It’s been a tough few months for investors. The S&P 500 is down more than 6% since the start of 2022… while the Nasdaq has lost more than 11% of its value.

But stocks are close to turning a corner…

Last week, I mentioned we’d seen the biggest selling since pandemic lows in March 2020… and highlighted a rare signal that typically indicates higher stock prices. Well, since March 7, 2022—when that signal triggered—the S&P 500 is up more than 6%… and the Nasdaq has jumped about 8%.

Many investors are wondering whether the coast is clear… and it’s time to start buying.

Nobody knows for sure…

But today, I’ll highlight one area you want to own in every type of market—both bull and bear. And the Big Money is pouring in right now…

Rush to cash (flow)

As you probably know, investors hate uncertainty. And right now, they’re worried about high inflation, rising interest rates, and the economic effects of the Russia-Ukraine war.

When the macro outlook looks shaky, institutional investors rush to high-quality companies—”cash cows” making big, steady profits.

The best way to screen for these kinds of businesses is by focusing on free cash flow (FCF).

You’ve probably heard of FCF before. It’s a measure of how much cash a company makes after covering the expenses needed to run the business. And it’s a different way to look at accounting than by earnings alone. Earnings are similar to FCF… since they also represent the money left over after doing business (revenue minus expenses). However, some “non-cash” expenses, like depreciation and amortization, can boost the earnings figure.

FCF differs because it takes into account many variables related to the health of a business (like working capital and capex, and it adds depreciation and amortization to expenses). It’s the amount a firm could theoretically give back to shareholders.

Investors love FCF because it can be used to pay dividends, repurchase shares, or grow the business.

These sorts of companies are usually stable performers. They have healthy balance sheets, big market share, and a history of growing dividend payments.

One terrific example is the healthcare giant Pfizer (PFE). It was founded in 1849, IPO’d in 1942, and began paying quarterly dividends in 1980. More recently, the company has become noteworthy for its contribution to COVID vaccines. But it works on treatments for many ailments and has a strong history of stock gains.

If you’ve been reading my research over the years, you know I love tracking the Big Money, or the big institutions that drive the stock market.

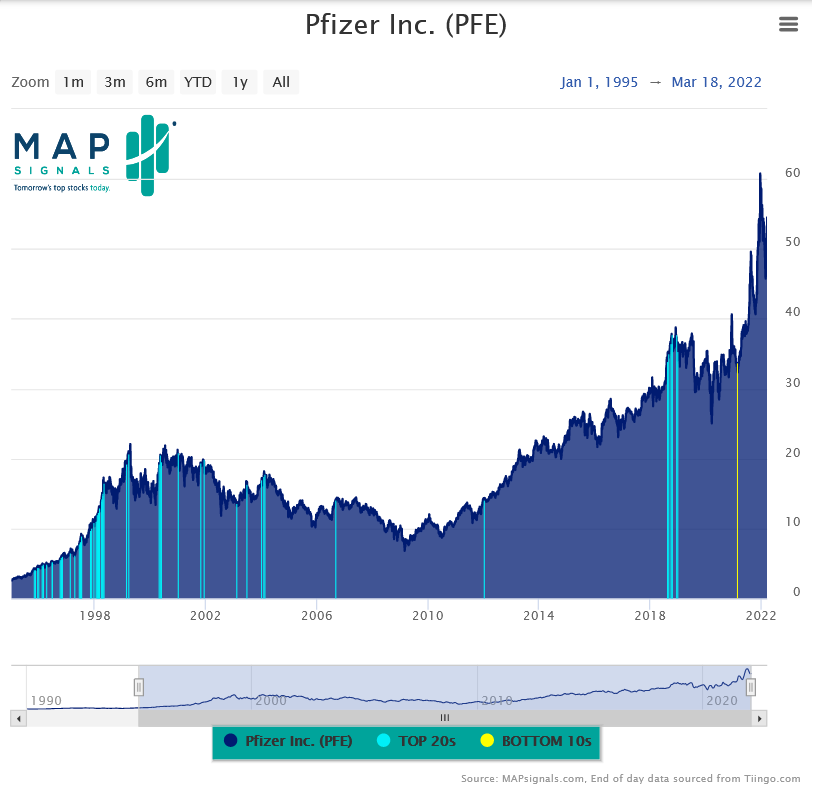

Below, I’ve included a chart that shows more than 25 years of Big Money action for Pfizer. Each blue bar shows when PFE was attracting a ton of Big Money buying… while the company had strong fundamentals.

Rising cash flows are one of the major signs of a company with strong fundamentals. And as I mentioned above, these are exactly the kind of stocks that big investors flock to in times of uncertainty.

The easiest way to invest in “cash cows”

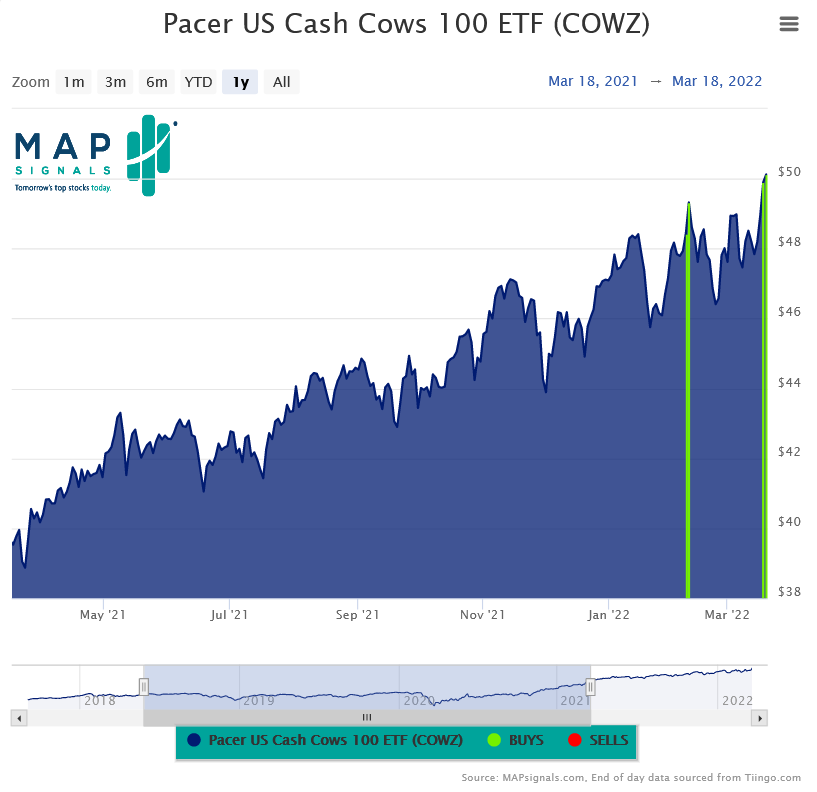

There’s an exchange-traded fund (ETF) that focuses on stocks with high cash flow… and it has a fitting name: the Pacer U.S. Cash Cows 100 ETF (COWZ).

This ETF’s objective is to screen the Russell 1000 large-cap index for its top 100 companies (based on cash flow yield). In other words, it screens the biggest stocks in the U.S. market and invests in the best ones, according to the amount of cash flow they’re generating.

COWZ has about $3.5 billion under management… It caps each holding at 2% and reconstitutes/rebalances every quarter.

The fund is up about 6.5% so far this year and pays a current dividend yield of around 1.6%.

Looking over the fund’s holdings, it owns a ton of high-quality names across a range of industries. In the drug space, its holdings include Pfizer and Moderna (MRNA). It also owns chemical giant DOW Inc. (DOW). And it even includes a few tech names that generate tons of cash flow, like Meta Platforms (FB) and HP Inc. (HPQ).

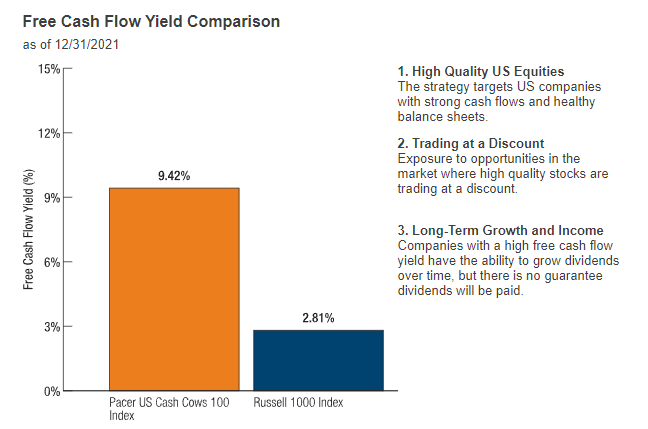

Below, you can see the fund’s overall holdings have a FCF yield more than three times (3x) higher than the rest of the large-cap market:

It’s also important to note that the Big Money has recently latched onto COWZ. Below, you can see the fund has triggered a handful of buy signals since the start of this year:

Remember, it’s a tough market out there, with very few stocks breaking out on heavy buying. But COWZ is one of the few areas avoiding the market’s downtrend… and attracting Big Money support.

If the recent market volatility is causing you to second-guess investing, look for firms with healthy FCFs. You’ll avoid many of the fluff stocks that have hurt so many investors lately.

Many of the stocks in the COWZ portfolio have been around for decades. Odds are they’ll be around for decades more…

Editor’s note:

Interested in the best high-yield, high-quality stocks for today’s market?

Join Genia Turanova at Unlimited Income—risk-free.