Last week, I discussed the sector I’m most interested in for upside this earnings season: semiconductors.

And my message was clear: Business is booming for these companies.

Earnings season is just kicking off… and we’ve already seen two semiconductor names—Silicon Motion (SIMO) and Taiwan Semiconductor (TSM)—upgrade their guidance.

As I explained last week, guidance is a critical signal for investors. It’s the best way to spot stocks (or entire sectors) that are ready to explode higher. When a company issues positive guidance, it means it’s doing better than expected… and investors should be putting a higher value on its stock.

That’s why semiconductors are my favorite sector to watch right now.

And last week, we got another bullish signal from one of the biggest names in the industry: Nvidia (NVDA).

Nvidia is one of the best companies in the entire tech sector. And as I’ll explain, its latest announcement tells me there’s more upside in store for semiconductor stocks…

One of the best growth stories in the world

There are good stocks and then there are great stocks…

Nvidia might be the best semiconductor stock on Earth.

It’s best known for its cutting-edge chips, which are used in demanding applications like graphics processing. Its graphics cards dominate the gaming market. And its chips are benefiting from growing demand in applications like crypto mining and artificial intelligence (AI).

As a result, Nvidia’s shares are soaring. Since 2015, the stock is up more than 3,200%… That’s a mindblowing gain!

Institutional investors love growth. And Nvidia has one of the best growth stories in the entire world.

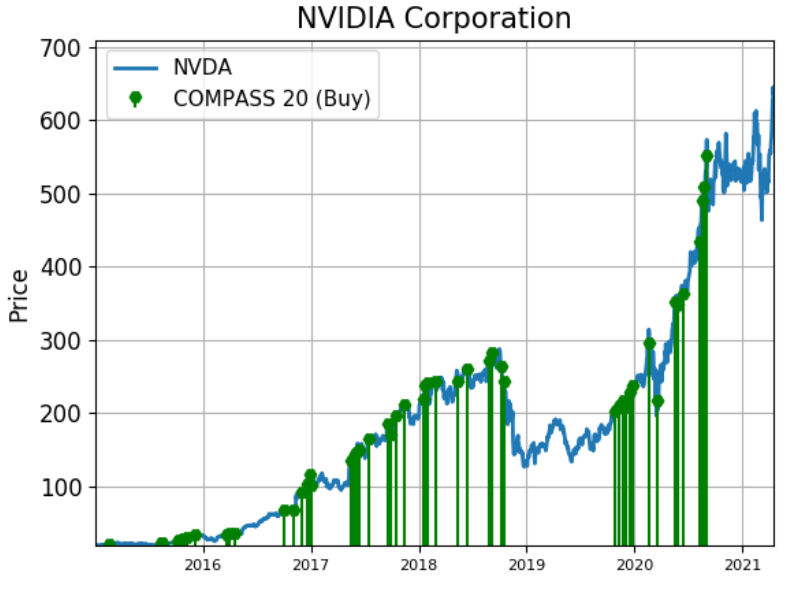

Below, you can see the stock’s incredible performance since 2015. I’ve included my Big Money signal, which shows the days when big institutions were buying heavily.

Each of those green bars means NVDA ranked high on earnings growth, sales growth, and—most importantly—Big Money buying.

Few companies have a Big Money profile as strong as Nvidia. And for good reason: It has a history of huge growth. Let’s take a look at its yearly numbers…

In 2018, the company had annual revenues of $9.71B and earnings of $3.05B. Now, compare that to its fiscal 2021 numbers: $16.6B in revenues and earnings of $4.33B. That’s a 71% rise in revenue and a 42% jump in earnings over just three years. For a company as big as Nvidia, those are massive growth numbers.

Below is an easy way to visualize it:

The green bars are yearly revenues and the blue bars are yearly earnings. One thing should be clear: The numbers are trending higher over time.

And, most importantly, Nvidia is insanely profitable. It has a gross margin of around 26%. That means it makes a profit of $0.26 on every $1 in sales. Meanwhile, the average gross margin for the rest of the semiconductor sector (around 70 companies) is just 2%!

Nvidia’s massive growth and profitability make it one of the most important companies to watch in the entire semiconductor industry.

And last week, the company delivered some huge news…

Nvidia’s guidance is another huge buy signal

Just last week, Nvidia confirmed its growth story is getting even stronger.

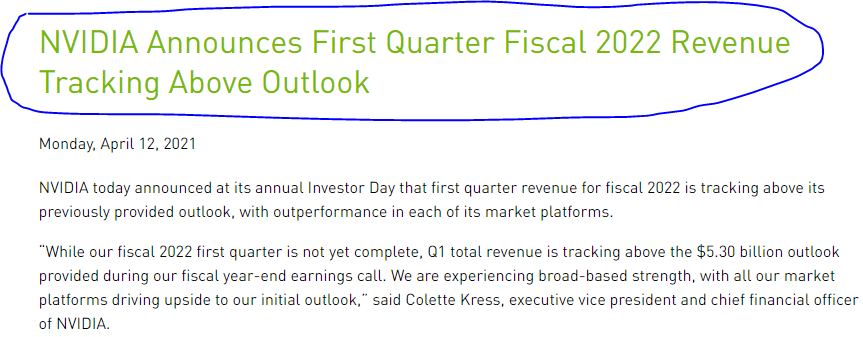

The company pre-announced its first quarter (Q1) results, noting strength in all of its business units, including gaming, data centers, professional visualization, and automotive. As a result, Nvidia said Q1 sales are going to be above $5.3 billion—the previous guidance it provided a few months ago.

Nvidia didn’t give a specific sales number, and that’s OK. The main takeaway is this: Sales are tracking ahead of expectations. Below, I’ve circled the 10 words that matter most to Wall Street…

That headline is like a foghorn signal saying, “All aboard!”

The news sent shares of Nvidia to all-time highs. The stock is up nearly 5% since the update.

It’s a great example of why guidance is so important. Before last week’s news, shares of NVDA were range-bound since February. This new information pushed the stock through its February highs.

But the bigger takeaway is for the semiconductor sector as a whole. As I mentioned last week, Silicon Motion issued a big upgrade to its guidance on April 8. And Taiwan Semiconductor’s latest results included a massive jump in sales growth.

When you add in Nvidia’s positive guidance, there’s a clear uptrend happening in the semiconductor industry.

It signals more upside for semiconductor stocks.

In the coming weeks, I bet we’ll see more positive outlooks from other big names in the sector.

As I mentioned last week, the best way to play the uptrend is by buying the VanEck Vectors Semiconductor fund (SMH). It’s an exchange-traded fund (ETF) that holds 25 stocks involved in semiconductor production and equipment.

So, there you have it. Pay attention to company guidance, especially in the booming semiconductor space.

And keep an eye out for my new advisory service: The Big Money Report. In it, I’ll be laser-focused on finding these kinds of fast-growing companies that constantly need to raise their guidance.

So, if you want to follow along on my best names, watch your inbox for the upcoming launch.

Editor’s note:

Semiconductors are essential for crypto mining… and the crypto space is at the start of a massive bull market

You don’t need to look further than our Crypto Intelligence portfolio to see the potential here. As of today, FIVE crypto assets are up 1,000%-plus.

And Frank just recommended a name he believes could be the SIXTH “10-bagger”…

To make sure you have a chance to get in, Frank’s offering this incredible service for 50% OFF—but only for a limited time.