“Will this market ever pull back again?”

I’ve fielded a hundred different forms of this question recently.

The answer is: Of course it will.

There’s no such thing as a never-ending rally.

The problem is… when extreme rallys do happen, most people fail to see trouble ahead.

This is nothing new, by the way.

Remember December 2017, when everyone and their grandmother were asking about bitcoin? Almost everyone I spoke to wanted in on the digital currency goldmine.

Very few people were considering the possibility of a pullback at the time…

Fast-forward just a couple short months to February 2018, and bitcoin had fallen by 57.5%.

The fact is, eventually, all markets and sentiment shift. It’s what they do.

The secret is figuring out when it will happen…

And according to my data, a shift has already started.

We all know that demand for stocks drives the market. When demand gets hot, stocks are up, up, and away. But when buyers stop buying, there’s nothing left to hold up the prices.

And right now, that demand is letting off the gas pedal.

But fear not: picking great stocks rarely happens when everyone is buying. It’s usually the opposite.

Big ETF buying is slowing

Two weeks ago, I showed you how ETF buying was off the charts. And as I said, that’s historically a bad time to buy stocks. Since I told you that, the S&P 500 (SPY) is down 4.08%.

Now you’ll see, epic ETF buying rarely lasts. Eventually, it runs out of gas. That’s what’s happening now: ETF buying is decelerating dramatically.

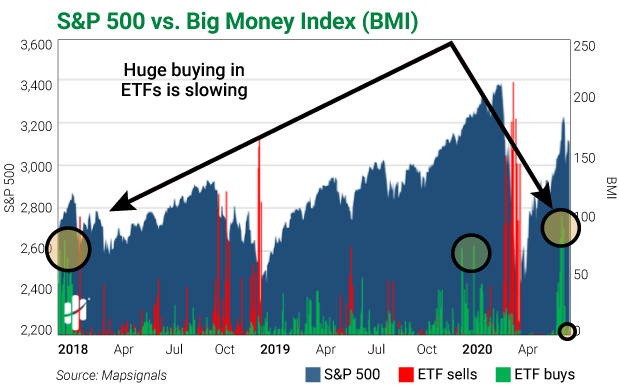

Below is the Mapsignals Big Money ETF Index vs. the S&P 500, going back to January 2018. It measures big unusual ETF buying/selling activity. The green bars represent the total number of ETFs being bought each day, and the red bars are ETFs being sold. This highlights when we believe Big Money is flowing in and out of ETFs.

The three circles point to extreme buying in ETFs. The right-most circle shows the big buys from June 8. But look closely at the tiny circle just off to the bottom right. That shows a huge drop off of ETF buys:

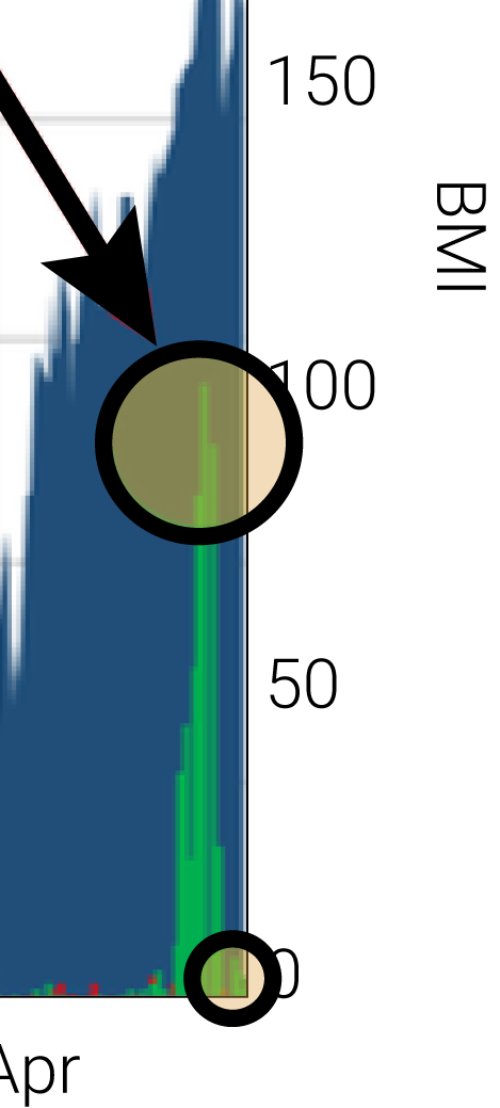

It’s hard to see, so let’s zoom in on that:

The data shows a measurable slowing in buy signals… or that buying is slowing down.

I believe peak exuberance has likely passed.

But ETFs aren’t the only sign of a slowdown…

Big stock buying is slowing

Let’s look at stocks through the same lens of Big Money activity.

We see the same thing: Buying peaked two weeks ago, coinciding with ETFs. (History says huge buying rarely lasts.)

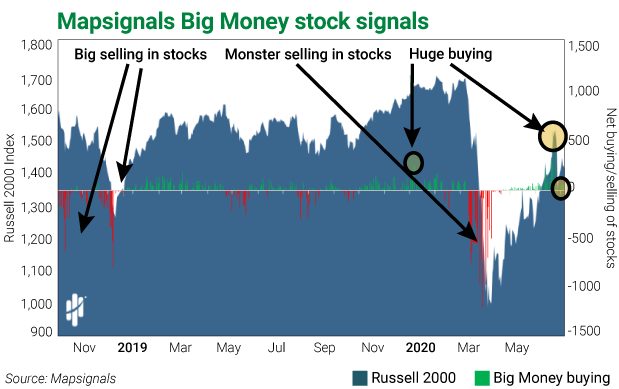

Below is a chart of Mapsignals Big Money buying and selling in stocks. It captures our analytical theory as to the real flow of money. A green bar means a day of net buys, and a red bar means a day of net sells.

Look at the huge green bar from two weeks ago:

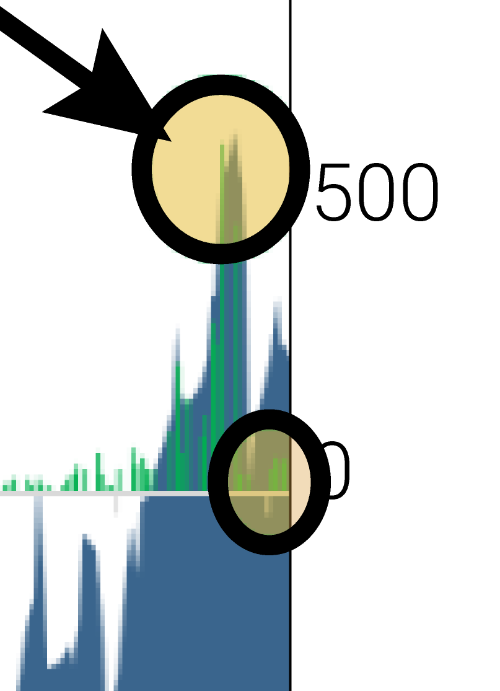

Now, I’ll zoom in to what’s important. The level of buying has slowed immensely:

This just means greed is cooling off in a big way. And it’s very typical after a huge flood of buying.

It’s like easing your foot off the gas pedal.

“So, what does all of this mean?”

Ahh, that’s a much better question.

It means I expect lower prices for stocks in the near-term.

But again, that’s a great thing! The time to scoop up great stocks is not when everyone else is scrambling to buy them. It’s when they’re getting rid of them from fear of loss.

You want to get involved and buy when the crowd is scared.

I think the markets are setting us up for a better entry point soon.

That’s what I told Frank last week on Wall Street Unplugged. (It was an awesome conversation… check it out here.)

No ride lasts forever—and certainly not at top speed. We stop for red lights. We take a break. We take a sip of coffee. We recharge and are ready for when the next green light comes.

Then we step on the gas…

Editor’s note:Like Luke says, a falling market is often the perfect time to pick up fantastic companies—at incredible discounts. And Frank just released two such names to his Curzio Research Advisory members. These companies are extremely undervalued at today’s levels… but they won’t be for long.

Sign up here for immediate access to these names… Plus, Frank’s exclusive COVID-19 report: How to prepare for what’s coming next…