It’s been a tough year for investors so far… Not just regular folks, but big institutions like hedge funds and pension funds too.

These Big Money investors are worried about the economy, inflation, and the effects of rising interest rates. But there’s one sector they’re confident about: energy.

Today I’ll explain why oil stocks (and the entire energy sector) are attracting a ton of buying right now… why they’re one of the best growth plays in 2022… and the easiest way to play the uptrend.

Prices Keep Climbing at the Pump

Energy is on a lot of people’s minds right now. The war in Ukraine sent ripples throughout the world earlier this year, rocking energy markets. Now everybody is feeling pain at the pump.

The last time I filled up, I paid just over $5 per gallon here in New York City.

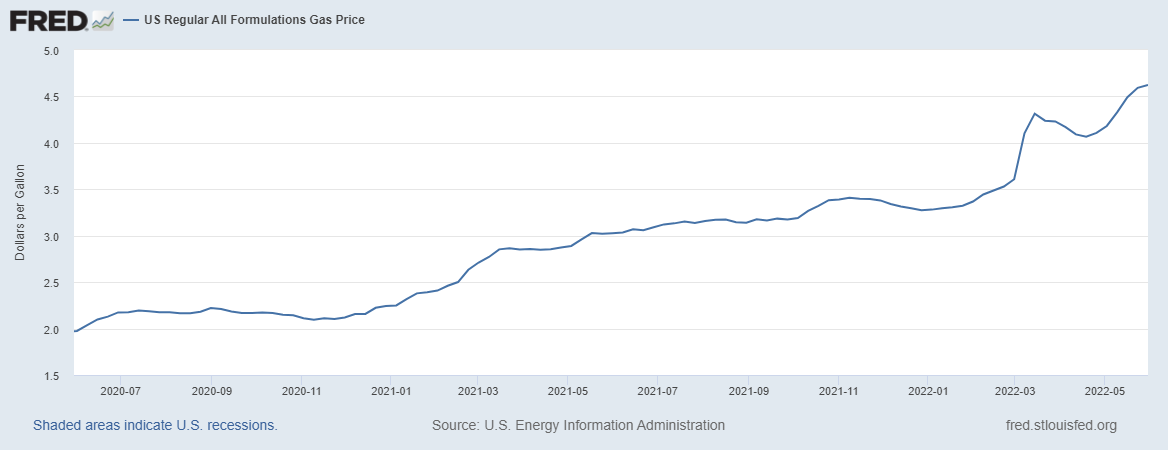

I know I’m not alone feeling the pinch. According to the U.S. Energy Information Administration, a gallon of gasoline costs $4.62 on average. That’s up more than 50% from a year ago (when the average was just over $3)… And prices have more than doubled since bottoming during the pandemic two years ago, as you can see below:

High gas prices are obviously a big problem for consumers. The more expensive it is to fill up your tank, the less money you have left over to spend on discretionary items. And as inflation sends food prices up, folks are tightening their pocketbooks.

But rather than gripe about it, investors can profit from the situation…

Energy stocks are printing money right now

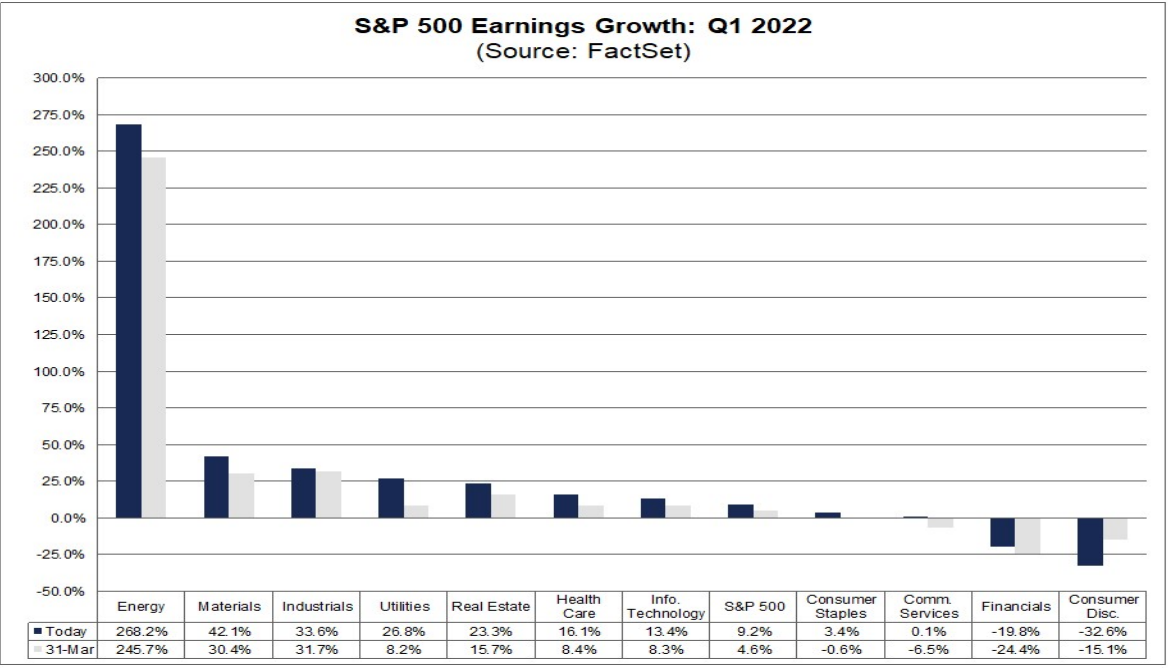

The energy sector was the big winner during the recently completed earnings season. According to FactSet, energy companies reported an incredible 268% earnings growth rate—by far the highest of any sector. Below, you can see how much of an outlier they are:

Put simply, no sector comes close to energy in terms of earnings growth.

And when Wall Street sniffs out growth in a particular industry, it plows into those stocks.

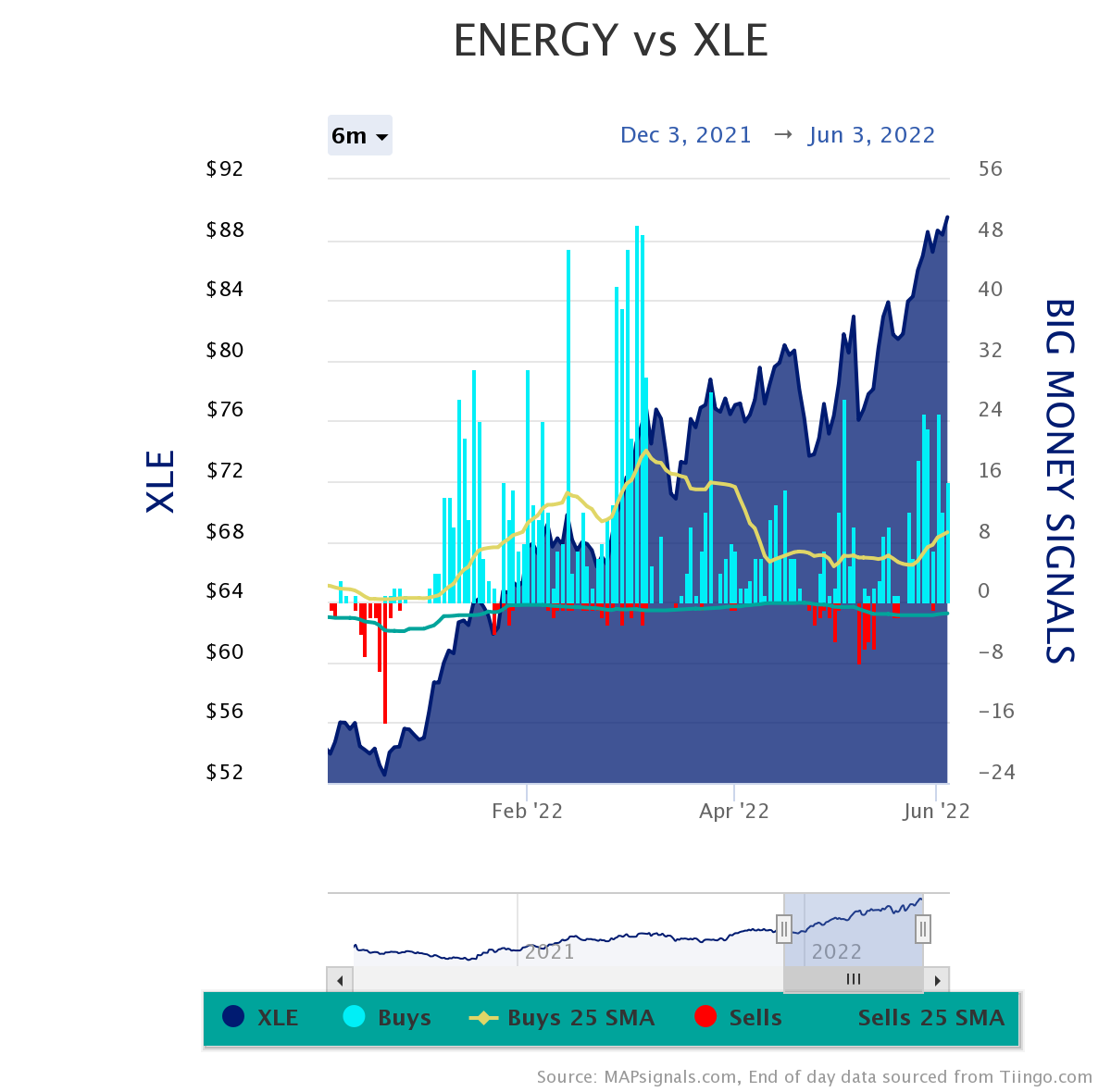

Long-time readers know I follow the Big Money data closely. And it’s been a one-way train higher for oil & gas stocks.

Below, you can see the recent buying by Big Money investors. Each light blue bar shows the number of Big Money buy signals in the energy sector on a given day. And the dark blue line shows the performance of the Energy Select Sector SPDR fund (XLE)—an exchange-traded fund (ETF) that focuses solely on energy stocks.

Put simply, energy stocks are attracting a lot of buying. And it’s for the right reason: Energy companies are growing their earnings faster than any other sector.

Many Big, Profitable Names

There are several quality names in the energy sector that are capitalizing on rising oil and gas prices.

One example is Exxon Mobil (XOM)—a longtime industry leader. Its sales have grown 57.4% over the past year. And even after a big jump in its stock price, XOM trades at just 10 times (10x) forward earnings. In other words, its forward price-to-earnings (P/E) ratio is much cheaper than the overall market—the S&P 500 trades at a forward P/E of 17.5.

Additionally, XOM also pays a current dividend around 3.6%. That’s a solid yield in today’s environment.

But it’s not just the fundamental picture that has me excited. My Big Money analysis shows a ton of buy signals for XOM.

As you can see above, institutions have been buying heavily since January. In fact, there are 27 buy signals (the green bars in the chart) over the past 12 months.

And Exxon Mobil isn’t alone. Chevron Corp. (CVX) is another energy giant seeing big buying. Its fundamentals are phenomenal: sales have grown 65.6% in a year, profit margins are sitting around 10%, and the stock pays a 3.2% dividend yield. (My colleague, Genia Turanova, recently shared her thesis for Chevron.)

And the Big Money is noticing Chevron’s booming business. Below, you can see an incredible 35 Big Money buys in the last year:

When I see steady green like that, I call it the “stairway to heaven.”

XOM and CVX are both fantastic picks in this market. But here’s my favorite way to ride this Big Money trend…

A Basket of Energy

The easiest way to gain exposure to a broad sector or trend is by buying ETFs.

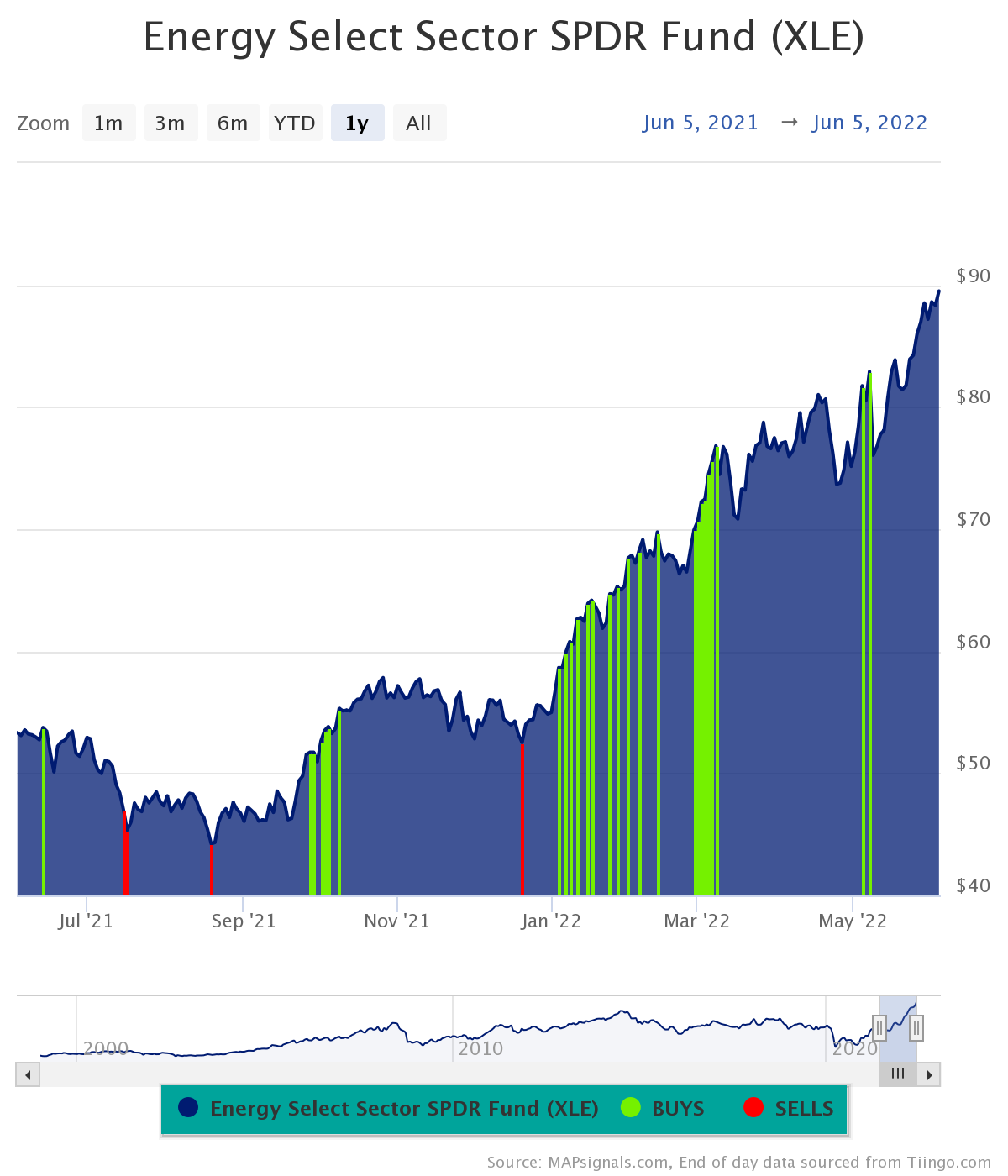

In this case, the Energy Select Sector SPDR fund (XLE) I mentioned earlier is the no-brainer pick.

By buying XLE, investors get exposure to a basket of 21 different energy stocks. XOM and CVX make up 43% of the fund, which includes plenty of other well-run oil companies like ConocoPhillips (COP) and Occidental Petroleum (OXY).

And as you can see below, XLE has generated dozens of green Big Money signals over the past year:

The Big Money picture has been bright for energy stocks in 2022. XLE is in a strong uptrend… and my bet is there’s room for higher highs in the coming months. Plus, investors get to collect a nearly 2.9% current dividend yield while holding this sector fund.

Here’s the bottom line:

Gas prices at the pump hurt. Investing in energy stocks is your way to take advantage of those high prices.

Energy companies like Exxon Mobil and Chevron and raking in huge profits. And when the money spigot is turned on, Wall Street floods in.

XLE gives us an easy way to own these winners, along with a handful of other high-quality energy stocks. Odds are a few months from now your portfolio will thank you.

Editor’s note:

Last week, Dollar Stock Club members received another great way to profit from rising oil… and collect huge dividends in the process.

Filled with the best ideas from Frank’s vast network of Wall Street insiders, this portfolio spans inflation-ready assets like energy and uranium… to massive trends like electric vehicles and security tokens.

And at just $4 a month, this product is a no-brainer for any market.