“The Great Lockdown.”

This is how history will likely refer to the 2020 economy… and it will result in a dramatic shift for income investors.

I stumbled upon this moniker yesterday in an International Monetary Fund (IMF) report on how much world economies will be impacted by pandemic lockdown measures.

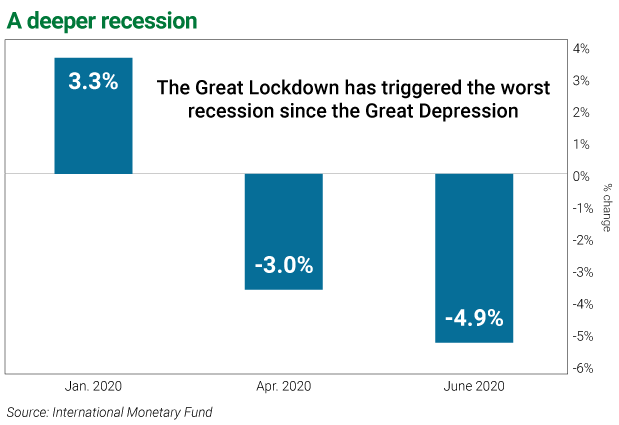

In April, the IMF predicted the Great Lockdown would result in a 3% decline in gross domestic product (GDP) worldwide.

Now, its estimate is a 4.9% decline.

This prediction shouldn’t be taken lightly…

For one thing, the IMF’s most recent GDP downgrade means both a deeper recession and slower recovery.

For another, the IMF predicts advanced economies will decline even more than the world average: The June estimate calls for an 8% GDP decline across the developed world.

If you think this is too pessimistic, consider that in the second quarter (Q2) of the year, U.S. GDP has already declined 5% (annualized) from Q1.

That’s already much more than the deepest drop we experienced in the Great Recession (2008–09). Back then, real GDP (adjusted for inflation) fell 4.3% from the peak in Q4 2007 to the trough in Q2 2009… was the largest decline (at the time) in the post-WWII era.

The U.S. might be in better shape than some other countries… but a large part of our economy won’t escape unscathed.

As you know, the reopenings aren’t going too smoothly… and the rate of infection is picking up.

If the resurgence of infections impacts the pace of businesses reopening, the outlook might worsen.

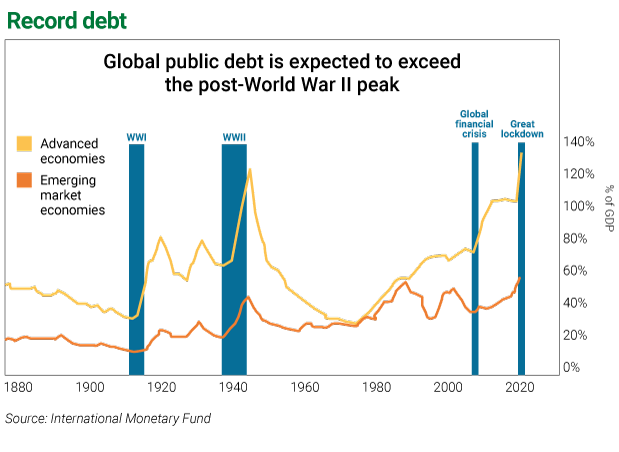

To combat this economic weakness, the U.S., like other countries, has been pulling out all the stops and borrowing at unprecedented rates.

With these fiscal actions, central governments worldwide have been helping their economies hold on.

But global debt is mounting quickly…

Already, these measures amount to $11 trillion in new global spending (compared to the April estimate of $8 trillion). The IMF says these levels of government spending will bring the global debt ratio above 100% for the first time ever.

And the longer this crisis lasts, the more the governments will need to borrow.

Massive debt, on its own, means slower recovery. It also means central banks will do everything they can to keep the costs of the debt down, by lowering interest rates and keeping the rates artificially low for longer.

So what does all this mean for investors?

It translates into a dramatic disruption of the one low-risk income source investors have traditionally relied upon—bonds. Bond interest isn’t even close to what it used to be… and it won’t generate nearly enough to allow for a safe retirement.

Already, interest rates in some countries have moved into the negative territory.

A German or Swiss 10-year bond (among the safest in Europe) now yields -0.45%. A 10-year French bond is also in a negative territory, yielding -0.11%. And the yield on the Japanese 10-year treasury… a big fat zero.

That’s right: you either pay the governments of Germany and Switzerland to hold your money… and you get nothing in return for lending your money for 10 years to the government of Japan.

To be fair, negative yields are still rare.

But, in most cases, treasury bonds issued by developed countries yield very, very little—most recently, 0.46% in Spain, and 1.45% in Italy and Greece.

In the U.S., 10-year Treasury rates are now as low as 0.68%.

Not only are we seeing rates at historic lows, but also—thanks to central bank bond-buying—some countries have already issued 100-year bonds.

Just yesterday, Austria made the news by issuing a 100-year bond with less than a 1% annual yield (a 0.88% coupon to be exact). This means you’d lend Austria money for a century—€1 million—in return for just €8,800 in annual payments. Not enough to live on… but the money is supposedly safe.

Ultra-low interest rates are here to stay…

And in this environment, gold, silver, and nontraditional assets like bitcoin will also continue to do well. They don’t yield anything—but they do offer some respite from the coming asset inflation.

Dividend stocks are well on their way to becoming the only game in town when it comes to income… and investors will continue flocking to equities despite the growing risks.

The best dividend payers—reliable businesses that hold shareholders’ interests above all other needs—will see growing investor demand… and rising share prices.

Note from Frank:Genia’s Moneyflow Trader strategy is one of the best things you can do to protect your portfolio—and profit—from today’s historic volatility. Plus, for a limited time, I’m offering subscribers access to Genia’s upcoming income advisory—FREE.

Guys, I couldn’t be more excited about what Moneyflow Trader is doing for subscribers… and with her expertise in income assets, there’s no doubt her new advisory will be equally outstanding. So please, take advantage of my special offer while you can.