Ethereum is making a historic jump from PoW to PoS… Snoop Dogg and Eminem show off their NFTs at the VMAs… And Andreessen Horowitz leads another big investment in the metaverse.

Huge news for Ethereum

Ethereum is one of the largest blockchains in the world… and it’s receiving a much-needed upgrade. Over a 10-day period starting September 10, Ethereum will change from a Proof of Work (PoW) system to a Proof of Stake (PoS) system.

PoW vs. PoS: What’s the big deal?

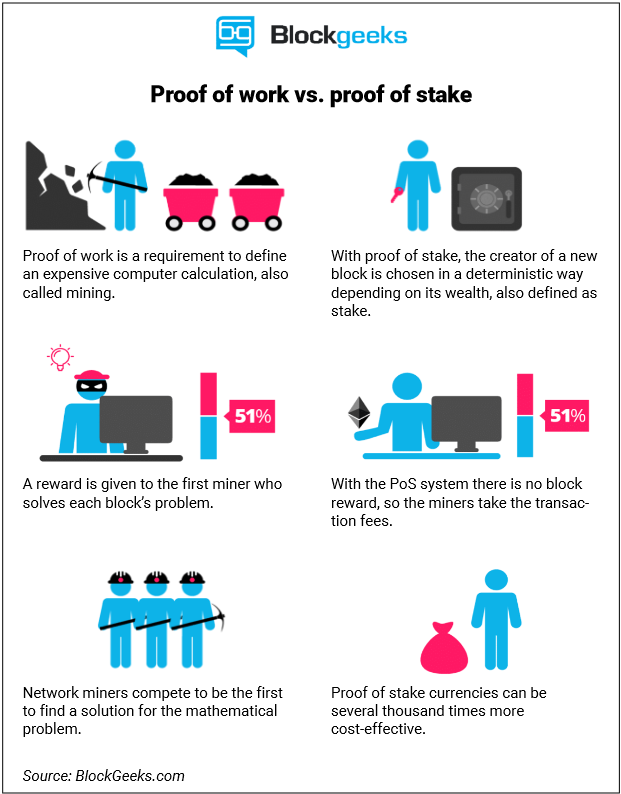

“Proof of Work” is the process used to validate transactions on the blockchain. The details can get super technical, but the important thing to understand is that PoW relies on “miners” to constantly solve complex math problems to secure token transactions. (Popular PoW-based blockchains include Bitcoin and Dogecoin.)

For doing the “work” needed to validate transactions (and add additional blocks to the blockchain), miners are rewarded with new Bitcoin (or whatever coin/token the specific blockchain uses).

But there are some major problems with PoW systems. For one, the computers require a massive amount of electricity to solve those math problems… which makes the process expensive and environmentally unfriendly. So, a PoW blockchain typically has higher fees for users… And they tend to be much slower during high volume periods.

However, a PoS setup relies on “validators” instead of miners. Validators play a similar role: They handle transactions and maintain the integrity of the blockchain. But there’s no “mining” of the coins involved, which is far more energy efficient. Each validator locks down—or “stakes”—their own crypto holdings (which takes the coins out of circulation).

This “stake” acts as collateral to ensure the validator handles a transaction properly. If a validator doesn’t do their job correctly, other validators will notice… and the original validator will lose the crypto they’ve staked.

I know this technical stuff can get boring… But the important thing to understand is that PoS systems fix the major problems of PoW systems. A PoS network can run smoothly and safely without needing to burn tons of energy doing a bunch of math problems.

Once Ethereum makes the switch, anyone who wants to be a validator will need to stake at least 32 ETH. These new validators will handle the same stuff as miners did previously… including checking transactions, maintaining records, etc. But the new Ethereum network will be faster, more scalable, and consume much less electricity.

The takeaway

Moving to a PoS system will make Ethereum “99% more efficient,” according to its founder, Vitalik Buterin. It will lower gas fees and electricity usage, and allow faster transaction speeds. In short, the move to PoS will drastically improve the Ethereum network… and attract developers and projects that would have previously gone to Ethereum’s competitors.

In sum, Ethereum is getting a major upgrade that will significantly improve its long-term growth profile.

If you’re an Ethereum investor, I’d recommend waiting until after the upgrade to add more ETH to your portfolio. The switch to PoS will require a major overhaul of the blockchain’s internal coding… which could cause significant complications for the network—and additional volatility in the price of ETH—as the changes roll out.

In other crypto news…

Avalanche (AVAX), a top-20 crypto project based on market cap, plunged more than 20% over the past week… on allegations its team (Ava Labs) paid “conspirators” to sue its competitors and distract U.S. regulators.

NFTs make a huge splash at the VMAs

The MTV Video Music Awards (VMAs) aired Sunday evening, bringing a ton of top artists to the main stage… including Taylor Swift, Justin Bieber, and Nicki Minaj.

One of the big highlights was a performance by Snoop Dogg and Eminem, who brought their Bored Ape Yacht Club NFTs to the show… and performed inside Yuga labs’ metaverse game called “Otherside.” Otherside had its first minting (creation of the actual NFT) process for land a few months ago (April 30)… and will be a major new entrant in the metaverse space.

NFT prices soar higher after the event

NFTs (non-fungible tokens) are starting to grab the attention of mainstream media. Bored Ape Yacht Club NFTs are super expensive… with dozens of big celebrities helping to create an exclusive community of owners.

New investors are joining this market… creating growth and causing a surge in NFT prices.: At the height of sales in the past 36 hours, the average price of NFTs rose 26% on OpenSea, the largest NFT marketplace.

It’s not just art anymore…

Right now, most NFT investors and traders are focused on digital art.

But here’s the thing: NFTs can be used to store any type of asset on the blockchain. That gives the technology far-reaching real-world applications… Companies are already creating NFTs for medical records, real estate deeds, sports tickets, music, and more.

NFTs will also have a huge role in the metaverse. For example, designers are using them to create unique clothing and footwear for avatars…

Avatar innovator scores $56 million investment

Ready Player Me, a company that’s spent years building its own technology to customize avatars and make them usable across different metaverses, raised $56 million on August 23 in a Series B funding round.

Whether we’re talking about video games or social media, avatars are a big deal. The movie Ready Player One is a great example of how important it is for players to be able to customize their avatar to represent themselves in a virtual world.

The breakdown…

- Andreessen Horowitz—arguably the world’s top venture capital firm—led the funding round

- Twitch co-founder Justin Kan and Roblox co-founder David Baszucki are key investors

- Investment funds will be used to hire more developers and expand the company’s platform

- Andreessen Horowitz added the company to its $600 million crypto gaming fund

The bottom line

Ready Player Me aims to be the leading avatar customization system for every major metaverse.

Plenty of companies are in the process of building out their metaverses… but few are focusing on the player/avatar details. Andreessen Horowitz picked up on this… and is leading an investment round in one of the major companies in the avatar market, which will be a key component of the metaverse.

But investment rounds aren’t only taking place for metaverses—we’re seeing big money pour into in-game components, too. Firms like Andreessen Horowitz are investing in areas that will be critical for every metaverse… And this $56 million deal is the latest example of the massive amount of money pouring into this trend.

Got a question about digital assets?

Let me know here… And I’ll answer your top questions in an upcoming letter.

P.S. NFTs will be the “currency” of the next frontier of the internet: the metaverse…

But what exactly IS the metaverse?

Frank is creating a documentary to uncover what you need to know.