remember in today’s difficult market, when everyone is running scared.

If you understand a few basic financial concepts—and stay disciplined—you’ll end up retiring with more money than you ever thought possible.

The key to building a fortune over time

Compound interest is essentially earning “interest on your interest.”

As you reinvest your gains, you start earning a return on those gains (as well as on your original investment). This exponential growth leads to an incredible rise in the value of your portfolio over time.

If you want to see the effects of compound interest on your own portfolio… you should visit Investor.gov, a website run by the Securities and Exchange Commission (SEC).

Here’s an example of how compound interest works from the site:

If you have $100 and it earns 5% interest each year, you’ll have $105 at the end of the first year. At the end of the second year, you’ll have $110.25. Not only did you earn $5 on the initial $100 deposit, you also earned $0.25 on the $5 in interest.

The amount of “extra” interest may seem small at first, but it adds up over time. If you’re patient and keep reinvesting the interest/gains… the annual growth eventually snowballs.

Let’s look at an example…

We’ll use one of my favorite tools for investors: the compound interest calculator (available at Investor.gov).

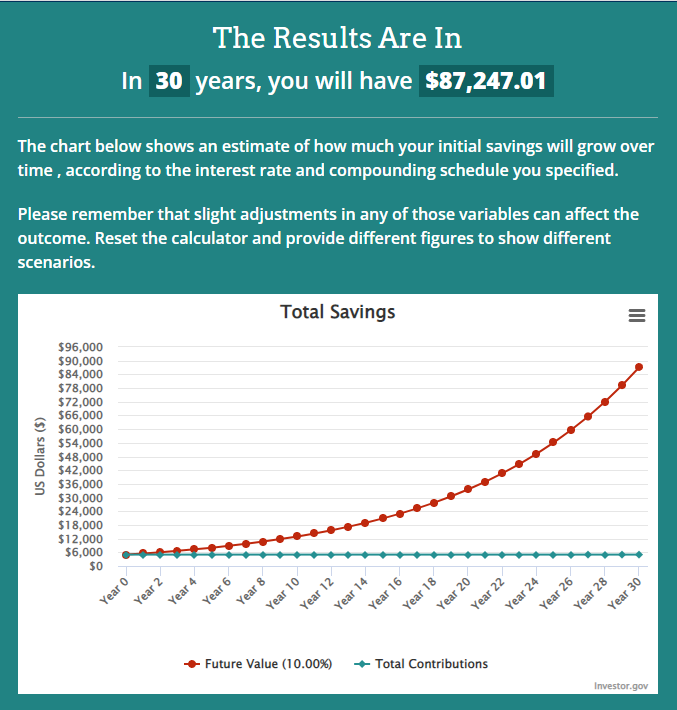

Say you took $5,000 and invested it in an asset that returns 10% every year (the average annual return for the S&P 500 Index). Look at what happens if you let that $5,000 sit for 30 years, undisturbed—in other words, if you let your gains continue to compound:

Over the course of 30 years, your $5,000 turned into $87,247. That’s a 1,644.94% gain!

No wonder Albert Einstein famously called compound interest “the eighth wonder of the world!”

But the lesson isn’t finished yet. There’s a way to make the gains even bigger…

Adding fuel to the fire

It’s easy for investors to get discouraged when the market pulls back. But if you keep buying over time… through bull markets and bear markets… you’ll boost your long-term returns.

Let me show you what I mean.

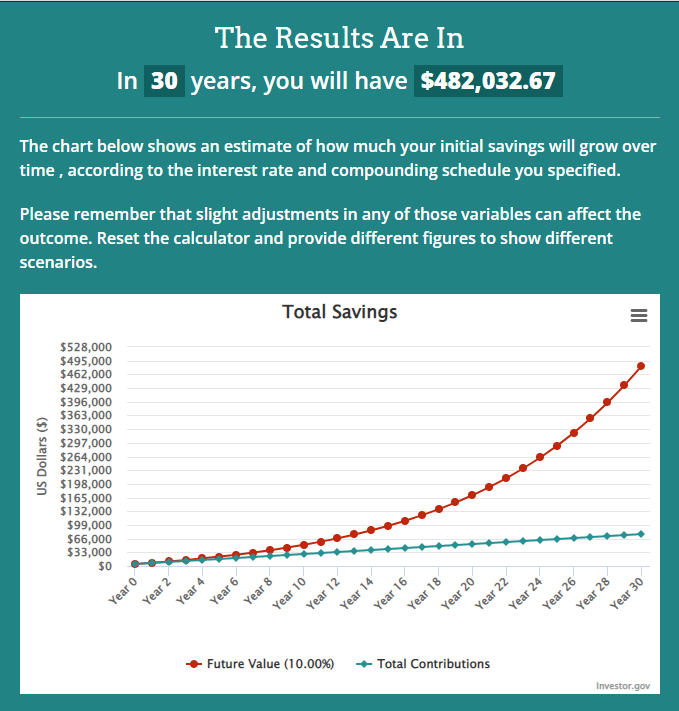

Below, I’ve taken our original example (starting with $5,000) and added a $200 monthly contribution. Check out how the gains absolutely explode over time:

Those $200 monthly contributions turn our ending value into a mind-boggling $482,032. In other words, by sticking to a $200 monthly contribution over 30 years, your final portfolio will be worth an extra $405,032.67. Keep in mind, this is on top of the massive gain you made on the original $5,000 (which grew into $87,247).

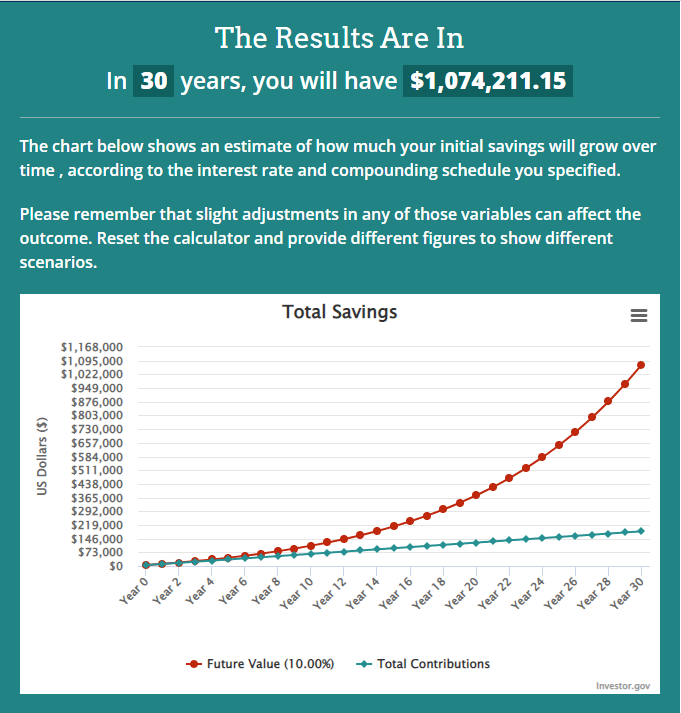

Let’s do one final example to see what happens when we boost our contribution a bit more. Here’s the same example as above, but with a $500 addition every month (on top of the initial $5,000):

Like the previous examples, our original $5,000 grew to over $87,000. But our $500 a month contribution turned into another $986,964.

For this example, our total return ends up being 480.65%.

And that’s how someone with $5,000 can turn into a millionaire!

You can’t afford NOT to do this

Put simply, compound interest is a true wealth-building force. And it’s even more powerful when you add fuel to the fire by contributing to your portfolio regularly.

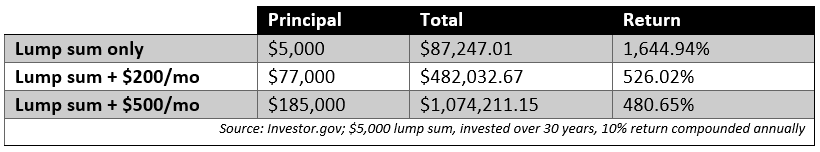

Here’s a summary of our 30-year examples:

The table above shows what happens when investors commit to investing, even in down markets. You can see how consistent contributions result in huge long-term rewards—and the bigger the contribution, the bigger the reward.

Putting a plan like this in place is a great way to secure your financial health. Some people may think they can’t afford something like this… but I say you can’t afford NOT to invest like this.

Since I was a teenager, not a month has gone by where I didn’t set aside money to invest in the market. Personally, it’s one of the best financial commitments I ever made.

It’s easy to forget your investment plan when markets are down.

When volatility jumps and stocks tumble… folks start to worry. They get more conservative with their investments or quit altogether.

But investors who stay disciplined and stick to the plan end up reaping massive rewards. In fact, buying in a down market is a great way to pick up cheaper shares that will fuel the rocket later.

Editor’s note:

There’s a simple reason Main Street investors consistently lose out to Wall Street insiders…

And if you don’t know about it, you’re probably leaving a LOT of money on the table.

Go here and Frank will show you how to turn the tables… and profit like a Wall Street insider.