After months of thinking about inflation in “transitory” terms, the Fed finally relented and announced a planned reduction in asset purchases—or a taper—earlier this month.

And the market hasn’t been the same since…

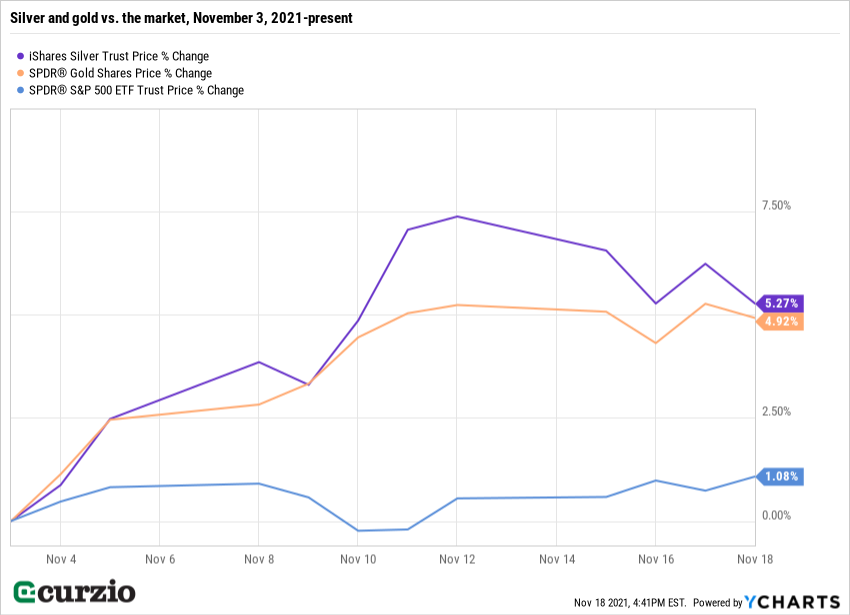

From November 3 (when the taper was announced) to today, the S&P is barely up…

Stocks haven’t fully lost their appeal, but other assets are beginning to look much more attractive to the investing public.

Especially those that act as hedges against inflation.

And today, I’ll tell you about one you might have overlooked…

This asset is set to profit from the Fed’s taper and ongoing inflationary trends… and it also plays a huge role in clean energies and the green economy.

But first, let’s talk about why the market’s become increasingly nervous…

In a word: inflation.

The Fed’s tapering plans imply an interest-rate increase—the most reliable tool for fighting inflation—well into 2022 (and possibly into 2023).

In the meantime, large-scale bond buying (a way to stimulate the economy and push down longer-dated interest rates) continues.

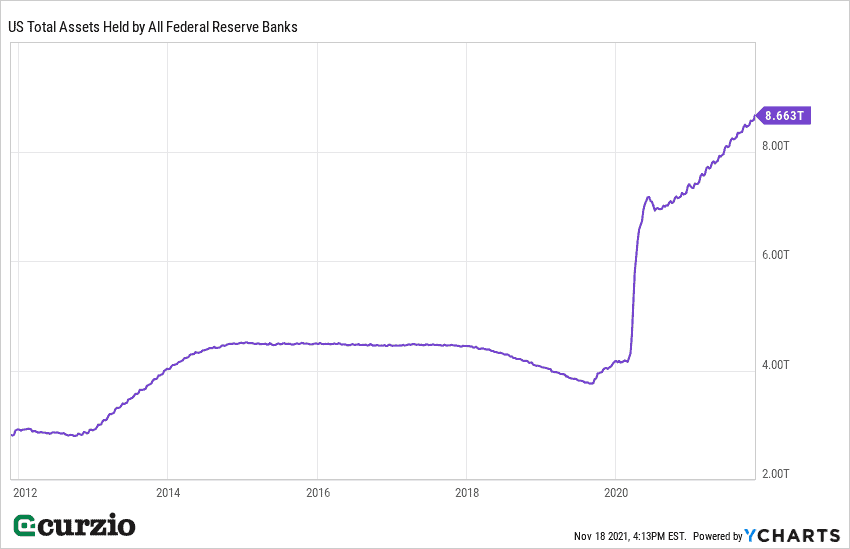

But don’t let the term “taper” fool you: The Fed’s balance sheet will continue to grow.

If all goes according to plan, the Fed will keep buying Treasuries and mortgage-backed securities (MBS) in sizeable amounts for months.

In November, the Fed will increase its Treasury security holdings by at least $70 billion and MBS holdings by at least $35 billion.

And in December, the buying will continue… “At least” $60 billion more in Treasuries and “at least” $30 billion in MBS will be purchased.

With the Fed’s balance sheet continuing to grow, inflation—which is at its highest levels in years—is here to stay.

The current monetary expansion, together with higher inflation, is creating some of the best conditions I can think of for precious metals.

Historically, gold has held its value—and more—during high inflation… and it’s one of the best hedges easily available to investors.

While the yellow metal rightfully generates the most attention in times like these, don’t forget about its cheaper relative—silver.

While silver isn’t as perfect a hedge as gold (due to its industrial uses), it’s been a monetary metal as long as gold… and will keep its value during periods of high inflation.

In the two weeks since the Fed’s taper meeting, both precious metals have outperformed the market… with silver outpacing gold.

Often seen as “a poor man’s gold,” silver is more than just a monetary metal…

It also has numerous industrial uses, from photography to electronics to solar (photovoltaic) panels. Plus, silver is widely used in jewelry and silverware…

When the COVID-19 pandemic hit in 2020, industrial demand for silver fell 5%… jewelry demand lost 27%… and demand for silverware fell by almost 50%.

But all of these groups have bounced back in 2021.

According to the just-released silver market review by the Silver Institute, industrial demand for the metal is up 8% this year.

And the industry group expects photovoltaic demand to rise by 13% by the end of the year. This will be a new all-time high—highlighting the important role silver plays in the green economy.

Silver investing is on the rise, too.

For the year, physical investment in silver is set to jump by 32% to a six-year high.

Meanwhile, mine output and silver recycling will only increase by 6% and 5%, respectively. This means the silver market will be undersupplied by 7 million ounces this year… the first deficit since 2015.

In the meantime, the price of silver is still down for the year… trading about $5 lower than its February high of $30 per ounce.

Put simply, conditions are ripe for the price to rebound—and then some.

If your portfolio lacks silver exposure, you can invest in this important metal through one of my favorite exchange-traded funds (ETF): the iShares Silver Trust (SLV).

SLV tracks the price of silver bullion pretty closely… and because it’s an ETF, it’s easy to buy and sell.

Silver is an essential metal in many areas of our lives… But thanks to high inflation and the rise of clean energies, it’s becoming one of the best investments for the current market.

Editor’s note:

In a nervous market, it’s important to hold portfolio “insurance.” And the easiest way to get it is through Genia’s Moneyflow Trader hedges.

The last time the market crashed, her recommendations returned gains like 220%… 260%… and even 508%—enough to keep a portfolio afloat… and then some.

Here’s how it works… and why Frank thinks everyone should follow Genia’s Moneyflow Trader advice.