Growth is dead.

The bear market of 2022 put an end to the long uptrend for large-cap growth stocks like Apple (AAPL), Tesla (TSLA), and Alphabet (GOOGL).

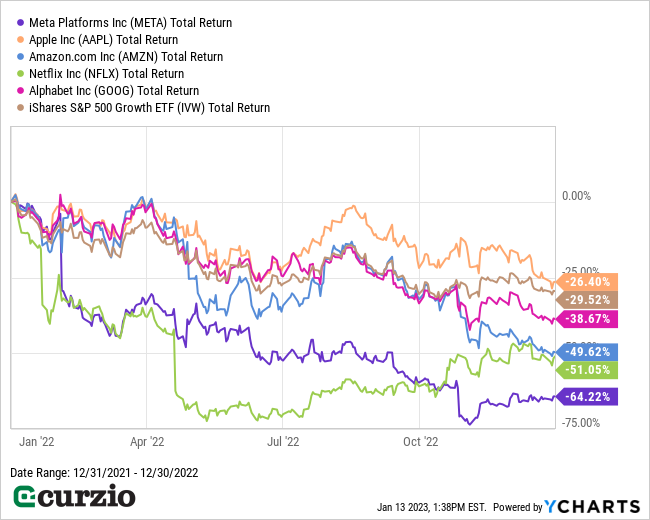

You’re probably familiar with the group of five giants known as the “FAANG” stocks (an acronym that didn’t age well, given that Facebook is now Meta). These popular stocks lost a lot of ground last year—as you can see from the chart below.

In short, the FAANG stocks were victims of their own success. Investors loved them. As a result, they were simply too expensive and priced for perfection…

Expensive valuations are dangerous in a rising-rate environment, where conditions are anything but perfect.

Today, we’ll look at what’s causing the trend reversal… and which stocks will benefit in this new market cycle.

Let’s start with how the largest, most dominant companies of the past few years got that way.

The rise and fall of large-cap growth stocks

For years, the market’s best-performing stocks enjoyed a virtuous cycle—thanks to the advent of indexing…

Index funds are typically weighted to favor the winners. In other words, as the strongest stocks kept rising and gaining in size (market cap), these funds would buy more shares… pushing even more money into the stocks and boosting their performance (and size) even more.

Meanwhile, index funds would sell shares of weaker stocks, hurting their performance and making them even cheaper (and smaller). And since growth stocks were the most popular corner of the market, it created a vicious cycle for their counterparts: value stocks.

Put simply, growth stocks (like the FAANG group) kept getting bigger… while value stocks kept getting smaller.

And the cycle didn’t just affect the size of these stocks. Growth stocks also became more expensive… while value stocks got even cheaper.

But no trend lasts forever… And large-cap growth stocks have shifted into a downtrend.

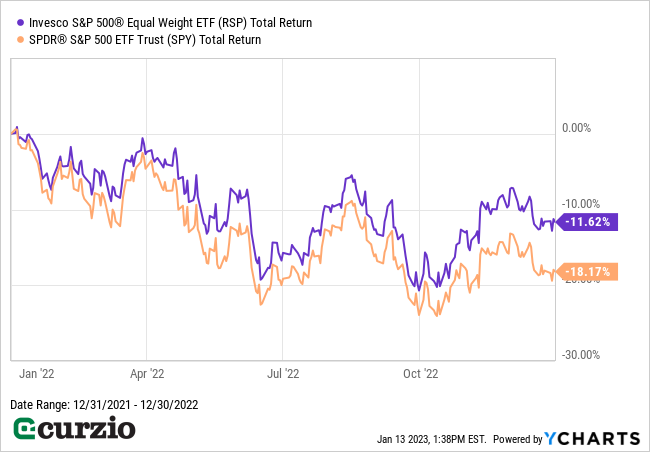

Below, I plotted the recent action in the Invesco S&P 500 Equal Weight ETF (RSP)—which assigns the same weight to all 500 stocks in the S&P, regardless of their size. I compared these to the market index (SPY), which is market-cap weighted (even though it holds the same 500 companies, just two of them—Apple and Microsoft—account for a massive 11% of the fund).

As you can see, RSP outperformed the market hands down last year…

The bottom line: Large-cap growth stocks were the market’s best performers for years. But those days are over… and that’s good news for a different group of stocks…

Smaller-cap companies are having a heyday

Neglected for years by big-money investors and index fund buyers, smaller stocks are finally on their way to a big rebound as the FAANG bubble unwinds.

We can see this on the chart below, where I’ve included an ETF that owns the next-largest 400 stocks by market cap following those in the S&P 500—the SPDR S&P Midcap ETF (MDY).

As you can see, MDY beat the market by 5% last year.

Many of these stocks are flying high, helped by the massive indexing tailwinds…

In short, now that money is flowing out of larger-cap companies, index weighting is now benefiting smaller-cap companies—giving them an infusion of new cash.

In addition to being comprised of smaller-cap companies, MDY is much more value-priced than the market: Its forecasted P/E is only 13.9 (vs. 16.9 for SPY).

And it’s almost twice as cheap as the market based on price-to-sales (P/S): MDY trades at the weighted average P/S of 1.25, vs. 2.25 for SPY.

Both metrics make it a bargain…

The bottom line: Smaller-cap, value-oriented stocks are the best bet for this stormy market. For my favorite selections, join us at Unlimited Income—risk-free.