When Paul Volcker became chair of the Federal Reserve in August 1979, he faced a serious problem…

Inflation had gripped the country… and was raging at levels unlike anything we’d ever seen.

You see, back in the early 1960s, inflation held steady around 2%. But by the mid-’60s, President Lyndon Johnson (with the help of Congress) began ramping up spending, both to help during the Vietnam War and to combat poverty.

In an effort to beat back inflation, Richard Nixon—who replaced Johnson in office in 1969—ended the gold standard and enacted wage and price controls in the early ’70s. But these measures only made the situation worse.

The final nail in the coffin was OPEC’s 1973–1974 oil embargo, which nearly quadrupled gas prices… sent inflation surging into the double digits… and plunged the nation into a recession.

While the recession ended in 1975 and inflation seemed to moderate around 6–7%, the troubles were far from over.

Food and energy prices kept climbing… sending inflation above 12% by 1979.

When Volcker took office, he knew drastic measures were required to bring inflation back under control.

In October 1979, he called an emergency Fed meeting to announce a new course of action. The plan involved hiking rates higher than they’d ever been. The fed funds rate, which started the year around 11%, rose to 17% by April 1980, and eventually peaked around 20% in 1981.

Volcker’s super-aggressive actions worked. Soaring interest rates dramatically decreased spending as the country’s money supply tightened. They also triggered two different recessions: the first in January 1980… and another in July 1981 as Volcker tightened monetary policy even further to respond to a rebound in inflation.

The second recession was particularly painful, with unemployment peaking at 10.2% in December 1982.

But inflation was finally under control, having settled at 3.4% when Volcker left office in 1987.

While Volcker’s actions remain polarizing to this day, one thing is clear: The “Volcker shock” worked… and the U.S. enjoyed low rates and economic prosperity for decades to follow.

But those days are over…

Today, the U.S. is once again facing a precarious inflation situation. And the Fed has very few options to fix the problem.

Last week, the Fed announced a “hawkish pause” to interest rate hikes…

The stock market reacted with a big surge. But as I’ll explain, it’s far too early to celebrate.

Today, we’ll take a closer look at the inflation situation… why the Fed will have to keep raising interest rates… and what it means for the market.

Let’s start with a recap of the Fed’s latest meeting…

What to make of the Fed’s ‘hawkish pause’

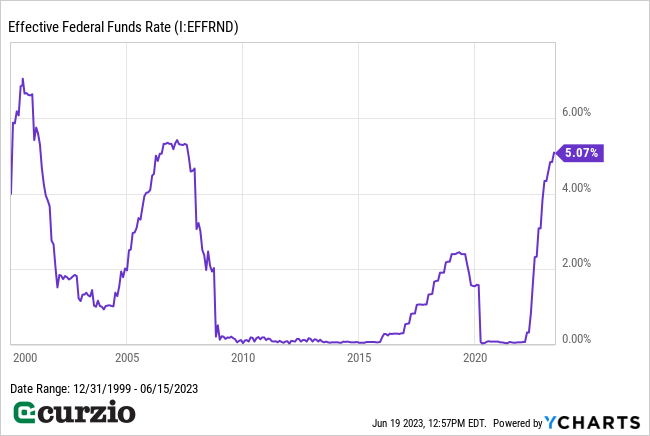

At last week’s Federal Open Market Committee (FOMC) meeting, the Fed announced a “hawkish pause” in interest rate hikes. The fed funds rate now sits at 5–5.25%.

A lot of folks believe it’s a bullish indicator—as it’s the Fed’s first pause since it launched its aggressive rate-hiking cycle in March 2022. And some even think it’s a prelude to the Fed switching from rate hikes to rate cuts (also known as a “pivot”). That’s why the market rallied sharply last week.

But a pivot isn’t in the cards anytime soon…

According to the Fed’s updated projections, we shouldn’t expect any rate cuts in 2023. Rather, the FOMC wants to raise rates by an additional 0.5% before the end of the year.

These additional rate hikes make sense, given the lingering inflation problem.

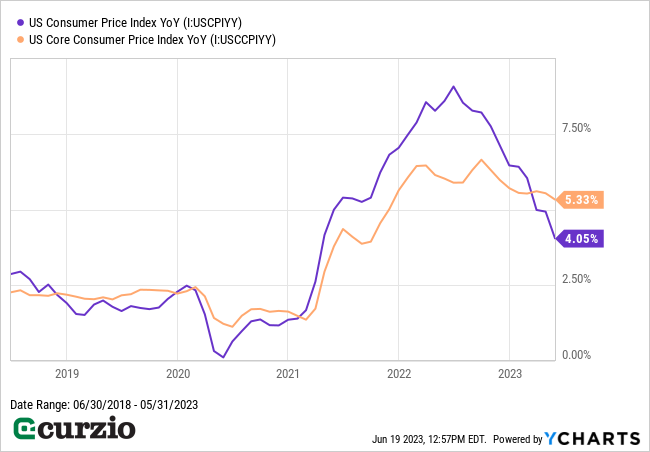

While inflation has come down from last year’s highs around 9% (a level not seen since Volcker)… at 4.1%, it’s still double the Fed’s target. And core inflation (which removes the more volatile food and energy prices) has been stuck above 5% since November, as you can see on the chart below.

As Volcker taught us, once high inflation rears its ugly head, the only way to kill it (for good) is by triggering a recession (via sharply higher interest rates).

Anything short of this goal risks bringing inflation back… with a vengeance.

In short, the Fed will only end its “higher-for-longer” policy when the economy slows… unemployment rises… or both.

Already, interest rates are near two-decade highs. Raising them another 0.5% would bring them to levels we haven’t seen since 2000 (when the dot-com bubble popped).

That spells trouble for the stock market—particularly for interest-rate sensitive sectors (like utilities, which are down more than 4% year to date)… and stocks that benefited the most from two decades of ultra-low rates (like unprofitable tech companies).

Here’s the bottom line: This market is in danger… and if you’re sitting on short-term profits in stocks, now is a good time to take some gains off the table… or risk losing them as this rally falters.

Next week, I’ll dive deeper into one particular sector that’s facing a potential collapse as a result of higher interest rates and a changing economy.

Editor’s note:

There’s no better way to protect yourself from a dangerous market than with Genia’s Moneyflow Trader strategy.

While other investors were losing their shirts during the bear market of 2022, Moneyflow Trader locked in 18 winners for gains as high as 271%!

Learn how this strategy can save you next time the market plunges.