The second quarter is coming to an end—which means earnings season is just around the corner.

Earnings season is a great time to sift through the latest results and find the companies poised to thrive (or struggle) in the months ahead.

But you don’t have to spend countless hours poring over every number—one particular piece of information can help you separate the companies best positioned for price growth in the near term.

Here’s how to find the best stocks this earnings season…

The problem with earnings results

When companies report earnings, they break down sales and product developments that happened during the quarter. Generally, they compare recent sales and earnings to the prior quarter and prior year.

Earnings results from the quarter can be useful because they tell you how fast the company is growing… and how well it’s doing in terms of converting sales into profits.

But the problem with those numbers is that they’ve already happened.

Wall Street puts much more weight on the future—where the company’s going rather than where it’s been. And that makes intuitive sense…

If the future looks bright, the stock is likely heading higher. If it’s grim, the stock is likely to fall.

This is why it’s so important to focus on company guidance.

Guidance is simply the company’s forward business projections. When a company raises its forecasted sales and earnings, it indicates management is confident about the future of the business (the upcoming quarter and the rest of the year).

Typically, higher guidance boosts shares almost instantly.

Let’s look at an example…

Focus on these numbers this earnings season

On May 26, cosmetics chain and retail darling Ulta Beauty (ULTA) delivered its Q1 2022 earnings results. (It was actually one of my favorite recent earnings reports.)

Comparable sales gained 18% year-over-year.

But what really got Wall Street’s attention was the boosted guidance.

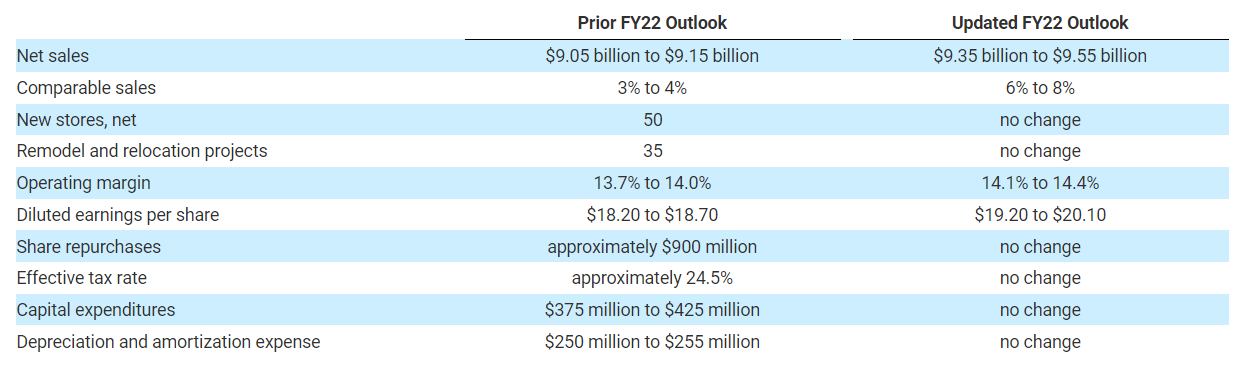

In the middle column of the table below, you’ll see the firm’s prior full-year 2022 outlook. The right column is the newly updated guidance.

The three updated numbers (for full-year 2022) were as follows:

- Net sales: Ulta now believes net sales will rise from about $9.1 billion to about $9.45 billion

- Comparable sales: Management sees sales growth of around 6–8%… double the prior estimate of 3–4%

- Earnings: The company expects earnings per share of $19.65 vs. the prior forecast of $18.45

It’s clear management feels confident in the strength of the consumer—and in its first-class product line.

These improved guidance numbers excited shareholders, sending the stock rallying 12.5% in a day. And since that report, shares have stayed well above their pre-earnings price of $377.96.

Ulta Beauty, Inc. (ULTA)

Here’s the bottom line: The start of earnings season is days away. And even in these tumultuous times, we’ll see companies issuing positive outlooks (by raising their forward guidance). Those can be some of the strongest stocks in the near term.

Ulta is a prime example of how a positive outlook can push stock prices higher. Start thinking like Wall Street, and bet on the companies that raise guidance.

Stay tuned… I’ll be watching closely as earnings come in over the coming weeks…

And in a follow-up article, I’ll share my favorite companies that raised guidance.

Editor’s note:

For easy access to an outstanding portfolio of stocks set to withstand inflation and build long-term wealth, join Unlimited Income…

Month after month, Genia Turanova uncovers assets that deliver market-beating yields… AND quick capital gains.