Fifty-one years ago this week, President Nixon shocked the nation when he announced the U.S. dollar would no longer be backed by gold.

It was the end of the Bretton Woods system… and the end of an era.

From 1944 until 1971, world currencies were tied to the U.S. dollar, and the price of gold was set at $35 per ounce.

This stabilized global currencies… but also meant that, for all practical purposes, the price of gold was fixed at $35 per ounce. Too cheap… especially in a world where governments were inclined to issue more money (while protecting their gold at all costs).

By the time of Nixon’s speech, the U.S. had found itself with less than half of its gold in reserves (some 10,000 tons). The rest had been redeemed by foreign governments, suspicious about the role of the dollar and its actual worth.

But the era of fiat money had begun… the era of inflation was unleashed… and the price of gold was set for a sharp jump.

It’s no secret we’re currently seeing the highest inflation since that period…

But it’s supply/demand inflation, not dollar devaluation, that has shocked our economy this time around…

Gold, a go-to asset in inflationary times (and a favorite safe haven of many investors) is set to resume its most recent bullish run.

The only question is “when.” Let’s take a closer look…

The best major asset to own in this century… and in 2022

In the market, the 1970s are remembered largely for two main things: high inflation and strong commodities.

Over the course of the decade, the Consumer Price Index nearly doubled.

The “Nifty Fifty,” a group of high-growth blue-chip companies, lost their edge as their high valuations became unsustainable…

Large-cap stocks returned less than 80%—with dividends…

And bonds outperformed stocks thanks to historically high interest rates.

But gold was the real star of the decade.

After Nixon got rid of the gold standard, the limits on the price of gold were removed… allowing the yellow metal to soar.

Over the course of the decade, gold beat all other major assets… as it lost the shackles of government limitations.

Market forces immediately took it higher… and by the end of the 1970s, the price of gold was up more than 1,000%.

Gold began to languish again once the economy stabilized in the ’80s… setting a major low in 1999.

Since then, it’s up more than sixfold.

The price performance of gold—an old-school, non-dividend-paying, unproductive asset—is better than the total return of the market so far this century.

And not by a small margin, as you can see from the chart below.

A strong dollar typically keeps gold from advancing too far… But gold doesn’t need a weak dollar to outperform the stock market.

Rather, it simply needs to be viewed as a safe haven.

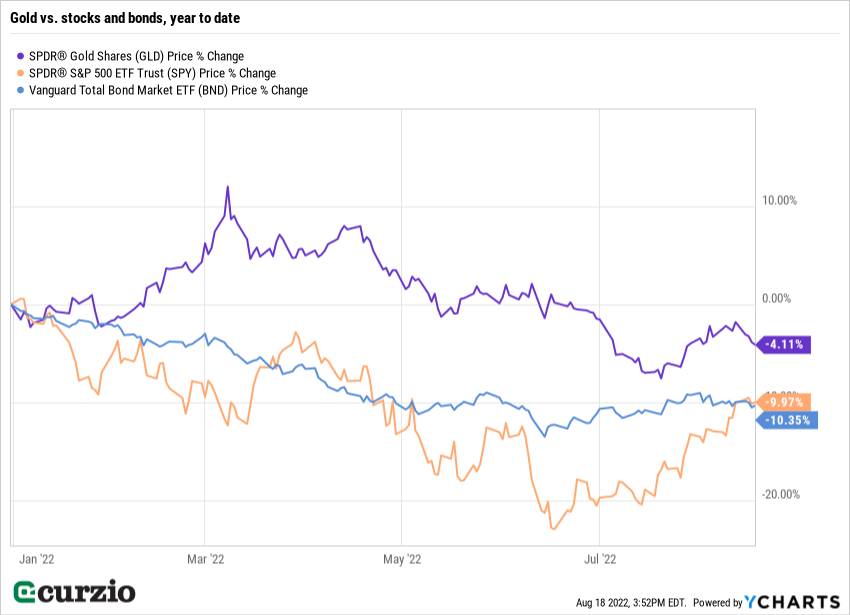

No wonder gold has been the only major asset class to beat the bear market of 2022.

Gold’s outperformance has faded over the past couple of months as the market rallied off its lows and inflation is showing some signs of abating.

But if inflation persists… the market falls again… or both… gold will shine.

With its millennia-long history of reliably storing value, the yellow metal remains a great way to protect your wealth against the ravages of inflation… and the possibility of another selloff.

One convenient way to play it is with SPDR Gold Shares (GLD), a popular exchange-traded fund designed to track the precious metal’s performance. And because it’s an ETF, it’s easy to buy and sell.

P.S. Unlimited Income subscribers have access to a portfolio full of my favorite ways to play inflation—including 2 unique, high-upside gold stocks.

If you’re looking for assets that will hold their value… and steadily grow your income, join us here—completely risk-free.