The record books will have to dedicate pages—if not entire chapters—to the market action of these past two years.

The sharpest S&P 500 decline… the largest point drop for the Dow to date… and the fastest bull market recovery on record… all happened in a span of just 18 months.

This week, we set another milestone… As of Monday, the S&P 500 doubled off its pandemic lows.

It’s a point to celebrate… and to fear.

Over the past 20 years, the markets have often undergone a correction—and sometimes a crash—soon after doubling.

There’s no good explanation of why this is happening. It’s as if market participants are taking gains after hitting 100%.

Of course, this market could be different from any past precedent. After all, we have unprecedented levels of liquidity, near-zero interest rates, and a fast-recovering economy.

But even if you anticipate a downturn, selling everything isn’t the answer.

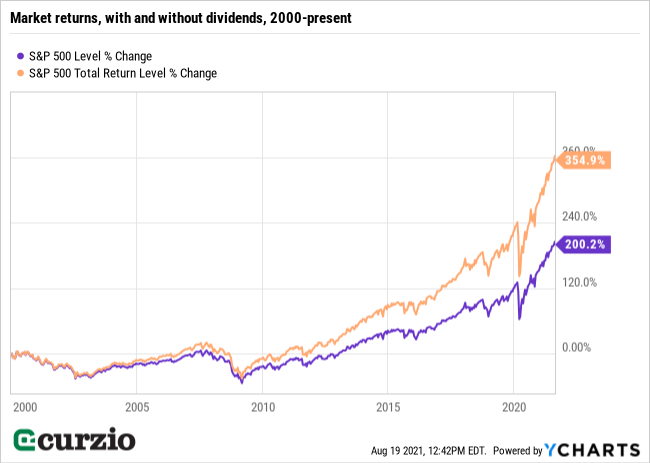

Despite all the corrections and bear market selloffs, the S&P 500 has tripled from the beginning of this century. If you include dividends, the total return jumps to more than 350%.

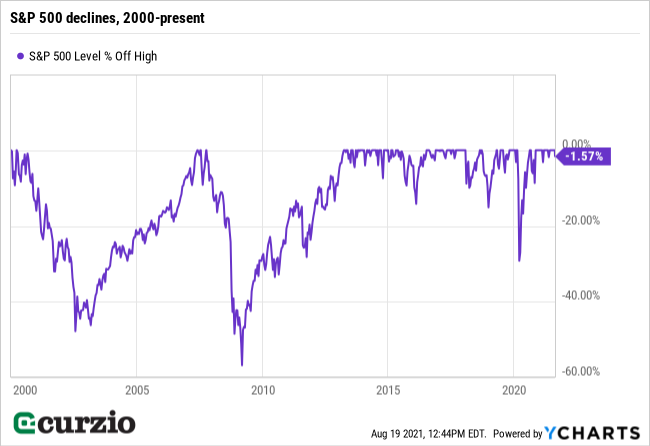

The chart below shows the timing and size of each S&P 500 decline over the past two decades.

You can see that the latest decline off this week’s high is about 2%…

Although I don’t believe the latest downturn will turn into something much more substantial (like the 57% selloff of 2007-2009 or the 47% decline off the dot-com highs)… the index doubling means the need for portfolio protection has increased.

Still, there are good reasons to remain optimistic, especially as long as interest rates remain low.

Plus, as you can see from the first chart above, giving up on the market means giving up on dividends—an important source of income these days.

So stay invested… but protect yourself with the three important strategies below. If you follow them, you can weather almost any market storm…

No. 1: Diversify your portfolio

One of the biggest mistakes any investor can make is the failure to diversify properly.

If you own a basket of different sectors and a bunch of companies from all walks of life, a one-company or one-sector tumble isn’t going to bring the entire portfolio down. The risks of single-company bankruptcy, dividend cuts, profit warnings, and even inflated valuations are all diluted in a well-diversified portfolio.

On the other hand, if all you own is a bunch of high-flying innovation leaders… or meme stocks… your portfolio may tank faster than you can press the sell button.

You can’t diversify away all of the market’s risks… but you can make sure your portfolio isn’t cratering if the market undergoes a small correction.

Just how many stocks should you own?

Studies show 25-30 stocks can be enough…

But you need to make sure your stocks aren’t all from the same sector. Owning a couple dozen internet startups in 1999 would have done nothing to help protect your portfolio from the dot-com bust.

Owning a dozen-plus stocks from different sectors of the market—Buffett-style—is a much better way.

Know your portfolio, and watch for “under-diversification.”

No. 2: Invest in income stocks

Take another look at the market return chart above.

It shows the virtue of income investing.

By reinvesting S&P 500 dividends back into the index, you would have nearly doubled your return over the past 20-some years.

But there’s another reason to own income stocks: Dividends can make any downturn easier to swallow.

Just like the market, income stocks are not immune to selloffs…

But companies that can afford to pay dividends tend to have profitable businesses and steady cash flow. In a downturn, these quality stocks often outperform.

And if you don’t need income right away, you can always reinvest your dividends…

Regardless of what the market is doing, by plowing your dividends back into the same stock, you’re increasing the number of shares you own… and this means more dividends and higher income down the line.

And when the market declines, reinvesting dividends allows you to buy more of the same stock at cheaper prices. You’ll get even more shares for the same amount reinvested—and an even higher payout in future dividends.

No. 3: Hedge your bets

Shorting the market with inverse ETFs or with put options can help your portfolio weather volatility… stay invested… and even make money when the rest of your portfolio is suffering.

In normal times, when the market is moving higher, hedges won’t make you any money.

In this sense, they’re very similar to the insurance policies you buy to protect yourself and your family from the worst-case scenario.

Just like an insurance policy, a hedge won’t do you much good if the market is sailing along just fine. But because it pays off in an unexpected disaster… or when volatility rises to uncomfortable and uncontrollable levels… having a hedge allows you to take bigger market risks.

By definition, a good hedge will move up when an underlying security (whether a single stock, a whole sector, or the entire market) is moving down.

This is why having hedges can help you weather big market declines.

Whatever your risk tolerance or trading strategy today, these three simple rules will help protect you from excessive portfolio volatility—and could even make you some money if the “100% return rule” results in another market crash…

P.S. This month in Unlimited Income, I recommended an ideal dividend stock for an inflationary economy… with a yield almost twice as high as the market’s. And for now, it’s trading at a super cheap price.

But here’s the thing… This is only one of over a dozen assets in this portfolio that offer safe, growing income.

I urge you to join me, and discover why Unlimited Income is one of the best ways to protect yourself in this market—and any market.