“Don’t look for the needle in the haystack. Just buy the haystack!”

That quote is attributed to John Bogle—one of the most influential people in market history.

He created the very first index fund—Vanguard Group—in 1976.

The quote summarizes his approach to investing: Don’t spend time searching for the best of the best… Instead, buy the whole market.

This is index investing (also known as passive investing) in a nutshell. And this simple structure works wonders, especially long-term…

But if you’re not careful, it could lead to a major mistake most investors don’t realize they’re making…

Index funds, in essence, sell losing stocks little by little, and buy more of the winners as they keep gaining in market cap. This way, you benefit even more as the winners gain… and lose less and less as the losers drop. No wonder there’s some $11 trillion in investments indexed or tied to the S&P 500 (the major U.S. index).

Passive investing is cheap and easy, and ultimately became mainstream…

Money kept pouring into index funds—and, by virtue of their structure, more and more of this money kept going into the top stocks such as Apple (AAPL), Microsoft (MSFT) or Tesla (TSLA), propping these stocks even higher…

This created a virtuous cycle for index investors… but distorted the value of other stocks in the market.

But if you’re not careful, the winning run of index funds could mean a big investment mistake: under-diversification.

You might not be as diversified as you think…

Diversifying is a major risk reduction tool in any investor’s arsenal.

But if you invest in the same few mega-cap stocks via funds (your index fund… your mutual fund… your 401[k]) and in each name individually, you might not be diversified enough… a mistake that many investors make without even realizing it.

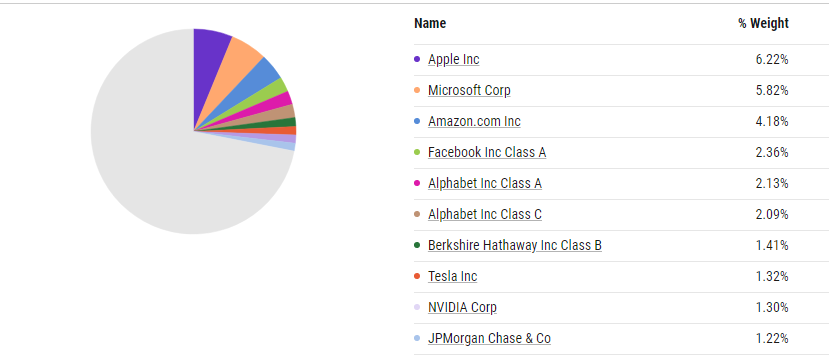

As you can see from the chart below, Apple, Microsoft and Amazon (AMZN)—all great companies—are so big they now account for more than 16% of the S&P 500.

And if you look at the top 10 stocks in the SPDR S&P 500 ETF Trust (SPY)—the index fund tracking the S&P 500—just 2% of index names account for more than a quarter of the fund.

In other words, each of the other 490 stocks in the S&P 500 index will impact the index much less than even one of its top positions.

10 largest stocks in the market

But this works both ways… If Apple declines, it will impact the market disproportionally. The same goes for Microsoft, Amazon, Facebook, Alphabet, Tesla, or NVIDIA.

They’re great stocks… but you want to have something else… especially if you’re heavily invested in index funds via your accounts. Not having a wide enough variety in your portfolio means less protection against the downside… and less profit potential outside of the market return.

Fortunately, it can be easy to overcome this mistake…

Ensure your portfolio is properly protected

Know your investments—not just “what” but also “how much”…

Inventory your entire portfolio (including the positions in all your funds)… Review your top holdings… Understand why you own your largest positions… And make sure you don’t own more of a single stock than you want to…

Consider diversifying outside of market-leading stocks and sectors.

And if you don’t want to give up on potentially higher returns, there’s nothing wrong with stock picking outside of the usual suspects… having some value plays… or even commodities and precious metals such as gold and silver.

You might underperform the mega-cap-driven market, but you’ll position yourself to find the next Netflix… to have higher dividend payouts… and to be protected when the market turns south.

P.S. My colleague Luke Downey’s new growth advisory, The Big Money Report, has officially launched to the public…

Luke’s unique investment strategy allowed him to retire from Wall Street at 31 years old… And now he’s sharing it with subscribers.

Sign up today… and get immediate access to Luke’s new special report, Get In and Get Out: The Stocks You Absolutely DO and DON’T Want to Own.