During my second year of business school, my professor presented my class with a game…

The goal was to earn the most money trading the markets by the end of the semester.

As competitive analysts-in-training, we attacked the assignment with relish.

It was January 2000… the peak of the dot-com bubble. The bull market had been raging for several years and most of my classmates (as well as most of Wall Street) assumed tech would continue to rally.

But my first job on Wall Street had taught me to go against the grain… look past recent trends… and focus on valuation instead.

It was clear to me that tech stocks were dramatically overvalued… and I believed the Nasdaq would fall within the first few months of 2000.

Here was my rationale:

In the late 1990s, investors had been pouring money into high-flying tech stocks—a motley crew of unprofitable, internet-adjacent companies. Traditional tech names were also flying high.

Then came the Y2K panic…

For over a year, the media had been hyping hysteria around the “bug”—a coding issue that, unless fixed, would supposedly cause computers to recalibrate to January 1, 1900… which would theoretically interrupt critical computerized infrastructures—like banking, electricity, and the World Wide Web.

Many folks feared that civilization was on the precipice of falling altogether.

Tech spending further accelerated as the world looked for a patch to this major, potentially civilization-destroying bug.

The Nasdaq rallied sharply… and by the end of 1999, it had doubled year over year. Valuations for tech stocks had reached unsustainable levels based on future growth prospects—and I knew it was just a matter of time before they came crashing down.

And I was right…

As we rang in the New Millennium, it became clear the apocalypse wasn’t happening… And investors no longer had an obvious reason to continue pouring into hardware and software.

It wasn’t long before the tech-driven rally started unraveling… And at the end of the semester, I won the game.

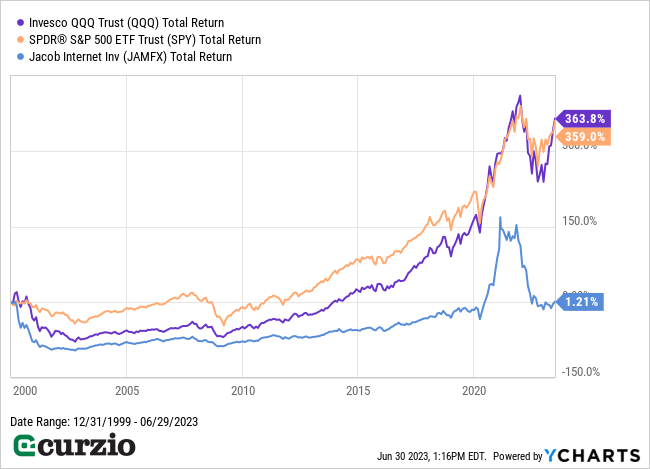

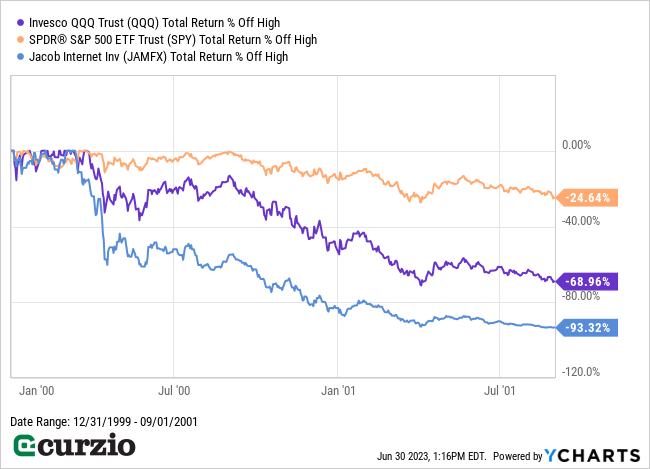

By September 2001, the tech-heavy Nasdaq—represented by the Invesco Nasdaq ETF (QQQ) on the chart below—was down almost 60%… while internet-related stocks as a group—represented by the Jacob Internet Fund (JAMFX)—crashed by more than 90%.

You might think investors would have learned their lesson… but today, we’re seeing a remarkably similar story playing out with the artificial intelligence (AI) rally.

Thanks to the launch of AI natural-language model ChatGPT, investor interest in AI has triggered a massive tech rally.

Shares of Nvidia (NVDA)—the leading manufacturer of AI chips—have soared. On May 25, investors bid the stock 25% higher in a single day. It’s up 38% since reporting earnings on May 24—and 190% since the start of 2023.

Meanwhile, the tech-heavy Nasdaq has surged 11% in just over a month… and 39% year to date.

And just like the dot-com bubble, this AI rally is bound to bust.

Overvalued businesses will inevitably underperform the market’s lofty expectations… and come crashing back to Earth. Even those companies that ultimately become winners of the AI trend could take years to regain their bubble levels—if they ever do.

Following the dot-com bubble bust, it took more than 10 years for software companies like Microsoft and Oracle to exceed their dot-com levels. And hardware giants Intel and Cisco still trade below their 2000 peaks (even counting dividends).

The bottom line: We’re in for another tech bubble burst…

Fortunately, the dot-com bust taught us several lessons that we can apply to stay safe—and profit—in today’s AI/tech-driven market.

Here they are.

1. Bear markets can pay off big

Bear markets don’t last forever.

If you have a long enough time horizon, buying during a big pullback can pay off big.

More than 23 years after the dot-com bubble (and after three more vicious bear markets), the major stock market indices are up multifold (as you can see below). Buying in the middle of any of the past selloffs rather than on top of the rallies would have improved your returns dramatically.

2. Diversify

If all your eggs are currently in the tech basket, the smart move is to put some of that money into other sectors. You’ll avoid a lot of pain when the AI rally inevitably unwinds.

Take another look at the chart above: During the dot-com bubble, the S&P 500 (the orange line) was cheaper than the Nasdaq (purple line) and internet stocks (blue line)… so it lost less—and bounced faster.

3. Own insurance

When the markets are down, there’s rarely a place to hide.

For example, while the S&P 500 outperformed the Nasdaq and the Jacob Internet Fund from 1999 to September 2001, it still fell 25% from its highs—as you can see from the chart below.

To prepare for—and profit from—selloffs, consider inverse ETFs and put options.

Both investments can act as “insurance policies” for a market downturn. When the markets plunge and investors panic, these investments move in the opposite direction—generating gains and keeping your portfolio afloat.

Conclusion

Everyone loves AI right now… and it’s sending tech stocks into insane valuation territory. This bubble is bound to pop… and when it does, it will pay to be a contrarian. Buy during a sector selloff, not a rally… keep your portfolio diversified… and own “insurance” investments like put options and inverse ETFs to profit when the rally falters.

Editor’s note:

Genia’s Moneyflow Trader is the best way to profit from a market selloff. In 2022, when other investors were losing their shirts, members had a shot at 18 winning trades for gains as high as 271%!

And right now, you can get a full year of Moneyflow Trader (or one of our other premium products)—FREE…

Plus, if you act quickly, a one-on-one call with Frank!